What Do You Owe The Irs

If you arent sure what your standing is with the federal government, you can find out by reviewing your tax account via the Internet. Head to the IRS login portal and use your credentials to get an overview of the information you might need when preparing your own tax return to file before the October deadline, including:

- Your AGI. This is your adjusted gross income, an important number for calculating your income tax.

- Your EIP amounts. These are the economic impact payments the government has sent you. If you did not receive the full amounts of both economic impact payments , you can claim the Recovery Rebate Credit on your 2020 return. This is a tax credit, meaning it reduces the amount of tax you owe the government.

- Your estimated tax amounts. These are a total of the estimated tax payments you have already made to the government as a self-employed individual, as well as any refunds applied.

- Your current tax balance. This is how you find out whether or not you currently owe the IRS any money.

- Any outstanding notices. If you have been sent physical notices via mail, you can review them digitally through your online tax account.

- Payment history and upcoming or pending payments. If you are currently in a payment plan with the IRS to pay off your tax debt, you can also review when your next payment is due, regardless of whether your plan is manual or automatic.

Penalty For Late Corporate Tax Filing

Banks Editorial Team

Banks Editorial Team

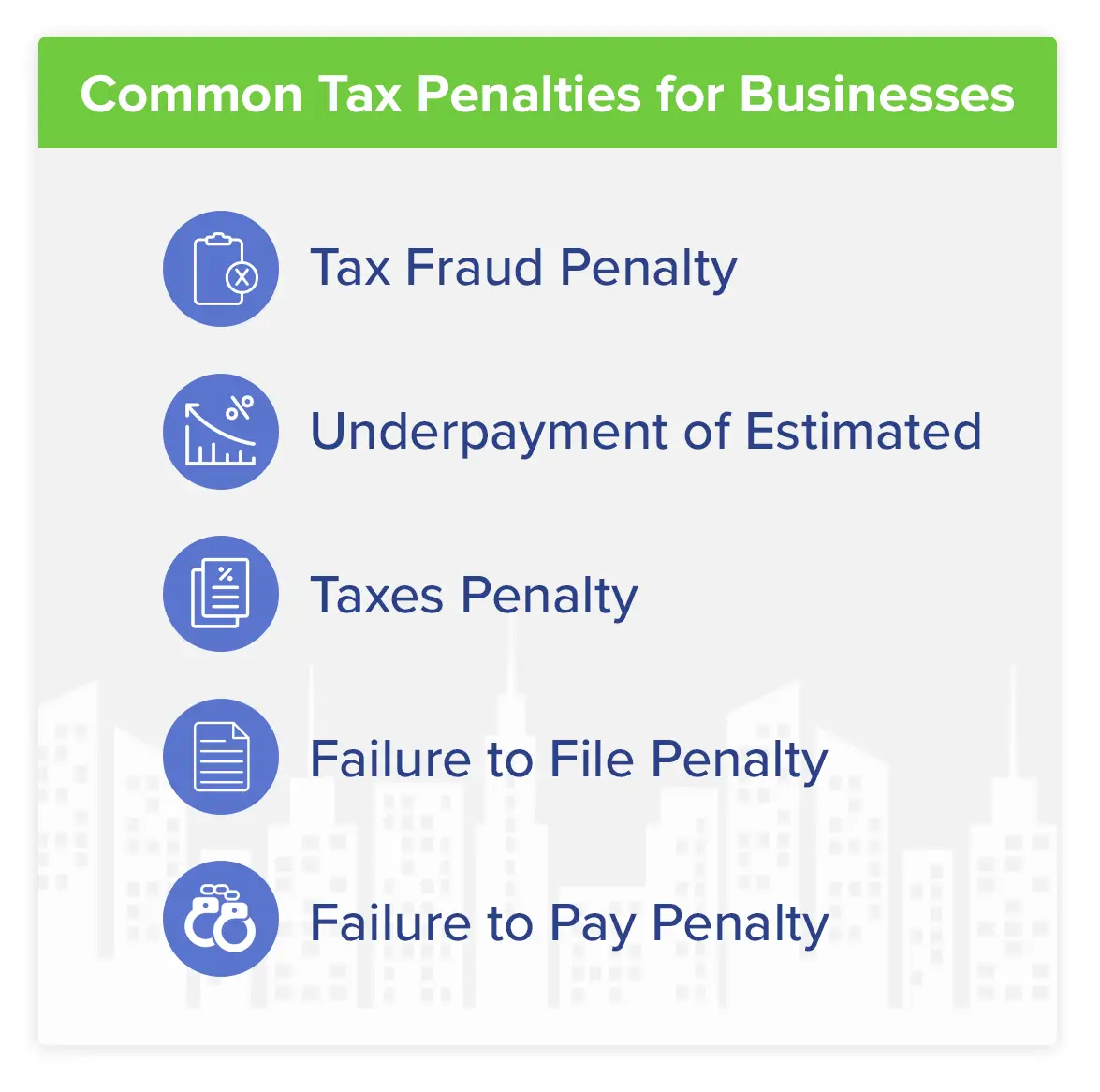

When corporate tax returns are filed late, companies are penalized by the IRS. The cost of filing late could be even steeper if you fail to pay the taxes you owe on time. Fortunately, there are ways to avoid late corporate tax filing penalties. But if the penalty has already been assessed, you also have options.

Read on for a breakdown of how late corporate tax filing penalties are calculated, what to do if you incur a penalty and actions you can take to avoid it.

How To Avoid A Failure

If youre going to miss the tax-filing deadline, help yourself avoid the penalty for not filing taxes by getting an extension to file your tax return. A tax extension can get you an extra six months to get your tax return to the IRS.

Remember, however, that a tax extension only gets you more time to file your tax return. It does not get you more time to pay your taxes. Some people, such as natural disaster victims, certain members of the military or Americans living overseas, may automatically get more time to file.

If you miss the tax extension deadline, though, that failure-to-file penalty could come back to haunt you.

» MORE:How to set up a payment plan with the IRS

Don’t Miss: How Much Do Corporations Pay In Taxes

Ways To File Your 2021 Tax Return

The IRS says that taxpayers can file and schedule their federal tax payments online, by phone or with the mobile IRS2Go app.

If you need to find a tax software service to use, and you make $72,000 or less, you can find an IRS-approved free filing service easily. Youll need to gather the following information: income statements any adjustments to your income your current filing status and dependent information. If you make more than $72,000, you can use the Free File Fillable Form.

If you havent already made a tax payment, the IRS prefers that payments be made electronically, and offers a variety of ways to do so, including IRS Direct Pay, which is directly linked to a checking or savings account. Another option is by credit card using the mobile IRS2Go app, or through the Electronic Federal Tax Payment System.

Also Check: What Does Tax Exempt Mean

What Is A 941 Tax Deposit

The 941 tax deposit includes all of the employment taxes withheld from your employees paychecks. This includes Social Security and Medicare taxes and federal income tax. You also have to deposit the employers portion of Social Security and Medicare taxes. Plus, you may also need to pay federal unemployment tax.

A lot of employers end up paying federal unemployment tax just once a year, but when you file the returns for your employment taxes, the forms will guide you through the calculations to see if you need to pay this tax during the quarter when you are filling. Typically, you only need to pay when your premiums exceed $500 for the quarter.

Don’t Miss: Is Past Year Tax Legit

Get A Professional Tax Filer

If you havent gotten around to filing your taxes yet, then getting in contact with a tax professional is crucial. You only have a few days until the October deadline, and every moment counts. Know what it takes to qualify as a professional tax preparer and choose your tax professional accordingly.

Neglecting Your Taxes Is Ill

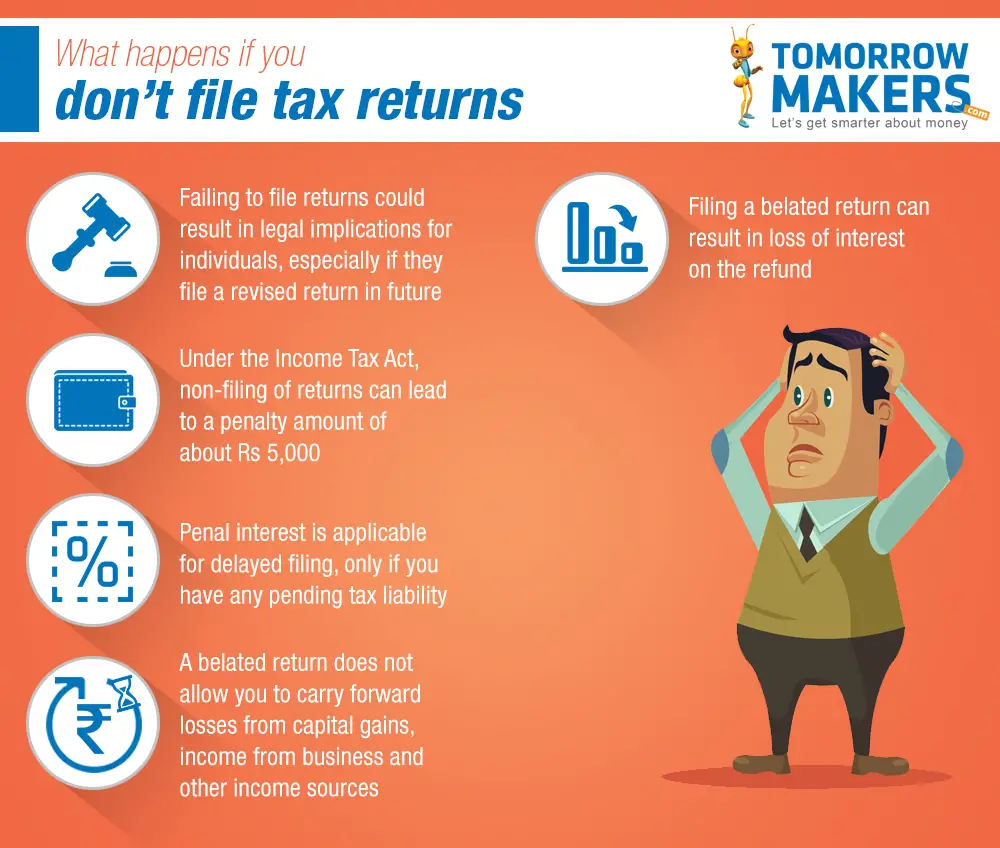

Filing taxes can be a drag, but unless your earnings fall below a certain threshold, it’s something you’re required to do. But what if you’re late with your taxes? Sometimes that happens to the best of us. Your accountant blows you off, your financial institutions are late with some forms, or life just gets busy.

If you’re late with a tax return but the IRS owes you money, there’s really no consequence other than delaying your own refund. But if you underpaid your taxes and owe the IRS money, filing late is a different story. In that case, you could be in line for serious consequences if you submit your return after the deadline — or don’t submit it at all.

Image source: Getty Images.

Don’t Miss: Which States Have The Lowest Property Taxes

Is Jane Stuck Paying The Penalty

Since the problem with the RMD was caused by the custodian , Jane can request a waiver of the excise tax for reasonable cause. She must also show that the RMD failure was or is in the process of being corrected . RMD penalty waivers are governed by section 4974 of the Internal Revenue Code.

The IRS will want to know the details, and the way to tell the story is by using IRS Form 5329, Additional Taxes on Qualified Plans and Other Tax-Favored Accounts, with attachments that explain the situation: A copy of the written instructions Jane gave the custodian a letter explaining what caused the delay a copy of the check or statement that proves the RMD was actually withdrawn and a request for an abatement of the 50% penalty.

Notice that there is no mention of attaching a check to pay the penalty.

How Bench Can Help

Tax filing is relatively straightforward once you know the numbers youâre working with. Filling out tax forms isnât usually what causes a delay for business ownersâitâs the number-crunching that happens beforehand.

If youâve fallen behind on your financial records and bookkeeping, Bench can help. Getting your financial records updated and correct is the first step to getting your taxes filed and avoiding additional penalties.

The specialized historical bookkeepers at Bench will get neglected financial records up to date, and they will help you identify the tax deductions and credits you qualify for. These can reduce your overall tax burden with the IRS. You might even discover a tax refund when your records are cleaned up.

When the IRS sends you a letter with penalties and fees, they are basing their numbers on an estimate of what they think you likely owe. You may owe a lot less, but you wonât know until your books tell you the proper amount.

Want to set a payment plan or negotiate a compromise? Bench will not only help you sort out your books, but we can also refer you to our extensive network of partners who specialize in negotiations with the IRS.

Working with the IRS can be intimidating. Knowing you have a CPA or an enrolled agent working by your side can make the process much less stressful.

Also Check: Can Students File Taxes For Free

What You Need To Know About Penalties For Late Filing Of Taxes

Taxpayers have a lot of questions about the penalties for not filing and paying taxes on time. It can be really troublesome to pay a large sum for fines you arent even aware of. Thats why taxpayers need to familiarize themselves with the different IRS penalties. Here are some of the frequently asked questions we get on filing and paying taxes late.

Penalties For Late Payments

There is also a penalty for paying late, but it’s less punitive than that for not filing. That penalty for late payments also depends on how much tax you still owe relative to what you’ve already paid.

“If you did underpay, the IRS is going to want interest,” said Davidoff. Currently, the IRS’ interest rate is 4% per year, compounded daily, on any taxes not paid.

“If you pay them less than 90% of your tax liability, in addition to the 4% per annum, there’s a half-percent-a-month penalty,” Davidoff said.

So, if a taxpayer hasn’t paid at least 90% of the tax they owe by the April deadline, “you’re paying basically 10% per annum in non-deductible interest and penalties,” Davidoff said.

Also Check: How To Pay My Taxes

Can I Still File My Taxes After The Deadline

Yes, you can still file after the deadline. However, you will incur two penalties. The IRS levies a failure-to-file penalty, which is 5% of unpaid taxes every month, and an inability to pay penalty, which amounts to .5% of total delinquent taxes.

As you can see, paying taxes late is actually cheaper than filing taxes late. A good way to save money from penalties is to ask the IRS to give you a tax extension. You can easily register for an extension with their e-file system. The IRS has tax extension guidelines for those who want to file for an extended filing period. Tax filing extension is usually six months. The extension goes a bit beyond that for the likes of military personnel in active duty.

Also Check: Can I File Taxes On Unemployment

What To Do If Paying Penalties Becomes Difficult

IRS laws apply to the general public, and they are not as stringent as one may believe. The IRS gives relief to taxpayers who face a failure to pay tax penalties in cases of emergency or some other reason that may be acceptable to the IRS. The IRS may provide some alternative ways through which a taxpayer may pay his or her tax easily.

Read Also: How Do I Find My Lost Tax Id Number

Irs Business Payment Plans: Pay Monthly

Dont let a cash shortfall prevent you from paying your business taxes. Payment in full should be your top priority. If, however, thats not possible, you could be eligible to pay off your tax bill monthly with the IRSs Business Payment Plan.

If you owe a total of $25,000 or less in taxes, penalties, and interest, you can even apply for a payment plan right now online.

Taking this short description at face value would be a mistake. It is complex and labor-intensive. Assess as best you can whether your business might be eligible. If youre convinced, bring your findings to a CPA.

Penalties For Filing And/or Paying Late

As it turns out, the penalty for failure to file is much steeper than the penalty for a late payment. Thus, if you cant afford the amount due, you should still file your return in a timely manner and then explore alternative payment options.

To be a bit more specific, the penalty for late payment is typically 0.5% of your unpaid taxes per month after the deadline that your taxes go unpaid. This penalty can wind up being as much as 25% of your total amount due, so dont let it slide any longer than absolutely necessary.

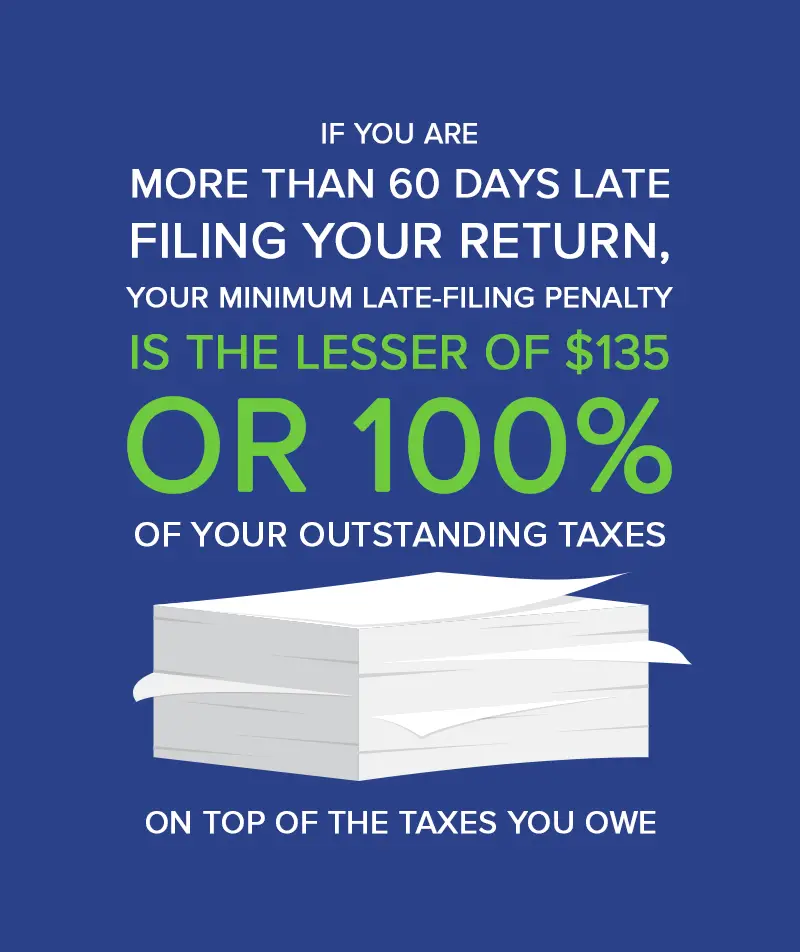

In contrast, the penalty for filing your return late is typically a whopping 5% of your unpaid taxes per month after the deadline that they receive your return, topping out at 25%. And if you file more than 60 days late, the minimum penalty is the smaller of $135 or 100% of the taxes that you owe.

Keep in mind that, as long as you request an extension and pay in at least 90% of your actual tax liability by the original due date , youll avoid any underpayment penalties as long as the balance if paid no later than the extended due date.

Read Also: Where Is My Federal Tax Return

A Few Insights To Pass Along To Family Members

- Beneficiaries may not be familiar with year-of-death RMD rules.

- Beneficiaries may be responsible for handling the owners year-of-death RMD.

- In such cases, beneficiaries may be liable for an excise tax if the RMD withdrawal is not accomplished by Dec. 31 of the owners year of death.

- Beneficiaries need to know about Form 5329 to request a waiver of the excise tax if the owners RMD failure was due to reasonable cause.

- IRA owners need to alert their younger family members that they may need to take quick action when a member of the family who is an IRA owner passes away.

Is There A One Time Tax Forgiveness

What is One-Time Forgiveness? IRS first-time penalty abatement, otherwise known as one-time forgiveness, is a long-standing IRS program. It offers amnesty to taxpayers who, although otherwise textbook taxpayers, have made an error in their tax filing or payment and are now subject to significant penalties or fines.

Recommended Reading: How To Pay Taxes With Doordash

Read Also: What If I Never Filed Taxes

How You Can Avoid Or Minimize Penalties

You can skip all IRS late-filing and late-payment penalties completely by filing and paying your tax balance due on time. While thatâs the obvious goal, we all know sometimes life just gets in the way.

If youâre doing your best to catch up, and you just didnât get there before the deadline, consider a few ways to minimize your tax penalties.

-

File an extension. If the April deadline hasnât yet passed, file for a tax extension and use those extra six months to get your finances caught up and organized for filing. Remember that an extension gives you more time for filingânot payment. Payment is still due by April 18. If youâve already missed the deadline, you no longer have the option to file for an extension.

-

File your taxes even if you canât pay them yet. The penalty for missing federal tax filing is larger than the penalty for missing the payment. File your income tax return with the IRS and avoid the larger of the two penalties. There are many ways to sort out how to pay your taxes.

-

Get help to file as quickly as possible. If you missed the deadline, penalties are creeping up every month. File as soon as possible, even if it means paying for help from a tax professional to sort out the numbers and get your tax forms prepared. The cost of bookkeeping and working with a tax agent may be far less than the increasing penalties for leaving your business income taxes unpaid.

Whats The Penalty For Filing Your Taxes Late

Is there a penalty for filing taxes late? The answer: yes. Taxpayers have to pay a separate fine if they fail to file their taxes on time. This is what we call the failure-to-file penalty. Meanwhile, failing to pay your taxes before the due date will result in a failure-to-pay penalty.

Failure-to-File Penalty: If a taxpayer fails to file within 60 days after the deadline, they have to pay $205 or 100% of their unpaid tax, whichever is the lesser amount.

Failure-to-Pay Penalty: The failure-to-pay penalty is 0.5% of every months unpaid taxes. Depending on the amount, it can accumulate up to 25% of the taxes you owe.

Tip: The failure-to-file penalty is about 10 times larger than the IRS failure-to-pay penalty. Thats why, even if you dont have enough cash, you should still file your taxes on time. As much as possible, you want to avoid the failure-to-file penalty.

The IRS can help you find solutions to pay off your taxes. But they cant help you if you dont file your taxes on time.

Read Also: How To Do State Taxes For Free

Whats The Penalty For Filing Taxes Late

In 2020 and 2021, taxpayers were granted relief to file their taxes late instead of filing on April 18, like every prior tax year. The relief was given due to the Covid-19 pandemic. But now, things are back to normal, and so for the 2021 tax year, the due date was April 18, 2022.

Taxpayers often neglect the tax filing deadline date because of various reasons including missing documents, improper bookkeeping, busy activities or events going on in their firms, or they might simply forget the date. So they may file their tax returns late. Therefore, they have to face a penalty for filing tax returns late. The longer the delay, the worst the consequences can become. The IRS charges hefty penalties for filing late tax returns or not filing at all.

We have discussed here briefly what fines will be charged against you for filing late tax returns. We have also mentioned some ways to get rid of these penalties and save yourself from a financial crisis.

What Are Willful And Non

Not knowing about your tax obligations and, therefore, not fulfilling them is considered to be a non-willful violation. But if you were aware of your tax obligations and chose not to file or pay for any reason, then it is an expat willful violation. The former approach leads to lower tax penalties and fines for US expats, or sometimes no penalties at all.

For example, if you knew about your duty to report information on FBAR or Form 8938, but intentionally decided not to report your accounts, this behavior is classified as willful. However, if you didnt know that you were required to report or disclose your foreign income and acted unintentionally, then your behavior was non-willful.

It is important to understand if your tax non-compliance is willful or non-willful conduct as it will determine whether you can use the Streamlined Foreign Offshore Program to become tax compliant. The vast majority of taxpayers who have previously undisclosed interests in a foreign financial account or asset are likely to believe they are non-willful, but the issue is whether the IRS will agree with them. So taxpayers and their representatives must be cautious when certifying non-willful status to the government.

Don’t Miss: Do I Pay Taxes On Social Security