Getting A Tax Id Number

Online submission is the fastest and preferred way to request a tax ID number. This service is available for all businesses whose main office or legal residence is within the U.S.

If submitted online during business hours, you will typically receive your tax ID number within one business day. If you are unable to submit the request online, you can also:

- Download the IRS Form SS-4 and mail or fax it to the IRS

- Complete the form directly on the IRS website

Social Security Number For Business

A tax id number is a mandatory requirement for a US based business as well as those individuals who have an income in the US. The Social Security number is a nine digit unique number that is normally issued to all citizens of the US as well as permanent and temporary residents. The Social Security number is considered to be a de facto identification number and is listed on individual income tax returns. Although it is issued primarily to individuals, there are specific exceptions as well. For example, certain businesses can use it as a tax ID.

If You Want To Learn More About Getting Your Financial Ducks In A Row Get Your Get Legit Checklist For Free Here

All information on this site is provided for general education purposes only and may not reflect changes in federal or state laws. It is not intended to be relied upon as legal, accounting, or tax advice. We strongly encourage you to always consult with a tax or accounting professional about your specific situation before taking any action. Please read our full disclaimer regarding this topic.

SaveSave

Don’t Miss: Tax Deductions Doordash

Ssn Where Can I Get It

In order to get an SSN, youll need to fill out an application form. This form is known as SS-5, and can be found at the SSAs forms page online. As well as this form, you should prepare to submit proof of identity, age, and U.S. citizenship or lawful alien status. If you need further information, you can read this article on applying for a personal taxpayer identification number.

Your Companys Ein And Business Identity Theft Issues

Its easy for someone to get your business EIN, and they might be able to use it to steal your business identity. The IRS recognizes that a companys EIN may be the target of hackers and identity thieves. It suggests some ways to be watchful for identity theft related to taxes. Your business may have been hacked if:

- You receive tax notices about fictitious employees

- Your business tax return is accepted, but you havent file for that year yet

- You receive bills for a line of credit or a credit card that you dont have

The best way to check for business identity theft is to get a copy of your business credit report. Check it in detail for unexplained creditors and inaccurate or out-of-date information.

Recommended Reading: Doordash Pay Calculator

Frequently Asked Questions: Ein Number Lookup

Do I need an EIN if Im self-employed?

You dont need an EIN if youre self-employed you can simply use your Social Security number. Some people who are self-employed choose to apply for an EIN instead of using their Social Security number to reduce the risk of identity theft its less likely for someone to break into your accounts when you keep business finances and personal finances separate.

I have a sole proprietorship with a DBA . Do I Need an EIN?

Having a DBA doesnt impact whether or not you are required to have an EIN for your sole proprietorship. The same rules apply to a sole proprietorship with a DBA as apply to a sole proprietorship without a DBA.

Per the IRS, A sole proprietor without employees and who doesnt file any excise or pension plan tax returns doesnt need an EIN. Once you hire employees or file excise or pension plan tax returns, you will immediately require an EIN.

Is there a difference between an EIN and a TIN?

No, there isn’t a difference between an Employer Identification Number and a Taxpayer Identification Number . Both refer to the nine-digit number issued by the IRS to identify your business.

Is there a difference between an EIN and a FEIN?

No, there is not a difference between an EIN and a Federal Employer Identification Number . A FEIN can also be referred to as a Federal Tax Identification Number.

What Is A Federal Tax Id

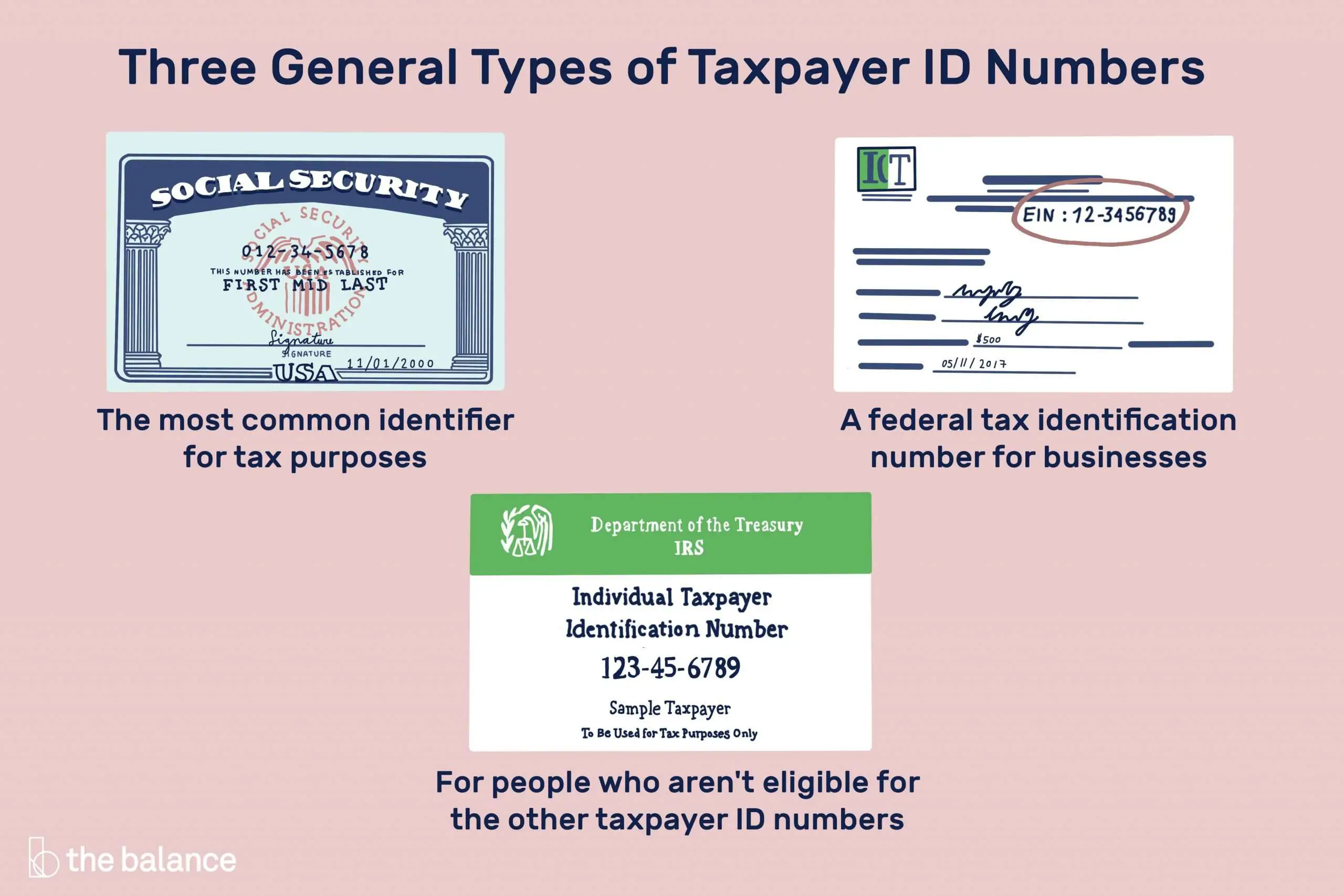

A federal tax ID or taxpayer ID is a number used to identify individuals, businesses, and other legal entities for tax purposes pursuant to the Internal Revenue Code and specific tax laws that affect different types of legal entities.

The most common type of tax ID is a Social Security Number , followed by whats called an Employer Identification Number or EIN. If youre planning to start a business, the latter of these two types of federal tax IDs will be relevant to you and your business.

Also Check: How To Report Plasma Donation On Taxes

Federal Tax Id Number Versus Ein

In short, a federal tax ID is the same as an EIN. As is often the case in business, though, youll hear several acronyms that all reflect the same concept. These acronyms can be confusing, but here is a clear breakdown of what each refers to and how they differ.

- The federal tax ID number is also known as the TIN.

- Another acronym for the federal tax ID number is the EIN, which stands for Employer Identification Number. An EIN must come from the IRS in order to be a federal tax ID number, and it is used to identify a business entity.

- An EIN may also be called a FEIN .

Obtain Federal Tax Id Number

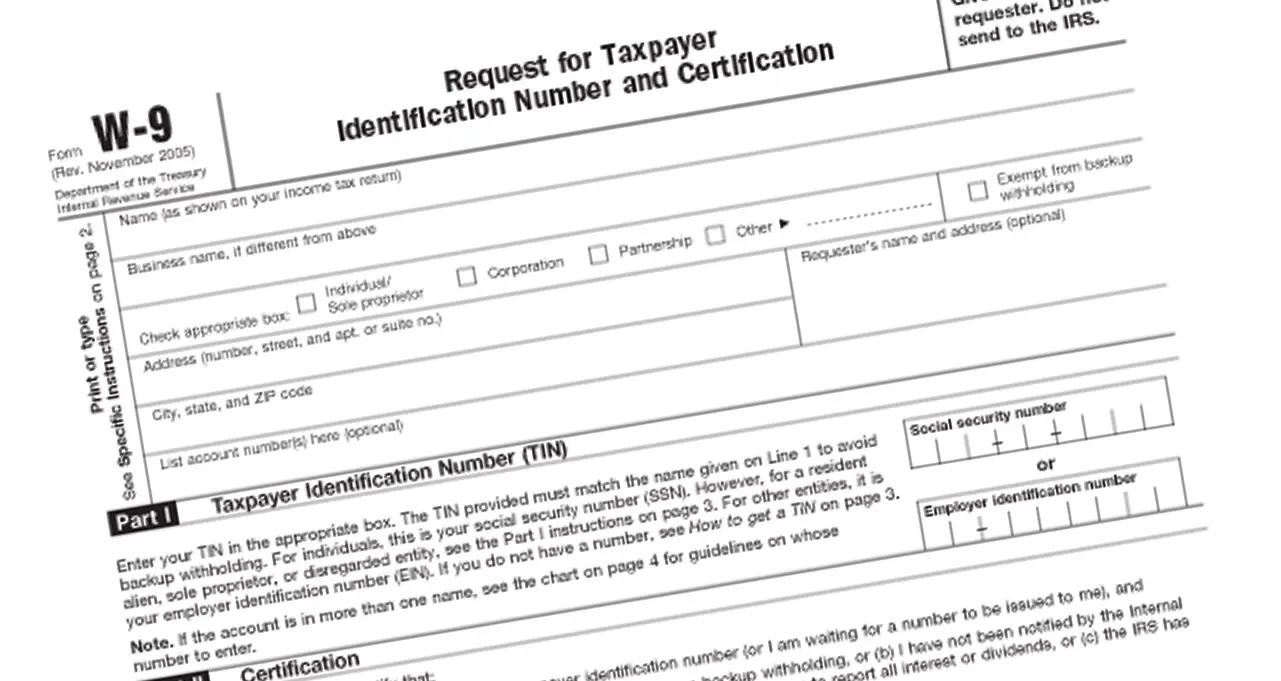

Your Employer Identification Number is a nine-digit number issued by the IRS to identify your business and the type of tax returns you file. It is to be used for business purposes only. You should never use your social security number in its place.

An EIN is generally required for all businesses and it is used for all transactions and correspondence with the IRS and Social Security Administration . Download Understanding Your EIN for a complete guide to how your tax ID number works.

Also Check: Efstatus Taxactcom

Claiming Reduced Withholding On A Tax Return

- A foreign person who has an ITIN and is claiming credit for FIRPTA withholding shown on Form 8288-A must complete a federal tax return using the ITIN assigned, and attach the date stamped Form 8288-A to the return as evidence of FIRPTA withholding.

- A foreign person who does not have a TIN and wishes to claim a credit for FIRPTA must request an ITIN. To request an ITIN the foreign person must send the following items to Internal Revenue Service, Austin Service Center, ITIN Operation, P.O. Box 149342, Austin TX 78714-9342:

Tin Search: Finding Your Tin Number

If youre a Canadian business owner looking for your TIN number, weve got good news: its easy to find.

For individual residents of Canada , your TIN number is your nine-digit SIN.

So long as you know your SIN, youre good to go!

However, for corporations , your TIN is your nine-digit Business Number issued by the Canada Revenue Agency .

So, lets talk about how to find your BN.

You May Like: Doordash Taxes 2021

What Can Business Owners Use Ssns For

A tax identification number is used for filing tax returns and exists in different forms. A Social Security number is a type of tax ID number just like an Employer Identification Number is, the difference being the former is for individuals and the latter for businesses. Does this mean businesses dont require SSN? Some businesses do and they are mostly categorized as self employed businesses.

A business owner of such an entity can use SSN to fulfill several purposes like:

- Filing of income tax return using SSN as a tax ID number

- Acquiring business credit including a business credit card

- Facilitating the opening of a bank account

- Applying for a loan for the business

- Ensurimg Social Security benefit is available on retirement

What Do I Need A Tin For

Once you know what your TIN is, you may be wondering when and why youll need it. You as a taxpayer will need to provide your TIN on all tax returns and other documents sent to the IRS. Even if you do not have a number issued to you by the IRS, your SSN must be on forms submitted to it. You have to provide your taxpayer identification number to others who use the identification number on any returns or documents that are sent to the IRS this is especially the case for business transactions that may be subject to Reverse-Charge procedures. This may also be the case when you are interacting with a bank as an entity.

Aside from using your EIN for tax returns and business to business transactions also known as B2B youll need to keep your SSN in mind for other purposes too. As well as for personal tax returns, your Social Security number is vital in daily life, because without it you wont be able to get a job or collect Social Security benefits if necessary. It is also a confidential piece of identity information, so avoid just telling anyone what it is. Keep it safe with other important documents.

Click here for important legal disclaimers.

- 06.12.19

Recommended Reading: Does Doordash Give You A 1099

How Does An Ssn Differ From A Tax Id

A social security number is a tax code used by an individual, while a tax ID is a nine-digit tax code for a business entity. For a business entity, a tax ID is usually called an EIN. Just like an individual uses their social security number to uniquely identify themselves on their tax paperwork, a business entity uses it in the same way. It is a unique way for a business to be identified by the IRS on their tax forms.

To file taxes as a business instead of an individual, a tax ID is required. A tax ID number is necessary for tax forms and when business owners open a business account through a bank. Sometimes, suppliers and customers also need it to create an account with the business.

Small business owner are sometimes unsure if they need a tax ID number. Almost all businesses need a tax ID number. Also, if a small business is associated with certain organizations, it may be required to apply for a tax ID. Here are some examples of those associated organizations:

- Non-profits

- Farmers cooperatives

- Certain types of trusts

However, not every business entity needs a tax ID number. An exception is a sole proprietor with no employees and no plans to hire employees. In this case, the sole proprietor can use their own personal social security number as a tax identification number because the person and the business are the same. Sole proprietors who do plan on hiring employees or have already hired employees are required to have a tax ID number, however.

How The Internal Revenue Service Works

Headquartered in Washington, D.C., the IRS services the taxation of all American individuals and companies. For fiscal year 2020 , it processed more than 240 million income tax returns and other forms. During that period, the IRS collected more than $3.5 trillion in revenue and issued more than $736 billion in tax refunds .

Individuals and corporations have the option to file income tax returns electronically, thanks to computer technology, software programs, and secure internet connections. The number of income tax returns that use e-file has grown steadily since the IRS began the program, and the overwhelming majority are now filed this way. During FY 2020, nearly 94.3% of all individual returns made use of the e-file option. By comparison, only about 40 million out of nearly 131 million returns, or nearly 31%, used it in 2001.

As of October 2021, just over 112 million taxpayers received their refunds through direct deposit rather than by a traditional paper check, and the average direct-deposited amount was $2,851.

Although the IRS recommends filing tax returns electronically, it does not endorse any particular platform or filing software.

Also Check: How To File Doordash Taxes

Where Can I Find My Tax Id

Did you lose the letter from the Federal Central Tax Office stating your tax ID? No worries it can also be found on your pay slip , your income tax statement , or on your last tax assessment notice .

You can also request your tax ID from Federal Central Tax Office using this form. The processing time lasts up to four weeks and in some cases, the information can take a bit longer than that.

Getting Irs Help To Look Up Your Ein

You can ask the IRS to search for your EIN by calling the Business and Specialty Tax Line at 800-829-4933. This department is open from 7 a.m. to 7 p.m. local time, Monday through Friday.

Only the authorized person for your business can obtain this information. The IRS will ask for your identification, and you must be able to prove your identity as a sole proprietor, a partner in a partnership, an LLC owner, or a corporate officer.

Also Check: Is A Raffle Ticket Tax Deductible

When Do I Need To Change My Fein

Once you’ve received your FEIN, you do not have to change your FEIN unless under special circumstances as deemed by the IRS.

If your business is a corporation, you’ll be required to change your FEIN if:

- Your business changes to a sole proprietorship or a partnership.

- A new corporation is created through a merger.

- Your business becomes subsidiary to another corporation.

If your business is a partnership, you’ll be required to change your FEIN if:

- The business changes to a sole proprietorship.

- Your business becomes a corporation.

- A new partnership is formed over an old one.

If you have a FEIN as a sole proprietor or an LLC, you’ll be required to change your FEIN if:

- You’re in bankruptcy proceedings.

Finding The Employer Id

If you’re looking for the EIN of a business, there are several places to search.

Hire the top business lawyers and save up to 60% on legal fees

Don’t Miss: Do I File Taxes For Doordash

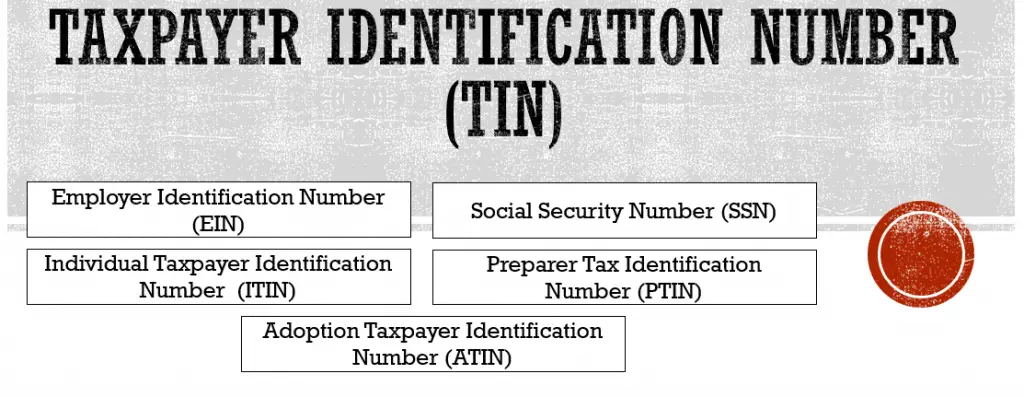

What Is A Tin Number

The tax identification number, known as a TIN, identifies your business to the IRS. Its a unique nine-digit number. To complete your tax returns or communicate with the IRS, youll need a federal tax ID number.

With the exception of social security numbers , the IRS issues all tax ID numbers. The Social Security Administration is the entity that issues SSNs. Non-U.S. taxpayers must obtain a foreign tax ID number. The country of origin issues this number to the individual.

How To Find Your Bn

Finding your BN is, fortunately, super easy and relatively straightforward.

To find your BN, use Canadas official Business Registration Online service:

Its used for not only registering for a BN if you dont already have one, but can be used to find your existing BN number.

If for some reason you cant get into the BRO service, contact Canadas official government website here.

Don’t Miss: Is Plasma Donation Taxable

Is My Ssn My Tax Id Number

For most individual taxpayers, your main tax ID is your Social Security number, but businesses often have separate employer identification numbers. Some people ineligible for Social Security numbers have numbers called Individual Taxpayer Identification Numbers, and states can issue their own tax IDs.

Your Tax Id Helps You Move Through The World Of Business Learn How It Differs From A Corporate Number And Other Id Numbers

- Tax ID comprises five different types of numbers, including Social Security numbers and employer identification numbers.

- You need tax ID numbers in order to file tax returns and pay your taxes.

- You can find or apply for most types of tax ID numbers through the IRS, SSNs being a notable exception.

- This article is for business owners looking for the proper type of tax identification number to operate their business and comply with tax payment requirements.

Tax identification numbers and corporate numbers are similar concepts with some important distinctions. A tax ID number is used to identify different kinds of taxpayers, while a corporate number is used by limited liability companies or other corporations. Understanding the differences between the types of identification numbers makes filing taxes easier, so keep reading to learn the different kinds of ID numbers you might need to operate your business.

What is a tax ID number? A tax identification number, or TIN, is an ID number the IRS uses to administer tax laws. The purpose is to assign a number to each taxpayer, whether thats an individual or a business. Each persons or businesss number is unique to them, which makes it easy for the government to track.

This number is assigned by the IRS and used by businesses to file tax returns, pay taxes and secure approval to conduct other business operations. When you first start a business, you apply for a taxpayer ID number through the IRS.

Also Check: Door Dash 1099