Property Tax Exemptions For Older Adults

In many states, home and property owners above a certain age can receive a property tax exemption. The specific details regarding the cutoff age and other eligibility requirements, such as Social Security status, may also play a part. Furthermore, there may be some additional requirements or other criteria. This kind of exemption could be a lifesaver for many older adults because 4.9 million Americans ages 65 and older were living in poverty as recently as 2019.

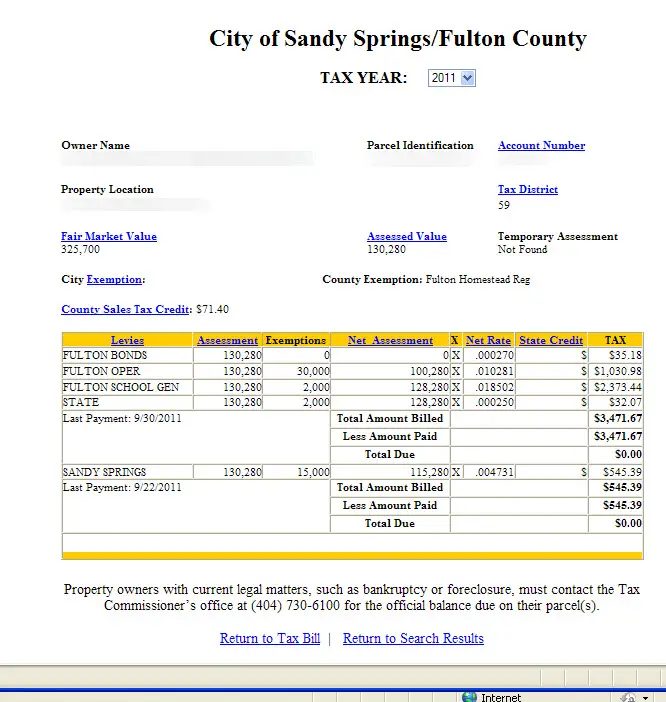

Apply Your Municipalitys Millage Rate

Youll typically see property taxes noted as millage rates. A mill rate is a tax you pay per $1,000 of your homes value. For every $0.001 mill rate, youll pay $1 for every $1,000 in home value.

It sounds complicated, but heres a simple formula. Find out your countys mill rate and divide it by 1,000. Next, multiply your homes assessed value by the mill rate, and thats your property tax liability.

For example, if your area’s mill rate is 8.5 and your homes assessed value is $200,000, youd do the following.

8.5/1000 = $0.0085

Example Of A Property Tax Calculation

The tax rate for a property is determined by how many city and school districts a property lies within, and adding together the rates applied by each. This aggregate rate is referred to as the mill levy. Generally, every city, county, and school district has the power to levy taxes against the properties within its boundaries. Each entity calculates its required mill levy, and they are then tallied together to calculate the total mill levy.

The mill levy is the total tax rate levied on your property value, with one mill representing one-tenth of one cent. So, for $1,000 of assessed property value, one mill would be equal to $1.

For example, suppose the total assessed property value in a county is $100 million, and the county decides it needs $1 million in tax revenues to run its necessary operations. The mill levy would be $1 million divided by $100 million, which equals 1%. Or, if the city and the school district calculated a mill levy of 0.5% and 3%, respectively, the total mill levy for the region would be 4.5% or 45 mills.

To calculate a tax bill, two further steps are required. First, a propertys value is assessed via one of the methods described below. Then, the value is multiplied by the assessment rate, which varies by jurisdiction and represents the percentage of a property on which taxes are due.

Read Also: What Is The Tax Rate On Social Security

Appeal The Assessed Value

There are two main ways to pay property taxes. Your mortgage lender can wrap your property tax payment in your monthly mortgage bill, then pay the tax on your behalf when its due. Or, you can pay the tax directly to your local government typically once a quarter.

In both cases, your local tax assessor should send you a statement that explains how they calculated your tax bill. You wont be able to appeal the tax rate, which is usually set at the county level, but you can appeal the assessed value of your home if you feel its incorrect.

Contact your local tax office. Ask how you can appeal your tax bill and request a copy of your propertys current assessment. Youll usually submit a form, but every city or county has a different system for filing an appeal.

Go over your homes assessment. Read through the document and look for areas in which you think mistakes were made, said Tendayi Kapfidze, Lending Trees chief economist. For example, if youre told your lot size is 10,000 square feet, and you can prove its only 8,000, you might be able to get the assessed value of your home lowered.

Order an appraisal. Tax assessors may rely on historical data to come up with your assessed value, Kapfidze said, but a private appraiser can provide a much more detailed examination of your home. Depending on what the appraiser says about the value of your home, you can use their findings to appeal how much money the government says you owe,” he noted.

Whats On The Table Now

With campaign season comes new promises to cut property taxes.

Abbott has touted a taxpayer bill of rights that includes proposals to further reduce school property tax rates, make property appraisals more transparent and limit local governments from taking on new debt without voter approval.

On Wednesday, ORourke put forth a set of ideas to reduce Texans property tax burden. That would include making sure that the state picks up 50% of the tab for public schools, expanding Medicaid to ease the property tax bill for publicly funded hospitals, plus legalizing marijuana and taxing its sale. He also floated the idea of legalizing casino gambling and sports betting as a way of generating more tax revenue.

Texas voters will have the opportunity to cut their own taxes at the May ballot box. On the ballot is a measure to raise the states homestead exemption from $25,000 to $40,000 for school district property taxes. The average homeowner would see about $176 in savings on their annual property tax bill, according to Republican state Sen. Paul Bettencourt of Houston, the proposals author.

Whether state lawmakers will be able to use federal stimulus funds to pay for property tax cuts hasnt been settled. The $3 billion comes out of the American Rescue Plan Act, the $1.9 trillion stimulus bill aimed at pandemic relief, which prohibits the use of stimulus funds for tax cuts.

Craymer, the TTARA president, is dismissive of that.

Read Also: How To File Va State Tax Extension

Indiana Offers Property Tax Exemption For Seniors

If you are 65 or older and own the property where taxes are owed, you may be able to purchase and continue to benefit from the exemption. If you are 65 years old or older and are unable to pay your taxes on time, you may be able to negotiate a payment plan with your county treasurer. Those over the age of 65 in Indiana are exempt from paying property taxes on any property they do not own. If you are 65 or older and have not paid your taxes in a timely manner, you may be able to negotiate a payment plan with your county treasurer.

Veterans Property Tax Exemptions

For those who served our country in the military, many states and municipalities offer property tax exemptions. Whether or not the exemption is available for just veterans with disabilities or for anyone who served in the armed forces depends on the state. How much this exemption can deduct from your overall property tax bill also depends on where you live. For example, California offered a basic exemption amount of $134,706 in 2018. Other states offer to completely eliminate property taxes for former armed forces members.

Also Check: Where Can I File 2017 Taxes Online

What Is The Iowa Income Tax Rate

Once current reforms have phased in, Iowa will be able to boast a 3.9 percent single-rate individual income tax, a 5.5 percent flat corporate income tax, and no inheritance tax or alternative minimum taxes. Improvements have been made to the state sales tax base and several tax credits have been reformed.

Why Is My Property Tax Higher Than My Neighbors

In the majority of cases, this will be due to the assessed value of your home being higher. Your home may have a higher value if you have a larger plot of land, if your home is larger, or if your home has desirable features. In some rare cases, however, you may live in a different jurisdiction from your neighbor.

You May Like: Is Car Registration Tax Deductible

What Is A Property Tax

Local governments levy property taxes on property owners within their locality. Governments use taxes to provide taxpayers with various services, including schools, police, fire and garbage collection. Property taxes are calculated by applying an assessment ratio to the propertys fair market value.

What Are Property Taxes

Often considered the financial backbone of local government, property taxes are generally levied by your municipality, county government, and in some cases, your local public school system. When collected, they help pay for your community’s needs, such as emergency services, trash collection, and public libraries, to name a few.

Property taxes are what’s called an ad valorem tax, which is considered by some circles to be a regressive tax, which means it’s based on the assessed value of a property. How much you’ll pay in property taxes will depend on several factors and varies among municipalities. Furthermore, some municipalities may levy taxes on more than just real estate, opting to include other tangible personal property, such as vehicles or furniture.

Don’t Miss: Should I Efile My Taxes

Home Improvements Increase Assessed Value

One of the most significant causes of property tax increases, which is also among the most controllable, is a rise in the value of a property due to home improvements. Adding a home office, a swimming pool or an addition to your home will undoubtedly increase its value at the time of the next assessment. Since assessments determine the value of the home, and property taxes are based on this value, a higher assessment means a higher tax bill.

Other improvements, including adding a garage or shed or improving fencing may also result in a higher assessed value. If a taxpayer objects to an increased assessment, he can file an appeal to request a lower assessment amount.

How Indianas Property Tax System Works

Property taxes in Indiana are relatively simple to calculate. Every year, the owner of a property is required to pay annual property taxes, which are due on May 10th and November 10th. If the owner chooses to pay the entire amount in May, 50% of the amount will be paid in May, and the remaining 50% will be paid in November. This system is intended to help keep property values stable while also preventing homeowners from having to pay too much in taxes at once.

Recommended Reading: How To File Taxes From Last Year

Does Canada Have Property Tax

Canadian property tax ratesEvery municipality across Canada determines its own annual property tax rate. Typically, this number falls between the range of 0.5% to 2.5%. Note that the size of your property, what you paid for it, and your income play no role in how much you will pay in property taxes.

Why Are Property Taxes In Texas So High

Texas local governments rely heavily on property taxes to paythe salaries of police officers and firefighters and for government services like roads, libraries, parks and public schools. Coupled with the fact that Texas has no state income tax, Texans property tax bills are among the highest in the nation.

Texas homeowners pay a higher proportion of their home value toward property taxes than most homeowners in other parts of the nation, according to the Tax Foundation. Texas depends more on property taxes than almost any other state to pay for government services edged out only by New Hampshire, Alaska and New Jersey.

In no arena is that more apparent than in Texas public schools which depend greatly on property taxes for funding.

School districts use local property tax revenue to cover as much of their base budgets as possible then the state chips in the rest. Over time, that formula has often resulted in fewer state dollars paying for public education as local property values have grown.

In any given year, revenue from property taxes makes up more than half of the states pot of funds to pay for public schools, the rest of which comes from state and federal sources. Of the $69.3 billion that went to public education in fiscal year 2020, property taxes kicked in $38.4 billion while the state provided $23.3 billion. The rest came from federal funds.

Don’t Miss: Is Credit Card Interest Tax Deductible

Property Tax Exemptions Can Help Lower Your Taxes

Property taxes can be a costly annual expense. Though a small reduction in your assessment could end up only saving you a few hundred dollars over the course of a year, if you can successfully argue that your property was grossly overassessed, you could easily end up keeping thousands of dollars in your pocket.

Though you can’t argue the tax rate, another way you can reduce your property taxes is by seeking and arguing for certain exemptions. Though certain exemptions, such as those for religious or government organizations, are out of reach for the average property owner, the following exemptions could fit your needs and help reduce your property tax bill.

Attend Appraisal Review Board Hearing

A formal hearing takes approximately 30 to 45 minutes and is held in front of three appointed ARB members. These board members are independently appointed and are not employed by the appraisal district.

When you argue your case during a formal hearing, you will need to provide strong evidence that supports your protest, just as you would in an informal hearing. In this situation, you are up against an appraiser who has full access to databases that include information on property values and listings, along with sales of comparable properties, which may not be readily available to you as a property owner.

If you do receive a reduction in your assessed property value for the year, the burden of proof moves to the appraisal district for the following year, so their chief appraiser must provide convincing evidence that supports a subsequent increase and establishes a higher value for your property. This can make an appraisal district reluctant to increase the value of your property for the next year. In addition, if the ARB reduces your assessed property value, its unlikely that they would reduce it again the following year.

Read Also: What Are Property Taxes Based On

How Do I Apply For A Homestead Exemption

For details on homestead tax exemptions, go directly to your county or local tax assessor’s website. Some states require you to fill out an application . Make sure you comply with your state’s application deadlines.

Also, be aware that some sites may be fraudulent and may request payment to fill out an application. Your county or local tax assessor will not require you to pay a fee to fill out an application for homestead tax exemption.

Deducting The Homestead Exemption

A homestead tax or property tax is typically applied to homes based on the assessed value of the property by the local government tax assessor’s office. The homestead tax can be a percentage of the property’s value or a fixed amount.

The homestead tax exemption may offer ongoing reductions in property taxes depending on local state laws. These exemptions can help surviving spouses remain in their homes after their income has been reduced by the death of their partner.

Homestead tax exemptions usually offer a fixed discount on taxes, such as exempting the first $50,000 of the assessed value, with the remainder taxed at the normal rate. For example, using a $50,000 homestead exemption, a home valued at $150,000 would be taxed on only $100,000 of assessed value, and a home valued at $75,000 would then be taxed on only $25,000.

Fixed homestead tax exemptions essentially turn a property tax into a progressive tax that is more favorable to those with more modest homes. In some areas, the exemption is paid for with a local or state sales tax.

To qualify for homestead exemption, homeowners must occupy the property as their permanent residence. Homestead exemption cannot be claimed for any other property that may be located elsewhere.

You May Like: Can You Pay Property Taxes Online

Failure To File For Property Tax Exclusion Of Seismic Ada And Fire Suppression Construction Costs Within 30 Days Of Project Completion

Here is an opportunity to be creative and save tax dollars at the same time. Like other overlooked opportunities to save property tax dollars -YOU MUST ACT TIMELY. This exclusion from property tax was enacted to encourage building owners to upgrade certain safety-related items in their buildings. The exclusion is for costs that are incurred in the remodel or upgrading of an existing building which include seismic or earthquake retrofitting, fire suppression or improvements that would make a building more assessable to disabled persons. The costs can include overlooked items such as demolition, and costs necessary to accommodate the retrofitted item. The development of these costs to be excluded from your assessment is a GREAT opportunity to save tax dollars.

To cash in on this opportunity, visit the assessors office before your project begins, and inform them that you want to take advantage of the applicable exclusion. FILE the exclusion forms as soon as your excluded costs have been identified, but in no case LATER THAT 30 DAYS PAST PROJECT COMPLETION. Remember, if you dont file, you lose.

Failure To Seek Refund Of Documentary Transfer Tax Erroneously Paid

This one always raises eyebrows. Most sellers of commercial property assume that if the Recorder demands payment of the tax as a condition to recording the grant deed or other transfer document, the tax must be owed. Not necessarily so. We recently recovered $170,000 for a seller who had no idea that no tax was owed, but the Recorder, once we provided the legal basis, quickly refunded all taxes paid. The documentary transfer tax statutes are ancient and ambiguous, and counties have resisted every effort to clarify those statutes at the state level. Couple that with the fact that most sellers are only giving up a small portion of their gains , and you have the perfect setting for a painless tax.

These are just the more common examples of non-value ways to reduce taxes related to commercial real estate in California. Since each requires timely action on the part of taxpayers, many of these opportunities are lost simply because an owner is unaware that the procedure exists or despite knowing about it, fails to appreciate the consequences of procrastination. AVS can help get you off the dime contact us at 415-956-8090 or .

All you have to lose is your money.

About the Author

Ted Bayer, Esq.

Don’t Miss: When Do We Get Our Taxes Back