Should I Become A Tax Preparer

When considering how to become a tax preparer, the decision depends on your unique circumstances and goals.

Benefits to consider include earning potential, job satisfaction from helping others, and challenges while working in the field.

A tax preparer may enjoy career progression after taking on more responsibilities and working with a variety of clients. However, there are pain points like long hours during tax season, or having to stay current on tax law changes.

Tax preparer pros include:

- Learning to file claims electronically to reduce tax return errors and speed up the tax preparation process.

- Access to tax records to make it easier for taxpayers to track tax liability.

Cons may include:

- Investing in new software or hardware to electronically file client taxes.

- Learning new skills to navigate electronic filing technology.

- Setting up new security protocols to access tax records.

Other Types Of Income

If you’re self-employed or you receive income from other sources, you’ll need to report that information on your tax return. If you’ve received any of the following IRS forms in the mail, share them with your tax preparer.

- Form 1099 and Form 1099-MISC for self-employment income

- Form 1099-A for foreclosure of a home

- Form 1099-B for proceeds from broker transactions

- Form 1099-DIV for dividends and distributions

- Form 1099-G for unemployment income or a state tax refund

- Form 1099-INT or Form 1099-OID for interest income

- Form 1099-K for business or rental income processed by third-party networks

- Form 1099-LTC for Long Term Care reimbursements

- Form 1099-PATR for patronage dividends

- Form 1099-Q for payments from qualified education programs

- Form 1099-QA for distributions from an ABLE account

- Form 1099-S proceeds from the sales of property

- Form 1099-SA for Health Savings Account and Medical Savings Account distributions

- Form SSA-1099 for Social Security benefits

- Form RRB-1099 for railroad retirement benefits

Optional Certifications And Degrees

While certifications and degrees for this specialty area are optional, tax preparers often seek these designations to enhance salary and job security. In fact, certain industries may require these certifications to confirm mastery of a specific domain or a commitment to professional development.

There are several voluntary paths for tax preparers when assessing how to become a certified tax preparer.

For unlimited representation rights, the most common are the certified public accountant , the enrolled agent , and tax attorney professions. The IRS grants limited representation rights to PTIN registrants.

CPA

Tax preparers must pass the Uniform CPA Examination, which the AICPA administers.

Tax preparers must also meet education and experience requirements set by their state’s board of accountancy. To maintain their license, CPAs must complete continuing education courses every year.

EA

EAs must pass the Special Enrollment Examination the IRS administers. To maintain the EA license, EAs must complete continuing education courses every year.

Tax Attorneys

As a certified tax preparer, the IRS allows tax attorneys to represent taxpayers before tax authorities. The road to a fulfilling tax attorney’s career may vary, depending on the candidate’s educational background and interests. However, a tax attorney routinely completes an accredited law degree, bar exam, and a specialty tax law program.

Read Also: Where Do I Send My Federal Tax Return To

Our Security Practices And Information Accuracy

TaxSlayer understands the importance of protecting customer information. TaxSlayer adheres to regulatory, security, and privacy standards applicable to the tax preparation industry. TaxSlayer web-based and desktop applications have a proven record of securing TaxSlayer information by utilizing a variety of security related technologies including, but not limited to, firewalls, intrusion detection systems, web application firewalls, encryption, access controls, network isolation, auditing systems, data classifications, and data obfuscation. In order to protect the data as our client enters it in the system, TaxSlayer incorporates the use of SSL encryption facilitated by an Extended Validation SSL Certificate issued by a recognized trusted certificate authority. TaxSlayer utilizes security guards, access controls, biometrics, man traps, and other security mechanisms to protect physical access to the datacenter.

Should I Give My Accountant Access To My Bank Account

Many people arent sure whether they should give their bank account access to their accountant. There is no concrete answer. You must personally decide how much information and access you give to your accountant. Most people feel the most comfortable with giving their accountant View Only bank account access.

Recommended Reading: How To File Stock Taxes

Tips On Finding Tax Preparers

A reputable preparer will ask multiple questions to determine whether expenses, deductions and other items qualify and remind clients that they need to keep careful and complete records in order to confirm the information contained on their tax return.

Here are some things to look for when choosing a preparer:

And dont forget before you sign your tax return or authorize it to be filed electronically, review the return and ask questions!

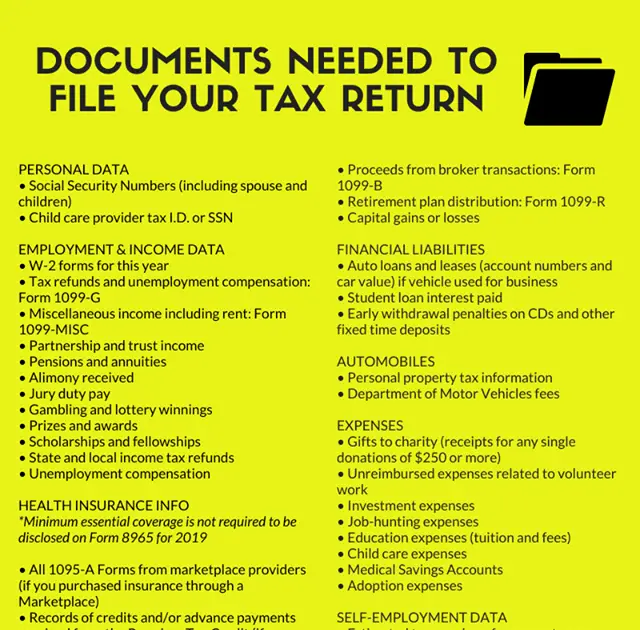

What Does A Tax Preparer Need To Prepare Tax Returns

Tax preparers need to efficiently and securely access and manage confidential information for their clients. As a result, most preparers look for software to manage their workflow effectively and efficiently.

Tax software should help preparers in the following ways:

- Learn. You cant know everything. There will always be knowledge gaps and questions from clients that you didnt anticipate. Professional tax software should increase your know-how, the ability to fill knowledge gaps with trusted and meaningful information for your daily work. Something to unstuck you when you dont know how to proceed.

- Research. Every client is different. And that means every answer you provide will need to be tailored to their specific questions and concerns. A tax research software solution can help get the answers when you need to go deeper and retrieve more information.

- Operate. Tax preparation requires a significant amount of day-to-day organization. You need tools to do the work and produce all the necessary forms. From document management solutions to e-filing assistance, tax software should make your operational duties easier, more productive, to do your job with confidence every time.

Also Check: What Is Schedule D Tax Form

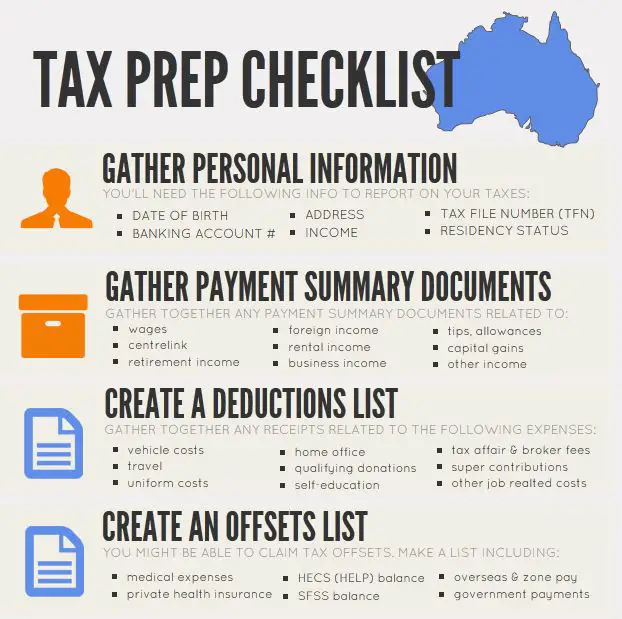

Bring These Items To The Neighborhood Tax Site If You Have Them

- Copy of 2012 tax return,

- Social Security cards, Social Security Number verification letters, or Individual Taxpayer ID Numbers for you, your children, and your spouse.

Documentation of your income. This includes:

- All W-2 forms for jobs you worked in 2013,

- All 1099 forms including 1099G forms . This shows other income you received for 2013,

- All 1098 forms .

Commonly Asked Questions About Our Free Tax Program

Thanks to our program partners, weve expanded access to our free on-site tax preparation services. Please look at our Locations to find the tax locations nearest you.

If you live in New York City and your income is less than $32,000 a year , were here to help!

Our services are open to all income-eligible New Yorkers and centered around underserved communities, such as immigrants, veterans, women, and people of color, as our mission is to create economic justice by removing barriers to access to financial resources and education.

If you dont have a Social Security number, we can help you apply for an Individual Taxpayer Identification Number , so you can file your return. If you havent filed in a few years, we can file some prior-year returns for you as well. If you are self-employed, we can probably do your return if you have less than $25,000 in business expenses.

Read our Free Tax Preparation Checklist before you visit us. Trust us. It will save you a lot of time!

Youll need:

- Government picture ID

- Your Social Security card or ITIN information . We can help you get an ITIN if you dont have and are not eligible for a Social Security number.

Income documents, such as:

You May Like: How To Find Tax Lien Properties

You May Like: How Much Should I Withhold For Taxes 1099

How We Collect Information

Visiting our Web Site

We will not collect personal information about you just because you visit this site. In order to improve the usefulness of our web site for our visitors, we automatically collect and maintain statistical information from our site’s data logs that concern network traffic flow and volume. This information consists of:

- The name of the domain from which the visitor accesses the Internet

- The Internet Protocol Address and

- The date and time our website is visited

- Operating system

This information does not identify individual visitors and is used to enhance and improve your experience on our site. No attempts are made to identify individual users unless illegal behavior is suspected.

Mobile

device you use and operating system version. We use mobile analytics software to allow us to better understand the functionality of our Mobile Software on your phone. This software may record information such as how often you use the application, the events that occur within the application, aggregated usage, performance data, and where the application was downloaded from. We do not link the information we store within the analytics software to any personally identifiable information you submit within the mobile app.

Purchasing our Products

Tracking Technologies

Behavioral Advertising

How Can I Check A Tax Preparer’s Credentials

Our Directory of Federal Tax Return Preparers with Credentials and Select Qualifications can help you find preparers in your area who currently hold professional credentials recognized by the IRS, or who hold an Annual Filing Season Program Record of Completion. You can also check the professional organizations many tax preparers belong to.

Don’t Miss: Where Is Amended Tax Return

Client Tax Prep Checklist: What To Bring To Your Accountant

Every clients list of requirements is going to be a little bit different. Some may have rental income from a property or business and others might have employment income and need W-2 forms as well as their business income forms. Giving them a list of documents broken down into categories can help them think through what they need to bring to file their tax return.

The checklist covers seven categories:

- Other business documents

- Estimated tax payments

Give them the checklist and tell them to think through any items that they need to find and bring in. You can also advise them if theyre not sure if you need something, to share it with you anyway. You can make the final decision about what is needed and what isnt, and theyll feel good knowing that theyve left no stone unturned in finding the necessary documentation.

Selecting A Tax Preparer

Selecting the right tax professional is enormously important. Taxpayers are ultimately responsible for the accuracy of their tax return, regardless of who prepares it.

There are numerous types of tax return preparers, including certified public accountants, attorneys, enrolled agents, and many others who do not have a professional credential. You hire a tax preparer to accurately file your return.

Most tax return preparers provide outstanding and professional tax service. Unfortunately, some taxpayers are scammed because they choose the wrong tax return preparer. Be sure to check our tips for choosing a tax preparer and how to avoid “ghost” return preparers.

Recommended Reading: How To Pay State Income Tax

So Can You Tell Me How To Get An Efin

Its a 3-step process. Heres the process to obtain an EFIN:

1. Create an IRS e-Services account on the IRS website.

2. Complete and submit your application to become an authorized IRS e-file provider. It can take up to 45 days for the IRS to approve an e-file application, so plan accordingly. All applicants must provide the following:

- Identification information for your firm

- Information about each Principal and Responsible Official in your organization

- Your e-file provider option

If the Principal or Responsible Official is a certified or licensed professional, such as an attorney, CPA, or enrolled agent, they must provide their current professional status information.

All other applicants must provide a fingerprint card, which can be arranged by calling the IRS toll-free at 866-255-0654. If you need to be fingerprinted, work with a trained professional. There are commercial services, but your local police station will likely provide this service for a modest fee. Then mail the signed and completed card to the IRS.

3. Pass a suitability check. After you submit your application and related documents, the IRS will conduct a suitability check on the firm and each person listed on your application as either a Principal or Responsible Official. This may include: a credit check a tax compliance check a criminal background check and a check for prior non-compliance with IRS e-file requirements. Once approved, you will receive an acceptance letter from the IRS with your EFIN.

Coming Prepared Will Benefit You

While it can seem overwhelming at the amount of documentations, files, and information you need to bring in to your tax preparer, it is worth the extra effort to know that you are providing your preparer with all the information they need in order to save you the most on your tax return.

Preparing before your meeting and making sure you have all the required documents, will help your tax preparer be the most efficient in preparing your taxes at the highest benefit to you. Things will move faster and smoother.

We hope this was helpful in providing you a tax prep for what to bring to your tax consultant. While there are more items that you could bring in, this is just a list of the main ones. If you have any questions, please contact us at we would be happy to answer them.

Recommended Reading: Are You Taxed When You Sell Your Home

The Following Points Will Assist You When Selecting A Tax Return Preparer:

- Be wary of tax return preparers who claim they can obtain larger refunds than others can.

- Avoid tax return preparers who base their fees on a percentage of the refund or who offer to deposit all or part of your refund into their financial accounts.

- Ensure you use a preparer with a PTIN. Paid tax return preparers must have a PTIN to prepare all or substantially all of a tax return.

- Use a reputable tax professional who enters his or her PTIN on the tax return, signs the tax return, and provides you a copy of the return .

- Consider whether the individual or firm will be around for months or years after filing the return to answer questions about the preparation of the tax return.

- Never sign a blank tax form.

- Check the person’s credentials. Only attorneys, CPAs, and enrolled agents can represent taxpayers before the IRS in all matters, including audits, collections, and appeals. Other tax return preparers who participate in the IRS Annual Filing Season Program have limited practice rights to represent taxpayers for audits of returns they prepared and signed. See Annual Filing Season Program for more information.

What Is Needed To Maintain Tax Preparation Certification

The EA certification lasts for three years. Enrolled agents can renew by filling out a form and paying the required fee. The IRS also requires EAs to take two hours of ethics and at least 14 hours of other credits each year. This totals 72 hours of continuing education per renewal cycle. EAs can pursue these credits through approved continuing education providers or the National Association of Enrolled Agents.

CPA license duration depends on the state but often lasts 1-3 years. Each state board generally requires continuing education hours, often including ethics courses. CPAs can join AICPA or their local state CPA association.

Don’t Miss: How Are Revocable Trusts Taxed

What Are The Most Common Tax Forms And Types Of Tax Returns Prepared By A Tax Preparer

Depending on levels of experience, your client roster, and the specifics of your business, the types of tax returns a preparer will work on can range from an Individual Income Tax Return, Form 1040 to a Corporation Income Tax Return, Form 1120 to interpreting complex partnership agreements.However, most tax forms will break down into two different groups:

- Individual forms, such as 1040.

- Business returns, including corporations, partnerships, trusts, not for profit exempt organizations.

Most preparers will usually focus on 1040s/individual tax preparations when starting out. This is generally because theyre easier to prepare and, honestly, easier clients to get. For some preparers, staying 1040 focused is a career choice, doing a little bit of business work as it arises from current clients.

However, often tax preparers are looking to get more business work, and their 1040 clients are a bridge to that career goal. Doing individual returns gets cash flow underway. Over time, they can get enough money and clients to transition to a more business-focused client list.

Proof Of Disaster Theft And Other Unexpected Losses

Despite all appearances, the Internal Revenue Service is not out to get you. In fact, there are several provisions in the tax code designed to help out folks who are victims of unexpected and expensive losses of property or cash.

For example, there are special deductions for people who are the victims of theft. For IRS purposes, that includes blackmail, burglary, embezzlement, extortion, kidnapping for ransom, larceny and robbery. To claim a loss from theft, you need to provide proof that you were the owner of the property and when it was taken from you. You don’t, however, have to prove that a conviction resulted from the crime . If you were a victim of theft, bring all related documentation to your tax preparer. Keep in mind that you must deduct any paid insurance claims from your losses.

The tax code also looks after people who are victims of natural disasters like fires, floods, earthquakes, tornadoes and hurricanes. In fact, there are special exemptions and deductions for people who live within federally declared disaster areas. To qualify for these deductions, you will need to provide your tax preparer with records of the lost property, clean-up expenses and rebuilding costs. You will also need to note any FEMA assistance or insurance reimbursements that you’ve already received.

Now that all of your deductions have been tallied, it’s time to find out if you’re getting a refund or paying even more to Uncle Sam.

Don’t Miss: How To Stop Property Tax Foreclosure