Tax Brackets For Income Earned In 2021

- 37% for incomes over $523,600

- 35% for incomes over $209,425

- 32% for incomes over $164,925

- 24% for incomes over $86,375

- 22% for incomes over $40,525

- 12% for incomes over $9,950

- 10% for incomes up to $9,950

Importantly, your highest tax bracket doesn’t reflect how much you pay in federal income taxes. If you’re a single filer in the 22 percent tax bracket for 2022, you won’t pay 22 percent on all your taxable income. You will pay 10 percent on taxable income up to $10,275, 12 percent on the amount from $10,275, to $41,775 and 22 percent above that .

You should also note that the standard deduction will rise to $12,950 for single filers for the 2022 tax year, from $12,550 the previous year. The standard deduction for couples filing jointly will rise to $25,900 in 2022, from $25,100 in the 2021 tax year. Single filers age 65 and older who are not a surviving spouse can increase the standard deduction by $1,750. Each joint filer 65 and over can increase the standard deduction by $1,400 apiece, for a total of $2,800 if both joint filers are 65-plus. You need to have more tax deductions than the standard deduction to make itemizing your tax return worthwhile.

AARP Membership -Join AARP for just $12 for your first year when you enroll in automatic renewal

Join today and save 25% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

More on Preparing Your Tax Return

Personal Income Tax Brackets And Rates

| Taxable Income – 2022 Brackets | |

| Over $227,091 | 20.5% |

Tax rates are applied on a cumulative basis. For example, if your taxable income is more than $43,070, the first $43,070 of taxable income is taxed at 5.06%, the next $43,071 of taxable income is taxed at 7.70%, the next $12,760 of taxable income is taxed at 10.5%, the next $21,193 of taxable income is taxed at 12.29%, the next $42,738 of taxable income is taxed at 14.70%, the next $64,259 is taxed at 16.80%, and any income above $227,091 is taxed at 20.5%.

Tax Brackets Play A Big Role In Determining How Much Federal Income Tax You Must Pay Each Year

A tax bracket is a range of income that is taxed at a certain tax rate. There are seven brackets and seven federal income tax rates , and its likely more than one will apply to your income.

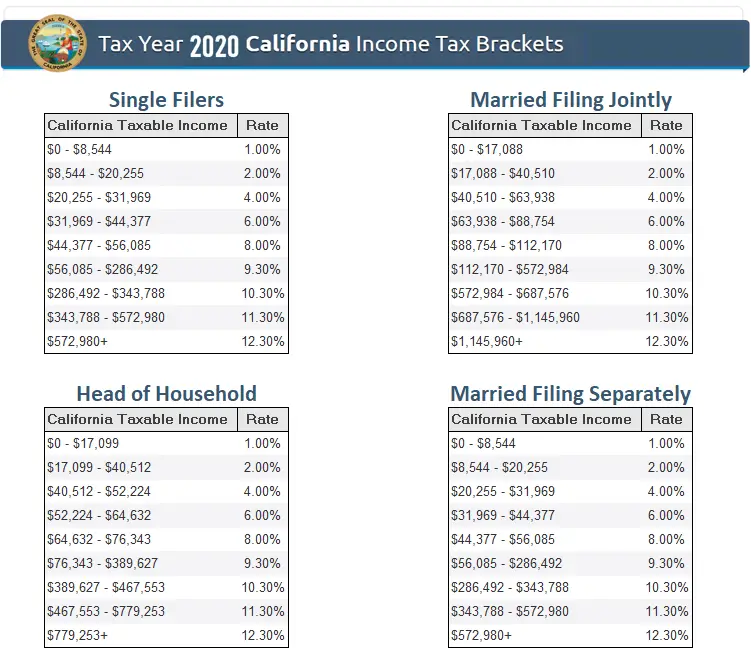

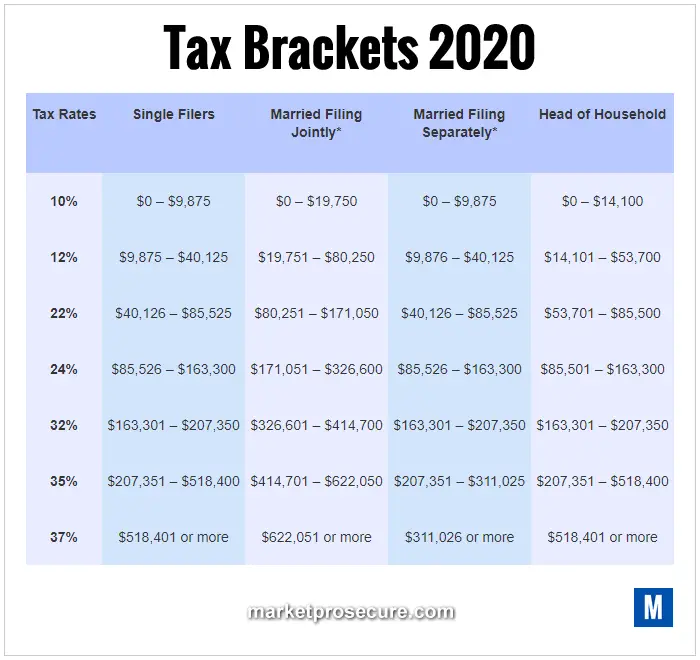

The federal government makes annual inflation adjustments to tax brackets, so the 2020 federal tax brackets are slightly different than the tax brackets that applied to your 2019 taxes.

Heres a look at 2020 federal tax brackets, how they work and how they can affect your tax calculations.

|

$311,026 and more |

Read Also: What Taxes Are Due This Year

How Do Tax Brackets Work In Ontario

In Ontario, tax brackets are based on net income for income tax purposes. There are 5 tax brackets:

- First: $45,142 or less

- Second: over $45,142 up to $90,287

- Third: over $90,287 up to $150,000

- Fourth over $150,000 up to $220,000

- Fifth: over $220,000 and over

Each tax bracket has a different rate of tax associated with it. If your net income falls in the second bracket, you will be taxed on the rate for the first bracket for the first $45,142, and the second bracket for the balance.

Recommended Reading: What Is The Sales Tax In Arkansas

Whats Your Marginal Tax Rate

The highest tax rate that applies to your income is called your . So in the example above, the single taxpayers marginal tax rate is 22%, because thats the rate that corresponds to the highest bracket that applies to their taxable income.

Identifying your marginal tax rate can help you understand the potential tax impact of earning more money or taking certain tax deductions. Keep in mind that a marginal tax rate of 22% doesnt mean youre actually paying 22% tax on all your income.

Effective tax rate can be a more accurate way to think of your tax liability.

Recommended Reading: How Do I Do My Tax Return Online

What Salary Puts You In A Higher Tax Bracket

If your taxable income for 2020 is $50,000 as a single filer, that puts you in the 22% tax bracket, because you earn more than $40,125 but less than $85,525. This is known as your marginal tax rate. Marginal tax rate is the tax rate you pay on your last dollar of income in other words the highest rate you pay.

The Tax Brackets For Every Province And Territory In Canada

In the same way that Canada has federal income brackets to calculate taxes, every province and territory has their own tax brackets and tax rates. Certain expenses are federal responsibilities and certain expenses are provincial responsibilities, says Zakharia. For example, health care is a provincial accountability, such the Ontario Health Insurance Plan , and B.C.s Medical Services Plan , and the military and national security is covered at the federal level with the Canadian Armed Forces and the RCMP.

What can you expect with provincial tax brackets? Every year, the tax brackets increase, says Zakharia, even if the rates for each bracket remain the same. This is mostly due to inflation, which is basically the increase of prices on some products.

Here are the tax brackets for all the provinces and territories in Canada, in alphabetical order:

Read Also: What Is Tax Resolution Services

Tax Brackets And Tax Rates

Single

| If taxable income is over: | but not over: |

| 10% of the amount over $0 | |

| $9,875 | $988 plus 12% of the amount over $9,875 |

| $40,125 | $4,618 plus 22% of the amount over $40,125 |

| $85,525 | $14,606 plus 24% of the amount over $85,525 |

| $163,300 | $33,272 plus 32% of the amount over $163,300 |

| $207,350 | $47,368 plus 35% of the amount over $207,350 |

| $518,400 | $156,235 plus 37% of the amount over $518,400 |

| If taxable income is over: | but not over: |

| 10% of the amount over $0 | |

| $19,750 | $1,975 plus 12% of the amount over $19,750 |

| $80,250 | $9,235 plus 22% of the amount over $80,250 |

| $171,050 | $29,211 plus 24% of the amount over $171,050 |

| $326,600 | $66,543 plus 32% of the amount over $326,600 |

| $414,700 | $94,735 plus 35% of the amount over $414,700 |

| $622,050 | $167,308 plus 37 % of the amount over $622,050 |

| If taxable income is over: | but not over: |

| 10% of the amount over $0 | |

| $9,875 | $988 plus 12% of the amount over $9,875 |

| $40,125 | $4,618 plus 22% of the amount over $40,126 |

| $85,525 | $14,605 plus 24% of the amount over $85,525 |

| $163,300 | $33,271 plus 32% of the amount over $163,300 |

| $207,350 | $47,367 plus 35% of the amount over $207,350 |

| $311,025 | $83,654 plus 37% of the amount over $311,025 |

Head of Household

How Many Kids Can You Claim On Taxes

You can claim as many children dependents as you have. You will get a dependent exemption for each, you will get child tax credit for children 16 or younger, Child and Dependent care credit has a maximum dollar amount. And for the EIC, you get credit for 3, but there is no increase in EIC for more than 3 dependents.

You May Like: When Will Child Tax Credit Payments Start

Tips To Prevent Tax Identity Theft

Learn how you can protect yourself from tax identity theft and help secure your return.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Ameriprise Financial Services, LLC. Member FINRA and SIPC.

What Tax Bracket Am I In

To determine your tax bracket, you need to know your taxable income in 2020. This involves figuring out two things: your income and your tax deductions.

- Income: Essentially all income is taxable income. This includes your salary, wages, tips, any payment for freelance work, sales from real estate, unemployment benefits over $10,200 and more. .

- Taxdeductions: Money thats subtracted from your total income, which lowers the amount of tax you have to pay.

Once youve determined your total income, you can generally subtract any deductions to arrive at your taxable income. See the chart above to find out where it places you.

Don’t Miss: Does Ebay Collect Sales Tax For Sellers

What Is The Standard Deduction

The most-used tax deduction is the standard deduction, which is a no-questions-asked amount that you can subtract from your income, lowering the amount of income on which you have to pay taxes. Before claiming the standard deduction, make sure you understand the rules for example, you cant deduct home mortgage interest if you are also claiming the standard deduction.

Example: Lets take a single person whose only income is from their salary of $32,000. If they only take the standard $12,400 deduction, they will have a taxable income of roughly $20,000. That means theyll fall into the 12% bracket.

Do Pensions Count As Earned Income

For the year you are filing, earned income includes all income from employment, but only if it is includable in gross income. … Earned income does not include amounts such as pensions and annuities, welfare benefits, unemployment compensation, worker’s compensation benefits, or social security benefits.

Read Also: Why Do I Owe Money On My Taxes

Will The Tax Rates Go Up

Will the federal income tax rates go up in the near future? Yesunless the current law is changed in the next couple of years. As it stands right now, the reduced tax rates that were part of the 2017 tax reform law will expire at the end of 2025. As a result, the tax rates are scheduled to be 10%, 15%, 25%, 28%, 33%, 35% and 39.6% starting in 2026.

Whether some or all those rates will actually go up in 2026 will depend on who controls Congress and the White House between now and then. If the Democrats retain control in the House of Representatives and expand their majority in the Senate during the 2022 mid-term elections, expect them to look at raising the top rate from 37% to 39.6% in 2023 or 2024. In March 2022, President Biden’s budget proposal called for the 39.6% rate being applied to taxable income over $450,000 for married couples filing a joint return, $400,000 for singles, $425,000 for head-of-household filers, and $225,000 for married people filing a separate return. Given the president’s frequent pledge not to raise taxes on anyone making under $400,000 per year, the other rates probably wouldn’t be touched before 2026.

Get An Early Start On Your Tax Planning For The Coming Year

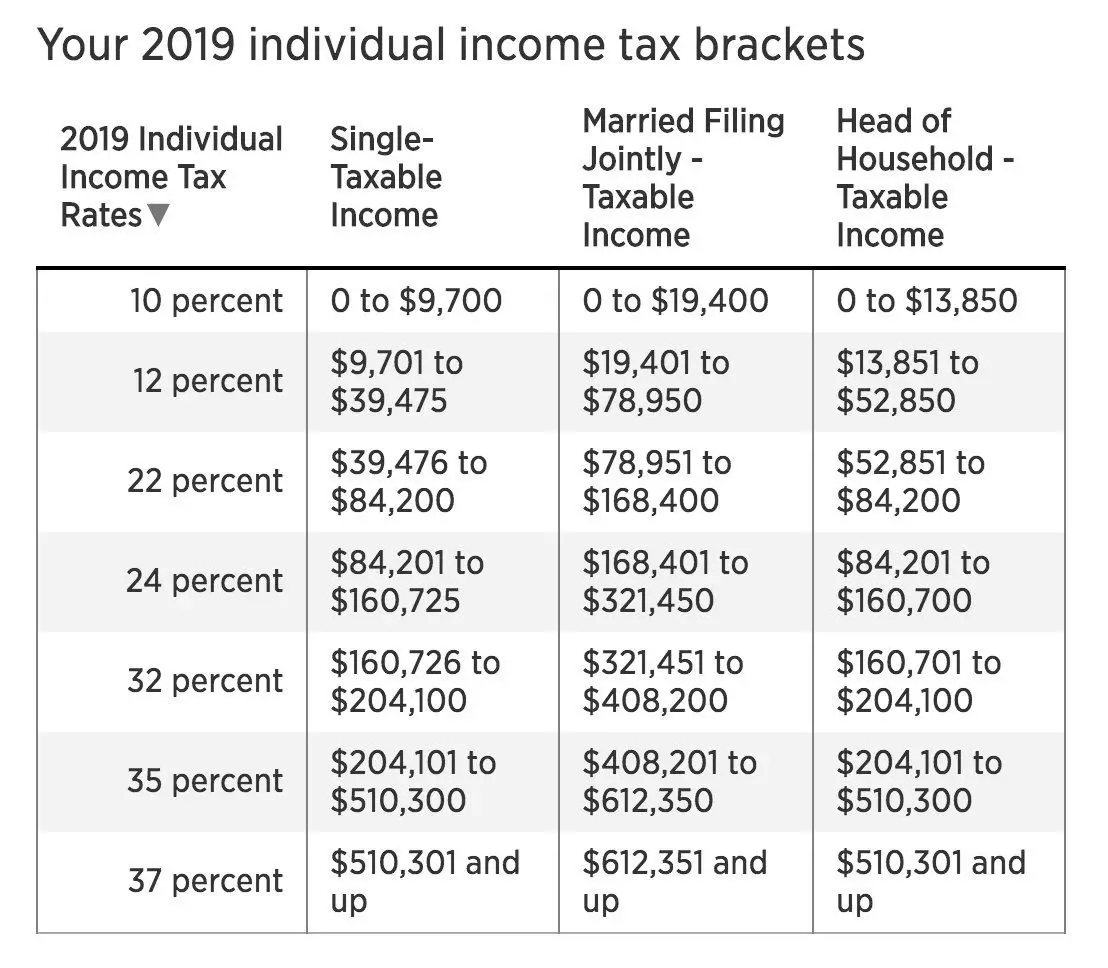

We haven’t even finished 2019 yet, but already people are starting to look forward to 2020. As tax season ramps up in late January, taxpayers will begin to look at how much they’re likely to owe to the federal government in income taxes for the 2019 tax year.

Yet even though there’s still a while to go before tax season gets started, the IRS has already released the 2020 income tax brackets that will apply to next year’s income. They look a lot like what the 2019 tax brackets did, except that they reflect some inflationary adjustments that take place nearly every year.

Image source: Getty Images.

You May Like: What Is The Penalty For Not Paying Taxes

What Are The Federal Tax Brackets For 2022

The top tax rate is 37% for individual single taxpayers with incomes greater than $539,900 . The other rates are:

- 35%, for incomes over $215,950

- 32% for incomes over $170,050

- 24% for incomes over $89,075

- 22% for incomes over $41,775

- 12% for incomes over $10,275

The lowest rate for the 2022 tax year is 10% for single individuals with incomes of $10,275 or less .

Tax Brackets: Rates Definition And How To Calculate

Tax brackets are the income range in which you are taxed a specific rate. Here’s what you need to know about tax brackets for the upcoming tax season.

When preparing their financial information for tax season, it’s important for taxpayers to have an idea of how much they’ll be paying. Even if your income didn’t change, the amount you’re paying in taxes may.

Several factors affect your taxes – not just your job and income, but your family situation as well.

The way this is all broken up to determine taxes is known as a tax bracket. Knowing what tax bracket you’re in and how they’ve changed in the past year can help you prepare for tax day.

So, what are tax brackets, and can you use them to calculate how much you’ll owe?

Read Also: When Is The Last Day To File Income Tax

Depending On Your Taxable Income You Can End Up In One Of Seven Different Federal Income Tax Brackets Each With Its Own Marginal Tax Rate

Getty Images

Smart taxpayers are planning ahead and already thinking about their next federal income tax return. For most Americans, that’s their return for the 2022 tax year which will be due on April 18, 2023 . When it comes to federal income tax rates and brackets, the tax rates themselves didn’t change from 2021 to 2022. There are still seven tax rates in effect for the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. However, as they are every year, the 2022 tax brackets were adjusted to account for inflation. That means you could wind up in a different tax bracket when you file your 2022 federal income tax return than the bracket you were in before which also means you could pay a different tax rate on some of your income.

The 2022 and 2021 tax bracket ranges also differ depending on your filing status. For example, for single filers, the 22% tax bracket for the 2022 tax year starts at $41,776 and ends at $89,075. However, for head-of-household filers, it goes from $55,901 to $89,050. So, that’s something else to keep in mind when you’re filing a return or planning to reduce a future tax bill.

What Is My Tax Bracket For 2020

The IRS recently released the new tax brackets for the 2020 tax year, so now you can start thinking about how to handle your 2020 finances in a tax-efficient way. The seven 2020 tax rates themselves didn’t change , however the tax bracket ranges were modified based on inflation. So, you could be in a different tax bracket for 2020 than the last time you reported your taxes, even if your income has not changed.1

Don’t Miss: What Is The Minimum Income To File Taxes

How To Calculate Taxable Income

Arriving at your taxable income requires a bit of arithmetic. Begin with your gross income, which is all the money you earned during the tax year: income from jobs, from owning a business, retirement withdrawals, Social Security), rents, and/or investment earnings.

Next up: determining your adjusted gross income . These are adjustments taken before any deductions are applied. These may include student loan interest, moving expenses, alimony you paid, tuition and fees, as well as contributions to a traditional IRA, among others. Subtract these expenses from your gross income to arrive at your AGI.

Finally, apply deductions.

Again, you may itemize your deductions by listing eligible expenses, or you may take the standard deduction. Everyone qualifies for the standard deduction, but if you think your allowable deductions exceed the standard deduction youre paying a lot in home mortgage interest your property or state income taxes are high medical expenses take a big bite out of your budget it would be make sense to take the time to itemize your deductions and see if it exceeds the allowable standard deduction.

The standard deduction for the 2022 tax year, due April 15, 2023

- Single filers: $12,950

- Heads of households: $19,400

Once of all that is calculated and subtracted from your AGI, youve arrived at your taxable income. But calculating how much you will pay in taxes isnt as simple as taking that number and multiplying it by your tax rate.

See Other Posts By John

-

Partnering with CPA firms to update and improve their firms productivity with solutions they can trust

20h

Partnering with CPA firms to update and improve their firms productivity with solutions they can trust

1d

Partnering with CPA firms to update and improve their firms productivity with solutions they can trust

1d

Partnering with CPA firms to update and improve their firms productivity with solutions they can trust

1d

Partnering with CPA firms to update and improve their firms productivity with solutions they can trust

2d

Partnering with CPA firms to update and improve their firms productivity with solutions they can trust

4d

Partnering with CPA firms to update and improve their firms productivity with solutions they can trust

4d

Partnering with CPA firms to update and improve their firms productivity with solutions they can trust

5d

Today, small firms have scalable access to the same powerful technology as the industry’s largest firms. But where does a small firm owner even start when analyzing which technologies to adopt now or in the future? Our white paper provides answers.

Partnering with CPA firms to update and improve their firms productivity with solutions they can trust

5d

Also Check: How Is Inheritance Tax Calculated