Deadline For Filing Your Income Tax Return

The deadline for sending us your personal income tax return is April 30. If you or your spouse carried on a business or earned income as a person responsible for a family-type resource or an intermediate resource, you have until June 15 to file your return.

Any balance due must be paid by April 30.

NoteannonceIncome tax filing deadline extended

Since the regular filing deadline falls on a Saturday this year, you have until May 2, 2022, to file your 2021 income tax return and pay any income tax you may owe. No interest or penalty will be charged.

End of noteNote

Even if you are unable to pay the full amount of your balance due by April 30, file your return no later than the deadline to avoid a late-filing penalty.

End of note

What Happens To My Tax Deadlines If I Live In An Area Impacted By A Natural Disaster

If you need more time because you live in an area hit by a natural disaster, you might qualify for tax relief from the IRS. The IRS often postpones the tax filing deadline for taxpayers who live in or have a business within a federally declared disaster area.

For example, the IRS announced it would postpone tax filing and tax payment deadlines for taxpayers affected by the September 2020 California wildfires. Taxpayers in that area who extended their 2019 tax returns to October 15, 2020, now have until January 15, 2021, to file those returns.

Contribute To A Sep Ira

Self-employed individuals and small business owners who wish to save money with an easy and affordable retirement plan frequently use a Simplified Employee Pension IRA, or SEP IRA. A SEP IRA actually allows you to save more for retirement than a 401 plan offered by your employer. You may deduct up to 25% of your salary for 2022, or $61,000, whichever is less.

As a result, you may save more for retirement using a SEP IRA than you could with a regular or Roth IRA. Keep in mind that the contribution maximum for both regular and Roth IRAs in 2022 is $6,000 .

You May Like: Can You Get The Stimulus Check Without Filing Taxes

Federal Income Tax Deadline For 2021 Tax Returns

The filing deadline for the 2021 tax year is April 18, which falls on a Monday. If you need even more time to complete your 2021 federal return you can request a six-month extension by filing Form 4868 through your tax professional, tax software or using the Free File link on IRS.gov. Filing Form 4868 gives taxpayers six extra months to file their 2021 tax return but does not grant an extension of time to pay taxes due. You may owe a late payment penalty on any tax not paid by the original due date of your return.

If you mail in your return, it must be postmarked April 18, 2022, or sooner. The IRS typically issues refunds within 21 days after a tax return is filed.

People who still want to contribute to an individual retirement account for the 2021 tax year still need to make contributions by April 15, 2022. It is also necessary to include contributions made to traditional IRAs on your tax return. If you contributed to a Roth IRA during 2021, you wont need to report those contributions on your tax return.

Taxpayers who requested an extension to file their individual income tax returns have less than a month to file a complete and accurate return, according to the Michigan Department of Treasury.

Individual income tax returns due under an extension must be received by Treasury on or before Oct. 17, 2022. Returns can be sent through the U.S. Postal Service or e-Filed.

Taxpayers who have yet to file their individual income tax return should consider:

What To Look For With Child Tax Credit Payments

In January, the IRS advised families to hold off filing taxes until they received IRS letter 6419, which can help them file an accurate return and avoid delays. However, some taxpayers received letters with inaccurate amounts. Before filing taxes, review your records and check the information at the IRS “Child Tax Credit Update Portal Site” at IRS.gov/ctcportal.

TAX SEASON GLITCH:First glitch of the tax season is here: That IRS child tax credit letter may be inaccurate

Don’t Miss: Where Is My Tax Return Check

When Is The Us Tax Deadline For 2022

The standard deadline for US residents to file a Federal Tax Return for tax year 2021 is April 18, 2022.

However, for US citizens living overseas, this deadline is automatically extended to June 15, 2022. You can then apply for a further deadline extension to October 17, 2022. In extreme cases, you can even request an extension to December 15.

Pro Tip: If you need more time to file your expat tax return, you can request an additional filing extension to October 17. In extreme cases, you can even request an extension to December 15.

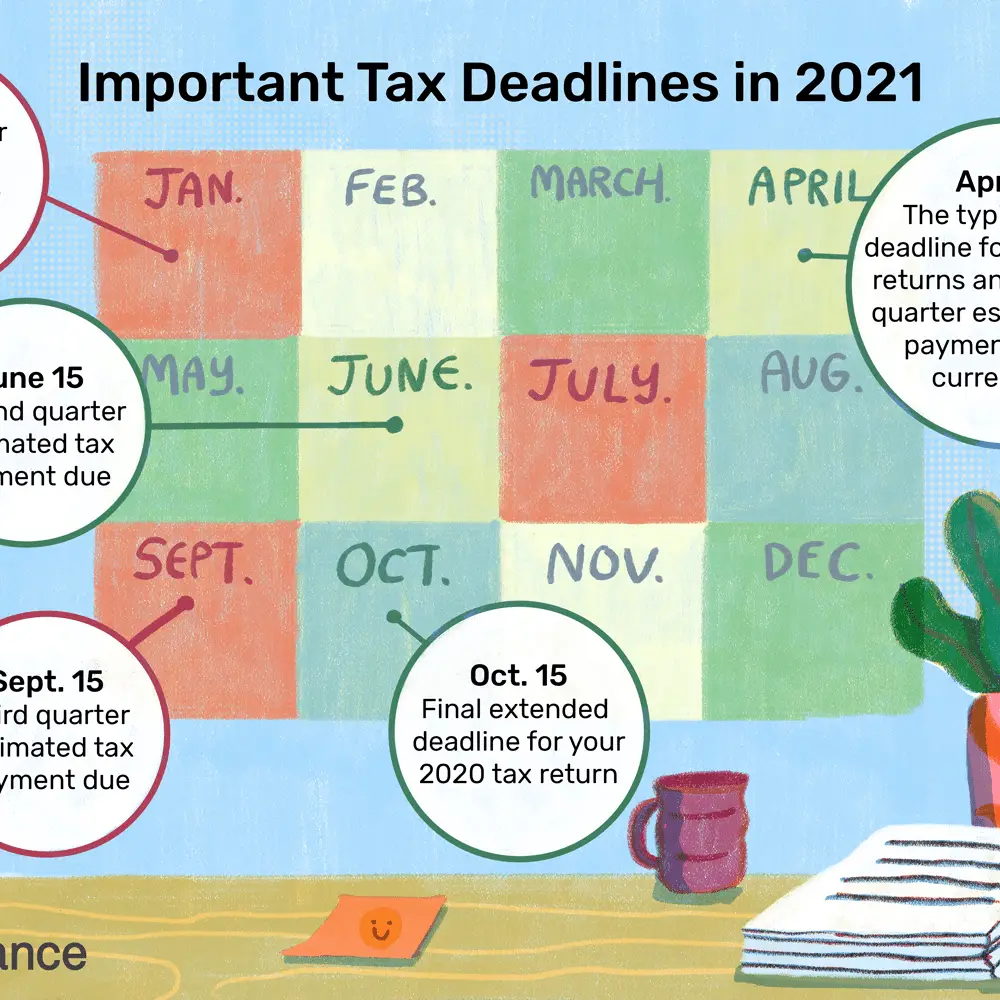

Every Tax Deadline You Need To Know

OVERVIEW

Make sure your calendars up-to-date with these tax deadlines, dates, possible extensions and other factors in play for both individuals and businesses in 2022.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

|

Key Takeaways Individual income tax returns are due April 15, unless the date falls on a weekend or holiday or you file Form 4868 seeking an extension until October 15. Independent contractors, gig workers, and self-employed people must also meet quarterly estimated tax filing deadlines. Small businesses must file their tax return either by March 15 or the 15th day of the third month following the close of their tax year, unless the date falls on a weekend or holiday or you file Form 7004 seeking an extension until September 15 . |

Don’t Miss: What Form Do I Need From Unemployment To File Taxes

I Was Working Remotely For Much Of 2021 Will That Affect My Taxes

It depends. If you worked from a state other than the one where your employer is based, you could be subject to the income tax rules of two or more states.

At the very least youll likely have to file more than one state tax return for 2021, which will cost you more if youre paying someone else to prepare your taxes.

And in some instances primarily involving five states that have so-called convenience rules you may even be double-taxed on the same income.

Is Tax Day Extended 2021

2021 Federal Tax Deadline Extensions The federal tax filing deadline for 2020 taxes has been automatically extended to May 17, 2021. Due to severe winter storms, the IRS has also extended the tax deadline for residents of Texas, Oklahoma and Louisiana to June 15, 2021. This extension also applies to 2020 tax payments.

Also Check: How Long It Take To Get Taxes Back

Contribute To A Solo 401

For self-employed individuals who want to make a Solo 401 contribution for the 2021 tax year but asked for an extension to submit their federal income tax return, the deadline is October 17. For 2021, a self-employed person’s maximum Solo 401 contribution is $58,000. The maximum contribution for people 50 and older is $64,500.

These sums may appear large given that you can contribute to a Solo 401 as both an employer and an employee, but keep in mind that the restrictions for contributions to all 401 plans are based on aggregate totals. The amount you can contribute to your Solo 401 plan will thus be reduced if you make a contribution to a 401 plan via your place of employment because it will count toward the overall limit of $58,000 or $64,500.

Tax Deadlines And Extended Filing Deadlines 2022

Donât miss important tax filing deadlines.

Advertiser Disclosure: Most products in our articles are from partners who may provide us with compensation. However, opinions expressed here are authorâs alone, not those of any bank, credit card issuer, airline or hotel chain.

Requesting an extension to file your income tax return has become common among taxpayers in the United States. According to the Internal Revenue Service , an estimated 19 million taxpayers requested an extension in 2021.

Whether you plan to file by the regular deadline or need an extension, make sure you are aware of all the relevant filing deadlines so you dont find yourself in trouble with the IRS.

Don’t Miss: How To Calculate My Tax Return

When Can I Expect My Refund

If you file electronically and choose direct deposit, the IRS says you can expect your refund within 21 days, assuming there are no problems with your return.

The IRS has already processed more than 70 million returns for fiscal 2021 and issued nearly 52 million refunds. But the agency has also warned about delays in processing returns, especially as the 2022 tax season involved complications like stimulus payments and an expanded child tax credit.

“The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays,” IRS Commissioner Chuck Rettig said in a statement.

Experts agree direct deposit is the fastest way to get your refund from the IRS.

When Are State Taxes Due

Of the 43 states that levy income tax, most are following this year’s federal April 18 deadline, though there are some exceptions below.

|

State |

|

|

May 1, 2022 |

Note: New Hampshire doesn’t tax earned income but it does tax investment income and dividends, so residents may still need to file a state return. .

Check with your state department of revenue for the most current information and deadlines.

You May Like: How Do I Pay Tax As Self Employed

What If The Irs Owes Me Money

If you file an accurate return electronically, and are owed a refund, the IRS will likely have that money sent to you or direct deposited into your bank account within 21 days of receiving your return.

You can check the status of where things stand by using the IRS online tool Wheres My Refund?

If youre not legally required to file a 2021 tax return because your income was too low, you may want to file a return anyway since youre likely due a refund thanks to the enhanced child tax credit and other tax breaks that you are eligible to claim even though you dont owe income tax.

What Is The Last Day To Contribute To My Retirement Account For 2019

As with other elements of the extension, individuals can wait to make 2019 contributions to their retirement accounts normally due April 15, 2020 until July 15, 2020. Consider using this extra time to set aside more money in your retirement accounts if you’re able. You can contribute a maximum of $6,000 to an IRA for 2019, plus an extra $1,000 if you’re 50 or older.

You don’t need to wait to file your tax return to make this contribution, however. If you know how much you’ll contribute by the tax deadline, you can put this on your tax return and make the actual contribution by the new deadline.

Read Also: How To File An Extension On Tax Return

Crypto Is Not Invisible To The Taxman

Many people falsely believe that regulators have no visibility into ones crypto activity because blockchain transactions are pseudo-anonymous . However, this is not the case, especially when it comes to centralized exchanges such as Coinbase. The IRS is aware of cryptocurrency activity through exchanges that report to them and information gathered through subpoenas.

When Are Taxes Due If I File An Extension

If you file Form 4868 and receive the automatic six-month extension, you will have until Oct. 17, 2022, to submit your 2021 tax return.

If you already know that youll need an extension, plan on filing Form 4868 sooner rather than later. That way, if anything goes wrong with your application, youll have plenty of time to fix any errors and resubmit it ahead of the April 18 tax deadline. This also ensures you have time to get your documents together for your extended deadline in October. The IRS website has all the forms, deadlines and information youll need.

Recommended Reading: Do Businesses Get Tax Refunds

What To Do If You Cant Pay By The Tax Deadline

If for whatever reason, you are unable to submit your tax returns in time for the deadline, dont worry, there are a few things you can do.

The number one thing to do if you feel like youre going to miss the tax deadline is to apply for a payment plan. A payment plan will grant you an extension for filing your taxes with the IRS.

Bear in mind, though, that a payment plan request is just that – a request. For it to be successful, you will need the IRS to approve the payment plan.

There are fees and conditions associated with requesting a payment plan, depending on whether its short-term or long-term.

Has Delaware Extended The Tax Filing Deadline

Asked by: Vernice Jakubowski

The deadline for Delaware taxpayers to file and pay their 2020 personal income tax returns to both federal and state governments has been extended from April 15 to May 17. This extension does not apply to estimated tax payments made quarterly by individuals those payments will still be due by April 30, 2021.

Don’t Miss: How To Pay Quarterly Taxes

Form 8949 & Schedule D

Form 8949 is used to report your cryptocurrency & NFT gains and losses. If you receive a complete and accurate 1099-B from an exchange you can enter those numbers on these forms. If you traded NFTs, you would have to rely on your manual records or connect your hosted wallet to a cryptocurrency tax software to get the numbers needed to fill out this form.

Form 8949

Internal Revenue Service

Always Start At Irsgov:

- From the homepage, select File Your Taxes for Free.

- Use the IRS Free File Lookup Tool to narrow the list of providers or the Browse All Offers page to see a full list of providers.

- Follow the link to the chosen IRS Free File provider’s website.

Taxpayers who requested the six-month filing extension should complete their tax returns and file on or before the October 17 deadline.

The IRS Free File program gives eligible taxpayers an opportunity to file their taxes and claim the 2021 Recovery Rebate Credit, their full Child Tax Credit, the Earned Income Tax Credit or other valuable credits for which they qualify. The IRS reminds taxpayers that the fastest way to get a tax refund is to file electronically and choose direct deposit.

Prior year returns can only be filed electronically by registered tax preparers for the two previous tax years. Otherwise, taxpayers must print, sign and mail prior year returns.

The IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications lists qualified local preparers.

Read Also: How Are Limited Partnerships Taxed

What Tax Documents Should I Look Out For Before Filing

The U.S. tax code can be complicated, with various forms that taxpayers need to file to report their income sources. Here are the most common tax forms and their respective deadlines.

Review the tax filing deadlines for each form below, including the due dates for businesses or employers to send forms and the filing dates for individual taxpayers.

- W-2 Form: Employers must send by January 31, 2022

- Form W-2 contains information about your employee earnings, any taxes withheld, and other employer-provided benefits. Your employer must provide your W-2 Form by January 31, 2022.

- Recipients must file by .

Does An S Corp Have To File Quarterly Taxes

If your S corporation has employees, it must withhold employment taxes on their wages. … As part of the payroll tax process, your corporation must periodically pay money to the federal government using electronic funds transfer. In addition, your corporation needs to file quarterly employer tax returns .

Recommended Reading: How To Pay Your Federal Taxes Online

Alignment With State And District Of Columbia Holidays And Changes In Date

Tax Day occasionally falls on Patriots Day, a civic holiday in the Commonwealth of Massachusetts and state of Maine, or the preceding weekend. When this occurred for some time, the federal tax deadline was extended by a day for the residents of Maine, , Massachusetts, New Hampshire, New York, Vermont, and the District of Columbia, because the IRS processing center for these areas was located in Andover, Massachusetts and the unionized IRS employees got the day off. In 2011 and 2015, Tax Day fell on Patriots Day. However, federal filings were directed to Hartford, Connecticut, Charlotte, North Carolina and Kansas City, Missouri, and there was no further extension for Maine, Massachusetts or other surrounding states residents. In 2019 and 2021, when Patriots Day was again observed on the tax filing deadline, residents of Maine and Massachusetts were given extra time to file as post offices in those states would be closed on normal deadline.

Emancipation Day is celebrated in Washington, D.C. on the weekday nearest April 16, and under a federal statute enacted decades ago, holidays observed in the District of Columbia have an impact nationwide. If April 15 falls on a Friday, then Emancipation Day is celebrated on the same day and tax returns are instead due the following Monday, April 18. When April 15 falls on a Saturday or Sunday then Emancipation Day is celebrated on the following Monday and tax returns are instead due on Tuesday.