Tobacco Products Tax Rate Calculation

The CDTFA annually determines the tobacco products tax rate, which is equivalent to the combined rate of the taxes imposed on cigarettes. The calculation of the rate is based on the wholesale cigarette prices reported to the CDTFA as of March 1 each year, and is effective during the next fiscal year . The tobacco products tax rate is calculated by dividing the tax rate imposed on cigarettes by the average wholesale cost of cigarettes:

Unstamped And Illegal Cigarettes

Unstamped Cigarettes

All packs of cigarettes must be stamped prior to shipping them to either other wholesaler distributors or retail outlets, unless they meet the exceptions discussed above. Stamping agents are subject to a $250,000 penalty for failure to properly affix the stamps. We may also revoke the stamping agent’s permit.

It shall be prima facie evidence of intent to defraud when the number of unstamped cigarettes is the greater of 30 packs, or 5 percent of the cigarette inventory in the place of business of such person or business. Notwithstanding these threshold limits, if the number of unstamped packs exceeds 500 packs, it shall be prima facie evidence of willful intent to defraud. Each pack not having proper stamps affixed is deemed a separate offense.

Illegal Cigarettes

Only cigarette brands approved by the Office of the Attorney General, and listed in the Tobacco Directory, can be sold in Virginia. Its illegal to stamp or sell any brand not listed in the directory.

Cigarette Trafficking

Youre considered to be involved with cigarette trafficking if you have in your possession:

- more than 3 cartons of unstamped cigarettes or

- more than 25 cartons of stamped cigarettes

An authorized holder is a:

- cigarette manufacturer

What Is Virginias Cigarette Tax

Its an excise tax on the sale of cigarettes and roll-your-own tobacco. For cigarettes, the tax amount is 3¢ per cigarette. This equals:

- 60¢ per pack or

Tax on roll-your-own tobacco is 10% of the manufacturers sale price.

This tax applies to cigarettes, to include bidis/beedies, and roll-your-own tobacco. Cigars, pipe tobacco, and other tobacco products are subject to the tobacco products tax.

While roll-your-own tobacco is subject to the cigarette tax, it is treated the same way as the tobacco products tax. Youll find more information on roll-your-own tobacco in that section.

Revenue generated by the cigarette tax and cigarette tax penalties is deposited into the Virginia Health Care Fund.

Read Also: How Much Can You Claim On Taxes For Donations

Federal Tobacco Excise Taxes

The price of all tobacco products sold in Ohio also includes Federal Tobacco excise taxes, which are collected from the manufacturer by the Tobacco and Tobacco Tax and Trade Bureau and generally passed on to the consumer in the product’s price. Federal excise tax rates on tobacco products are as follows:

Vapes And Electronic Cigarettes Examples Of Who Owes The Tobacco Products Tax

Example 1: Business A purchases untaxed eLiquids containing nicotine from a manufacturer .

- Business A is considered a tobacco products distributor and owes the tobacco products tax to us upon distribution in California.

- Sales invoices from licensed distributors must include a statement that indicates the California tobacco products taxes have been paid on the tobacco products sold.

Example 2: Business B purchases untaxed eLiquids containing nicotine from an out-of-state vendor who is not licensed by us as a tobacco products distributor and sells to stores in California.

- Business B is considered a tobacco products distributor and owes the tobacco products tax to us upon distribution in California.

- Only licensed distributors may be in possession of untaxed tobacco products.

- Licensed distributors must include a statement on their sales invoices that indicates the California tobacco products taxes have been paid on the tobacco products sold.

Example 3: Business C, a licensed tobacco products distributor, is located in California and sells eLiquids containing nicotine online to stores outside of California.

- Sales of tobacco products delivered to customers at an out-of-state location are exempt from the California tobacco products tax.

Example 4: Business D manufactures eLiquids containing nicotine in California and sells them directly and online across the U.S., including to California distributors, wholesalers, retailers, and consumers.

Also Check: How To Calculate Gas For Taxes

Regional Cigarette Tax Boards

Special dual stamping requirements apply to cigarettes sold in localities covered by 1 of Virginias regional cigarette tax boards:

- Blue Ridge Cigarette Tax Board

- Chesapeake Bay Cigarette Tax Board

- Mount Rogers Cigarette Tax Board

- Northern Virginia Cigarette Tax Board

For more information, including a list of the localities covered by the boards, please visit our Regional Cigarette Tax Boards page.

Debate Around Taxing Cigarettes

Many smokers resent the high and regularly rising prices that they have to pay for tobacco products. Nonetheless, the principle of government taxing tobacco heavily, both as a source of revenue and to provide a price-based deterrent to smoking, is long standing.

The political debate around this issue often involves the following aspects.

Cigarette duty as a public health toolTaxation is said to be a key policy weapon to deter cigarette smoking. Its success in doing so is evidenced by figures which show that the number of smokers has dropped from approximately 30% of the population in the year 2000, to under 15% in 2020. The increasing duty on cigarettes during that period is said to have supported this decline. In 2016, tobacco was said to be 27 per cent less affordable than it was in 2006.

Those supporting an ongoing increase in tobacco tax point to the dangers involved in smoking.

Cigarette consumption continues to be the leading cause of preventable deaths in the UK. In 2015, 16% of all deaths in people aged 35 or over in England were estimated to be attributable to smoking. Public Health England further estimate that 474,000 hospital admissions a year in England are directly attributable to a tobacco product, a figure which represents 4% of all hospital admissions.

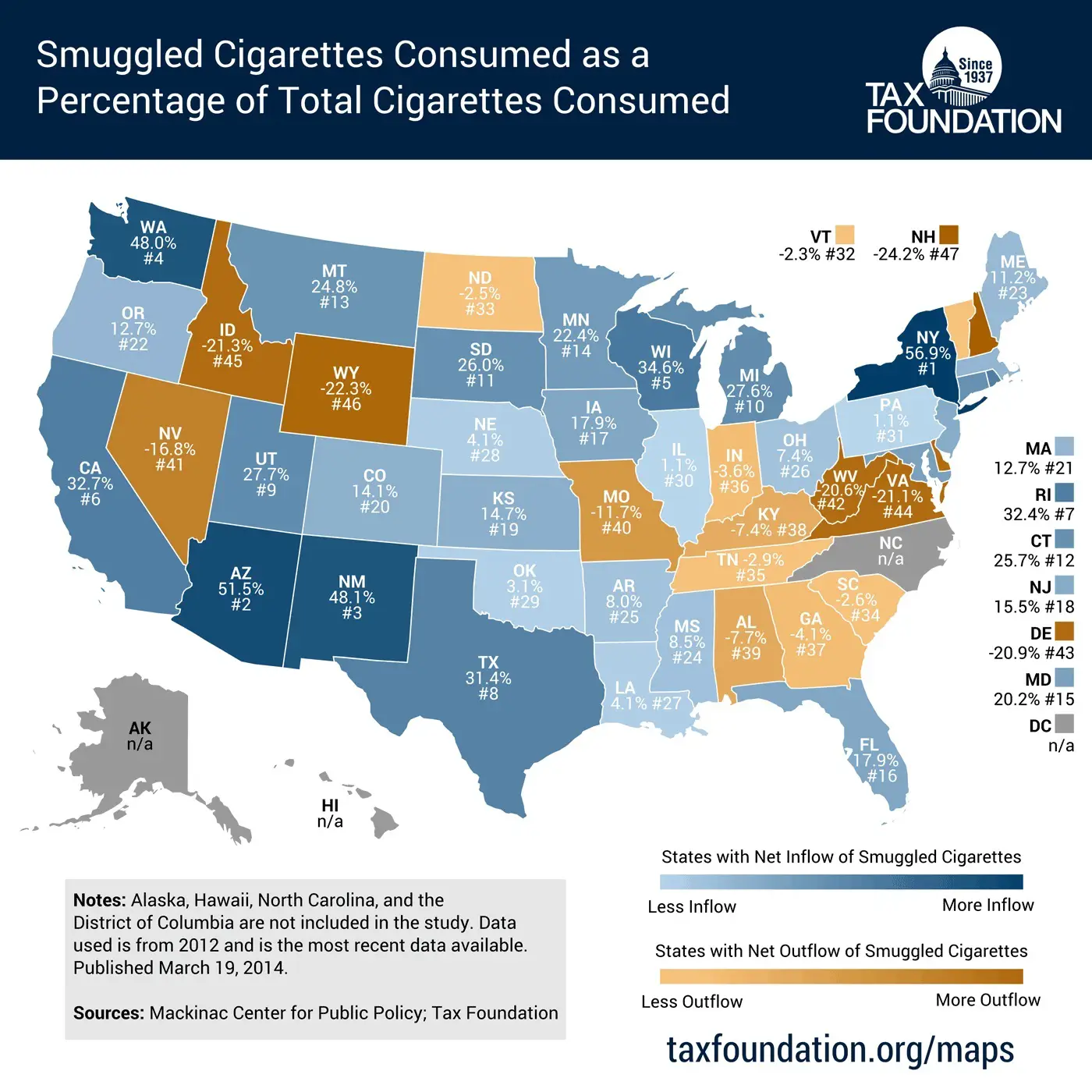

Problems with cigarette smugglingThose critical of the current rates of duty levied on cigarettes in recent years point to the problems it creates with smuggling.

Read Also: How To Find Federal Income Tax

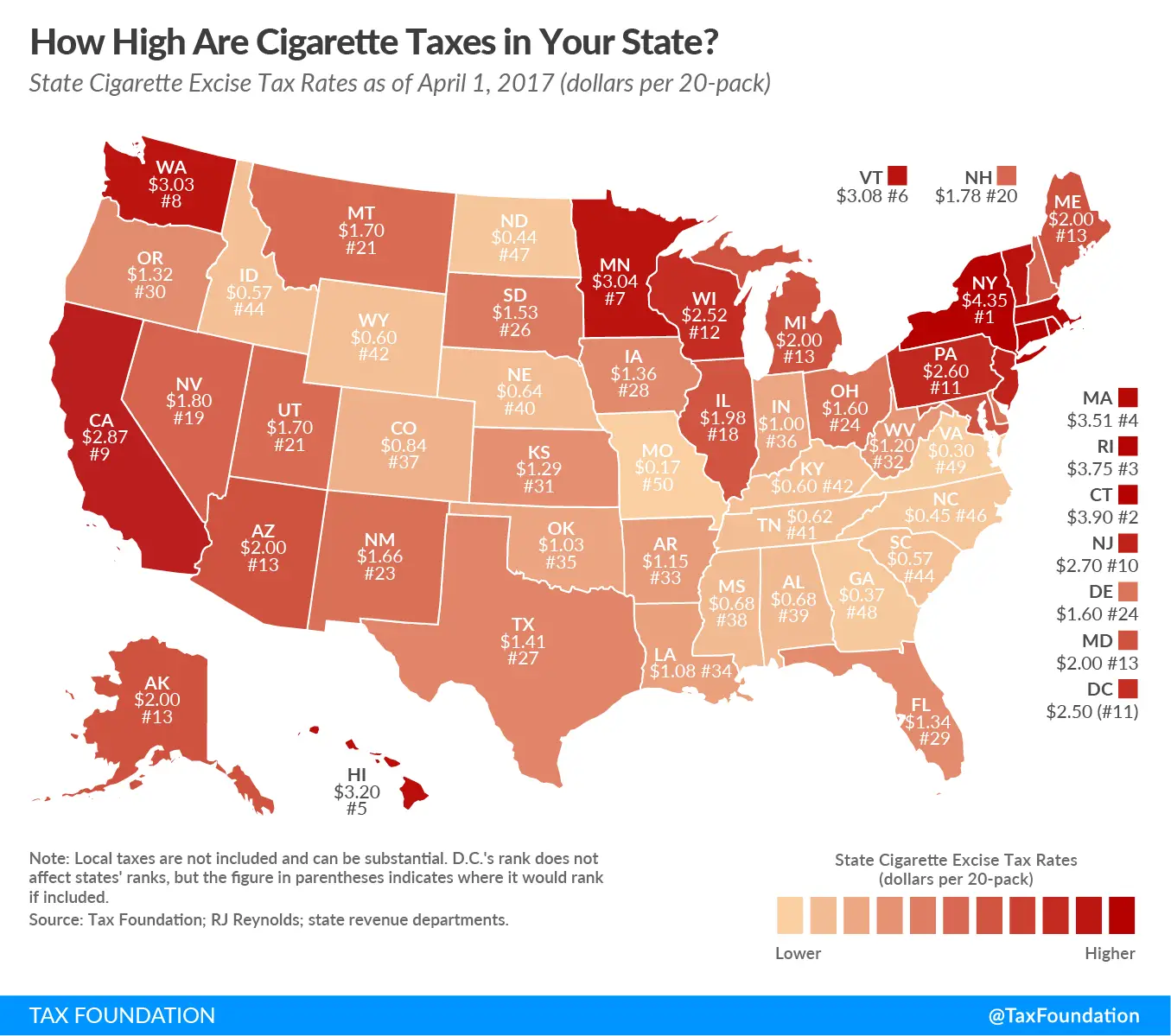

Cigarette Tax Rates By Jurisdiction

The following table lists American state and territory tax rates :

| Excise tax per pack | State or territory |

|---|---|

| U.S. Virgin Islands |

The above table does not include the federal excise tax on cigarettes of $1.01 per pack, cigarette taxes levied by individual municipalities , or sales taxes levied in addition to the retail price and excise taxes.

Cigarette Stamp Validator And Schedule Ct

Cigarette stamp validators

Cigarette stamp validators allow licensed retailers to:

- Determine if the stamps in their inventory are authentic and

- Enables them to take part in the revenue enforcement process.

Visit the Form10Group to purchase a validator.

To learn more visit Cigarette Stamp Validator Information.

Schedule CT-NPM for stampers

Stampers are authorized by DOR’s Commissioner.

All Stampers are required to file a Schedule CT-NPM within 20 days of the close of each reporting month. Learn more.

Any questions regarding Schedule CT-NPM should be addressed to:

Cigarette and Tobacco UnitEmail:

Also Check: How Long Should Tax Records Be Kept

Higher Tobacco Taxes Can Improve Health And Raise Revenue

Chuck Marr and Chye-Ching Huang

The Presidents proposal to raise the federal excise tax on tobacco products and use the additional revenue to expand preschool education, which he included in both his fiscal year 2014 and 2015 budgets, could achieve the dual goals of reducing the number of premature deaths due to smoking and raising an estimated $78 billion over ten years to finance early childhood education.

Tobacco taxes are a proven strategy to reduce smoking, particularly among teenagers and low-income people. Given the high health costs of tobacco use, reducing smoking rates would lead to substantial health gains. Moreover, youth and lower-income people would benefit disproportionately from improved health, partially offsetting the regressivity of tobacco taxes, and lower-income children and families would be the primary beneficiaries of the expanded availability of early childhood education that these tax revenues would finance.

Product Transfers Retailers With Multiple Locations

Generally, the sale or transfer of cigarettes and tobacco products between retailers is not permitted. However, if a retailer owns more than one store and the retailer’s licenses are held by the same legal entity, that retailer may be allowed to transfer cigarettes or tobacco products between stores belonging to the same legal entity so long as transfer logs are maintained.

Transfer logs must be prepared at the time of transfer. Transfer logs created or provided after an inspection are not acceptable. Legible transfer logs and copies of purchase invoices must be kept at each of the retailer’s locations involved in the transfer. Transfer logs must include:

- The transferring retailer’s address and license number where the original purchase was made.

- The receiving retailer’s address and license number where the product was transferred.

- The supplier’s name, license number, purchase invoice number, and date of original purchase.

- A detailed description of each product transferred .

- The quantity of each product transferred.

These retailer’s product transfer requirements do not apply to tobacco products that are not subject to the tobacco products tax. For example, vape liquids that do not contain any nicotine are not subject to these requirements however, they are subject to retail licensing.

Sample Retailer’s Transfer Log

Also Check: How To File Previous Years Taxes For Free

What Is The Cigarette Tax

It is a tax on the sale, use, consumption, handling, possession, or distribution of cigarettes in Washington.

Washington consumers who purchase cigarettes outside Washington State, or from some other source without paying Washington taxes, must pay both the cigarette tax and the use tax directly to the Department of Revenue.

License Requirement For Retailers Of Electronic Nicotine Delivery Systems

Electronic cigarettes, personal vaporizers, eCigars, eHookahs, ePipes, and vaping devices are some of the terms used to describe electronic nicotine delivery systems . Generally, these ENDS heat a liquid solution or eLiquid, which typically, but not always, contains nicotine as well as varying flavorings and other ingredients, to create a vapor that the user inhales.

The ENDS that do not contain nicotine or are not sold in a kit that contains nicotine, are considered tobacco products for retail licensing purposes, but not for tax purposes. Thus, the sale of ENDS that do not contain nicotine or are not sold with nicotine are not subject to the California excise tax on tobacco products. However, a California Cigarette and Tobacco Products Retailer’s License is required if you sell ENDS that do not contain nicotine or are not sold with nicotine to a consumer in California. A distributor or wholesaler does not need to be licensed under the California Cigarette and Tobacco Products Licensing Act of 2003 to sell ENDS that do not contain nicotine or are not sold with nicotine to a retailer.

Important Note: The California Cigarette and Tobacco Products Licensing Act does not apply to cannabis or other cannabis products such as cannabis vape pens or accessories. In addition, cigarette and tobacco products may not be sold at the same location that is licensed as a cannabis business.

Don’t Miss: How The Wealthy Avoid Taxes

What Is Vape & E

Revenues collected from vape and e-cigarette taxes are used for a variety of purposes depending on the jurisdiction.

Some states dedicate a portion of tax revenues to smoking cessation programs and health care. For many the revenue ends up in the general fund.

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Read next:

A Tobacco Products Retailer May Also Need To Register As A Tobacco Products Manufacturer

A tobacco product manufacturer is:

- Any person, including any repacker or relabeler, who manufactures, fabricates, assembles, mixes, blends, combines, processes, or labels a finished tobacco product.

- An owner of a brand or formula for a tobacco product who contracts with another person to complete the fabrication and assembly of the product to the owner’s standard.

- A retailer who mixes, blends, or combines a tobacco product that is not in a form suitable for human consumption, such as liquid nicotine, with other ingredients or components to make a tobacco product that is suitable for human consumption.

A tobacco products retailer is not a tobacco product manufacturer solely because:

- A retailer packages liquid nicotine with other items as one unit.

- A retailer packages finished tobacco products, such as cigars, together as one unit.

- A retailer allows its customers to mix, blend, or combine liquid nicotine and other components after a sale has been made.

- A retailer mixes, blends, or combines finished tobacco products, such as pipe tobacco.

A tobacco products retailer who is a tobacco product manufacturer must also register as a tobacco products distributor. A tobacco products retailer who is not licensed as a tobacco products manufacturer, importer, or distributor must purchase its tobacco products from a licensed tobacco products distributor or wholesaler.

For more information about manufacturers, see our Manufacturer & Importer section.

Recommended Reading: When Can We File Taxes 2021

Taxes As A Proportion Of Cigarette Prices

While the price of cigarettes has continuously increased since 1965, the percentage of that price going towards taxes is now half of what it was then. As of 2011, Phillip Morris lists total government revenue, including federal, state, local, and sales taxes, as 55% of the estimated retail price of a pack of cigarettes in the US.

According to data from the World Health Organization on cigarette taxes around the world, the US is ranked 36th out of the 50 most populous countries in terms of the percent of cigarette pack costs from taxes. Their data estimates that taxes make up 42.5% of the cost of a pack of cigarettes in the US, compared to 82.2% in the United Kingdom, which has the highest cigarette taxes.

Which State Has The Highest Tax Rate

The jurisdiction with the highest tax rate on cigarettes is currently the District of Columbia at $5.01 for a pack of 20. New York and Connecticut are tied for second at $4.35/20-pack.

Comparing tax rates for other tobacco products is difficult as some states levy a per-unit rate and others take a percentage of wholesale or manufacturer prices.

Vermont has one of the highest rates for cigars at 92% of the wholesale price or up to $4.00 a cigar, depending on the cigars category.

One of the highest tax rates for moist snuff is Massachusetts at 210% of the manufacturers sale price. Connecticut is right up there at $3.00/oz. for snuff.

Also Check: What Is Tax In Texas

Exemptions To Stamping Requirement

All packs of cigarettes must be stamped prior to shipping them to either other wholesaler distributors or retail outlets. There are 3 exceptions to the stamping requirement.

- Cigarettes sold to a dealer for resale in another state, provided the cigarettes are stamped with the other states revenue stamps

- Cigarettes sold to the United States government or any instrumentality thereof for resale to members of the armed forces

- Cigarettes sold to commercial ships for sale or consumption on those ships.

Effects Of Increased Cannabis Sales

The results from the study highlight several important topics that come up in conversations regarding . Not only do legalized states make significant revenue from cannabis sales, but the data also points toward the decreased consumption of substances, including alcohol and cigarettes.

Another study out of Florida made some interesting findings about the effects of medical marijuana. According to medical marijuana patients, they are far less likely to use opioids for pain management. Other respondents indicated that medical cannabis relieved symptoms of other diseases like PTSD, chronic pain, and anxiety.

However, states with legalization have also seen an increase in car accidents. Canada was the second country to legalize marijuana fully, and this trend is also apparent across the border. Car insurance rates in Canada have increased due to legalization and a lack of understanding of how driving under the influence should affect the rates of medical marijuana patients. Evidence suggests that as law enforcement evolves to account for marijuana users driving under the influence, car insurance rates will level out.

Don’t Miss: What Day Can You File Taxes 2021

Pact Act Requirements With Other States Localities Or Indian Country Shipped In Interstate Commerce Out Of California

Any person engaged in the activities described below must register and file reports with the ATF and with the other state tobacco tax administrators, localities, or Indian country.

Any person who sells, transfers, or ships for profit cigarettes, roll-your-own/smokeless tobacco, or ENDS in interstate commerce in which such products are shipped out of California into a state, locality, or Indian country of an Indian tribe taxing the sale or use of such products, or who advertises or offers such products for such a sale, transfer, or shipment, must contact the state, locality, or Indian country of an Indian tribe receiving the cigarettes, roll-your-own/smokeless tobacco, or ENDS to register and file monthly PACT Act reports with them and also for your state, local, or tribal tax reporting requirements and responsibilities.

Pact Act Reporting Requirements

Monthly PACT Act reports must be filed with us .

Due Date not later than the 10th day of each calendar month for each and every shipment made into California during the previous calendar month.

File Online Go paperless! File your PACT Act reports online with us. Below are some resources to help you file online:

- CDTFA-5204-PA, California PACT Act Report Online Filing Template when completing your PACT Act reports for California, you may upload your information using our Excel file template for filing periods August 2019 and after.

Don’t Miss: How Do I Get My Past Tax Records

Limitations Of Tobacco Tax/cigarette Taxes

The World Health Organization admits that, on average, a 10% increase in price of tobacco products would account for only a 4 to 5% drop in cigarette demand. These estimates may be generous, and most independent research finds much smaller effects. The Center for Tobacco Control Research and Education, for example, points out that cigarette taxes are among the least effective means to reduce smoking.

Since smoking is an addictive habit, increasing the price of tobacco products does little to curb the number of sales made. Instead, most tobacco consumers simply pay the higher price and continue smoking.

This often results in a large revenue windfall for the taxing authorityor for organized crime groups that smuggle in untaxed productsbut a comparatively small effect on actually reducing tobacco consumption. In some cases, this may even create incentives for governments to at least tolerateif not encouragetobacco use, as it becomes a major cash cow for general spending budgets.