New Data Highlights Progressivity Of The Income Tax Code Under The Tcja

Each fall the IRSs Statistics of Income division publishes data showing the share of taxes paid by taxpayers across ranges of Adjusted Gross Income . The most recent release covers Tax Year 2018 . This is the first year of reported data under the changes in the TCJA which lowered tax rates, nearly doubled the standard deduction, and expanded the child tax credit.

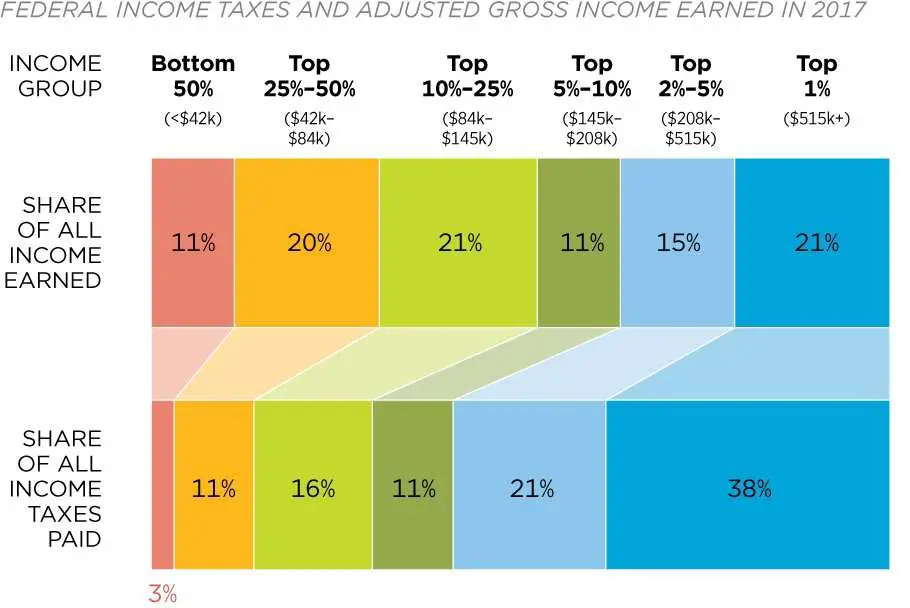

The new data shows that the top 1 percent of earners paid over 40 percent of all income taxes. Despite the tax rate reductions associated with TCJA, this figure is up slightly from the previous tax years 38.5 percent share. In fact, NTUF has compiled historical IRS data tracking the distribution of the federal income tax burden back to 1980 and this is the highest share recorded over that period, topping 2007s 39.8 percent income tax share for the top 1 percent. The amount of taxes paid in this percentile is nearly twice as much their adjusted gross income share.

The top 10 percent of earners bore responsibility for over 71 percent of all income taxes paid and the top 25 percent paid 87 percent of all income taxes. Both of those figures represent an increased tax share compared to 2017. The top fifty percent of filers earned 88 percent of all income and were responsible for 97 percent of all income taxes paid in 2018.

The other half of earners took home 11.6 percent of total nation-wide income and owed 2.9 percent of all income taxes in 2018, compared to 3.1 percent in 2017.

The Share Of Total Taxes Contributed By The Top 10% Isnt Changing

Thats why its better to look at what top earners pay in all taxes: those on what people earn like income tax and national insurance, plus those on what people buy like VAT and tobacco duties.

The only show what the top 10% of earners contribute, but its a start.

In 2014/15, an average household in the top 10% paid nearly £38,000 in taxes.Asagroup,theycontributed about 27% of all taxes paid. A household in the bottom 10% would have paid just over £5,000.

The share paid by the top 10% is hardly changing. In the last six years its been about 27%.

Of course, wed expect the richest to be contributing more to the total tax pot: they earn more and spend more, so theres more to tax.

But what about what the richest pay out of their own budgets?

How Do I Pay Stamp Duty

Stamp duty is payable once you complete the purchase of the property, and in England and Northern Ireland you must pay HMRC within 14 days. To do this, you need to submit a Stamp Duty Land Tax return.

In Scotland and Wales, buyers have 30 days to make the payment for the equivalent land taxes.

In a lot of cases, your conveyancer will pay HMRC for you and will add the stamp duty charge in with all of the other fees, but it is still your responsibility to pay it on time.

You May Like: Do You Pay Taxes On Crypto

Personal Income Tax Rate Structure

Of the states currently levying a broad-based personal income tax, all but nine apply graduated tax rates . Colorado, Illinois, Indiana, Kentucky, Massachusetts, Michigan, North Carolina, Pennsylvania, and Utah tax income at one flat rate. While most of the Terrible 10 states achieve membership in this club by having no income taxes at all, two of them Pennsylvania and Illinois achieve this dubious honor through their use of a flat-rate tax.

However, using a graduated rate structure is not enough to guarantee an overall progressive income tax some graduated-rate income taxes are about as fair as some flat-rate taxes, and some even less fair. The level of graduation in state income tax rates varies widely. As does the level of progressivity. This is illustrated by a look at the income tax structures in the District of Columbia, Pennsylvania, and Virginia, three jurisdictions with income taxes whose wide-ranging structures result in very different distributional impacts.

The District of Columbias income tax is quite progressive. Its six-tier graduated tax rates range from 4 percent to 8.95 percent. Because the top tax rate of 8.95 percent is a millionaires tax, most District residents pay a lower top rate. And most of those at the bottom of the income scale are held harmless by a generous Earned Income Tax Credit provided at 40 percent of the federal credit for workers with children and 100 percent for workers without children in the home.

FIGURE 7

The Build Back Better Agenda Would Address These Inequities By Reforming Capital Gains Taxes And Providing Tax Cuts To Families

The Build Back Better bill now pending in the House of Representatives takes many important steps toward a fairer tax code. Millionaires tax rates would rise by 7.1 percentage points on average, according to the Joint Committee on Taxation this estimate does not count unrealized gains toward income. If policymakers want to ensure that the wealthiest Americans pay significantly more, they must reform the capital gains tax base to prevent the massive gains of the wealthiest Americans from escaping income tax.

President Biden proposes in Build Back Better to tax unrealized gains when an asset is gifted or bequeathed to heirs. Two other options are also under consideration in Congress to ensure that ultrawealthy Americans pay taxes on their large unrealized capital gains. Congress could: 1) tax the gains of ultrawealthy people as they accrue, not only when they are realized, through what is known as mark to market taxation or 2) repeal stepped-up basis and move to carryover basis, where no tax is due when an asset is handed down between generations but the original owners gain is taxed when an heir sells the asset. President Bidens plan and the Houses Build Back Better legislation also raise the top rate on capital gains.

Also Check: Where Do I Go For My Taxes

Where Do We Go From Here

One thing is for sure the issues surrounding whether the wealthiest in the U.S. are paying less taxes than the middle class, wont rest. From economists to presidential hopefuls to tax policy organizations, everyone has a point or two or three to make. Heres a preview of what you can look forward to in the future regarding these issues.

What Do The Wealthiest Pay In Tax

The wealthiest are paying more and more tax.

Our verdict

Theres no one-line answer: it depends on who you define as the wealthiest.

The amount of tax paid by the wealthiest in our society has risen and risen in the last few years

Chris Grayling, 20 January 2017

That depends on two things: which taxes youre looking at, and who you count as the wealthiest.

Were also limited in what we can know by the data thats available. For example, theres a lot we can say about what the highest earners pay, but figures by wealth are harder to come by.

Here we give figures based on what the highest earners pay, but remember this isnt the same as the wealthiest. Weve asked Mr Grayling how hed define the term.

Fact checks like these are made possible with your support

Recommended Reading: How To Prepare Business Taxes

State Local And Territorial Income Taxes

Income tax is also levied by most U.S. states and many localities on individuals, corporations, estates, and trusts. These taxes are in addition to federal income tax and are deductible for federal tax purposes. State and local income tax rates vary from 1% to 16% of taxable income. Some state and local income tax rates are flat and some are graduated. State and local definitions of what income is taxable vary highly. Some states incorporate the federal definitions by reference. Taxable income is defined separately and differently for individuals and corporations in some jurisdictions. Some states impose alternative or additional taxes based on a second measure of income or capital.

States and localities tend to tax all income of residents. States and localities only tax nonresidents on income allocated or apportioned to the jurisdiction. Generally, nonresident individuals are taxed on wages earned in the state based on the portion of days worked in the state. Many states require partnerships to pay tax for nonresident partners.

Tax returns are filed separately for states and localities imposing income tax, and may be due on dates that differ from federal due dates. Some states permit related corporations to file combined or consolidated returns. Most states and localities imposing income tax require estimated payments where tax exceeds certain thresholds, and require withholding tax on payment of wages.

Restoring A Meaningful Estate Tax

If the tax system were working well at the top end, wealthy people would pay a fair amount of tax each year on their economic income and their wealthy heirs would pay a fair amount of tax on their inherited windfalls of income. Neither side of this equation is working today. As the ProPublica story vividly displayed, many of the wealthiest people pay little tax during their lives. In addition, over the course of a number of decades, policymakers have eviscerated the estate tax so much that Gary Cohn, then-director of President Trumps National Economic Council, reportedly told Senate Democrats in 2017, Only morons pay the estate tax.

Today, fewer than 1 in 1,000 estates owe any estate tax, and the first $23.4 million in value is often tax-free even for these estates. Moreover, the few estates that are large enough to potentially face the tax can use loopholes to reduce or eliminate their tax liability. Wealthy people, for instance, use special funds to shelter massive sums from the estate tax. Casino owner Sheldon Adelson, who recently died, passed $7.9 billion to his heirs tax-free by shuffling his company stock in and out of more than 30 trusts.

Read Also: How To Fill Out Small Business Tax Forms

What If The Government Increased The Corporate Income Tax

Taxing corporations can sound like a great idea. But the economic incidence ultimately falls on people. Part of that tax falls on the shareholders of the corporation, which tend to be wealthier people, and part of the economic incidence falls on the firms employees and customers.

Another issue is competitiveness. Just like companies compete for business, so do countries. Countries benefit from the jobs and investment that firms provide, and taxes are one way they compete. Theres an old saying that you dont want to kill the goose that lays the golden egg. In this context, if you tax the goose too heavily, it may just decide to fly to the next pond. On the other hand, the goose may stay if the taxes are used to provide things it values like a clean environment, public safety, education for its goslings, etc. Taxes are just one factor.

About 50% of federal revenue comes from individual income taxes, 7% from corporate income taxes and another 36% from payroll taxes that fund social insurance programs. The rest comes from a mix of sources.

Millions Benefit From Tax Credits And Pay Zero Income Taxes

It is hard to say that the tax code is rigged in favor of the rich when more than 53 million taxpayers, more than one-third of all taxpayers, have no income tax liability because of the numerous credits and deductions that have been created or expanded in recent decades.

As Figure 2 illustrates, the percentage of these filers with no liability began to grow following the Tax Reform Act of 1986 expansion of the zero tax bracket. Since the creation of the Child Tax Credit in 1997 the percentage of income tax filers who have no tax liability increased from 23.6 percent to 34.7 percent in 2018.

The percentage of filers with no liability spiked at 42 percent in 2009 with creation of the Making Work Pay tax credit. As the economy recovered from the Great Recession, the percentage of filers with no liability declined to 32 percent in 2017. The percentage has begun to spike again after the TCJA doubled the Child Tax Credit to $2,000 from $1,000. This increased the number of non-payers by more than 4 million, from 49.1 million to 53.3 million.

Many of these low-income taxpayers receive refundable tax credits, which means that they get a check back from the IRS even if they have no income tax liability.

Recommended Reading: What’s The Capital Gains Tax

Bolstering Other Taxes Wealthy People And Their Heirs Pay

Even if Congress were to enact President Bidens proposal to close the stepped-up basis loophole by taxing unrealized capital gains when a person dies , much of the income of the wealthiest people in the country would still escape individual income taxation each year. As a result, there is plenty of room for Congress to bolster other federal taxes, including the corporate income tax and estate and gift tax, which are both highly progressive taxes, and closing a Medicare tax loophole for wealthy pass-through owners.

What Conservatives Say And Why Its Wrong

Conservatives claim the wealthy are overtaxed. But the overall share of taxes paid by the top 1% and the top 5% is about their share of total income. This shows that the tax system is not progressive when it comes to the wealthy. The richest 1% pay an effective federal income tax rate of 24.7%. That is a little more than the 19.3% rate paid by someone making an average of $75,000. And 1 out of 5 millionaires pays a lower rate than someone making $50,000 to $100,000.

Conservatives claim that the estate tax is a death tax, wrongly implying that the tax is paid when every American dies. In fact, the tax primarily is paid by estates of multi-millionaires and billionaires. The vast majority of deaths 99.9% do not trigger estate taxes today.

–

Don’t Miss: How Much Taxes Do The Top 10 Percent Pay

The Headline Fact Rests On A Bunch Of Assumptions

Treatment of the corporate income tax is particularly important for this exercise because Congress enacted a big corporate tax cut in 2017.

Prior to that, the Saez/Zucman data shows the top 400 taxpayers paying a lower overall tax rate than the top 0.01 percent or the top 0.1 percent, but a similar rate to the rest of the top 20 percent of the income distribution and a clearly higher rate than the bottom 80 percent.

And this is important because, as first noted by libertarian economic historian Phil Magness, changing how corporate income taxes are handled makes a big difference in terms of assessing what rate the richest Americans are paying in taxes.

The solid orange line represents the tax rates estimated by Saez, Zucman, and Pikettys scholarly article, using the assumption that the burden of the corporate income tax is spread across all non-housing capital , whereas the dotted line shows the Saez/Zucman books estimates based on the idea that corporate taxes are all paid by corporate shareholders.

Since ownership of corporations is very highly concentrated among the richest people, if you consider a corporate tax rate cut to be a pure tax cut for owners of tax-paying corporations, then you will get the conclusion that the Trump tax cut was an incredible windfall for the top 400 taxpayers.

Weve entered a new phase. Lets call it post-truth economics.

Income Tax Is Only A Part Of The Governments Total Tax Take

Income tax is only a fraction of the total tax take. Over three-quarters of the Governments income comes from other taxes. So Theresa Mays claim is incorrect when considering all government taxes.

There are direct taxes, such as Council Tax, and National Insurance contributions. There are also indirect taxes, such as VAT, Tobacco and Alcohol Duty, and Corporation Tax.

It is much more difficult to say what percentage of these other taxes the top 1% of earners pay. Households earning the top 10% of incomes pay about 27% in total of most direct and indirect taxes, according to Office of National Statistics data. This figure has remained roughly constant since 2009/10.

These numbers at least indicate that the top 1% of households would be paying a smaller fraction of total taxes than 27%, so Mrs Mays claim is unlikely to be correct for the governments total tax take.

Read Also: How Can I Avoid Paying Taxes On Retirement Income

In Most States State And Local Tax Systems Worsen Inequality

Forty-five states have regressive tax systems that exacerbate income inequality. When tax systems rely on the lowest-income earners to pay the greatest proportion of their income in state and local taxes, gaps between the most affluent and the rest of us continue to grow.

The ITEP Tax Inequality Index measures the effects of each states tax system on income inequality by assessing the comparative impact a states tax system has on the post-tax incomes of taxpayers at different income levels. Essentially, it answers the following question: Are incomes more equal, or less equal, after state taxes than before taxes?

For example, consider this scenario: if taxpayers in the top 1 percent are left with a higher percentage of their pre-tax income to spend on their day-to-day living and to save for the future than low- and middle-income taxpayers, the tax system is regressive and receives a negative tax inequality index score. This indicates that the income inequality that existed before the levying of state and local taxes has been made worse by those taxes. On the other hand, states with slightly progressive tax structures have positive tax inequality indexes. This means that after taking state and local taxes into account incomes are no less equal than they were before taxes and tax systems in those states, at the very least, did not worsen income inequality.

FIGURE 2

NOTE: See Appendix B for detailed ITEP Tax Inequality Index and Methodology for more information.

FIGURE 3