How Can A Small Business Reduce Taxable Income

Small businesses can reduce taxable income by taking advantage of tax deductions. Businesses can deduct ordinary and necessary costs of running the business, such as advertising, salaries and wages, interest expense and insurance. You can find more information on deductible business expenses in IRS Publication 535.

Should I Pay Myself A Salary

Your small business earnings are a reflection of the hard work that you had put in to bring your business to life. Its quite a fascinating experience as a business owner.

However, the challenge that you face is how to pay yourself as a business owner. There are various factors that you should consider while deciding how to pay yourself.

Remember This All Flows Through To Your Personal Tax Return

So let me do my best to explain how this works. The table above shows the percentage of tax that you will owe for each various dollar amount in income. Now remember this is a pass through entity so this is a personal income tax bracket. When you business makes net income that net income is passed through to the owners. You may also have other income that plays a role in how much you owe in taxes. For example, lets say you also have some dividend and interest income from your investments, and maybe you have some rental income from a residential rental home that you own. All of this income will be added to your business income, but right now I want to keep things simple and assume that your only income is your business income.

If this is truly your only income then you can simply follow this table and figure out exactly how much you will owe in federal income taxes.

You can find many useful templates to assist you with this on our website

You May Like: How Much Taxes Come Out Of Paycheck

How Do I Calculate Alternative Minimum Tax

Calculating the AMT is complicated. Taxpayers first calculate their normal adjusted gross income, then add back in certain items. Next, they subtract the applicable AMT exemption amount, multiply that by the appropriate AMT tax rate and subtract the AMT foreign tax credit to calculate a tentative minimum tax.

Read Also: Stripe Doordash 1099

How Much Tax Does A Small Business Pay

dowell / Getty Images

How much small businesses pay in taxes depends on a few factors like income, deductions, expenses, business structure, and more. From corporate and business taxes to tax rates and tax forms, here’s how to figure out how much small businesses really pay in taxes.

You May Like: How To Get Maximum Tax Refund

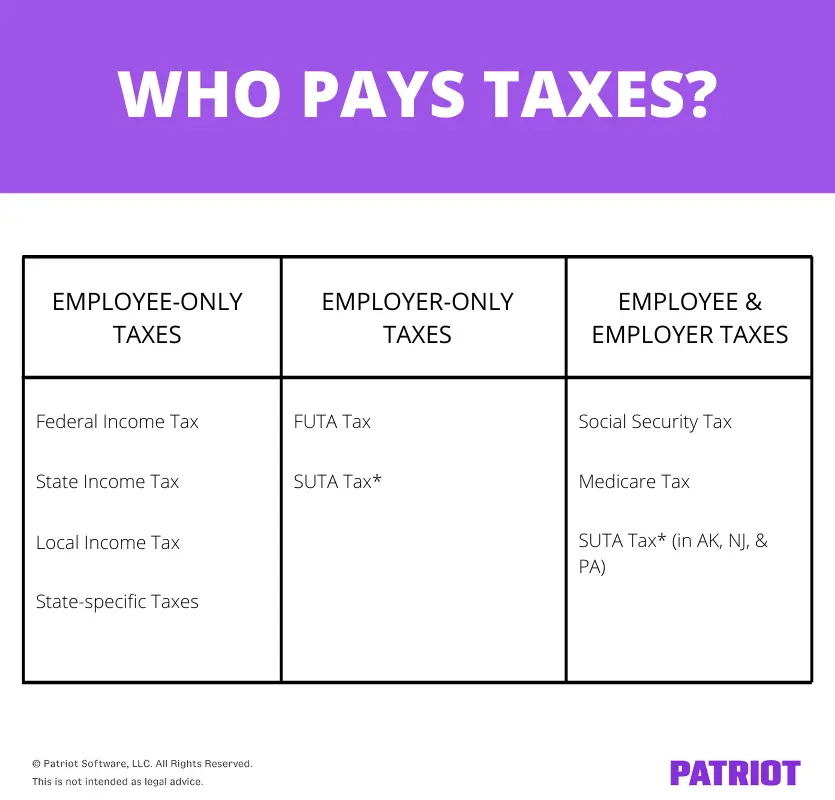

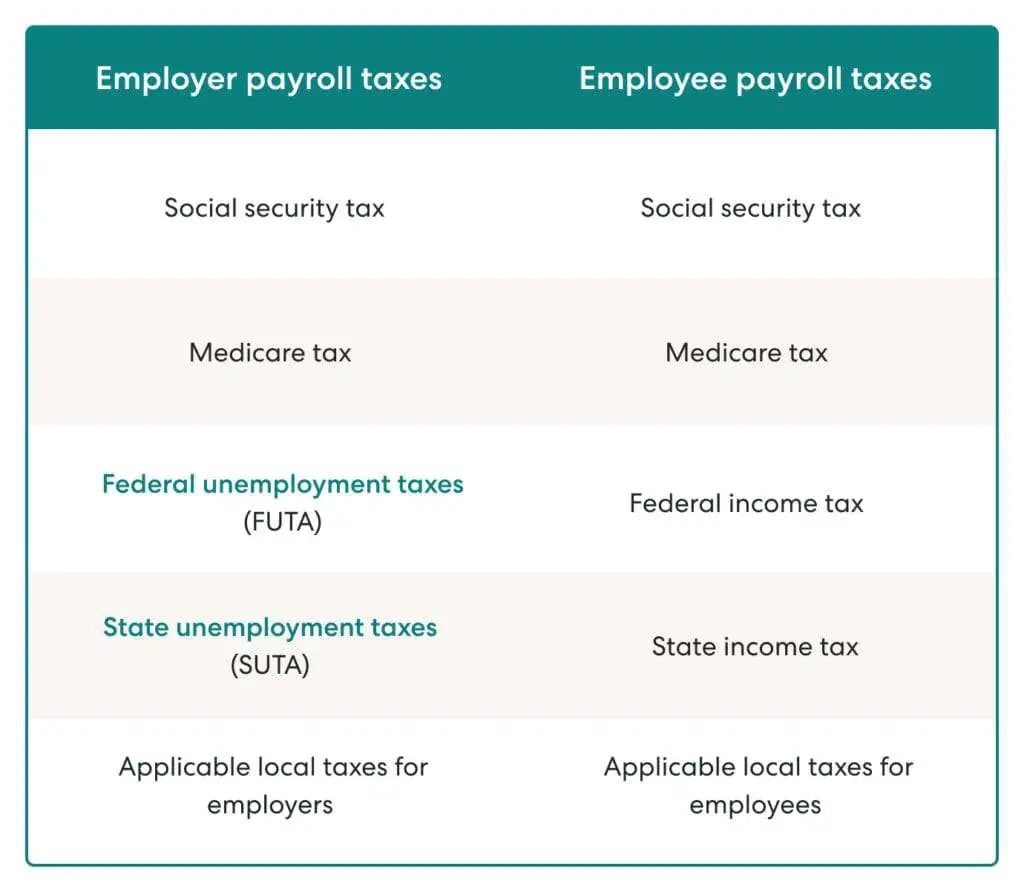

What Taxes Do Employers Need To Pay

Small business owners must pay all of the taxes mandated by the federal government, as well as those required in the state and local governments where they have employees. If unsure about what they owe, employers should consult a licensed tax professional.

See how simple small business payroll can be.

How Much Can A Small Business Make Before Paying Taxes

In short, yes, you may also be accountable for paying taxes like profits tax, self-employment tax, worker payroll tax, and neighborhood property tax. The quantity you owe relies upon on elements such as your enterprise type, whether or not you made earnings and relevant deductions.

Steven J. Weil, president of RMS Accounting, stated the definition of a commercial enterprise is an undertaking engaged in making a profit.

If you do not intend to make a profit, then you have a hobby, no longer a business, Weil advised business.com. If you make a profit, that earnings are a concern to federal profits tax and may additionally be a problem to country profits tax relying on the kingdom you are doing enterprise in. Some states, like California, tax companies even when they do not make a profit. How your enterprise is taxed relies upon on how it is set up.

Recommended Reading: How Does Property Tax Work

How Do Payroll Taxes Work

Payroll taxes are charged as a percentage of employee wages using these general steps:

Taking Profits Out Of Your Business

If you own a business that makes money, you may want to move the money from the business’s account to your personal account. This is a best practice, as you do not want to pay personal expenses from your business account. Doing so can create a number of issues, including the IRS questioning whether or not your business expenses are valid. How you do this can depend on the type of business entity you created.

With a sole proprietorship or single-member LLC that doesn’t pick a corporate tax election, there’s no distinction between you and the business and you can transfer money back and forth between the accounts. Partnerships must track distributions to each partner, as this affects the partners cost basis in the partnership and helps ensure distributions are being taken fairly.

It’s more complicated with C corps and S corps .

With C corps, profits can be distributed as a dividend. However, as noted previously, this can lead to “double taxation.” The corporation pays income taxes on its profits, the profits get distributed as dividends and then you pay individual income taxes on the income from your dividend.

Alternatively, C corps can choose to keep the money and spend it on future business expenses. The corporation still has to pay income tax on the profits, but you won’t receive a dividend and won’t have to include the money on your personal tax return. However, this means you also won’t be able to use the money for personal expenses.

Don’t Miss: How To Save Capital Gain Tax

Corporate Income Tax Rates In 2022

The corporate income tax rate depends on the taxable amount. The taxable amount is the taxable profit in a year reduced by deductible losses.

- If the taxable amount is 395,000 or less, the corporate income tax rate is 15%.

- If the taxable amount is more than 395,000, the corporate income tax rate is 59,250 plus 25,8% for the taxable amount exceeding 395,000.

A reduced rate of 9% applies to activities covered by the innovation box. The innovation box provides tax relief to encourage innovative research. All profits earned from innovative activities are taxed at this special rate.

Canadian Income Tax Returns For Small Business

The tax return you need to complete and file for your small business depends on how your business is structured. If your business is a sole proprietorship or partnership, you report your business income on your T1 personal income tax form. Your small business is you, so to speak, and the T1 income tax return package includes Form T2125, Statement of Business or Professional Activities, which you will use to report your business income.

If your small business is incorporated, you will need to report your business income on a T2 corporate income tax return. Legally, your incorporated small business is a separate entity and must complete and file its own Canadian income tax return.

As a separate legal entity, you are also required to complete and file your own T1 personal income tax return.

You May Like: Efstatus.taxact.xom

Don’t Miss: Where To File Va State Taxes

What Kind Of Taxes Does A Company Pay

Just like a private individual, a business needs to pay its fair share of tax, and there are several different types of tax that a business can be subject to. Just because you are a new start-up does not mean you are exempt, eithermake sure you are aware of what taxes you need to pay so that you can account for them in your pricing when it comes to making an invoice!

Depending on where you are in the world, your companys tax liability will vary. Some countries tax companies very heavily whereas others dont tax them very much at all. Also, some countries will vary the tax depending on your status, size, and turnover.

If you are just starting out, it helps to learn what types of taxes you may need to pay by being aware of some of the more common ones.

What Is The Tax Bracket For A Small Business

Most small businesses are not taxed like corporations.

The Internal Revenue Service agency does not recognize the legality of a sole proprietorship, partnerships, limited liability companies and limited liability partnerships as taxable corporation they are instead considered pass through entities. This means that taxable income goes directly to the owners and members who report the income on their own personal income and pay taxes at the qualifying rate.

Since most small businesses are charged at an individual income tax level, here is the Federal tax brackets for 2019 for single taxpayers tax brackets:

Don’t Miss: What Does Tax Exempt Mean

When To File Your Small Business Taxes

Corporations must make estimated tax payments on the 15th day of the fourth, sixth, ninth and 12th month of its fiscal year. Owners of pass-through businesses must make estimated tax payments, which are generally due April 15, June 15, Sept. 15 and Jan. 15 of the following year. If any of those dates fall on a weekend or legal holiday, the due date moves to the following business day.

Some payroll, accounting or tax preparation software will estimate the businesss tax liability and send estimated tax payments to the IRS on their behalf. Just make sure to regularly set money aside for taxes, so its available when payments are due.

How Do I Manage Sales Tax Questions Successfully

Most sales tax questions and issues arent one-time problems. The most common pain points for small business owners are concerns that come up again and again. While you cant avoid paying sales tax, you can find a comprehensive solution that makes how you deal with taxes smarter and more efficient.

- Save time. When all your information is in one place, it saves you valuable time. A comprehensive sales tax solution allows you to look up sales tax rates, identify appropriate product taxability statuses, get due dates, and search sourcing rules easily, putting all your sales tax answers in one place.

- Stay organized. Gone are the days of managing multiple stacks of paper, hoping you remembered to file the one you need in the exact moment you need it. A comprehensive tax solution helps you stay organized, save time, free up capital, and keep ahead of upcoming legislative changes without risk to your business.

- Lower risk. You want to see a problem before it becomes a problem. Having industry leading, up-to-date information at your fingertips is critical to success. The ability to access step-by-step tax guidance, automated compliance, and exemption forms in a single space allows you to work confidently while minimizing risk.

You May Like: How To Correct State Tax Return

Federal Business Income Taxes

Federal income tax for businesses is based on net profit . With sole proprietorships, partnerships, most LLCs, and S-corporations, tax on business income is paid by the owners through their personal tax returns. This is called pass-through taxation. Owners are generally required to make quarterly estimated tax payments during the tax year using Internal Revenue Service Form 1040-ES. These payments are due April 15, June 15, September 15 and January 15.

If youre a working owner of an S-corporation, you are also an employee who receives standard paychecks. You may not need to make estimated tax payments if you have enough income tax withheld from your paycheck.

Standard corporations are generally required to make quarterly estimated tax payments on the 15th day of the 4th, 6th, 9th, and 12th months of each fiscal year. If you want your corporation to be treated as an S-corporation, complete Form 2553 Election by a Small Business Corporation within 75 days of forming your business or within 75 days of the beginning of a tax year .

Limited Liability Companies are taxed like sole proprietorships if there is only one owner. If there is more than one owner, LLCs are taxed like partnerships. However, LLCs can elect to be treated as standard or S-corporations for federal tax purposes by filing an IRS Form 8832. Consult your tax professional for more information.

Who Pays Corporatie Income Tax

Public and private companies usually have to pay corporate income tax on their profits. In certain circumstances, foundations and associations must also file corporate income tax returns.

Some legal entities, such as fiscal investment institutions, do not pay corporate income tax. Some legal entities that collectively invest, may also be exempt from corporate income tax.

Natural persons pay tax on their profits through their personal income tax returns.

Also Check: Can I File Taxes With My Last Pay Stub

Tax Rules Were Written To Smooth Out Effects Of Business Cycles

If some corporations paid zero corporate income taxes because they were carrying forward past losses, it should be seen as a normal feature of the U.S. tax code, not a cause for concern. Deductions for carried-forward losses ensure firms are taxed on profitability over time and not penalized for losses that dont align with calendar years. Tax losses can be carried forward for 20 years with some limitations, so many companies could be carrying forward losses from the financial crisis or other company-specific downturns.

What Can Small Businesses Do To Save Money On Their Taxes

The complexity and constant changes of the U.S. tax code make it difficult for small businesses to stay up to date on all the laws and regulations affecting them.

The primary difficulty for small business owners is that they can’t take advantage of the same tax deductions as more giant corporations. While a business owner may take a $20,000 deduction, for example, it’s not possible to take $20,000 out of the business and pocket it as personal income without paying taxes on that amount.

Here are some ways small businesses can save money on their taxes:

- Simplify your accounting â There’s no reason to overcomplicate your tax preparation. You don’t need to hire an accountant or use complicated software to handle your taxes as a small business owner. Keeping things simple will help you save money on taxes because you won’t have to pay anyone to do your taxes for you

- Incorporate â Incorporating as a limited liability company or corporation allows you to separate your finances from your business and protect yourself from potential lawsuits or other financial setbacks that could threaten your business and personal finances. The more complex your business gets, the more critical this feature becomes

Recommended Reading: When Do You Have To File Your Taxes By

Take The Long View: A Multiyear Horizon Is Necessary To Accurately Analyze Corporate Taxes

A one-year snapshot of corporate tax situations paints an inaccurate picture of the taxes paid by corporations. Provisions like accelerated depreciation cause short-term gaps in book and taxable income due to timing differences, but over the life of an asset the same nominal deductions are taken for both calculations. Deductions for past losses help smooth out tax liability over time to avoid penalizing companies with volatile earning patterns.

Over a multiyear horizon, timing differences between book and tax income largely disappear, making the two measures more consistent.

Taxes Done Right For Freelancers And Gig Workers

TurboTax Self-Employed searches 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: When Are Quarterly Estimated Taxes Due

Calculate Your Tax Deductions

Paying taxes is painful however, dont neglect that tax deductions can soften the blow.

Tax deductions assist decide how tons cash you owe or how lots you get lower back from the Department of Revenue. The identical aspect applies to commercial enterprise tax deductions, and the extra you have, the much less you pay in taxes.

Estimated Taxes For Business Owners

Because you are the owner of a business, no one withholds income tax and self-employment tax from the money you take out of the business.

The IRS requires that these taxes be paid throughout the year, so you must pay estimated taxes quarterly. The first payment of the year is due April 15, then again on June 15, Sept. 15, and Jan. 15 of the following year.

The estimated tax form for business owners combines business and personal income and taxes, including self-employment taxes.

Don’t Miss: What Will My Tax Return Be

Llc Tax Tips For Business Owners

Its easy to feel overwhelmed by all the tax responsibilities an LLC might have. Fortunately, there are a few ways to lower your tax burden and make tax filing easier.

Here are some tips for LLC tax filing:

-

Take advantage of any tax deductions and tax credits that your LLC is eligible for.

-

Review business tax deadlines in advance, and note relevant due dates.

-

Hire a certified public accountant or tax professional to assist you with tax filing.

-

Talk with your CPA or tax professional about the potential benefits of electing corporation tax status for your LLC.

-

Understand your state and localitys tax requirements.

Porter says that understanding your LLCs tax setup in the beginning is important. Common mistakes are not engaging a CPA that is familiar with the tax rules surrounding LLCs. Its much easier and cheaper in the long run to set up the LLC correctly the first time and make the valid elections for the LLC to be taxed as the business owner wishes.