Do I Have To File Taxes If I Made Less Than $10000

If your gross income was less than $10,000, you may not have to file a federal income tax return. But you may still want to file if you worked during 2020 and your employer withheld tax from your paycheck. Filing a tax return even if youre not required to do so is the only way to get any tax youre owed refunded to you.

Ira And 401 Withdrawals

Withdrawals from tax-deferred retirement accounts are taxed at ordinary income rates. These are long-term assets, but withdrawals aren’t taxed at long-term capital gains rates. IRA withdrawals, as well as withdrawals from 401 plans, 403 plans, and 457 plans, are reported on your tax return as taxable income.

Most people will pay some tax when they withdraw money from their IRA or other retirement plans. The amount of tax depends on the total amount of income and deductions and what tax bracket you’re in. You might not pay taxes on withdrawals if you have a year with more deductions than income and itemize your deductions to claim them.

Roth IRA withdrawals are typically tax free because you can’t take a tax deduction for your contributions in the year you make them. You’ve already paid taxes on this money once, so you won’t have to pay again when you take it back out.

How To Calculate W4 Exemptions

Each pay period, your employer withholds a part of your wages to cover your income tax bill. The amount of taxes that your employer withholds depends on your filing status, the amount of your paycheck and the number of withholding allowances you claim on Form W-4. The Internal Revenue Service offers two methods to withhold taxes — the wage bracket method and the percentage method. The wage bracket method uses a chart to determine your income tax to determine what percentage of federal taxes is withheld from your paycheck, you must use the percentage method.

Read Also: What Does H& r Block Charge

Putting It All Together: Calculating Your Tax Bill

To calculate how much you owe in taxes, start with the lowest bracket. Multiply the rate by the maximum amount of income for that bracket. Repeat that step for the next bracket, and continue until you reach your bracket. Add the taxes from each bracket together to get your total tax bill.

For example, the single filer with $80,000 in taxable income would pay the lowest rate on the first $9,875 he makes then 12% on anything earned from $9,786 to $40,125 then 22% on the rest, up to $80,000 for a total tax bill of $13,774.

Effectively, this filer is paying a tax rate of 17.2% , which is less that the 22% tax bracket our taxpayer actually is in.

But, wait. Effective tax rates dont factor in any deductions, so if you wanted get closer to what percentage of your salary goes to Uncle Sam, try using your adjusted gross income. Assuming the single filer with $80,000 in taxable income opted for the standard deduction , the amount of his AGI that went to the IRS was 14.9% a far cry from 22%.

For a final figure, take your gross income before adjustments. Add back in your allowable above the line deductions for example, retirement and health savings account contributions certain business-related expenses alimony paid and divide your tax bill by that number. The overall rate for our single filer with $80,000 in taxable income might be closer to 12% or even lower.

How Are These Taxes Being Calculated

If you are employed under a U.S.-registered business, the burden is off your shoulder as your employer will make the computation for you and automatically deducts it on your gross pay. However, if you are a self-employed or a freelancer, you need to make the calculations for yourself. You can use this app to compute your federal tax withholding. For state taxes, you may refer directly to your State Department of Revenue to know the imposed individual tax systems.

Don’t Miss: What Does Agi Mean In Taxes

How Are Lottery Winnings Taxed Under Federal And State

Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. That means your winnings are taxed the same as your wages or salary. And you must report the entire amount you receive each year on your tax return.

For example, lets say you elected to receive your lottery winnings in the form of annuity payments and received $50,000 in 2019. You must report that money as income on your 2019 tax return. The same is true, however, if you take a lump-sum payout in 2019. You must report that entire amount as well. For this, a tax calculator is an essential tool.

Note: Before you receive one dollar, the IRS automatically takes 25 percent of your winnings as tax money. Youre expected to pay the rest of your tax bill on that prize money when you file your return.

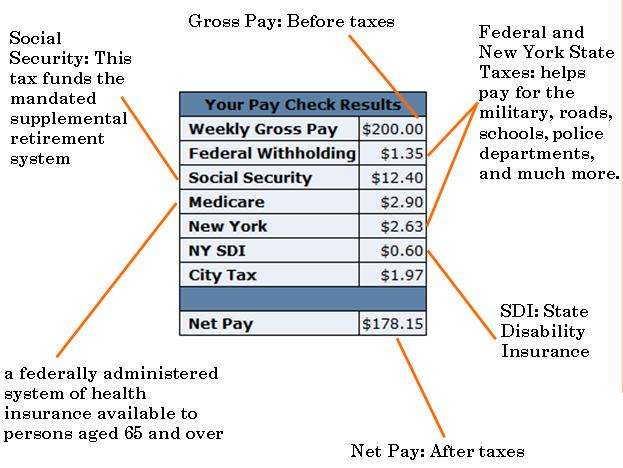

How Your Paycheck Works: Fica Withholding

In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act. Your FICA taxes are your contribution to the Social Security and Medicare programs that youll have access to when youre a senior. Its your way of paying into the system.

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2021 is $142,800 . Any income you earn above $142,800 doesnt have Social Security taxes withheld from it. It will still have Medicare taxes withheld, though.

There is no income limit on Medicare taxes. 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1.45%. If you make more than a certain amount, you’ll be on the hook for an extra 0.9% in Medicare taxes. Here’s a breakdown of these amounts:

- $200,000 for single filers

- $250,000 for married taxpayers filing jointly

- $125,000 for married taxpayers filing separately

Also Check: How Do I Get My Pin For My Taxes

Do You Pay Local Taxes Where You Live Or Work In Ohio

* For people who live in one city and work in another, it gets complicated. The full tax is charged in the work city. Then, some taxes may be due to the city where the person lives, depending on their home citys rules on credits for taxes paid elsewhere. In some places residents have no additional tax bill.

How Is Retirement Income Taxed

How is your retirement income taxed by your state?

Sterling Raskie May 18, 2016

Individuals are taxed on a 1040, according to the pertinent tax tables, which set the rates for income taxes. At each income bracket, you are taxed a greater amount. In the lower brackets, that rate is smaller, while in the higher brackets it grows.

For instance, lets take the example of the 2017 tax brackets and rates. A single person making between $0 and $9,325, the tax rate is 10% of taxable income. For a single person making between $9,325 and $37,950, its 15%. The good news is you only pay 10% on all income up to $9,325, then 15% on income up to $37,950, and so on.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

How Tax Brackets Work

The United States has a progressive tax system, meaning people with higher taxable incomes pay higher federal income tax rates.

-

Being “in” a tax bracket doesn’t mean you pay that federal income tax rate on everything you make. The progressive tax system means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

-

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

-

Example #1: Lets say youre a single filer with $32,000 in taxable income. That puts you in the 12% tax bracket in 2020. But do you pay 12% on all $32,000? No. Actually, you pay only 10% on the first $9,875 you pay 12% on the rest.

-

Example #2: If you had $50,000 of taxable income, youd pay 10% on that first $9,875 and 12% on the chunk of income between $9,876 and $40,125. And then youd pay 22% on the rest, because some of your $50,000 of taxable income falls into the 22% tax bracket. The total bill would be about $6,800 about 14% of your taxable income, even though you’re in the 22% bracket. That 14% is called your effective tax rate.

» MORE:See state income tax brackets here

What Is Fica Taxes And How Much Do I Need To Pay For This

A short-term for Federal Insurance Contributions Act, FICA taxes serves as social security and Medicare taxes paid by each individual working under a U.S.-registered company. A total of 15.3% is applied to an employees gross compensation. Both employee and employer shares in paying these taxes each paying 7.65%. For self-employed individuals, they have to pay the full percentage themselves.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

Simple Annual Overview Of Deductions On A $40000000 Salary

Lets start our review of the $400,000.00 Salary example with a simple overview of income tax deductions and other payroll deductions for 2022. The table below provides the total amounts that are due for Income Tax, Social Security and Medicare. We will look at each of these and a periodic split as we go through the salary example.

| What? | |

|---|---|

| Salary After Tax and Deductions | $238,924.29 |

It is worth noting that you can print or email this $400,000.00 salary example for later reference. There is a lot of detailed information which is worth reading and using as a reference, particularly if you file your own tax return without using a tax return software provider and/or accountant.

Save this Salary Tax Calculation for later use

State Taxes On Social Security

There are 13 states which tax Social Security benefits in some cases. If you live in one of those statesColorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginiacheck with the state tax agency. As with the federal tax, how these agencies tax Social Security varies by income and other criteria.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Keep Some Retirement Income In Roth Accounts

Contributions to a Roth IRA or Roth 401 are made with after-tax dollars. This means they’re not subject to taxation when the funds are withdrawn. So the distributions from your Roth IRA are tax-free, provided their taken after you turn 59 1/2 and have had the account for five or more years. Distributions taken from a traditional IRA or 401 plan, on the other hand, are taxable.

That means the Roth payout won’t affect your taxable income calculation. That also means it won’t increase the tax you owe on your Social Security benefits.

This advantage makes it wise to consider a mix of regular and Roth retirement accounts well before retirement age. The blend will give you greater flexibility to manage the withdrawals from each account and minimize the taxes you owe on your Social Security benefits.

A similar effect can be achieved by managing your withdrawals from conventional savings, money market accounts, or tax-sheltered accounts.

Determining The Amount Of Taxes You Should Withhold

If you are newly retired, it can be difficult to figure out how much in taxes to withhold from your pension as your tax rate depends on your household sources of income and deductions.

When you add up all of your sources of income and subtract your deductions, you get your taxable income, which determines your tax bracket. You can use this tax bracket to estimate how much to withhold. When you look at a chart of tax rates, you can see that higher amounts of income will be taxed at higher rates.

Tax planning can help you figure out the right amount to withhold. With tax planning, you put together a “pretend” tax return, called a “tax projection.” As you transition into retirement, you might want to work with a CPA, tax professional, or retirement planner to help you with this.

If you prefer to do it yourself, you can plug numbers into an online 1040 tax calculator to get a rough estimate, or you can fill out your federal tax form as if you were filing taxes. Follow the instructions to see where each source of income goes. Calculate the tax you think you will owe. Divide that by your total income. Use the answer to see what percentage to withhold.

You May Like: 1040paytax.com Official Site

Tax Brackets & The Tax Cuts And Jobs Act Of 2017

The Tax Cuts and Jobs Act of 2017 guides current tax policy. Among its notable achievements:

- Number of brackets remained steady at seven.

- Four of the lowest five marginal rates dropped between one and four points the top rate sank 2.6 points, to 37%.

- Modified bracket widths.

- Eliminated the personal exemption, but nearly doubled the standard deduction.

- Indexed brackets and other provisions to the Chained Consumer Price Index measure of inflation .

- Retains the charitable contribution deduction.

- Caps the mortgage interest deduction to the first $750,000 in principal value.

- Deduction for state and local income, sales, and property taxes limited to a combined $10,000.

While taxpayers still may use itemizing if their total deductions work to their advantage , boosting the standard deduction was designed to simplify calculations for the vast majority of filers and it worked. For the 2018 tax year, 90% of households opted for the standard deduction, up from 70% in recent previous years .

Gains Upon The Sale Of Your Home

You most likely won’t pay taxes on gains from the sale of your home if you’ve lived there for at least two years, unless you have gains in excess of $250,000 if you’re single, or $500,000 if you’re married. The rules get more complex if you rented your home out for a while, so you might want to work with a tax professional to determine whether and how you should report any gains.

Recommended Reading: Mcl 206.707

What Is A State Income Tax Withholding

This is how all 50 U.S. states stack up when it comes to paying taxes. via

CNBC

You may get confused between a federal and state income taxes which is crucial especially when you are filing your own taxes. They are separate from each other and unlike federal income tax, state taxes are generally dependent on laws imposed by the State Department of Revenue. This means each state has a different tax system and seven out of the fifty states currently impose no state taxes. These states include Wyoming, Washington, Texas, South Dakota, Nevada, Florida, and Alaska.

You Can Set Up Withholding For Non

If you receive taxable income that isn’t from wages like interest, dividends or distributions from a traditional IRA you can have your employer withhold tax from your paycheck to cover the extra taxes. Just put the estimated total amount of this income for the year on Line 4 of your W-4 form and your employer will calculate the proper withholding amount for each pay period. In most cases, you won’t have to submit estimated tax payments for this income.

Don’t include income from a side gig on Line 4. Keep reading for information on how to get your boss to withhold taxes from your regular paycheck for self-employment income.

Read Also: Michigan Gov Collectionseservice

Estimate Your Tax Bracket

Having a rough idea of your tax bracket can help you estimate the tax impact of major financial decisions.

Have you ever been asked for your approximate tax bracket by an advisor, attorney, financial provider, or even a Fidelity representative? Knowing your tax bracket can be useful in many scenarios, including when you open new accounts.

While your tax bracket won’t tell you exactly how much you’ll pay in taxes, it can help you assess the tax impact of financial decisions. For instance, if you’re in the 35% tax bracket, you could save 35 cents in federal tax for every dollar spent on a tax-deductible expense, such as mortgage interest or charity.

What Are The Benefits Of Taking A Lump Sum Payment Versus Annuity Payments

If you take a lump sum, you have more control over your money right now. You can choose to invest it into a retirement account or other stock option to generate a return. You could also use it to buy or expand a business.

Several financial advisors recommend taking the lump sum because you typically receive a better return on investing lottery winnings in higher-return assets, like stocks. If you elect annuity payments, however, you can take advantage of your tax deductions each year with the help of lottery tax calculator and a lower tax bracket to reduce your tax bill.

The decision for which option is better is complex. It all depends on the size of the lottery winnings, your current and projected income tax rates, where you reside, and the potential rate of return on any investments. If you win big, its in your best interest to work with a financial advisor to determine whats right for you. However, you can also determine the taxes using a federal tax calculator.

You May Like: Efstatus Taxact Com Login