Tips For Better Address Searches

- Check the spelling of the street name

- Use “Springwood St” instead of “Spring Wood St”,

- Use “Manor Rd” instead of “Maynor Rd”,

- Use “Belmont Dr” instead of “Bellmont Dr”,

- Use “Lemmon Ave” instead of “Lemon Ave”

Discounts Penalties Interest And Refunds

- Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid.

- Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying. See Prepayment Discounts, Extensions and Amendments FAQs.

- A $50 penalty is assessed on each report filed after the due date.

- If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed.

- If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

Texas Sales Tax Guide

Texas businesses must collect and pay sales taxes on most items they sell. The sales tax varies from county to county the state has a base sales tax, plus the counties have discretionary taxes that they can add to the state sales tax rate. Texas also charges use taxes, transient rental taxes, and franchise taxes. This guide does not fully describe all of Texass laws and regulations regarding taxes. Businesses should contact a business attorney or visit the Comptrollers Office to learn which rules and regulations are associated with their industries.

Don’t Miss: Can You File Past Taxes On Turbotax

About The Texas Sales Tax

The state of Texas has relatively simple sales tax rate, and utilizes a flat state tax rate. However, the local cities, counties, transit authorities , and special purpose districts do have the ability to charge local taxes, which will vary depending on location. These local tax rates would be in addition to the state rate. Local jurisdictions also have the ability to impose some other additional taxes if they so choose, which would be cumulative with the state taxes of the same nature.

What Transactions Are Generally Subject To Sales Tax In Texas

In the state of Texas, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. An example of items that are exempt from Texas sales tax are items specifically purchased for resale.This means that an individual in the state of Texas purchases school supplies and books for their children would be required to pay sales tax, but an individual who purchases school supplies to resell them would not be required to charge sales tax.

You May Like: How To Calculate My Tax Return

Is The Texas Sales Tax Destination

Texas is a origin-based sales tax state, which meanssales tax rates are determined by the location of the vendor, not by the location of the buyer. The origin-based method of determining sales tax is less complicated for vendors than destination-based sales tax, because all in-state buyers are charged the same sales tax rate regardless of their location.

Texas Alcohol And Tobacco Taxes

Texas has a tax of 20 cents per gallon of wine and 19 cents per gallon of beer. Liquor, on the other hand, is taxed at $2.40 per gallon. All of these taxes are below average for the U.S.

Texas’ taxes on a pack of 20 cigarettes totals $1.41, which ranks in the middle of the pack on a nationwide basis.

Read Also: Can I Do My Taxes Online

How 2022 Sales Taxes Are Calculated In Texas

The state general sales tax rate of Texas is 6.25%. Cities and/or municipalities of Texas are allowed to collect their own rate that can get up to 2% in city sales tax.Every 2022 combined rates mentioned above are the results of Texas state rate , the county rate , the Texas cities rate , and in some case, special rate . The Texas’s tax rate may change depending of the type of purchase. Some of the Texas tax type are: Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.Please refer to the Texas website for more sales taxes information.

Do You Have Nexus In Texas

The word ânexusâ refers to a commercial connection in the state. Nexus determines the following questions for a state tax agency: Do you do business here, what kind, and how much? And when you do have nexus, that means youâre obligated to collect tax on your sales there.

So the first question for you to answer is whether you have nexus in Texas.

You probably have nexus in Texas if any of the following points describe your business:

- A physical presence in Texas: a store, an office, a warehouse or distribution center, storage space, you, an employee, a representative, etc.

- Any affiliate businesses or individuals in the Texas, which generate sales.

- A significant amount of sales in Texas within twelve months. *

* This is called an economic nexus, a sales tax nexus determined by economic activity, i.e. – the amount of sales you make in a particular state. Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount.

The threshold in Texas is $500,000 in annual sales. To learn more about how this works, check out the Ultimate Guide to US Economic Nexus.

Also Check: How To Avoid Paying Taxes On Divorce Settlement

Texas’ Sales Tax By The Numbers:

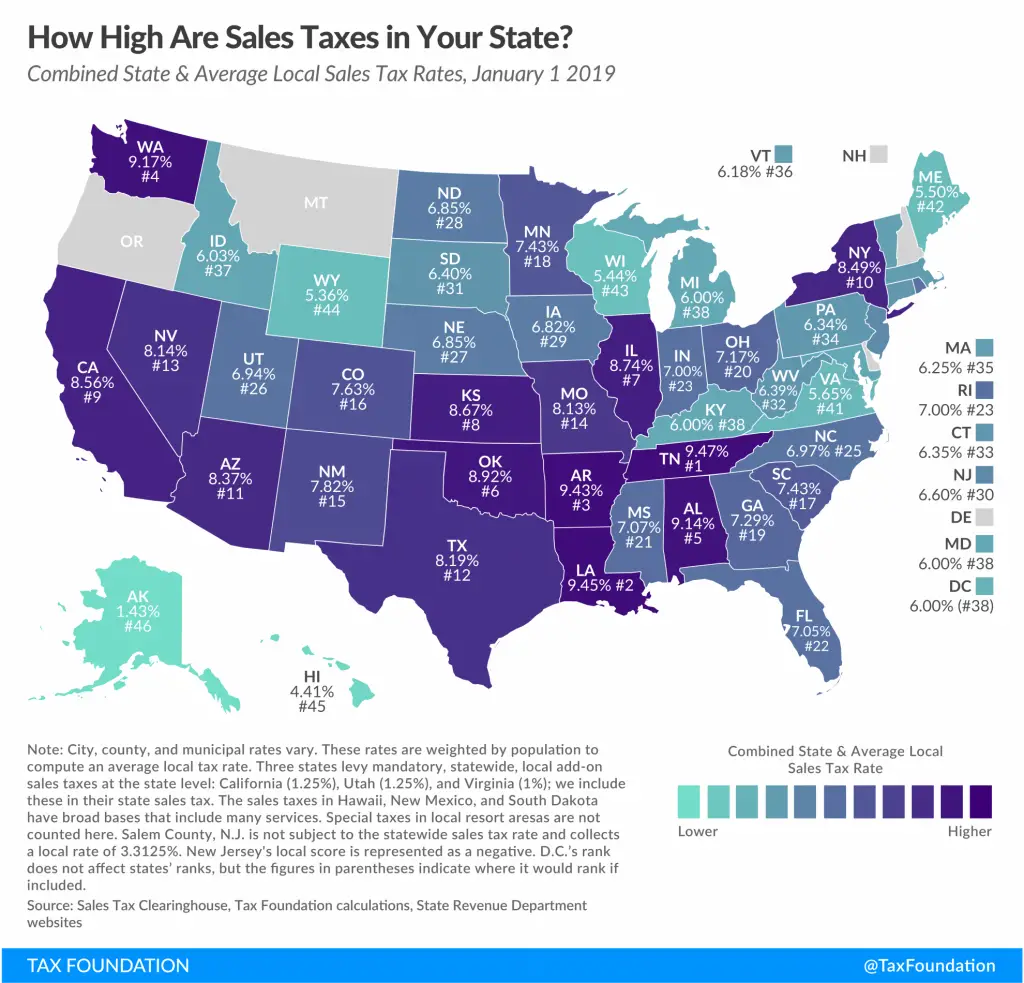

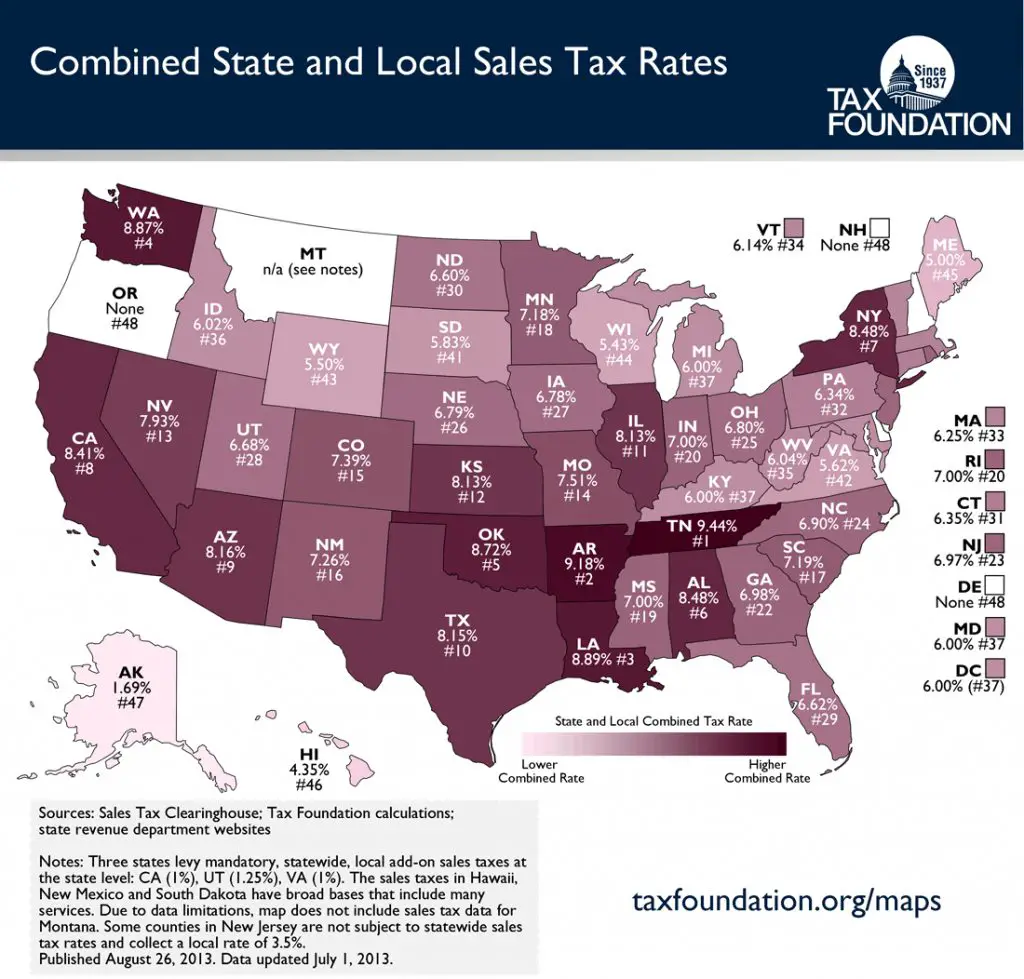

Texas has ahigher-than-average sales tax, includingwhen local sales taxes from Texas’s 988 local tax jurisdictions are taken into account.

Rankings by Average State + Local Sales Tax:

Ranked 14th highest by combined state + local sales tax

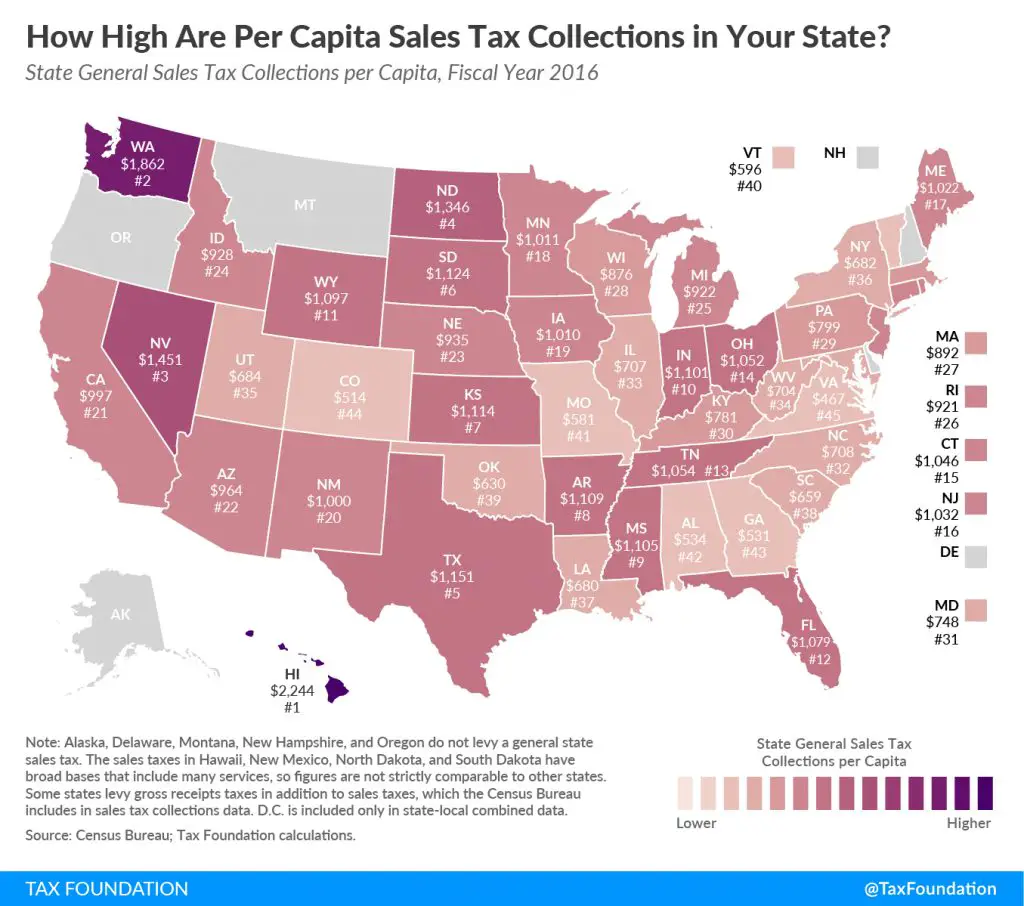

Ranked 14th highest by per capita revenue from state + local sales taxes

Rankings by State Sales Tax Only:

Ranked 7th highest by state sales tax rate

Ranked 13th highest by per capita revenue from the statewide sales tax

Texas has a statewide sales tax rate of 6.25%, which has been in place since 1961.

Municipal governments in Texas are also allowed to collect a local-option sales tax that ranges from 0% to 2% across the state, with an average local tax of 1.69% .The maximum local tax rate allowed by Texas law is 2%.You can lookup Texas city and county sales tax rates here.

This page provides an overview of the sales tax rates and laws in Texas. If you are a business owner and need to learn more about things like getting a sales tax permit, filing a sales tax return, or making tax-exempt purchases for resale see the Texas Sales Tax Handbook’s Table of Contents above.

Experienced Texas Sales Tax Lawyers For Local And Online Sellers

Not every business offering products or services in Texas is required to collect and remit sales tax. The seller must have a sufficient nexus to the State of Texas. Out-of-state sellers, however, often satisfy this requirement. Navigating sales tax regulations in each of the 50 states can put a significant burden on small business owners. Fortunately, the tax attorneys at Freeman Law are available to help with Texas sales tax compliance. Call us today at 984-3410 or contact us online for a free sales tax consultation.

You May Like: Where Do I Pay My Federal Taxes

Sweeny Sales Tax Could Take On New Use

SWEENY A shift of the sales tax pie to fund a new Crime Control Prevention District will come at the expense of the Sweeny Economic Development Corp.

After 30 minutes of discussion at Tuesdays city council meeting, the board decided to put a measure on the ballot that would divide its half-cent sales tax into one-eighth toward the Crime Control and Prevention District and three-eighths for the development corporation.

Initially, splitting the two with a quarter apiece was suggested. This was the basis for the first motion, but it failed. The second motion for one-eighth towards CCPD and three-eighths for EDC carried.

If passed, it would mark the first time the EDC did not receive the entire one-half cent sales tax apportionment since 1997.

A survey, organized by City Manager Lindsay Koskiniemi, was circulated to Sweeny residents to get their opinion on how the split should be made, if at all. The city made a concerted effort to push the survey out to the city, through various platforms, including Facebook, the citys website and word of mouth.

Koskiniemi organized the three question survey and gave the results of what the community had urged. Former councilman Neil Best also spoke about the issue to help provide a community member standpoint.

Neither the executive director nor the president of the Economic Development Corporation were in attendance at the meeting.

Talks of raises and new vehicles were discussed for the polices funds should they be approved by voters.

Nexus Triggers For Collecting Sales Tax In Texas

Since the Supreme Courts decision in South Dakota v. Wayfair, Inc., 138 S.Ct. 2080 , Texas has added an economic nexus rule to its nexus determination. In light of this change, many out-of-state sellers must determine whether they are responsible for registering with the Texas Comptroller for a Texas sales and use tax permit and collecting Texas sales or use tax. As mentioned above, this depends on whether you have a legal nexus to the State of Texas. You may need to register with the state of Texas, as well as collect and remit sales tax to the state of Texas, if any of the following are true:

- The business has a substantial physical presence in the state

- The seller stores its inventory in the State of Texas, such as in an Amazon warehouse, whether the items ship in or out of state

- A business affiliate or third party is soliciting sales in Texas on behalf of a remote seller

- A remote seller has over $500,000 in annual revenue derived from the sale of goods and/or services in Texas

- Items were sold or advertised at a trade show or convention in Texas even if for only a day or

- The online products were designed, developed, or shipped from within Texas

Anyone who has nexus with Texas must register with the Texas Comptroller and collect and remit sales tax.

Also Check: Do I Charge Sales Tax On Services

How To File Taxes In Texas

When tax time rolls around in Texas, whether itâs monthly or annually, you must do three things:

Texas requires that any seller with a sales tax permit file a sales tax return on your due date, even if you donât have any sales tax to report or pay. Even if you didnât make a single sale in Texas during the reporting period, you should must do a âzero tax filing.â

Settling A Texas Sales Tax Liability

Along the way, or even after one the critical notices are issued, there is the possibility to settle your Texas sales tax case by negotiating with the Texas Comptroller. Often, you can get better results here than with the auditor. If you or your professional seldom does state and local tax work, it might be difficult to evaluate fair versus unreasonable settlements. DO NOT try to negotiate a settlement without an experienced Texas state and local tax lawyer or other professional.

Read Also: Where To Send Amended Tax Return

Texas Sales Tax Nexus

Sales tax nexus is a term that means that a retailer has a significant presence within a state. If you have nexus in Texas, you are required to collect and remit sales tax on your businesss orders.

A business with a physical presence within the state of Texas will have nexus. That means if you have an office within the state, you must collect sales tax on retail sales.

Other activities that create Texas sales tax nexus are:

- Having an employee, or another agent who operates under the authority of the seller, within the state

- Having an independent salesperson within the state

- Having a distribution center in Texas

- Storing products within a Texas-based warehouse, including Fulfillment by Amazon warehouses

For a complete list of activities that may cause your business to have nexus in Texas, please refer to this web page maintained by the state of Texas.

If you are unsure whether your business is required to collect sales tax, consult with a tax attorney or other licensed professional.

How To Figure The Amount Of Sales Tax In Texas

Related

If you do business in Texas, you may be required to collect and submit state sales taxes. Texas law mandates the collection of taxes on most retail goods and services, and also allows local jurisdictions to impose sales taxes as well. Owners of new businesses in Texas, as well as mail order or e-commerce companies that sell a significant amount of merchandise to Texas consumers, must register to collect and submit Texas sales taxes.

Recommended Reading: How Much To Withhold For Taxes

Establishment Of Economic Sales Tax Nexus In Texas

In addition to physical nexus, Texas has implemented economic nexus laws establishing requirements for out-of-state businesses that make significant sales to residents within Texas to collect and remit sales tax.

Starting with sales made on April 1, 2019, remote sellers are required to collect sales tax if they have made sales of tangible personal property and taxable services in excess of $500,000 over the previous 12 months.

Other Notable Taxes In Texas

Texas has an oyster sales fee. Shellfish dealers in Texas are required to pay a tax of $1 per 300 pounds of oysters taken from Texas waters.

- Cameron County, Texas is located at 26.15° North, and contains the most southern point along the US-Mexico border.

- Three of the ten most populous cities in the country are in Texas.

- In 2014, Texas produced more oil than any country in the world except Saudi Arabia.

Also Check: Can I Still File Taxes

Collecting Sales Tax In Texas

Businesses that make their products or services available for sale in Texas can unwittingly be held liable for Texas sales or use tax. This means that anyonea business or an individualoffering products or services for sale in the state of Texas, whether online, in their living room, or through brick-and-mortar stores, is generally responsible for collecting sales tax from their customers. In turn, they have an obligation to remit any collected sales tax to the Texas Comptroller of Public Accounts.

Any person who collects a tax holds the tax in trust for the benefit of the state and may be held liable for the full amount of the tax collected plus any accrued penalties and interest. In Texas, individuals and business owners are generally legally responsible for knowing whether they need a Texas sales and use tax permit, determining which products are subject to tax, and for collecting and remitting the tax and applicable local tax to the Texas Comptroller.

Were At A Time When Things Are Starting To Turn Says Planos Budget Manager

7:00 AM on Nov 18, 2022 CST

Signs of a soft landing are emerging in Texas on the spending side of the ledger.

In November, monthly sales tax allocations for all taxing entities rose 7.1% compared with a year earlier, the Texas comptroller reported. Thats less than half the average monthly gain of 17.5% over the previous 12 months.

In Plano, where strong gains were the norm for 17 straight months, sales tax revenue actually declined slightly compared with a year ago down 2%.

When things were going gangbusters, the question in the back of everyones mind was, How much longer is this sustainable? said Casey Srader, Planos senior budget manager. Everyone knows it cant be forever. Now were at a time when things are starting to turn.

Sales tax allocated to cities in November primarily reflects receipts from September. After taxes are collected and sent to Austin, the appropriate shares are later returned to cities, counties, transit systems and special tax districts.

That means the slowdown in sales tax growth was appearing in September in much of the state.

People are retrenching a little bit, Srader said. Theres a lot of talk about recession, and all of that plays into people just being more cautious.

Sales didnt actually decline in September for the vast majority of Texas cities. But the pace of growth slowed, and those numbers are being compared against the sometimes spectacular gains of the pandemic recovery.

Don’t Miss: Can You File Taxes If You Get Unemployment

Overview Of Texas Taxes

Texas is often considered tax-friendly because the state does not collect any income taxes. But there are other taxes that Texans have to pay, such as significant property and sales taxes.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

Contest A Texas Jeopardy Assessment

Texas may issue a Notice of Jeopardy Determination in certain situations. The jeopardy assessment gives Texas Comptroller accelerated rights and it may immediately begin to try and collect. Due to the jeopardy nature, the taxpayer only has20 days to contest the assessment and must place a security deposit to fight the issue.

Also Check: How To Calculate Tax Bracket