Q& a: How Long Do You Have To Fix An E

In most cases, if your electronic tax return gets rejected initially by the IRS, you will have an opportunity to correct the return and retransmit it. In the event that a rejection comes back after the April 15th tax deadline, you will be provided an additional five days to fix the errors and retransmit the return.

If the IRS rejects a return, it will provide an error code in order to identify what information must be fixed. Oftentimes, it can be something as simple as inputting the wrong AGI, date of birth, or Social Security number for you or a dependent.

Errors like these are typically easy to fix and can usually be completed within minutes. If for some reason the mistake is more complex or cannot be fixed when filing electronically, you may need to print out the return and mail it to the IRS.

Why The Irs Might Reject Your Return

Generally, if the IRS rejects your return its probably because it contains an error other than a simple math mistake. The IRS typically corrects math errors without rejecting a return.

Grafton Willey, managing director of CBIZ MHMs Providence, Rhode Island, office says he sees tax returns get rejected because a name or number on the return doesnt match information in the IRS or Social Security Administration databases.

Typos and misspellings can be quick and easy to fix. You might even be able to correct the issue online and e-file again. Other issues, such as someone fraudulently filing a return with your Social Security number, may require you to mail your corrected return.

Correct Mistakes And File An Amended Return

When an e-filed return gets rejected, the IRS will often let you know within a few hours. It also sends a rejection code and explanation of why the e-filed return was rejected.

If you had a company e-file your return, it must either correct the mistake on your behalf or inform you that your return was rejected within 24 hours.

You may be able to e-file a corrected return if your return was rejected for any of these reasons:

- A Social Security number or Taxpayer Identification Number doesnt match the taxpayers name.

- You misspelled a name.

- A payers identification number, such as your employers Employer Identification Number, isnt correct.

- Your return is missing a form.

The important thing to do is to make sure that the names and numbers reported on your tax returns match the paper information that they are taken from, says Willey.

Remember, whether you hand-key information into e-filing software, write it on a paper form, or rely on software to import information, be sure to thoroughly check the accuracy of all information before filing your return.

Read Also: How To Write Off Donations On Taxes

My Return Was Rejected But Turbotax Is Not Giving Me The Option To Fix My Return

Many returns are rejected because there was an issue with last years AGI. Try entering 0 for your 2019 AGI and see if that fixes the problem. If that doesnt work, follow these instructions:

Weve put together a list of common IRS rejections with links to instructions for that specific code. Select your code from the list under Common IRS rejection codes and follow the instructions to fix and refile your return.

If youre still unable to e-file, you can always print andmail your return.

How Long Does It Take To Go From Accepted To Approved

Once accepted, it can take anywhere from a few days to 3 weeks to go from acceptance to approval, and this timeframe is unrelated to how, where, or when you filed, nor is it connected to how quickly you got your refund last year. If your refund is still processing, it has not been approved.4 jun. 2019

You May Like: How To File Taxes For Doordash

Recommended Reading: How Can I File Previous Years Taxes For Free

Dont Respond To Any Emails Texts Or Calls

The IRS will never call, text or email you about a rejected return. If you receive any official notifications from the IRS, they will come via the U.S. Postal Service. Once you have begun a correspondence with the IRS, an agent may call you, but otherwise the IRS will not contact you via these other methods.

This common scam is on the rise, so be sure to only respond to mailed correspondence from the IRS. If you receive texts or phone calls from scammers, contact the IRS.

Read: The Wildest Things Your Taxes Are Paying For

Individual/fiduciary Due Dates For Calendar Year Filers

| Timeframes |

|---|

| Participant Acceptance Testing System begins |

| First Day to Transmit Live Current Year Returns |

| Last Day to Retransmit Rejected Timely-Filed Returns |

| Last Day to Transmit Timely Filed Current Year Returns on Extension |

| Last Day to Retransmit Rejected Current Year Returns Filed on Extension |

| Last Day for EROs and Transmitters to Retain Acknowledgment File Material for Returns e-filed in 2022 |

Also Check: How Many Tax Forms Are There

Ask If A Return Has Already Been Filed In Your Name

While youre on the phone with the IRS and/or SSA, ask them to check if a return has already been filed in your name. This is a common type of fraud, and its on the rise. If someone else has already filed a tax return in your name, the IRS computers will automatically block you from filing your return to help prevent fraud. Ironically, this could actually be an indication that fraud using your Social Security number has occurred.

If you go this route, youll have to include Form 14039, the Identity Theft Affidavit, when you refile. But check with the IRS and SSA to see what additional steps you might have to take to confirm your identity and refile your tax return.

More: Heres the No. 1 Thing Americans Do With Their Tax Refund

How To Avoid A Rejected Tax Return

In some cases, there may not be anything you can do to prevent your tax return from getting rejected, such as if a criminal files a fraudulent one in your name early on in the season. But one easy way to avoid a rejection is to proofread your return carefully before submitting it. Better yet, enlist the help of a spouse, family member, or friend to give it a second look if you’re filing solo.

Sometimes, it’s difficult to catch an error you make yourself, but it’s easier for a second set of eyes to spot one. Taking that step could spare you some hassle.

Recommended Reading: Who Does Not Have To File Taxes

What Happens If Your Tax Return Is Rejected Twice

The Rejection If you attempt to file your return twice, the IRS will reject the return and return it with an error code and explanation. The IRS typically uses error code 0515 or IND-515 to inform the sender that the taxpayer already filed a tax return for the same year using the same Social Security number.

Why Tax Returns Get Rejected

The IRS will commonly reject a tax return when it has missing information, or information that’s deemed erroneous. You may end up having your tax return rejected if you:

- Enter the wrong Social Security number

- Enter the wrong date of birth

- Misspell your name

The IRS will also generally reject a tax return if it already has a return on file with the same Social Security number — even if you entered the right one. In fact, criminals will commonly file tax returns in other people’s names and steal their refunds by diverting those funds to their own bank accounts. It’s for this reason that taxpayers are often advised to file early — to avoid a scenario where their returns are flagged as duplicates.

Either way, if your tax return is rejected, you’ll generally get a notice about that in the mail. Or, in some cases, the tax-filing software you use may notify you that your return was rejected.

Don’t Miss: Do You Pay Taxes On Cash Out Refinance

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

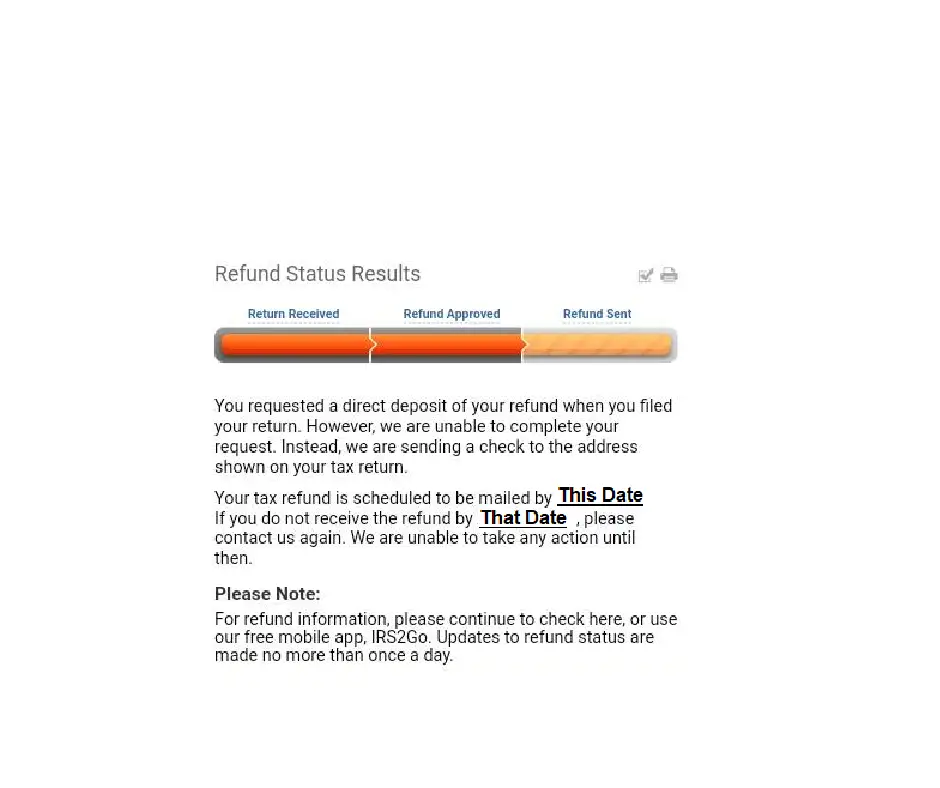

Looking For Information About Your Tax Refund

E-file and sign up for Direct Deposit to receive your refund faster, safer, and easier! You can check the status of your refund using IRS Wheres My Refund?

Not using e-file? You can still get all the benefits of Direct Deposit by getting your tax refund deposited into your account. Simply provide your banking information to the IRS at the time you are submitting your taxes.

Convenience, reliability and security. No more special trips to your institution to deposit your check a nice feature if you are busy, ill, away from home, located far from a branch or in a place where parking is hard to find. You no longer need to wait for your check to arrive in the mail. Your money will always be in your account on time. If you move without changing financial institutions, you will not have to wait for your check to catch up with you. You do not have to worry about lost, stolen or misplaced checks.

We issue most refunds in less than 21 calendar days.

Use the IRS2Go mobile app or the Wheres My Refund? tool. You can start checking on the status of your tax return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return.

The Treasury Bureau of the Fiscal Service’s Kansas City Regional Financial Center will be disbursing all tax refund direct deposits on behalf of the IRS. Information in the ACH Batch Header Record can be used to identify an IRS tax refund, as follows:

Direct Deposit

You May Like: How To Get Tax Return Information

How A 2020 Tax Delay Can Hurt Now

A year later, the IRS continues to deal with a massive inventory of millions of unprocessed returns and thats an issue thats triggering problems for some taxpayers who want to electronically file a 2021 income tax return.

For someone who has not received their 2020 refund yet yes, a year or so after filing the return its not a pleasant thought to imagine that youd run into snags filing a 2021 return.

The last thing you want to do is be rejected for an e-filed 2021 return and then be stuck filing a paper return which could trigger an extraordinary delay of the 2021 refund.

If youre in this group, you definitely want a workaround.

The problem? The e-filing system is going to lock you out or reject your electronically filed return in some cases just because the IRS doesnt have your return on file.

If you try and file electronically, the system asks what your adjusted gross income is for the prior year, trying to validate you are who you say you are, Erin Collins, the national taxpayer advocate, told me in a phone interview.

Not surprisingly, a lot of taxpayers are putting their adjusted gross income from a copy of their 2020 tax return. After all, why wouldnt they do that? Thats what theyre being asked to do, right?

Dont Miss: Grieved Taxes

Dependent Claimed On Another Return

This normally happens when a taxpayer claims a dependent that is also being claimed on another taxpayers return. Such things happen when there is confusion or miscommunication between the custodial and non-custodial parents or guardians about who should claim the dependent.

The rejection codes for this circumstance are R0000-507-01 and/or SEIC-F1040-521-02.

Don’t Miss: How To Get Stimulus Check 2021 Without Filing Taxes

What If My Return Is Rejected Because Ador Already Received It

Tax-related identity theft occurs when someone uses your stolen Social Security number to file a tax return claiming a fraudulent refund. Generally, a criminal will use your SSN to file a false return early in the year. You may be unaware you are a victim until you receive a notice from ADOR or try to file your taxes and learn one already has been filed using your SSN.

Identity theft occurs when someone obtains your personal information such as your social security number, credit card or bank account numbers, passwords, etc. to defraud or commit crimes. You might be a victim of identity theft if:

- Someone else has filed a tax return in your name

- You have an overdue balance or collection action from a year you did not file a tax return

- You find confirmed IRS records of wages from an employer you never worked for.

IDENTITY THEFT PREVENTION TIPS:

How Long Do I Have To Resubmit My Rejected State Return For Electronic Filing

If the return is rejected on the deadline, you have the number calendar/business days from the due date of the return to e-file the corrected return.For example: A 1040 return is e-filed and rejected on April 15, the return can be corrected and resubmitted, no later than April 20 . If the return cannot be filed electronically, it must be paper filed by April 25 *.

If the return was rejected on April 14, it must be resubmitted by the 15th to be timely filed. The five day rule applies only if the rejection is on or after the deadline.

- In the event that paper filing is required after rejection, we advise to include a copy of the rejection detail and return history with the paper filed return.

- 0 indicates the return is due no later than the due date.

| State |

|---|

Also Check: Does Doordash Send You A 1099

You May Like: What Is The Income Tax Rate In Texas

Common Causes Of Rejected Tax Returns And Rejection Codes

There are a lot of reasons why your tax return can be rejected by the Internal Revenue Service. If the error occurred when transmitting Form 1040 through electronic means, this could be resolved, and the taxpayers return can be resubmitted.

However, there are certain cases that require the tax return to be printed and mailed to the IRS office. Here is a list of the most common causes of rejected tax returns and their respective rejection codes.

Dont Worry About Math Errors

Perhaps surprisingly, one area that you dont have to worry about when it comes to reviewing your return is your addition. If you make any math errors, the IRS will automatically catch them and calculate the correct numbers on your behalf. If any adjustments are made, youll receive a notice in the mail from the IRS.

Of course, you shouldnt purposely make math errors on your return if you miscalculate and pay less than you owe, your IRS notice may include penalties and interest. But mathematical errors wont result in your return being rejected by the IRS.

Read: Do I Have To File Taxes? 3 Times You Can Skip It

Read Also: How Much Tax Do You Have To Pay On Stocks

Failure To Sign The Return

IRS will only accept signed tax returns. Signing your return serves as affirmation that the details are true and correct to the best of your knowledge. Both manual and electronic tax filers must sign their returns to avoid rejection by the IRS.

Those submitting their returns electronically must enter either their Adjusted Gross Income from the previous year or their Identity Protection Personal Identification Number to sign their return electronically. The IRS matches those with the agencys database to detect and prevent tax fraud since only the correct taxpayer should know their AGI or IP PIN.

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response…

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterday’s audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldn’t have asked for more. I cannot thank you enough for your help.

Mary C.Freshfield, Liverpool, UK

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

Don’t Miss: When Are Taxes Due In Arizona