Coming Prepared Will Benefit You

While it can seem overwhelming at the amount of documentations, files, and information you need to bring in to your tax preparer, it is worth the extra effort to know that you are providing your preparer with all the information they need in order to save you the most on your tax return.

Preparing before your meeting and making sure you have all the required documents, will help your tax preparer be the most efficient in preparing your taxes at the highest benefit to you. Things will move faster and smoother.

We hope this was helpful in providing you a tax prep for what to bring to your tax consultant. While there are more items that you could bring in, this is just a list of the main ones. If you have any questions, please contact us at we would be happy to answer them.

Free Tax Assistance Sites

Eligible filers can take advantage of the opportunity to safely and efficiently e-file their returns at free tax assistance sites. Tax Department experts will be available at each location to assist low- and middle-income New Yorkers through the filing process at no charge. At certain locations, they can assist taxpayers in multiple languages, including Arabic, Bengali, Chinese, Haitian Creole, Italian, Japanese, Korean, Russian, Spanish, and Urdu.

A schedule of dates, times, and locations for all free filing sessions statewide is available at Facilitated Self Assistance program.

How Much Should Tax Preparers Charge For Their Services

For most preparers, this will vary wildly by the region in which they work. So, while theres no clear cut, silver bullet answer about how much a preparer should charge, there are some tips to get started.

- The National Society of Accountants cites the latest data on the average price for a 1040 preparation.

- Associations and professional groups, including collegiate accounting clubs, can be good resources to determine prices.

- Most preparers will call around and get quotes from other firms and then use that to make up their pricing system.

Once youve determined a competitive price for your context, consider whether you want to charge an hourly rate, or price your services with a fixed fee.

While an hourly rate may seem more intuitive at first , consider what will be the best way to make money when you become efficient. Why would you charge an hourly rate for a 1040 form that might take you 15 minutes to complete? Fixed fee or value billing is not about the time you spend on a clients preparation but instead focuses on the expertise and efficiency youve gained as a professional.

It takes the preparer a short amount of time because they are talented and efficient. And thats what clients are truly paying for your experience.

Read Also: How To Know If Your Taxes Are Filed

What Documents To Bring To Tax Preparer

What documents do I need to send to the IRS?

- W-2 and Income Forms. When you file a tax return electronically,an electronic copy of your W-2 and other income forms,such as 1099 s,is created.

- Attaching Schedules. In some cases,your income tax return may require more forms or schedules than the 1040 form.

- Receipts and Proof of Expenses.

- Keep for Your Records.

What Questions Do I Ask Before Hiring

- What kind of formal training does the preparer have and how current is the training?

- How long has the preparer been doing tax returns?

- Will the preparer explain how the return was prepared in the event of an examination by ADOR or the IRS?

- Did the preparer explain charges for services in advance?

- Does the preparer provide copies of complete returns to clients?

Don’t Miss: How To File Taxes With No Income

How Do I File An Extension With The Irs

Income tax returns are generally due on or around April 15 each year. If you can’t file on time, you can file for an automatic six-month extension using Form 4868. Keep in mind that the extension applies to filing your tax returnnot to paying any taxes you may owe. To avoid penalties and interest, you’ll need to pay your taxes by the regular filing deadline .

A Little Prep Work Can Save You Time And Money

Small Business Taxes, The Complete Idiots Guide to Starting a Home-Based BusinessGuide to Self-Employment, The Wall Street JournalU.S. News and World Report

Almost 85 million taxpayers pay professionals to complete and submit their tax returns, according to the Internal Revenue Service . If you’re one of them, it is important to organize your receipts, forms, and other documents well before tax time.

Your preparer may take information directly from you or ask you to complete a questionnaire. Either way, a little preparation will help you get through the process quickly and easily. Even if you do your own taxes, the steps below will help you get organized.

Also Check: What Is The Current Capital Gains Tax Rate

How Do You Get A Ptin

This process begins on the IRS website and requires annual renewal. However, there is no fee for either the initial registration process or the renewal.Once a PTIN is issued, the tax preparer is required to put this on every single return they prepare. In general, the IRS website includes many helpful solutions and other tips for people beginning this process.

What You Need To Provide To Your Tax Preparer

Its almost time. Time to get everything together to get your taxes done.

If I was doing your taxes, what would I need to see? Depending upon your personal situation you may have a couple of documents for your tax return or you could have dozens. Whether you are doing your taxes yourself, handing them off to a tax preparer or accountant, or taking advantage of TurboTax Live Full Service, getting ready to have your taxes done is made easy with just a little preparation.

This is a checklist list of the most common things you need to do and should do when getting ready to have your taxes done. If youre the family tax preparer, you should do the same for each one of your family members.

Also Check: Are Tax Id And Ein The Same

Collect These Documents Before You Start Your Tax Return

The Good Brigade / Getty Images

The challenge of gathering everything you need to file your annual tax return can be either minimal and yawn-worthy or aggravating and time-consuming. How you feel about doing your taxes can depend on your financial situation. You can probably yawn if youre single, rent your home, and work one job, but youll have to dedicate some time to the filing process if youre married, are a single parent with at least one of your children living at home, have investments, are self-employed, or work multiple jobs.

Each of the latter scenarios will require gathering multiple documents.

Weve you can download and print to help you find and gather the information and documents youll need when filing your taxes.

Find A Professional Tax Preparer

- Current: Find a Professional Tax Preparer

If you are going to pay someone to do your tax return, be sure to choose your tax preparer wisely. Remember, you are legally responsible for what is on your tax returns even if they are prepared by someone else. So, it is important to find a qualified tax professional.

If you are looking for a local tax professional, some locations to find quality, qualified tax preparers are among the members of the Indiana CPA Society or the Indiana Society of Enrolled Agents.

Don’t Miss: How Do I Get My Pin Number To File Taxes

What Are The Most Common Tax Forms And Types Of Tax Returns Prepared By A Tax Preparer

Depending on levels of experience, your client roster, and the specifics of your business, the types of tax returns a preparer will work on can range from an Individual Income Tax Return, Form 1040 to a Corporation Income Tax Return, Form 1120 to interpreting complex partnership agreements.However, most tax forms will break down into two different groups:

- Individual forms, such as 1040.

- Business returns, including corporations, partnerships, trusts, not for profit exempt organizations.

Most preparers will usually focus on 1040s/individual tax preparations when starting out. This is generally because theyre easier to prepare and, honestly, easier clients to get. For some preparers, staying 1040 focused is a career choice, doing a little bit of business work as it arises from current clients.

However, often tax preparers are looking to get more business work, and their 1040 clients are a bridge to that career goal. Doing individual returns gets cash flow underway. Over time, they can get enough money and clients to transition to a more business-focused client list.

What Documents Do I Need To Bring To My Tax Preparer

OVERVIEW

Whether you prepare your taxes yourself or get help from a tax preparer online or in-store, knowing what documents you’ll need at hand can help prevent tax filing errors and possibly lower your tax bill.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Don’t Miss: How To Calculate Tax Return

What Does A Tax Preparer Do

Most tax preparers prepare, file, or assist with general tax forms. Beyond these basic services, a tax preparer can also defend a taxpayer with the IRS. This includes audits and tax court issues. However, the extent of what a tax preparer can do is based on their credentials and whether they have representation rights.

In a way, tax preparers are asked to serve two masters their clients and the IRS. They must assist their clients in complying with the state and federal tax codes, while simultaneously minimizing the clients tax burden. While they are hired to serve their client, they must also diligently remember their obligation to the IRS and not break any laws or help others file a fraudulent return.

Check Your State For Tax Preparer Requirements

- Tax return preparer regulations vary widely by state. So be sure to check with the state you live in to see if you have specific requirements that you must meet. States like California, Connecticut, Iowa, Maryland, New York, and Oregon, do have requirements.

- State requirements for tax return preparers can range from nothing, to annual registration, a required beginner course, and/or a state exam that you must pass. You may also have continuing education requirements. Many states still dont have any requirements!

Read Also: How Far Back Can I File Taxes

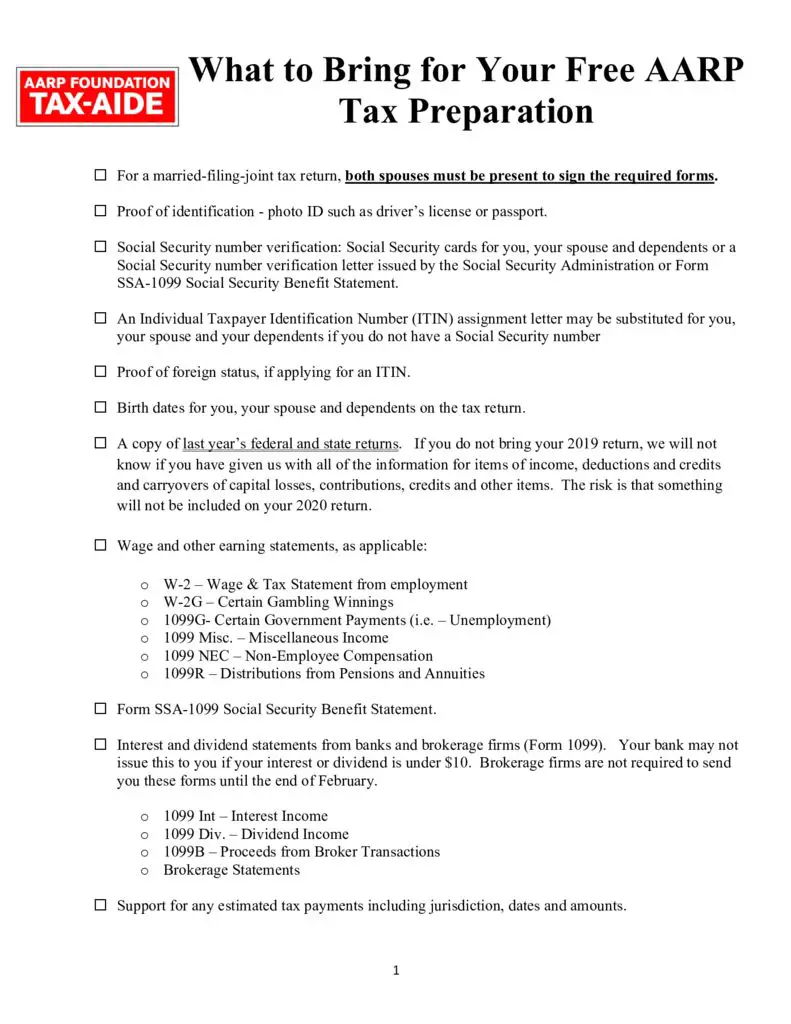

What To Bring To Your Local Vita Or Tce Site

-

Proof of identification

-

Social Security cards for you, your spouse and dependents

-

An Individual Taxpayer Identification Number assignment letter may be substituted for you, your spouse and your dependents if you do not have a Social Security number

-

Proof of foreign status, if applying for an ITIN

-

Birth dates for you, your spouse and dependents on the tax return

-

Wage and earning statements from all employers

-

Interest and dividend statements from banks

-

Health Insurance Exemption Certificate, if received

-

A copy of last years federal and state returns, if available

-

Proof of bank account routing and account numbers for direct deposit such as a blank check

-

To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms

-

Total paid for daycare provider and the daycare provider’s tax identifying number such as their Social Security number or business Employer Identification Number

-

Forms 1095-A, B and C, Health Coverage Statements

-

Copies of income transcripts from IRS and state, if applicable

Include Either Your Income Statement Or Profit And Loss

These accounting terms can be used interchangeably. They are merely financial statements. Dont be scared. They are fancy words for your businesss financial results. They are all the expenses and earnings related to your business.

Some people use QuickBooks or other accounting software, while others use Excel or Google Sheets. I even have some clients who take an old school approach and write their numbers by hand and use their own accounting system.

Regardless of what you choose, its critical to be organized, complete, accurate, and consistent. If you need help with your bookkeeping, there are professionals out there who can help.

Save all of your receipts and source documents. Youll need proof if the IRS asks a question or pulls your return for an audit.

This includes 1099s for any income received and invoices and receipts for your expenses. If you are comfortable with your accounting and financials, you dont have to give your tax preparer your source documents.

If you dont have your financials documented, youll need to compile a list of your income and expenses or have a bookkeeper, accountant, or tax preparer help you.

The last thing a tax preparer wants is to be handed a bag or box of receipts during tax season. If you are in this category, may still have time to get prepared. Save yourself time and money by being organized as it relates to the documents you should bring to your tax preparer.

Read Also: How To Not Pay Taxes Legally

What To Bring To Your Accountant At Tax Time

Youll need all this information and documentation whether you prepare your tax return yourself or if you decide to use a tax professional. The difference with the professional is that youll have to take all pertinent information with you to your appointment or gather it together in advance to send through fax or electronically. Youll also need some additional documentation if youre using a tax professional for the first time.

Your tax preparer will require identifying information for you, your spouse , and your qualifying dependents, if applicable. This means Social Security cards, although you can typically take a copy of your most recent years tax return instead. This will detail all your identifying information unless youve since acquired another dependent who wasnt listed on that return.

Of course, you wont have to bring all of this with you if youre using the same professional youve used before. Theyll already have everything at their fingertips.

Its a good idea to take your previous years tax return with you to meet a tax professional, even if you have Social Security cards for everyone in your family. This should give your tax preparer an accurate picture of your personal tax situation, in addition to the identifying information it includes.

While it may seem like a lot of paperwork, gathering and organizing it will be worth it, especially if your tax situation is complex and requires a great deal of documentation.

Commonly Asked Questions About Our Free Tax Program

Thanks to our program partners, weve expanded access to our free on-site tax preparation services. Please look at our Locations to find the tax locations nearest you.

If you live in New York City and your income is less than $32,000 a year , were here to help!

Our services are open to all income-eligible New Yorkers and centered around underserved communities, such as immigrants, veterans, women, and people of color, as our mission is to create economic justice by removing barriers to access to financial resources and education.

If you dont have a Social Security number, we can help you apply for an Individual Taxpayer Identification Number , so you can file your return. If you havent filed in a few years, we can file some prior-year returns for you as well. If you are self-employed, we can probably do your return if you have less than $25,000 in business expenses.

Read our Free Tax Preparation Checklist before you visit us. Trust us. It will save you a lot of time!

Youll need:

- Government picture ID

- Your Social Security card or ITIN information . We can help you get an ITIN if you dont have and are not eligible for a Social Security number.

Income documents, such as:

You May Like: How To Find Tax Lien Properties

What Kind Of Tax Preparer Do I Need

Anyone can be a paid tax return preparer as long as they have an IRS Preparer Tax Identification Number . However, tax return preparers have differing levels of skills, education and expertise.

Learn about tax preparer credentials and qualifications. Watch Choose a Tax Preparer Wisely. Get information on the Volunteer Income Tax Assistance program.

What Bank Statements Do I Need For Taxes

Form 1099-INT is a statement that your bank is required to send you if it paid you at least $10 in interest during the tax year. Use this form to report interest income on Form 1040, because the bank will send a copy to the IRS and the IRS will compare their copy with the amount you reported on your Form 1040.

Read Also: Are Goodwill Donations Tax Deductible

What Is Needed To Maintain Tax Preparation Certification

The EA certification lasts for three years. Enrolled agents can renew by filling out a form and paying the required fee. The IRS also requires EAs to take two hours of ethics and at least 14 hours of other credits each year. This totals 72 hours of continuing education per renewal cycle. EAs can pursue these credits through approved continuing education providers or the National Association of Enrolled Agents.

CPA license duration depends on the state but often lasts 1-3 years. Each state board generally requires continuing education hours, often including ethics courses. CPAs can join AICPA or their local state CPA association.

Dont Miss: H& r Block Early Access W2