Extension Of Time To File

- Filers will receive an automatic 6-month extension to file an estate tax return if you paid at least 80% of the tax finally determined to be due within nine months after the date of death of the decedent. See TlR 16-10.

- The 6-month extension begins from the due date of the original return.

- Failure to meet the 80% payment requirements will result in the imposition of interest and penalties calculated from the original due date of the return.

How To File Your Tax Return Electronically

You might want to e-file your late return if you haven’t missed that deadline as well. Many taxpayers can e-file at IRS Free File if their AGIs were under $73,000 in 2021. Some other rules can apply as well, imposed by the individual software providers that participate in the Free File Alliance.

The IRS will accept e-filed returns until November. It will announce the exact November cutoff date sometime in October 2022.

Paid Family And Medical Leave Contributions

Employers, other business entities and self-employed individuals electing PFML coverage are required to file Quarterly Returns through MassTaxConnect.

The first required quarterly return will cover the period from October 1, 2019 to December 31, 2019 and must be filed on or before January 31, 2020. All subsequent return filings will be due on or before the last day of the month following a calendar quarters close.

For more PFML information visit:

Also Check: How Much Capital Gains Tax Will I Pay

Tax Deadlines: July To September

- :Deadline for employees who earned more than $20 in tip income in June to report this income to their employers.

- : Deadline for employees who earned more than $20 in tip income in July to report this income to their employers.

- Deadline for employees who earned more than $20 in tip income in August to report this income to their employers.

- : Deadline forthird-quarter estimated tax payments for the 2021 tax year.

- : Final deadline to file partnership and S-corporation tax returns for tax year 2021, if an extension was requested .

When Are Taxes Due

2020 federal income tax returns for individuals are now due on May 17, 2021. The IRS announced in March that its tax deadline would be pushed back from the usual date, April 15. Even with the new deadline, we urge taxpayers to consider filing as soon as possible, especially those who are owed refunds. Filing electronically with direct deposit is the quickest way to get refunds, IRS Commissioner Chuck Rettig said in the statement.

The deadline for paying federal income tax for individuals has also moved to May 17, 2021.

Read Also: How Can I Find Out Where My Tax Refund Is

Tax Deadline For Quarterly Estimated Payments

If you’re self-employed, an independent contractor or have investment earnings, you might be curious about another set of deadlines: quarterly estimated payments. The IRS requires these quarterly estimated tax payments from many people whose income isnt subject to payroll withholding tax.

For estimated taxes, the answer to “When are taxes due?” varies. The year is divided into four payment periods, and each period has its own payment due date. Check below to see the dates for 2022.

|

If you earned income during this period |

Estimated tax payment deadline |

|---|

What’s The Fastest Way To File My Tax Return

The fastest and most accurate way to file your tax return is to file electronically.

E-filing your tax return with the IRS is more secure than paper filing. Because the tax return is electronically transmitted to the IRS, you don’t have to worry about it getting lost in the mail or arriving late. You’ll also get confirmation right away that the IRS has received your return and has started processing it.

If you’re waiting for a tax refund, the fastest way to get your money is to have it electronically deposited into your bank account. The IRS typically issues 90% of refunds in less than 21 days when taxpayers combine direct deposit with electronic filing.

Also Check: How Fast Can You Get Your Tax Refund

Every Tax Deadline You Need To Know

OVERVIEW

Make sure your calendars up-to-date with these tax deadlines, dates, possible extensions and other factors in play for both individuals and businesses in 2023.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

|

Key Takeaways Individual income tax returns are typically due April 15, unless the date falls on a weekend or holiday or you file Form 4868 seeking an extension until October 15. Independent contractors, gig workers, and self-employed people usually have to make quarterly estimated tax payments are pre-set dates throughout the year. Partnerships and S-Corps filing deadlines are typically either March 15 unless they operate on a fiscal year. A six-month extension to September 15 can be requested using Form 7004. |

What If I Need More Time

Don’t let a looming tax deadline force you to rush through the tax filing process and make a mistake on your return. Simply request an extension.

The IRS typically grants a six-month extension of the tax filing deadline to anyone who requests it. You can request an extension electronically with TurboTax or use Form 4868.

Just keep in mind, the tax extension gives you more time to file your return, not more time to pay the tax you owe. You’ll need to estimate the amount you owe and make your payment by the tax filing deadline even if you file an extension.

Don’t Miss: How Much Do Small Businesses Get Taxed

Keep Your Cra Information Up

File your taxes online or by paper, or find other options such as having someone else complete them for you:

File your tax return online or mail us your completed tax return to your tax centre

You May Like: What Is The Last Date You Can File Your Taxes

Important Due Dates For Filing Your 2021 Tax Return And Making Payments

The Balance / Catherine Song

Tax filing season can be stressful, but if you plan ahead, the process can be much more seamless.

Generally, April 15 is the official deadline for filing your federal income tax return each year, but that date isnt carved in stone. The deadline moves to the next business day when April 15 falls on a Saturday, a Sunday, or a legal holiday, and other national events can shift it as well. For example. the tax filing deadline in 2022 is April 18 .

The Internal Revenue Service typically begins processing tax returns in late January of each year, but you can start filing as soon as you have all of the necessary paperwork together. In this guide, youll learn all of the important dates to know in 2022 in order to ensure a smooth and easy tax filing process.

Recommended Reading: Do I Have To Pay Taxes On Social Security Income

Also Check: Why Appeal Property Tax Assessment

If You Need Help With Your Return

If you are unable to get help filling out your North Carolina return, you can contact a service center for assistance or call toll-free at 1-877-252-3052. Your federal return must be completed before we can assist you in filling out your North Carolina return.

If you are disabled, have a low income, or are a senior citizen, income tax returns can be prepared free of charge through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. For location and dates of assistance call the Internal Revenue Service toll-free at 1-800-829-1040.

Do I Also Get More Time To File My State Taxes Then

In most instances.

Even though the IRS extended the federal filing deadline, each individual state sets its own tax deadlines.

Filers in states that don’t push their deadline to May 17 or beyond may need to file their federal return — or at least calculate what they will put on their federal return — by April 15 anyway.

That’s because states often use one’s federal adjusted gross income or federal taxable income as the starting point to determine a filer’s income subject to state tax.

But most states have extended their filing deadlines to May 17 to align with the federal deadline. They include Alabama, Arkansas, California, Colorado, Connecticut, Delaware, Georgia, Illinois, Kansas, Kentucky, Maine, Massachusetts, Michigan, Minnesota, Missouri, Montana, Nebraska, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Utah, Vermont, Virginia, West Virginia and Wisconsin.

Oklahoma has extended its deadline to June 15. And Maryland previously had extended its filing deadline to July 15.

The remaining states still have their original filing date, which is April 15 in most instances, according to the Federation of Tax Administrators.

Some states’ and the District of Columbia’s current filing dates differ. They are Hawaii, April 20 Iowa, April 30 and DC, July 15.

You May Like: Will My Property Tax Increase If I Refinance

What Is Not Covered By The Extension:

- The extension does not apply to federal tax returns and payments that are not due on April 15, 2020, which means estimated tax payments for the second quarter of 2020 are still due on June 15, 2020, and tax returns and payments for taxpayers who use a fiscal year rather than the calendar year generally will not be eligible for the extension.

- The extension is generally not available to S corporations, partnerships, and LLCs treated as partnerships because their tax returns were generally due on March 16, 2020.

- The extension does not apply to information returns, payroll tax deposits, excise taxes, or any other taxes other than federal income taxes, but the IRS has similarly extended the due date for filing 2019 gift and generation-skipping transfer tax returns and making payments that were otherwise due April 15, 2020.

- The extension does not apply to claims for refund that are required to be filed by April 15, 2020.

- The extension does not apply to state tax filing and payment deadlines, but many states have issued their own form of relief in response to the federal extension.

The facts, laws, and regulations regarding COVID-19 are developing rapidly. Since the date of publication, there may be new or additional information not referenced in this advisory. Please consult with your legal counsel for guidance.

Tax Year 2021 Filing Season Update Video

View the tax year 2021 Filing Season Update Video to learn about a wide range of topics including:

- Detailed updates related to personal income tax filings

- The expansion of electronic filing and payment requirements for a number of tax types

- A summary of the COVID relief efforts for small businesses

- Trustee tax return changes for 2022

- A review of important webpages and DOR contact information, and

- A brief overview of operations at DOR in response to the current pandemic.

Read Also: Where Do I Go To Pay My Property Taxes

Where To File Your Return

Taxpayers using eFile will have their returns processed electronically once they are submitted.

For taxpayers filing using paper forms:

- If you expect a refund, be sure to mail your return to the North Carolina Department of Revenue, PO Box R, Raleigh, NC 27634-0001.

- If you owe taxes, mail your return and payment to the North Carolina Department of Revenue , PO Box 25000, Raleigh, NC 27640-0640. Make your check or money order payable to the NC Department of Revenue. Important: The Department will not accept a check, money order, or cashier’s check unless it is drawn on a U.S. bank and the funds are payable in U.S. dollars.

More Time To File And Pay

If you wont be able to file by the original May 1 deadline, dont worry. Everyone has an automatic 6-month filing extension in Virginia, which moves the filing deadline from May 1 to November 1 for most taxpayers .

In addition, as part of the state’s COVID-19 tax relief actions, if you owe taxes, you have until June 1, 2020 to pay without any penalties or interest.

This also applies to individual extension payments for Taxable Year 2019 as well as the first estimated income tax payments for Taxable Year 2020.

Recommended Reading: How To Find Out If You Owe Back Taxes

What Happens To My Tax Deadlines If I Live In An Area Impacted By A Natural Disaster

If you need more time because you live in an area hit by a natural disaster, you might qualify for tax relief from the IRS. The IRS often postpones the tax filing deadline for taxpayers who live in or have a business within a federally declared disaster area.

For example, the IRS announced it would postpone tax filing and tax payment deadlines for taxpayers affected by the September 2020 California wildfires.

Individual Tax Returns Due

This is the deadline to file Individual tax returns . If your income is below $66,000 for the tax year, you can e-file for free using IRS Free File. If your income was above that, you can use the IRSâ free, fillable forms.

If youâre a sole proprietor filing Schedule C on your personal tax returns, the April 18, 2022 deadline applies to you too.

April 18 is also the deadline to file for an extension to file your individual tax return.

You May Like: When Will Taxes Be Released 2021

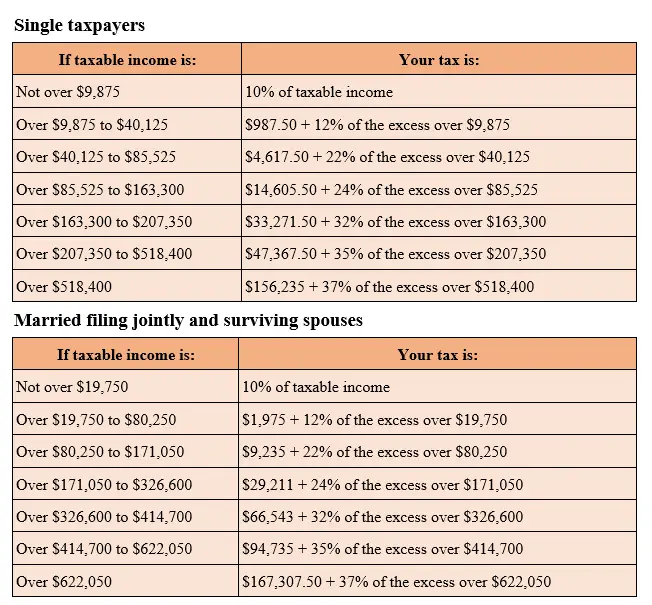

How To Get Into A Lower Tax Bracket And Pay A Lower Federal Income Tax Rate

Two common ways of reducing your tax bill are credits and deductions.

-

Tax credits can reduce your tax bill on a dollar-for-dollar basis they don’t affect what bracket you’re in.

-

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words: Take all the tax deductions you can claim they can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

Promotion: NerdWallet users get 25% off federal and state filing costs. |

Promotion: NerdWallet users can save up to $15 on TurboTax. |

|

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: Where To Send Kentucky State Tax Return

Chat With Charlie Unread Messages

The Educator School Supply Tax Credit and the Return of Fuel Charge Proceeds to Farmers Tax Credit have received Parliamentary approval. This means that the CRA can now process your 2021 income tax and benefit return if you claimed these credits. Contact Us if you have questions.

Find out whats new for the 2021 tax season and your filing and payment due dates. Begin by gathering your documents to report income and claim deductions, and choose how you want to file and send your completed tax return to the CRA.

The 2021 Tax Deadline Extension: Everything You Need To Know

OVERVIEW

In response to the Coronavirus pandemic, the Treasury and IRS issued new instructions that call for a tax deadline extension, moving the customary April 15 deadline to May 17, 2021. Read more to learn about the relevant details and how they impact your situation.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Recommended Reading: How Long Does It Take To Get Your Tax Refund

When Are 2022 Taxes Due

The due date for filing your tax return is typically April 15 if youre a calendar year filer. Generally, most individuals are calendar year filers.

For individuals, the last day to file your 2022 taxes without an extension is April 18, 2023, unless extended because of a state holiday. You could have submitted Form 4868 to request an extension to file later during the year.

If you have a business that operates on a fiscal year basis, your return is typically due on or before the 15th day of the third or fourth month after the close of your fiscal year. In instances where this due date falls on a Saturday, Sunday, or legal holiday, the due date is moved to the next business day.

The last day to do taxes isnt the only important tax deadline to know, however. There are several other important tax deadlines you should know for 2023. If you’re wondering, “When are taxes due, anyway?” Here are the important dates at a glance.