State Tax Rates And Rules For Income Sales Property Fuel Cigarette And Other Taxes That Impact Georgia Residents

Retirees: Tax-Friendly

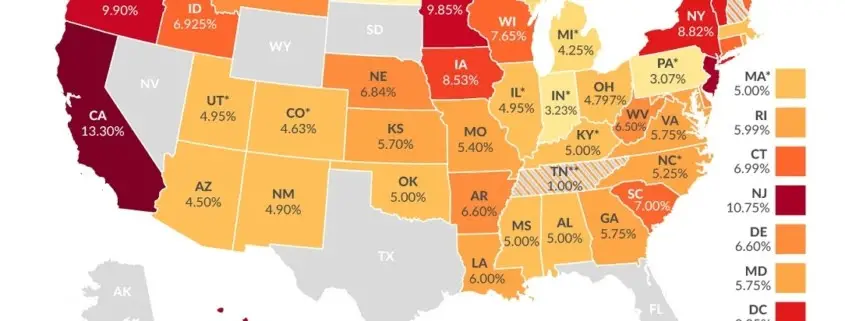

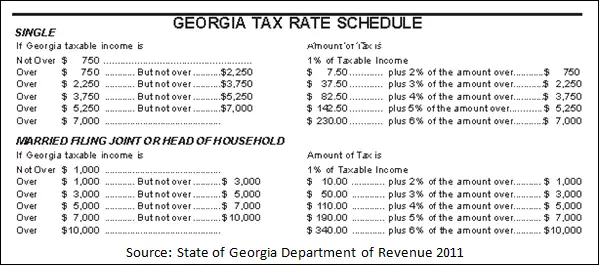

Georgia’s “tax-friendliness” often depends on where you are in life at least when it comes to income taxes. Most middle-class families find themselves paying the state’s top marginal income tax rate of 5.75%, which kicks in at just $10,000 of taxable income for married couples filing jointly or $7,000 for individual filers . On the other hand, retirees find the state more agreeable, thanks to generous tax breaks for retirement income.

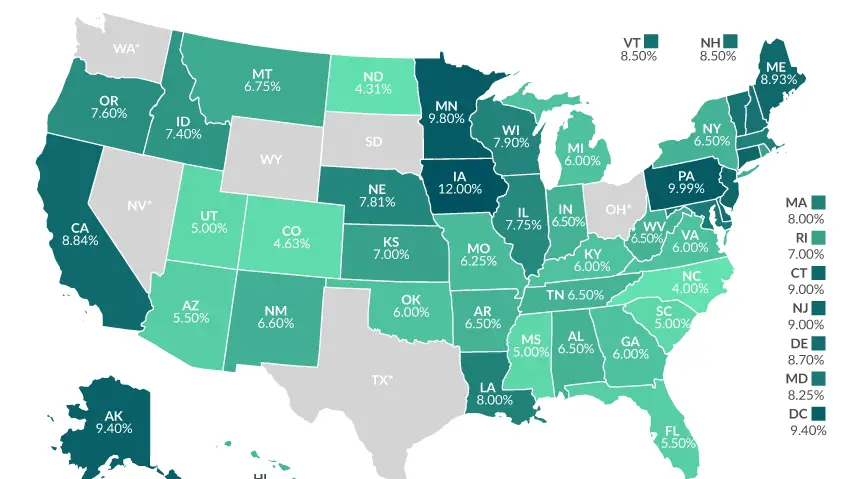

The Peach State’s sales tax rates lean high , and in some areas, groceries are taxed as well.

Property taxes are middle-of-the-road, though. Plus, there are no estate or inheritance taxes to worry about.

Georgia Property Tax Rates

Property tax rates in Georgia can be described in mills, which are equal to $1 of taxes for every $1,000 in assessed value. In most counties, taxes for schools are the largest source of property taxes. They are typically between 15 and 20 mills.

Because millage rates apply to assessed value, which varies depending on the assessment ratio and the local exemptions offered, it can be difficult to compare millage rates between two locations. For an apples-to-apples comparison, it’s useful to look at effective property tax rates. These are the median property taxes paid as a percentage of median home value. They give a good idea as to how much a new homeowner can expect to pay in property taxes.

The table below shows the average effective property tax rate, median annual real estate tax payment and median home value for every county in Georgia.

| County |

|---|

Looking to calculate your potential monthly mortgage payment? Check out our mortgage calculator.

Atlanta Georgia Sales Tax Rate

atlanta Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Atlanta, Georgia?

The minimum combined 2022 sales tax rate for Atlanta, Georgia is . This is the total of state, county and city sales tax rates. The Georgia sales tax rate is currently %. The County sales tax rate is %. The Atlanta sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Georgia?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Georgia, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Atlanta?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Atlanta. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Georgia and beyond. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

Recommended Reading: How To Claim Stock Losses On Taxes

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

How Do I File Georgia Sales And Use Tax Returns

You may file a Georgia sales tax return via paper Form ST-3 or electronically via the Georgia Tax Center or approved software vendors. If you owe more than $500, you will be required to file electronically. If you owe less, you may choose either method. However, if you submit funds via ACH then you must also file your return electronically, regardless of the amount.

You must file a return even if no sales tax is due.

Vendors are allowed to keep a percentage of the tax collected, known as the Vendors Compensation. The deduction consists of 3% of the first $3000 collected, and 0.5% of any amount collected over $3000. For example, if you collected $5000 in taxes, your deduction would be $100. Thats $90 for the first $3000, and $10 for the next $2000. The Vendors Compensation can only be taken for returns that are filed and paid on time.

Read Also: How Do I Find My Taxes

Do I Have To Pay Income Tax In Georgia

You are required to file a Georgia tax return if you receive income from Georgia and you fall into one of the following categories:

- Full-year resident: Your legal residence is in Georgia, even if you are absent from it or live out of state temporarily during the year.

- Part-Year resident: You were a legal resident of Georgia for only a portion of the tax year.

- Nonresident: You didnât live in Georgia but received income from Georgia sources, such as wages, lottery winnings and rent.

Qualified Education Donation Tax Credit

Those who make qualified education donations can claim a credit for them on their Georgia state tax return. The state of Georgia will only allow $5 million in this credit each year and you must request pre-approval electronically before claiming it. This credit is on a first-come, first-serve basisâwhich means youâll want to take action as soon as possible to claim it.

Recommended Reading: How Do I Find My Business Tax Id Number

Georgia Enacts Income Tax Sales Tax Changes

Georgia Gov. Brian Kemp recently approved significant tax legislation making amendments to the states corporate income tax law by allowing affiliated groups to file Georgia consolidated corporate income tax returns and advancing the states Internal Revenue Code conformity date to Jan. 1, 2022. The enacted legislation also implements a flat 5.75% personal income tax rate beginning in the 2024 tax year, with annual phased-in rate reductions planned through 2029. Finally, the legislation extends the sunset date for the sales and use tax exemption related to the purchase of qualified computer equipment by high-technology companies.

Where To Send Your Georgia Tax Return

| Estimated Income Tax Payments |

You can save time and money by electronically filing your Georgia income tax directly with the . Benefits of e-Filing your Georgia tax return include instant submission, error checking, and faster refund response times. Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

Georgia allows all filers, resident and nonresident, to file their Form 500 electronically using the Georgia eFile system. You don’t need to notify Georgia that you’re planning on e-filing directly – your IRS intent to eFile will be sufficient. If you have a simple tax return, you can eFile for free by using one of the companies in Georgia’s Free Fila Alliance to prepare your taxes – details are available on the Department of Revenue’s eFile website.

To e-file your Georgia and Federal income tax returns, you need a piece of tax software that is certified for eFile by the IRS. While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

You May Like: Can I Pay My Personal Taxes From My Business Account

Georgia Tax Id Number

Before you can collect sales tax, you may need to apply for a GA state taxpayer identification number, also referred to as a Georgia Tax ID. You’ll do this by submitting a Form CRF-002, which you can only do online via the Georgia Tax Center digital portal.Check with the Georgia Tax Center to confirm whether you need a Georgia Tax ID.

Tax Policy In Georgia

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

| Tax policy in Georgia |

Georgia generates the bulk of its tax revenue by levying a personal income tax and a sales tax. The state derives its constitutional authority to tax from Article VII of the state constitution.

Tax policy can vary from state to state. States levy taxes to help fund the variety of services provided by state governments. Tax collections comprise approximately 40 percent of the states’ total revenues. The rest comes from non-tax sources, such as intergovernmental aid , lottery revenues and fees. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise taxes and corporate income tax.

HIGHLIGHTS

Don’t Miss: What Is California State Tax Rate

Georgia Sales Tax Penalties And Interest

Sales tax returns are considered late if not complete by the 20th of the month following the end of the sales tax period . For returns that are mailed via US mail, the return must be postmarked by the due date. For electronic payments, the Electronic Funds Transfer must be completed by the due date.

Delinquent returns/payments forfeit the Vendors Compensation amount. In the case of a delinquent filing, the entire tax collected is due.

Late returns, late payments, or partial payments are subject to the following penalties:

- Less than 30 Days Late the greater of 5% or $5.

- 30 Days Late or More the greater of 5% or $5 for each 30-day period during which the payment was late

The penalty for any single violation is not to exceed 25% of the total tax due on the return date.

If a sales tax return is fraudulent or late with willful intent to defraud the state, a penalty of 50% will be assessed.

In addition to penalties, unpaid taxes are also subject to interest. Interest is charged at the annual prime rate plus 3%, and accrues monthly. Interest begins to accrue on the due date, if unpaid.

Keep The Receipts For Your Home Improvements

The cost basis of your home not only includes what you paid to purchase it but all of the improvements youve made over the years. When your cost basis is higher, your exposure to the capital gains tax is lower. Renovations, new windows, new roofs, landscaping, fences, new driveways, air conditioning installs theyre all examples of things that can cut your capital gains tax.

Read Also: Can You Still File Taxes After Deadline

Georgia Lawmakers Pass New Income Tax Cut On 2022 Sessions Final Day

House and Senate leaders agreed to a measure late Monday that would gradually drop the states income tax rate from 5.75% to 4.99%.

The House and Senate passed the measure in the final hour of the 2022 session.

Under a rewritten House Bill 1437, a compromise was reached to lower the rate to 5.49% in 2024, then it would step down until it reaches 4.99% in 2029.

Standard exemptions would rise gradually as well. The standard exemption would eventually go from $2,700 for single filers to $12,000. For married couples filing jointly, it would go from $7,400 to $24,000.

The original House bill would have saved taxpayers $1 billion a year. The new version could save even more, but it would take several years. Danny Kanso, a senior policy analyst for the left-leaning Georgia Budget & Policy Institute think tank, projected it would save taxpayers and cost the state more than $2 billion.

Its simple, its fair and it allows hardworking Georgians to keep more of their money, said House Ways and Means Chairman Shaw Blackmon, R-Bonaire.

Critics of the original House version said 500,000 families would have paid higher taxes under its plan because of other changes it made in tax law, but legislative leaders said the final version aims to ensure nobody would pay higher taxes.

As is mostly the case when lowering tax rates, the biggest beneficiaries would be top income earners. They would pay a smaller percentage on their higher earnings.

Live In The House For At Least Two Years

The two years dont need to be consecutive. Meaning, you can live in the house for a year, relocate for a job for a year, and move back for another year, which will total two years living in the property. If you sell a house that you didnt live in for at least two years, the gains can be taxable. Selling in less than a year is especially expensive because you could be subject to the short-term capital gains tax, which is higher than long-term capital gains tax.

Recommended Reading: What Is The Sales Tax In Arkansas

Sales And Use Tax Changes

Computer equipment sales tax exemption

Georgia Economic Recovery Act

Enacted on May 10, 2022, the Georgia Economic Recovery Act extends the sales and use tax exemption for sales of tickets, fees, or charges for admission to a fine arts performance or exhibition through Dec. 31, 2027.8 The bill also reduces the cap on the aggregate amount of conservation tax credits allowed from $30 million to $4 million per calendar year.9 This provision is effective from June 1, 2022 through Dec. 31, 2026.10

Nonrecurring major sporting event ticket sales tax exemption

Enacted on May 2, 2022, House Bill 1034 expands the existing sales tax exemption for sales of admissions to any nonrecurring major sporting events in Georgia that generate over $50 million in the host locality.11 Specifically, FIFA World Cup matches are added to the definition of a major sporting event, which also include the Super Bowl, professional sports all-star games, or national collegiate tournament semifinal or final games.12 The legislation also extends the sales tax exemption from December 31, 2022 to Dec. 31, 2031.13

Elective consolidated filing election for affiliated corporations

General IRC conformity date advanced to Jan. 1, 2022

Personal income tax rate reduction

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Recommended Reading: Where Is My Federal Income Tax

What Is The Sales Tax Rate In Georgia

Georgia sales tax varies by location. There is a state sales tax as well as local tax in many counties. Georgias statewide sales tax rate is 4%, but local rates typically vary from 7-8% . The city of Atlanta charges a 1.9% local tax rate, for a total rate of 8.9%. Sales tax is due for the retail sale of certain services, and for storage, use, and consumption of all tangible personal property.

Capital Gains Taxes In Georgia

First things first. What are capital gains taxes?

The IRS assesses capital gains taxes on the different between what you pay for an asset and what you sell it for.

For example, if you bought the house for $100,000 and sell it for $175,000, then your capital gains are $75,000. This is what you are going to be taxed on, not the ENTIRE $175,000.

Think ahead when planning for paying taxes.

You arent going to be paying taxes immediately when you sell your home. And the real estate attorneys in Atlanta wont be setting that money aside for you.

Saving the amount of capital gains taxes that you are going to be owing the government will be your responsibility to set aside and save for tax time in April.

If you spend the proceeds before tax season, you could find yourself unable to pay the tax debt. Not being able to pay the IRS the tens of thousands that you owe them will lead to foreclosure in Georgia.

Figure out what taxes you will owe when you sell your home in Georgia.

You May Like: Do You Have To Pay Unemployment Back In Taxes

What Is The Georgia Homestead Exemption

The Georgia homestead exemption is available to every homeowner who occupies his or her home as a primary, permanent residence. It exempts the first $2,000 from the 40% assessed value from property taxes. Seniors age 65 or older may be eligible for a double homestead exemption. To qualify, the applicants total household income, not including Social Security and pension income, cannot exceed $10,000 annually.

Other forms of property tax relief for retirees in Georgia include an exemption of all property value accumulated after the base year in which a senior age 62 or older applies.

So if your home is worth $80,000 when you apply and the value grows to $100,000 the next year, you will only pay property taxes on that first $80,000. If the property value grows to $150,000 over the course of the next seven years, you will still only pay taxes on the first $80,000. To qualify, household income must not exceed $30,000.

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Taxes can really put a dent in your paycheck. But with a Savings or CD account, you can let your money work for you. Check out these deals below:

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Read Also: Has Anyone Received Tax Refund 2021