How Do You Apply Your 2021 Net Capital Loss To Previous Years

You can carry your 2021 net capital loss back to 2018, 2019, and 2020 and use it to reduce your taxable capital gains in any of these years. When you carry back your net capital loss, you can choose the year to which you apply the loss.

Note

When you apply a net capital loss back to a previous year’s taxable capital gain, it will reduce your taxable income for that previous year. However, your net income, which is used to calculate certain credits and benefits, will not change.

If you carry your 2021 net capital loss back to 2018, 2019, or 2020, you do not have to adjust the amount of the 2021 net capital loss since the inclusion rate is the same for these years.

To apply a 2021 net capital loss to 2018, 2019, or 2020, complete “Section III Net capital loss for carryback” on Form T1A, Request for Loss Carryback. This form will also help you determine the amount you have left to carry forward to future years. Do not file an amended income tax and benefit return for the year to which you want to apply the loss.

Note

If you apply a 2021 net capital loss to a previous year, any capital gains deduction that you claimed in that year, or a following year, may be reduced.

What Rate Is Cgt Charged At

The rate of CGT you pay depends partly on what type of chargeable asset you have disposed of and partly on the tax band into which the gain falls when it is added to your taxable income.

CGT is charged at the rate of either 10% or 18% for basic rate taxpayers. For higher or additional rate taxpayers, the rate is either 20% or 28%. If you are normally a basic-rate taxpayer but when you add the gain to your taxable income you are pushed into the higher-rate threshold, then you will pay some CGT at both rates.

Gains on most chargeable assets are subject to the 10% or 20% rate, depending on whether the taxpayer is a basic rate or higher/additional rate taxpayer. Chargeable gains on disposals of residential property that do not qualify for, or are not fully covered by, private residence relief are subject to the 18% or 28% rate.

There is a special rate of 10% that applies on the sale of certain business assets. This is called business asset disposal relief . You can find more information on GOV.UK.

If you live in Scotland and are a Scottish taxpayer, or if you live in Wales and you are a Welsh taxpayer, the same rules as explained above apply to you. You must use the UK rates and bands to work out your CGT, even if you pay income tax at the Scottish or Welsh rates and bands on your salary, self-employed profits, rental income or pension.

When Do You Have A Capital Gain Or Loss

Usually, you have a capital gain or loss when you sell or are considered to have sold capital property. The following are examples of cases where you are considered to have sold capital property:

- You exchange one property for another

- You give property as a gift

- You settle or cancel a debt owed to you

- You transfer certain property to a trust

- Your property is expropriated

- The owner of the capital property passes away

Disposing of Canadian securities

If you dispose of Canadian securities, it’s possible that you could have a gain or loss on income account . However, in the year you dispose of Canadian securities, you can elect to report such a gain or loss as a capital gain or loss. If you make this election for a tax year, the CRA will consider every Canadian security you owned in that year and later years to be capital properties. A trader or dealer in securities or anyone who was a non-resident of Canada when the security was sold cannot make this election.

If a partnership owns Canadian securities, each partner is treated as owning the security. When the partnership disposes of the security, each partner can elect to treat the security as capital property. An election by one partner will not result in each partner being treated as having made the election.

To make this election, complete Form T123, Election on Disposition of Canadian Securities, and attach it to your 2021 income tax and benefit return. Once you make this election, you cannot reverse your decision.

Don’t Miss: Where Is My Agi On My Tax Return

Do Renovations Reduce Capital Gains

You can also reduce the amount of capital gains subject to capital gains tax by the cost of home improvements youve made. You can add the amount of money you spent on any home improvementssuch as replacing the roof, building a deck, replacing the flooring, or finishing a basementto the initial price of your home to give you the adjusted cost basis. The higher your adjusted cost basis, the lower your capital gain when you sell the home.

For example: if you purchased your home for $200,000 in 1990 and sold it for $550,000, but over the past three decades have spent $100,000 on home improvements. That $100,000 would be subtracted from the sales price of your home this year. Instead of owing capital gains taxes on the $350,000 profit from the sale, you would owe taxes on $250,000. In that case, youd meet the requirements for a capital gains tax exclusion and owe nothing.

Take-home lesson: Make sure to save receipts of any renovations, since they can help reduce your taxable income when you sell your home. However, keep in mind that these must be home improvements. You cant take a deduction from income for ordinary repairs and maintenance on your house.

How Much Cgt Will I Pay

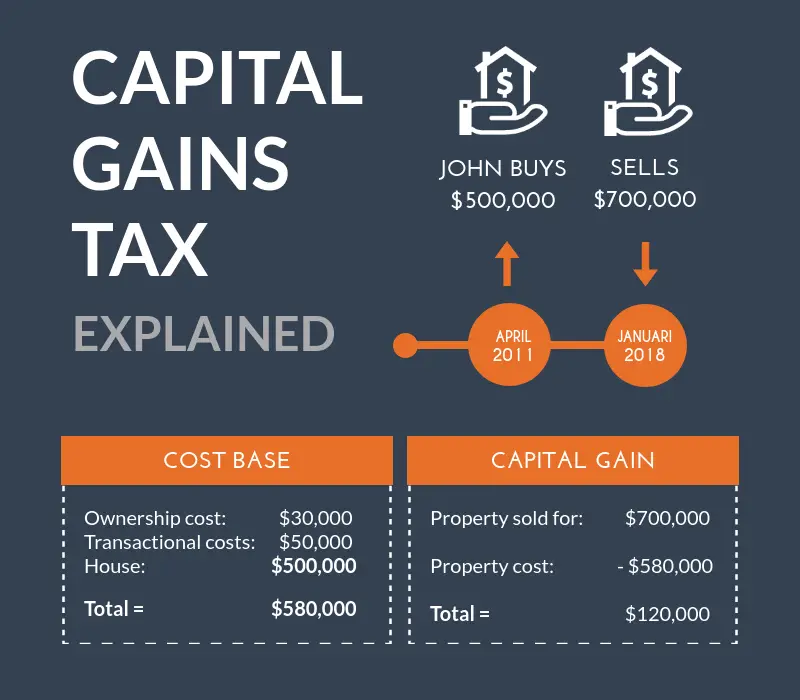

As the name suggests, CGT is only charged on the gains you make , rather than the full amount you sell the property for.

To work out your gain, you can deduct the amount you originally paid for the property from the sales price.

You can also deduct any legitimate costs involved with buying and selling the property. This includes things like broker fees, stamp duty, and some improvements to the property that were made while you owned it.

You can also offset losses you’ve made when selling other assets. For instance, if you own several properties and make, say, a £50,000 loss when selling one of them, you can use that against the gains you make from another property and therefore reduce your overall CGT bill.

You should claim any losses on your self-assessment tax return, or by calling HMRC. You can claim losses up to four years after they were incurred.

For any taxable gains above the tax-free allowance of £12,300 in 2022-23 , you’ll pay the CGT property rates.

You can find out more in our guide to capital gains tax rates and allowances.

- Do your 2021-22 tax return with the Which? tax calculator. Tot up your tax bill, get tips on where to save and submit your return direct to HMRC with Which?.

Also Check: How Do You End Up Owing Taxes

Do You Pay Capital Gains Taxes When You Sell A Second Home

Because the IRS allows exemptions from capital gains taxes only on a principal residence, its difficult to avoid capital gains taxes on the sale of a second home without converting that home to your principal residence. This involves conforming to the two-in-five-year rule . Put simply, you can prove that you spent enough time in one home that it qualifies as your principal residence.

If one of the homes was primarily an investment, its not set up to be the exemption-eligible home.

The demarcation between investment property and vacation property goes like this: Its investment property if the taxpayer has owned the property for two full years, it has been rented to someone for a fair rental rate for at least 14 days in each of the previous two years, and it cannot have been used for personal use for 14 days or 10% of the time that it was otherwise rented, whichever is greater, for the previous 12 months.

If you or your family use the home for more than two weeks a year, its likely to be considered personal property, not investment property. This makes it subject to taxes on capital gains, as would any other asset other than your principal residence.

Capital Gains Tax On Selling A Converted Vacation Home

What if you convert a vacation home to your primary residence, live there for at least two years and then sell it? Can you qualify for the full $250,000/$500,000 capital gains tax exclusion? No.

If you sell a main home that you previously used as a vacation home, some or all of the gain is ineligible for the home-sale exclusion. The portion of the gain that is taxed is based on the ratio of the period of time after 2008 that the home was used as a second residence or rented out to the total time that the seller owned the house. The remaining gain is eligible for the $250,000 or $500,000 home-sale exclusion.

Read Also: What Is Medicare Tax Used For

Capital Gains On Rental Property: What You Need To Know

Investing in rental properties is a great way to generate passive income, but it also comes with a few tax considerations. Namely, youll need to pay capital gains tax on any profit you make when you sell the property.

Unfortunately, taxes are a necessary evil when it comes to investing, so youll need to account for them when performing your investment analysis and running the numbers on your potential profits.

How To Avoid Capital Gains Tax

The short answer is that if you owe CGT contributions then you cant and shouldnt avoid paying them. Not declaring or paying what you owe is an offence that could land you with a fine, possibly leaving you to pay even more than you originally owed in interest.

However, there are a number of reliefs and conditions which, if you receive the right financial advice, may mean the amount of CGT you pay is lower.

Don’t Miss: What Is The Sales Tax In Philadelphia

Capital Gains Tax On Selling A Rental Home

If you hold rental property, the gain or loss when you sell is generally characterized as a capital gain or loss. If held for more than one year, it’s long-term capital gain or loss, and if held for one year or less, it’s short-term capital gain or loss. The gain or loss is the difference between the amount realized on the sale and your tax basis in the property.

The capital gain will generally be taxed at 0%, 15% or 20%, plus the 3.8% surtax for people with higher incomes. However, a special rule applies to gain on the sale of rental property for which you took depreciation deductions. When depreciable real property held for more than one year is sold at a gain, the rule requires that previously deducted depreciation be recaptured into income and taxed at a top rate of 25%. It’s known as unrecaptured Section 1250 gain, the number of its own federal tax code section.

Take this simple example: You bought a rental home for $400,000, deducted $140,000 of depreciation and sold the property for $600,000 this year. The $140,000 of depreciation is subtracted from the original purchase price to arrive at an adjusted basis in the property of $260,000. That means your gain on the sale is $340,000 . The first $140,000 of your $340,000 gain is unrecaptured Section 1250 gain that is taxed at a maximum rate of 25%, while the remaining $200,000 is taxed at the regular long-term capital gains tax rates.

Cgt Rates On Property

In the UK, you pay higher rates of CGT on property than other assets.

Basic-rate taxpayers pay 18% on gains they make when selling property, while higher and additional-rate taxpayers pay 28%.

With other assets, such as shares, the basic-rate of CGT is 10%, and the higher-rate is 20%.

Bear in mind that any capital gains will be added to your other income sources when working out which income tax bracket you’ll fall into for the year, and therefore might push you into a higher bracket.

All taxpayers have an annual CGT allowance, meaning they can earn a certain amount tax-free.

In 2022-23 you can make tax-free capital gains of up to £12,300 – the same as in 2021-22.

Couples who jointly own assets can combine this allowance, potentially allowing a gain of £24,600 without paying any tax.

You’re not allowed to carry over any unused CGT allowance into the next tax year – so if you don’t use it, you’ll lose it.

Further, in the 2022 Autumn Statement, the government announced that the CGT allowance will be cut from £12,300 to £6,000 in 2023-24 and then to £3,000 from April 2024.

You can find out more in our guide to capital gains tax rates and allowances.

Recommended Reading: How Much Taxes Do The Top 10 Percent Pay

What Is Capital Gains Tax

The definition is pretty simple: Its the difference between what you paid for a capital asset and what you sold it for. If you sell your asset for more than you bought it, youll have a capital gain If the opposite is true and you sell the asset for less than you bought it, youll have a capital loss.

Capital gains tax is the taxation of capital assets. The taxation is classified by the length in which you own the asset, which well describe in detail below!

Tax Implications On Ltcg On Property

Currently, the long term capital gain tax rate on property is set at 20% with the addition of cess and surcharge. This tax rate is applicable on every property sold after 1st April 2017.

However, this tax implication is not valid for any inherited property. For instance, ancestral properties inherited from family members by way of gifts will not be taxed until the inheritor decides to sell off the same. If the said individual sells off the property, then the long term capital gains generated from it will be taxed under the same rules as applicable for other properties.

Following are a few crucial points to remember about the LTCG tax rate on property

Recommended Reading: How Much Can You Donate For Taxes

Can Home Sales Be Tax Free

Yes. Home sales can be tax free as long as the condition of the sale meets certain criteria:

- The seller must have owned the home and used it as their principal residence for two out of the last five years . The two years do not have to be consecutive to qualify.

- The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion.

- If the capital gains do not exceed the exclusion threshold , the seller does not owe taxes on the sale of their house.

Calculating Your Capital Gains

Capital losses can be deducted from capital gains to calculate your taxable gains for the year.

The calculation becomes a little more complex if you’ve incurred capital gains and capital losses on both short-term and long-term investments.

First, sort short-term gains and losses in a separate pile from long-term gains and losses. All short-term gains must be reconciled to yield a total short-term gain. Then the short-term losses are totaled. Finally, long-term gains and losses are tallied.

The short-term gains are netted against the short-term losses to produce a net short-term gain or loss. The same is done with the long-term gains and losses.

Read Also: Do You Pay Taxes On Court Settlements

Deduct Certain Buying And Selling Costs

It is possible to deduct some costs when working out your CGT bill including legal and estate agents fees, and stamp duty incurred when buying the property. Costs involved with improving assets, such as paying for an extension, can also be taken into account when working out your taxable gain. However, youre not allowed to deduct costs involved with the upkeep of the property. You cannot deduct certain costs, like interest on a loan to buy your property.

So Whats My Capital Gains Tax Rate

For capital gains over that $250,000-per-person exemption, just how much tax will Uncle Sam take out of your long-term real estate sale? Long-term capital gains tax rates are based on your income , explains Park.

Lets break it down.

For single folks, you can benefit from the 0% capital gains rate if you have an income below $40,400 in 2021. Most single people will fall into the 15% capital gains rate, which applies to incomes between $40,401 and $445,850. Single filers with incomes more than $445,851, will get hit with a 20% long-term capital gains rate.

The brackets are a little bigger for married couples filing jointly, but most will get hit with the marriage tax penalty here. Married couples with incomes of $80,800 or less remain in the 0% bracket, which is great news. However, married couples who earn between $80,801 and $501,600 will have a capital gains rate of 15%. Those with incomes above $501,601 will find themselves getting hit with a 20% long-term capital gains rate.

Dont forget, your state may have its own tax on income from capital gains. And very high-income taxpayers may pay a higher effective tax rate because of an additional 3.8% net investment income tax.

If you held the property for one year or less, its a short-term gain. You pay ordinary income tax rates on your short-term capital gains. Thats the same income tax rates you would pay on other ordinary income such as wages.

Recommended Reading: How Many Years Of Taxes Should You Keep