Impact Of The Tax Exemption On Instalments

The instalment examples below show an eligible employer claiming the full exemption amount of $1 million. The employer’s total Ontario remuneration exceeds $1,200,000. The employer must remit monthly instalments once its total Ontario remuneration exceeds $1.2 million.

An eligible associated employer, whose available exemption amount for the year is less than $1 million, must adjust the available exemption amount it would claim in column C accordingly.

What Is The Percentage Of Federal Income Tax Withheld

As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax authorities.

To calculate how much of your employeeâs federal income tax to withhold, youâll need a copy of their Form W-4, as well as your employeeâs gross pay.

Your next step is to determine the method you want to use to calculate withholding. Most employers have two options, the wage bracket method and the percentage method. While not exactly simple, the wage bracket method is the more straightforward way to calculate payroll tax.

What Are Payroll Taxes

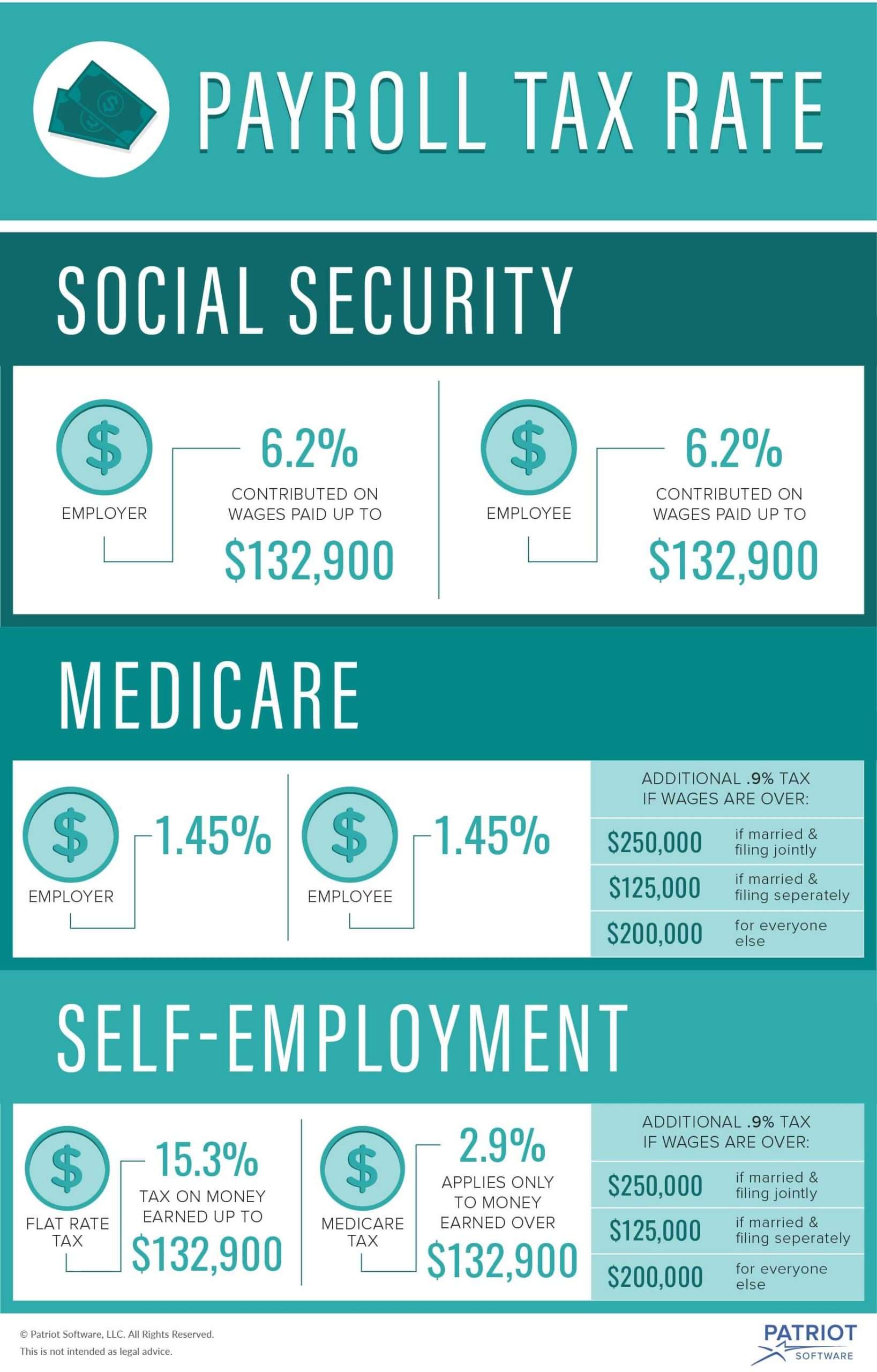

Put simply, payroll taxes are taxes paid on the wages and salaries of employees. These taxes are used to finance social insurance programs, such as Social Security and Medicare. According to recent Tax Foundation research, these social insurance taxes make up 23.05 percent of combined federal, state, and local government revenue the second largest source of government revenue in the United States.

The largest of these social insurance taxes are the two federal payroll taxes, which show up as FICA and MEDFICA on your pay stub. The first is a 12.4 percent tax to fund Social Security, and the second is a 2.9 percent tax to fund Medicare, for a combined rate of 15.3 percent. Half of payroll taxes are remitted directly by employers, while the other half are taken out of workers paychecks.

Don’t Miss: How To Buy Tax Lien Properties In California

Statutory Payroll Tax Deductions

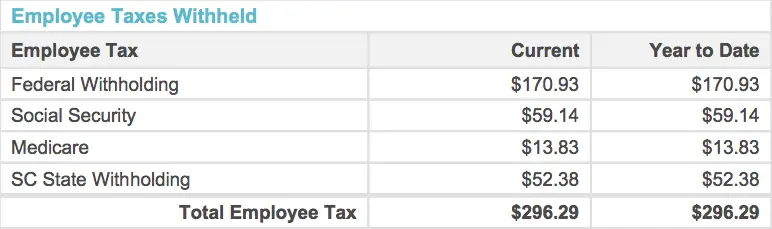

The law requires that payroll taxes must be withheld from an employee’s paycheck each pay period. Employers must then transmit these withholdings to various tax agencies. Payroll tax deductions include the following:

- Federal income tax withholding based on the withholding tables in Publication 15

- Social Security tax withholding of 6.2% in 2020 and 2021, up to the annual maximum taxable earnings or wage base of $137,700 for 2020 and $142,800 for 2021

- Medicare tax withholding of 1.45%

- Additional Medicare tax withholding of 0.9% for employees earning over $200,000

- State income tax withholding

- Various local tax withholdings, such as city, county, or school district taxes state disability or unemployment insurance

How Do Payroll Taxes Differ From Income Taxes

Payroll taxes are used to fund specific programs and are distinct from income taxes. Individuals are typically taxed at both the federal and state levels, and, in some cases, municipalities may also impose local taxes. While everyone pays a flat payroll tax, income taxes are progressive meaning the rates vary based on earning amounts. Federal income taxes are put into the governments funds at the U.S. Treasury, while state and municipality income tax, if applicable, goes into the states or municipalitys treasury.

Recommended Reading: How To Buy Tax Lien Properties In California

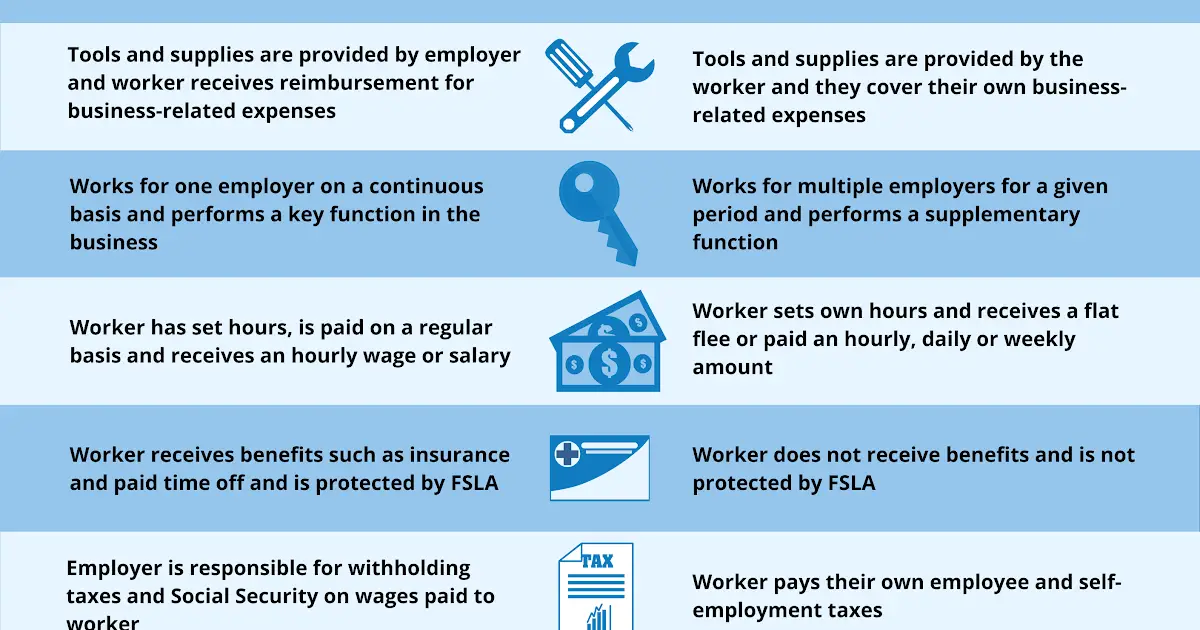

Who Pays For Payroll Taxes For 1099 Workers

As a client of a 1099 worker, you dont pay your freelancer a salary. You pay fees based on the scope of work agreed to, according to terms agreed upon by both parties in your Master Service Agreement / consulting agreement / independent contractor agreement.

Since you dont pay salaries to your freelancers, independent contractors, and other 1099 workers and vendors, you dont pay their payroll taxes. How those taxes get paid depends on the tax and legal structure of your 1099 worker.

Generally, since 1099 workers dont receive wages, they must pay their own payroll taxes. For those who are self-employed or sole proprietorships, they must pay the entire payroll tax on their own. This self-employment tax totals 15.3% plus another 0.9% surtax for Medicare for those whose self-employment earnings exceed $200,000 and independent contractors must pay for this on their own as part of their quarterly estimated taxes.

1099 workers who have incorporated an S Corp are still responsible for paying their own payroll taxes but do so at a slightly higher rate on the portion paid to themselves as their employee wage. They are able to split their profits between their own employee wage and their distribution of profits, minimizing their payroll tax expenditures.

Calculate Your Federal Unemployment Tax On Form 940

If you are an employer and pay wages of $1,500 or more in any calendar quarter of the previous year, or if you had one or more employees who worked at least 20 or more different weeks, then you have a responsibility to pay FUTA. If so, report the amount of tax you owe for the year on Form 940 by January 31.

However, you must determine the amount of tax you owe each quarter and make a payment when the cumulative amount for the year reaches $500. If after one quarter you owe less than $500, carry it forward and evaluate the amount again after the next quarter.

Recommended Reading: How Can I Make Payments For My Taxes

Factors That Affect Base Salary

The base salary is affected by some of the factors we mentioned at the beginning of this article. Location, for instance, affects salaries in a decisive way even if we are considering the same role. Costs of living are the main drive, as you can see from the following chart we created using the cost of living calculator from CNNMoney.

| From / To | |

|---|---|

| $23,219 | $40,000 |

Based on the above, if you live in Miami with a salary of $40,000, a comparable salary in Manhattan would be around $83,322 just because the costs of living in New York City are much higher than in the Miami-Dade County area. However, a comparable salary in San Antonio, Texas, where the cost of living is lower than Miami, would be around $30,769. Again, this calculator is useful in terms of providing an indication of how your salary will compare in different cities across the country taking into consideration things like housing, groceries, utilities, transportation, and health care.

How To Calculate Federal Income Tax Withholding Using The Wage Bracket Method

In IRS Publication 15-A, find the tables marked âWage Bracket Percentage Method Tables.â Use the table corresponding to your employeeâs pay period.

Check form W-4 to determine whether the employee files income tax as married or single and the number of allowances they claim.

Find the employeeâs gross wage for the pay period in columns A and B. The wage should be over the amount found in column A but under the amount found in column B.

Subtract the amount found in Column C.

Multiply the result by the percentage found in Column D.

Check form W-4 to determine if the employee requests additional tax withheld from each paycheck. If they do, add that amount to the final number.

The end result is the amount you should withhold from the employeeâs paycheck for that pay period.

The Percentage Method is much more complicatedânot recommended if youâre doing this alone. If you want to learn more about the Percentage Method, you can read all about both methods in IRS Publication 15-A.

Once youâve figured out how much income tax to withhold from your employeesâ paychecks, your next step is to figure out how much FICA to withhold , and how much youâll be required to pay on their behalf.

Don’t Miss: How Much H And R Block Charge For Taxes

At Some Financial Institutions

Monthly payments may be made free of charge, by the due date, at some financial institutions in Ontario. You should confirm with your financial institution whether it will accept monthly payments. Employers will need the Instalment Statement to make the payment. Employers should retain the top portion, date stamped by their financial institution, as proof of payment.

NoteAnnual, final and special returns are not accepted at financial institutions.

Employer And Employee Responsibilities

Both employer and employee hold the responsibility for collecting and remitting withholding taxes to the Internal Revenue Service . For the most part, the employer withholds these taxes on behalf of their employees, but in cases where an employer does not do this, or where an employee is self-employed, it is the responsibility of the employee to pay these withholding taxes.

You May Like: How To Buy Tax Lien Properties In California

Other Things To Report

As part of your regular reports, you should tell HMRC when a new employee joins and if an employees circumstances change, for example they reach State Pension age or become a director.

You have to run annual reports at the end of the tax year – including telling HMRC about any expenses or benefits.

Form Td1 Personal Tax Credits Return

There are two types of Form TD1, Personal Tax Credits Return federal and provincial or territorial. Both forms, once completed, are used to determine the amount of federal and provincial or territorial tax to deduct from the income an individual receives in a year.

Individuals who will receive salary, wages, commissions, employment insurance benefits, pensions, or other remuneration must fill out a federal Form TD1 and, if more than the basic personal amount is claimed, a provincial or territorial Form TD1. For Quebec, see Employment in Quebec.

An employee must fill out a Form TD1 and give it to the employer when the employee starts work. The employee should fill out a new Form TD1 within seven days of any change that may result in a change to their personal tax credits for the year.

Note

cannot claim them againmore

Employees who do not fill out new forms may be penalized $25 for each day the form is late. The minimum penalty is $100, and increases by $25 per day to the maximum of $2,500.

Employees do not have to fill out new TD1 forms every year if their personal tax credit amounts have not changed.

You are committing a serious offence if you knowingly accept a Form TD1 that contains false or deceptive statements. If you think a Form TD1 contains incorrect information, call 1-800-959-5525.

Have a completed Form TD1 on file for each of your employees or recipients. We may ask to see it.

Note

Employment in Quebec

You can get Quebec forms from Revenu Québec.

Claim codes

Recommended Reading: How Can I Make Payments For My Taxes

Payroll Taxes And Moving Expense Payments To Employees

Employee moving expenses paid by your company, even if you have an accountable plan, are subject to withholding for federal income taxes, FICA taxes , and federal unemployment taxes.

You must report the amount of this benefit when you complete the W-2 annual tax report for the employee for the previous year.

To clarify how these expenses are entered on an employee’s W-2 form. We’ll use the example above, where the employee receives $5,000 for moving expenses, has receipts for $3,650, and keeps the remaining $1,350. The amount the employee keeps is taxable to the employee. We’ll assume this payment is done under the requirements for an accountable plan, as described above:

- The taxable $1,350 is included in Box 1 of the W-2 .

- Federal and state income tax withholding and FICA taxes must be calculated for the taxable $1,350 and included in the appropriate boxes on the W-2.

- You must include the $3,650 in box 12 of Form W-2 using code L.

For more details on how this works, see IRS Publication 15 .

Deduction And Employer Contribution Amounts

The amount of employee deductions and employer contributions will depend on the employees income. To find out how much you have to deduct or contribute you can call Canada Revenue Agency or visit them online to get a copy of the Payroll Deduction Tables. CRA also provides various forms that you and the employee will need to fill out before the employee is paid for the first time.

An employer is required to fill out special forms when reporting employee earnings. To report salaries, wages and taxable benefits, an employer is required to fill out a T4 form and give the employee their copy by the end of February of the following year. To obtain these forms and for more information call CRA.

Most employers are also responsible for paying the Employer Health Tax and Workplace Safety and Insurance premiums, which are calculated as a percentage of the businesss total payroll expense and are administered by provincial government offices. If you are starting a new business or hiring new employees for the first time, you should contact the Employer Health Tax Branch in your area and the Workplace Safety and Insurance Board to register your business and to find out how much tax you will have to pay.

Read Also: What Does H& r Block Charge

Reducing Remuneration On Which You Have To Deduct Income Tax

Certain amounts that you deduct from the remuneration you pay an employee, as well as other authorized or claimed amounts, can reduce the amount of remuneration from which you deduct tax for the pay period. Reduce the remuneration by the following amounts before you calculate tax:

Do not subtractCPP contributions and EI premiums to determine the remuneration that requires tax deductions.

Example

$442.50

Letter of authority

Your employee will have to give you a letter of authority from a tax services office in order for you to reduce remuneration on which you have to deduct tax. For example, this would be the case if an employee makes deductible RRSP contributions during the year, or if an employee lives in one province or territory but works in another and will have too much tax deducted.

To get a letter of authority, the employee has to send Form T1213, Request to Reduce Tax Deductions at Source, or a written request to the appropriate Taxpayer Services Regional Correspondence Centre. For a complete list of these centres and their address, go to Where to send the request. The employee should include documents that support their position why less tax should be deducted at source. For example, if the employee regularly contributes to an RRSP in the year, they should provide documents to show the amounts they contribute.

Keep all letters of authority with your payroll records so our officers can review them.

Note

RRSP contributions you withhold from remuneration

Note

Note

Employees Profit Sharing Plan

An employees profit sharing plan is an arrangement that allows an employer to share profits with all or a designated group of employees. Under an EPSP, amounts are paid to a trustee to be held and invested for the benefit of the employees who are beneficiaries of the plan.

Each year, the trustee is required to allocate to such beneficiaries all employer contributions, profits from trust property, capital gains and losses, and certain amounts in respect of forfeitures.

Report payments from EPSPs on a T4PS slip instead of a T4 slip. You must show on the T4PS slip if the employee is a specified employee: one who is dealing with the employer in a non-arms length relationship, or who has a significant equity interest in their employer or a company related to their employer. If the amount paid to the specified employee is more than 20% of that employees total income for the year from employment with the employer, a tax will apply to the exceeding amount.

For more information, go to Employees profit sharing plan .

Recommended Reading: How To Buy Tax Liens In California

Security Options On Pier Listings

The PIER program checks security options reported as a non-cash taxable benefit in box 38 and box 14 on T4 slips because such a benefit is pensionable but not insurable. If this type of benefit is the only amount reported on a T4 slip, enter an X or a check mark in box 28 under EI. Do not place an X or a check mark in box 28 under CPP. This benefit is pensionable and CPP contributions are required.

The Additional Medicare Tax

Since 2013, an additional Medicare tax of 0.9% has been applied to unmarried employees who file an individual tax return and whose Medicare wages exceed $200,000. The additional Medicare tax applies to income over $250,000 for married taxpayers who file a joint return and to income over $125,000 for married couples who file separate returns.

The additional Medicare tax is an employee-only tax. There’s no corresponding tax imposed on the employer.

Recommended Reading: How Can I Make Payments For My Taxes

You Can Outsource Payroll Tax

Payroll tax is complex. The calculations are nitpicky and penalties are steep. Even paying payroll taxes just a day late comes with a 2% penalty on the amount due, with that penalty rising as high as 15% for past due payroll taxes.

We highly recommend outsourcing your payroll to a company like Gusto. Theyâll take the headache out of everything from paying your employees the right amount at the right time, to handling pesky withholding calculations and payroll taxes.

When it comes time to record payroll costs on your books, Bench can take care of that for you. Learn more about how we are saving small business owners hours of admin every month.

Calculating The Cpp Deductions

To determine the amount of CPP contributions to deduct, use one of the following tools:

- the Payroll Deductions Online Calculator

- the Payroll Deductions Tables

- the Payroll Deductions Supplementary Tables

- the Payroll Deductions Formulas

Note

The Payroll Deduction Tables break the CPP basic yearly exemption down by pay periods.

To find out which method is best for you, see Payroll Deductions Tables.

You can also use a manual method to calculate your employees CPP deductions. For a single pay period, use the calculation in Appendix 2. For multiple pay periods, or to verify the CPP contributions deducted at the end of the year before filling out the T4 Slip, use the calculation in Appendix 3.

Notes

A pay period means the period for which you pay earnings or other remuneration to an employee.

Once you have established your type of pay period, the pay-period exemption must remain the same, even when an unpaid leave of absence occurs, or when earnings are paid for part of a pay period.

Recommended Reading: How Much Does H And R Block Charge To Do Your Taxes