Example Of A Tax Computation

Income tax for year 2017:

Single taxpayer making $40,000 gross income, no children, under 65 and not blind, taking standard deduction

- $40,000 gross income â $6,350 standard deduction â $4,050 personal exemption = $29,600 taxable income

- amount in the first income bracket = $9,325 taxation of the amount in the first income bracket = $9,325 Ã 10% = $932.50

- amount in the second income bracket = $29,600 â $9,325 = $20,275.00 taxation of the amount in the second income bracket = $20,275.00 Ã 15% = $3,041.25

Note, however, that taxpayers with taxable income of less than $100,000 must use IRS provided tax tables. Under that table for 2016, the income tax in the above example would be $3,980.00.

In addition to income tax, a wage earner would also have to pay Federal Insurance Contributions Act tax :

- $40,000 Ã 6.2% = $2,480

- $40,000 Ã 1.45% = $580

Total federal tax including employer’s contribution:

- Total FICA tax contributed by employer = $3,060

- Total federal tax of individual including employer’s contribution = $3,973.75 + $3,060.00 + $3,060.00 = $10,093.75

How To Get Into A Lower Tax Bracket

You can lower your income into another tax bracket by using tax deductions, such as the write-offs for charitable donations, property taxes and mortgage interest. Deductions help cut your taxes by reducing your taxable income.

Tax credits, such as the earned income tax credit or child tax credit, also can put you into a lower tax bracket. Credits provide a dollar-for-dollar reduction in the amount of taxes you owe.

Depending on your financial situation, you can use both tax deductions and credits to lower the amount you pay Uncle Sam each year.

How To Figure Out Your Tax Bracket

You can calculate your taxes by dividing your income into the portions that will be taxed in each applicable bracket. Every bracket has its own tax rate. The bracket youre in depends on your filing status: if youre a single filer, married filing jointly, married filing separately or head of household.

The tax bracket your top dollar falls into is your marginal tax bracket. This bracket is your highest tax ratewhich applies to the top portion of your income.

For example, if you are single and your 2022 taxable income is $75,000, your marginal tax bracket is 22%. However, some of your income will be taxed in lower tax brackets: 10% and 12%. As your income moves up the ladder, your taxes will increase:

- The first $10,275 is taxed at 10%: $1,027.50.

- The next $31,500 is taxed at 12%: $3,780.

- The last $33,225 is taxed at 22% $7,309.50

- The total tax amount for your $75,000 income is the sum of $1,027.50 + $3,780 + $7,309.50 = $12,117 .

Recommended Reading: Do I Have To File Taxes On Unemployment Benefits

States Inaugurate A Flat Tax Revolution

A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

Inflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a hidden tax, as it leaves taxpayers less well-off due to higher costs and bracket creep, while increasing the governments spending power.

A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets the federal corporate income tax system is flat.

The standard deduction reduces a taxpayers taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

What Is A Tax Bracket

A tax bracket refers to a range of incomes subject to a certain income tax rate. Tax brackets are part of a progressive tax system, in which the level of tax rates progressively increases as an individuals income grows. Low incomes fall into tax brackets with relatively low income tax rates, while higher earnings fall into brackets with higher rates.

For tax years 2022 and 2023, there are seven federal tax brackets, with rates ranging from 10% to 37%. Read on to learn the details.

Also Check: What Percentage Of Business Expenses Are Tax Deductible

Understanding The Current Federal Income Tax Brackets

Our current tax brackets were adjusted when Congress passed new legislation in 2017 that changed the brackets and how taxes are filed. The tax reform passed by President Trump and Congressional Republicans lowered the top rate for five of the seven brackets. It also increased the standard deduction to nearly twice its 2017 amount.

For the most recent taxes filed, for the 2021 tax year that was filed in 2022, the standard deduction was $12,550 for single filers and married filers who file separately. Joint filers will have a $25,100 deduction and heads of household get $18,800.

Sales And Capital Gains Tax Rates

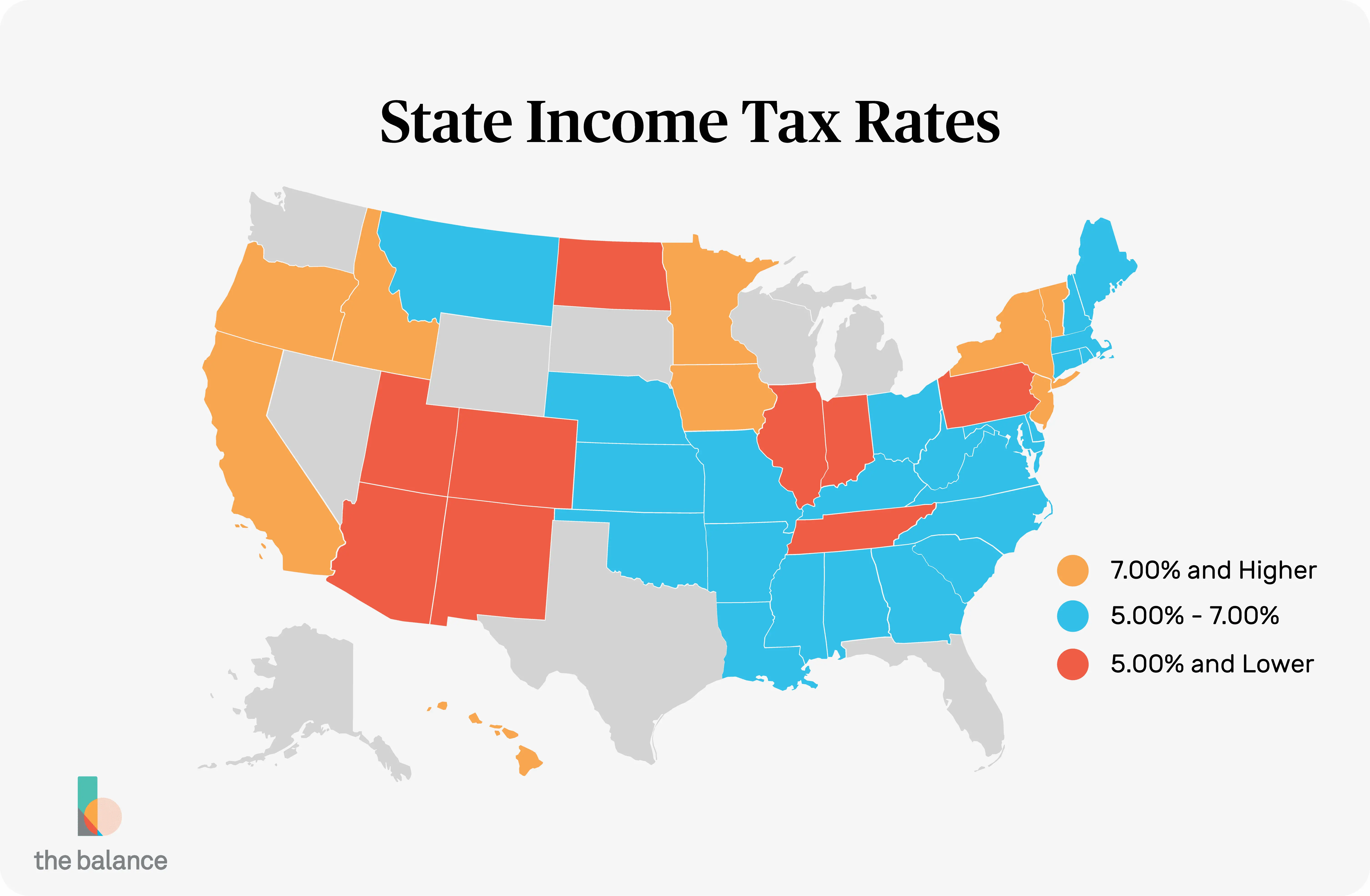

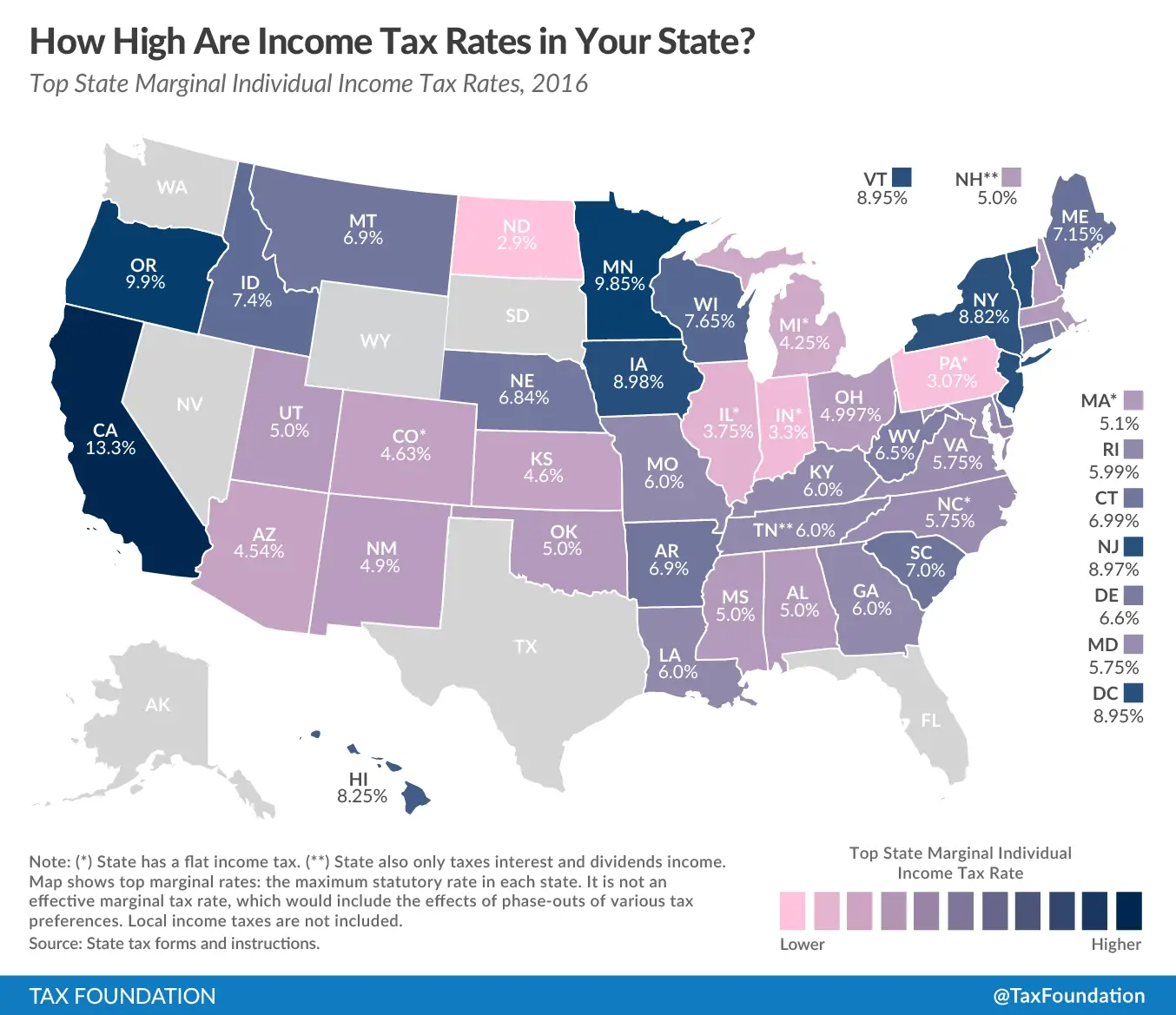

Tax rates dont only apply to earned income and corporate profits. Tax rates can also apply on other occasions when taxes are imposed, including sales tax on goods and services, real property tax, short-term capital gains tax, and long-term capital gains tax. When a consumer purchases certain goods and services from a retailer, a sales tax is applied to the sales price of the commodity at the point of sale. Since sales tax is governed by individual state governments, the sales tax rate will vary from state to state. For example, the state sales tax rate in Georgia is 4%, while the tax rate in California is 7.25%, as of 2022.

Since additional income gained from investments is categorized as earnings, the government also applies tax rates on capital gains and dividends. When the value of an investment rises and the security is sold for a profit, the tax rate that the investor pays depends on how long s/he held the asset. The tax rate on the capital gain of a short-term investment is equal to the investors ordinary income tax. So, an individual who falls into the 22% marginal tax bracket will pay 22% on his or her short-term capital gains.

The tax rate on profits from investments held longer than a year ranges from 0% to 20%. For the taxable year 2023, individuals with taxable income below $44,625 pay 0%. Individuals with taxable income between $44,625 and $492,300 pay 15%, and investors with income above $492,300 pay a 20% tax rate on capital gains.

You May Like: How To Owe Less On Taxes

Do Capital Gains Count As Income

Capital gains are included in your taxable income, but they are not part of your ordinary income. This is an important distinction, because capital gains and ordinary income are taxed at different rates if the capital assets were held for more than a year.

Capital gains can increase your adjusted gross income, which can phase you out of itemized deductions, tax credits, Roth IRA eligibility and IRA contribution deductions. However, they do not push you into a higher tax bracket because they are taxed before your ordinary income.

Taxes On Director’s Fee Consultation Fees And All Other Income

The tax rate for non-resident individuals is currently at 22%. It applies to all income including rental income from properties, pension and director’s fees, except employment income and certain income taxable at reduced withholding rates .

New!

Withholding taxes on income of non-resident individuals^

Certain income of non-resident individuals is subject to withholding tax when they are due and receivable. The withholding tax rate applicable is dependent on the type of income derived and the YA involved.

| Type of income | ||

| 5. Interest, commission, fee or other payment in connection with any loan or indebtedness** | 15% reduced final withholding tax rate or 22% if reduced withholding tax rate is not applicable |

15% reduced final withholding tax rate or 24% if reduced withholding tax rate is not applicable |

| 6. Royalty or other lump sum payments for the use of movable properties** | 10% reduced final withholding tax rate or 22% if reduced withholding tax rate is not applicable |

10% reduced final withholding tax rate or 24% if reduced withholding tax rate is not applicable |

^The same withholding tax rates also apply to the income derived by a Hindu Joint Family that is registered outside Singapore.

*With effect from 1 Jul 2014, the concessionary withholding tax rate of 15% will apply if the following conditions are met:

i. Cumulative amount withdrawn by the SRS account holder in the calendar year does not exceed $200,000 and

Read Also: Do I Need To Report Roth Ira On Taxes

How To Read The K

- The date needs to be entered correctly in Part 1 for any calendar year.

- Partnership details need to be entered correctly, like the Partnerships employer identification number, address, zip code, etc.

- IRS center where partnership filed returns.

- Part 2 consists of partner information such as SSN, name, address, etc.

- Check the options that suit a General Partner, a Limited Partner, or a Domestic Partner.

- H2, I1, and I2 are for the partnership to fill in.

- J is where the profit-sharing percentage is declared at the start and end of the year.

- K and L are left blank when a business uses a cash basis of accounting if not, it needs to enter details of capital invested, withdrawals, losses, distributions, and ending capital accounts.

- Part 3 contains the partners share of income, deductions, credits, etc.

What About The 2023 Tax Brackets

The IRS typically provides the tax brackets for the upcoming year in late October or early November. At this point, there’s no reason to believe that the timetable will be modified this year, so that’s when we expect the 2023 tax brackets to be released.

Again, the 2023 rates won’t change, but the brackets will be adjusted for inflation. And, since inflation is much higher now than it has been in the recent past, the extent to which the brackets will get “wider” is expected to be greater for 2023 than it has been for the past several years.

For example, the 22% bracket for a single person in 2021, which ran from $40,526 to $86,375 of taxable income, covered $45,849 of taxable income . For the 2022 tax year, that same bracket covers $47,299 of taxable income . So, for 2022, the 22% bracket for single filers is $1,450 wider than it was for 2021. However, for 2023, the width of the same bracket is expected to increase by more than twice the rate of growth seen in 2022. projects an increase of $3,351 from 2022 to 2023 for the bracket.)

Wider tax brackets are generally a good thing, since it helps prevent “bracket creep.” In other words, if a bracket gets wider, you’re less likely to end up in a higher tax bracket if your income stays flat or doesn’t increase at the rate of inflation from one year to the next.

Read Also: When Do Taxes Have To Be Filed By

Income Tax Rates And Bands

The table shows the tax rates you pay in each band if you have a standard Personal Allowance of £12,570.

Income tax bands are different if you live in Scotland.

| Band | |

|---|---|

| over £150,000 | 45% |

You can also see the rates and bands without the Personal Allowance. You do not get a Personal Allowance on taxable income over £125,140.

History Of Federal Tax Brackets

Tax brackets have existed in the U.S. tax code since the inception of the very first income tax, when the Union government passed the Revenue Act of 1861 to help fund its war against the Confederacy. A second revenue act in 1862 established the first two tax brackets: 3% for annual incomes from $600 to $10,000, and 5% on incomes above $10,000. The original four filing statuses were single, married filing jointly, married filing separately, and head of household, though rates were the same regardless of tax status.

In 1872, Congress rescinded the income tax. It didnt reappear until the ratification of the 16th Amendment to the U.S. Constitution in 1913 established Congress right to levy a federal income tax. That same year, Congress enacted a 1% income tax for individuals earning more than $3,000 a year and couples earning more than $4,000, with a graduated surtax of 1% to 7% on incomes from $20,000 and up.

Over the years, the number of tax brackets has fluctuated. When the federal income tax began in 1913, there were seven tax brackets. In 1918, the number mushroomed to 56 brackets, ranging from 6% to 77%. In 1944, the top rate hit 91%. But it was brought back down to 70% in 1964 by then-President Lyndon B. Johnson. In 1981, then-President Ronald Reagan initially brought the top rate down to 50%.

Don’t Miss: Why Appeal Property Tax Assessment

Economic And Policy Aspects

| This section needs expansion. You can help by adding to it. |

Multiple conflicting theories have been proposed regarding the economic impact of income taxes. Income taxes are widely viewed as a progressive tax .

Some studies have suggested that an income tax doesn’t have much effect on the numbers of hours worked.

Scottish Government Considering Income Tax Rate Rises For Middle And Top Earners

EXCLUSIVE: It is understood tax rates could rise in the Scottish Budget in order to address funding challenges

- 04:30, 9 DEC 2022

The SNP /Green Government is considering higher income tax rates for Scots earning over £43,663 in a bid to shore up public services. Ministers are looking at whether to put up the 41p and 46p rates in next weeks Budget.

Acting Finance Secretary John Swinney is facing one of the toughest budgets of the devolution era due to inflation and having to fund public sector pay deals. Senior figures in the Government are looking at how to raise extra cash through devolved taxes.

Under the current system, Scots pay a 41 per cent higher rate on income between £43,663 to £150,000. It is understood there are around 478,000 taxpayers north of the border paying it. A top rate of 46p applies to income over £150,000.

Read More

It is understood the Government is examining an increase in both rates, with an insider saying that raising the 41p rate would generate serious money. According to research by the IPPR think tank, every half percentage point increase on the higher and top rates of income tax would raise an extra £100 million.

They also estimated that the same sum would be raised if the top rate rose by 2 percentage points. In its own Budget, the UK Government lowered the threshold at which wealthier people pay the top rate in England from £150,000 to £125,140.

Also Check: How Can I Check My Income Tax Refund Status

The Taxation Of Capital Income

An important strand of the literature on optimal taxation in dynamic economies concerns the proposition that the income tax rate on income from capital should be zero. This proposition was initiated by Judd , who considered a closed economy producing a single product that could be used for consumption by infinitely lived consumers or invested in physical capital. Judd argued that, in the short run capital is fixed and adjusts slowly over time and so a positive tax rate on capital income can be beneficial for redistribution purposes. In the long run, a tax on capital income discourages capital accumulation resulting in a reduction in the capitallabor ratio and the wage rate . The smaller capital stock and the lower wage rate have detrimental affects upon consumer welfare. Accordingly, the optimal policy is to have a zero tax on income from capital in the long run. This proposition is supported by Chamley . He shows that, in his model, the optimal policy is for a positive capital income tax along the transition path, jumping to zero in finite time. Again, the result is that it is optimal for capital income not to be taxed in the long run.

These papers spawned further research into the generality of the zero capital income tax proposition. Some papers, such as Jones et al. , show that the result is fairly robust, extending to zero taxes on labor income and consumption, but exceptions arise when taxes are restricted or there are positive profits.

Tax Extensions 202: How And When To Get One

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

You May Like: What Is The Deadline To File Your Taxes