Filing An Amended Return

In order to amend the amounts reported for the computation of income or franchise taxes, you must file an amended Form CIFT-620. Louisiana Revised Statute 47:287.614 requires every taxpayer whose federal return is adjusted to furnish a statement disclosing the nature and amounts of such adjustments within 180 days after the adjustments have been made and accepted. This statement should accompany the amended return.

Important Due Dates For Filing Your 2021 Tax Return And Making Payments

The Balance / Catherine Song

Tax filing season can be stressful, but if you plan ahead, the process can be much more seamless.

Generally, April 15 is the official deadline for filing your federal income tax return each year, but that date isn’t carved in stone. The deadline moves to the next business day when April 15 falls on a Saturday, a Sunday, or a legal holiday, and other national events can shift it as well. For example. the tax filing deadline in 2022 is April 18 .

The Internal Revenue Service typically begins processing tax returns in late January of each year, but you can start filing as soon as you have all of the necessary paperwork together. In this guide, you’ll learn all of the important dates to know in 2022 in order to ensure a smooth and easy tax filing process.

Tax Tips For Canadians

To help you navigate tax season, weve rounded up our 15 most popular and helpful tips, from how long to keep tax documents to what happens if you lie on your return. Youll also find advice for dealing with U.S. investments, how much money to set aside for taxes if youre self-employed, and much more, with links to our full articles on each topic. There really is something for everyone.

You May Like: How Do I Pay State Taxes

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Filing Your Tax Return

You should file a tax return before the April 30 deadline after the end of the tax year. Youll need your social insurance number and T4 or final payslip to file. While the deadline is April 30, you can file your tax return in February after the end of the tax year.

You may be due an income tax refund if:

- You overpaid income tax

- You overpaid in the Canadian Pension Plan

- You overpaid Employer Insurance

You can also find out if youre due some tax back in Canada by using our online tax calculator.

Need help with your Canadian tax affairs?

Do not hesitate to contact us at or visit our Canadian tax website today.

You can calculate your refund with our Free Canadian income tax refund calculator.

Read Also: How To Find Annual Income Before Taxes

Us Tax Filing Deadlines And Important Dates In 2022

Are you a citizen of the United States or a Green Card Holder residing in Canada? Do you have an interest in the U.S. or foreign business entity? Are you a Canadian individual or a business owner with U.S. interests? Or maybe you are in charge of your business tax compliance? You should be aware of the important dates and deadlines of your income tax filing requirements.We designed this page to assist you or your qualified cross-border and U.S. tax advisor in determining U.S. tax filing deadlines that may apply to your case. For example, if you are a U.S. expat and live in Canada, your general deadline for filing a U.S. income tax return with the Internal Revenue Service is April 15 . However, an automatic extension to June 15 is granted to those U.S. citizens or residents whose tax home and abode, in real and substantial sense, is outside the United States and Puerto Rico. Further extensions may be requested by taking affirmative action and filing Form 4868 ), sending a letter with a relevant explanation to the IRS , and filing Form 2350 requirements extends the filing deadline to meet the FEIC requirements).

The extension of time to file ones tax return DOES NOT extend the time for making the tax payment. To avoid potential penalties and/or interest for late tax payment, please ensure that you either pay tax with a timely filed tax return or along with filing an extension to file the respective tax return.

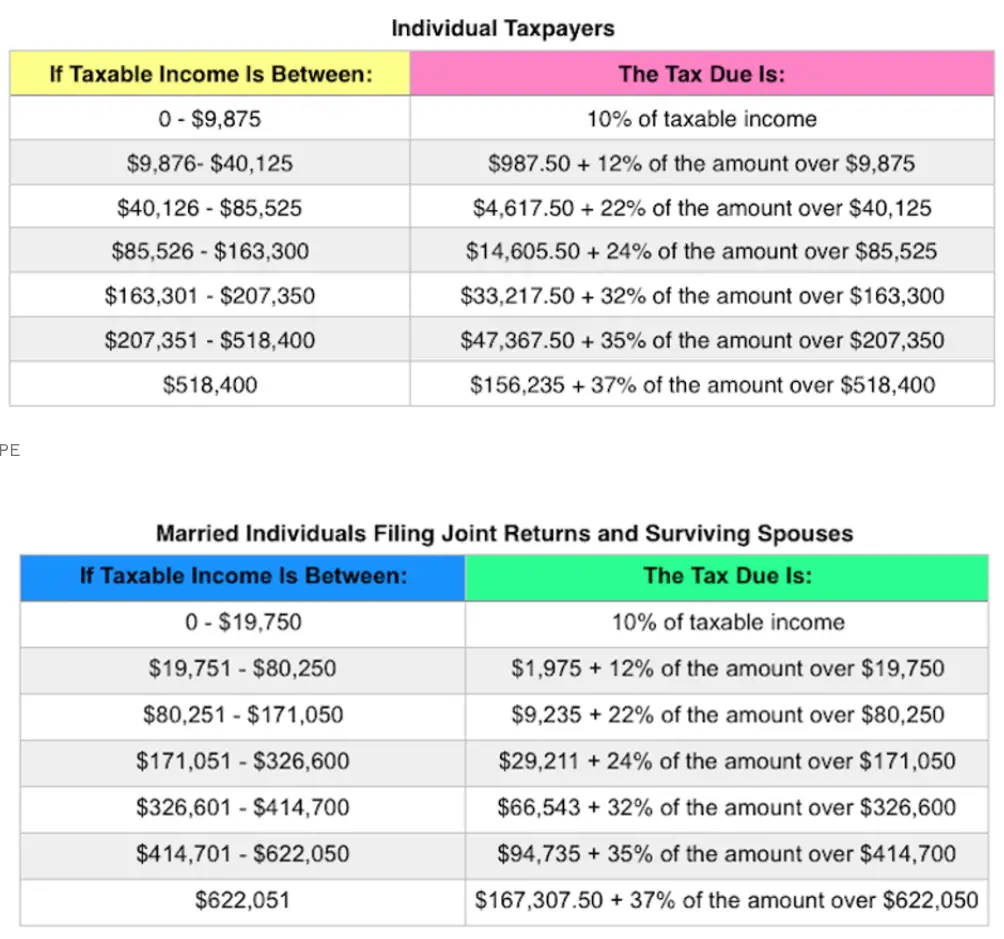

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The 2021 credit can be up to $6,728 for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $4,000 or $8,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

Read Also: Can I Pay My Federal Taxes Online

Deadline For Filing Your Income Tax Return

The deadline for sending us your personal income tax return is April 30. If you or your spouse carried on a business or earned income as a person responsible for a family-type resource or an intermediate resource, you have until June 15 to file your return.

Any balance due must be paid by April 30.

NoteannonceIncome tax filing deadline extended

Since the regular filing deadline falls on a Saturday this year, you have until May 2, 2022, to file your 2021 income tax return and pay any income tax you may owe. No interest or penalty will be charged.

End of noteNote

Even if you are unable to pay the full amount of your balance due by April 30, file your return no later than the deadline to avoid a late-filing penalty.

End of note

Tax Day Now July 1: Treasury Irs Extend Filing Deadline And Federal Tax Payments Regardless Of Amount Owed

IR-2020-58, March 21, 2020

WASHINGTON The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date is automatically extended from April 15, 2020, to July 15, 2020.

Taxpayers can also defer federal income tax payments due on April 15, 2020, to July 15, 2020, without penalties and interest, regardless of the amount owed. This deferment applies to all taxpayers, including individuals, trusts and estates, corporations and other non-corporate tax filers as well as those who pay self-employment tax.

Taxpayers do not need to file any additional forms or call the IRS to qualify for this automatic federal tax filing and payment relief. Individual taxpayers who need additional time to file beyond the July 15 deadline, can request a filing extension by filing Form 4868 through their tax professional, tax software or using the Free File link on IRS.gov. Businesses who need additional time must file Form 7004.

The IRS urges taxpayers who are due a refund to file as soon as possible. Most tax refunds are still being issued within 21 days.

The IRS will continue to monitor issues related to the COVID-19 virus, and updated information will be posted on a special coronavirus page on IRS.gov.

Treasury and IRS will issue additional guidance as needed and continue working with Congress, on a bipartisan basis, on legislation to provide further relief to the American people.

Don’t Miss: How To Pay My Federal Income Taxes Online

How To Get Started Doing Your Tax Return

If you procrastinate with your tax return, know that youre not alone: in 2020, over 60% of Canadians didnt file on time. Being late can be costly, though, so we want to help you conquer procrastinationand avoid penalties and interest chargesthis tax season. Get motivated with the psychological hacks in our article: How to do your taxes and beat procrastination.

Unclaimed Refunds Deadline Extended To May 17

For tax year 2017 Federal income tax returns, the normal April 15 deadline to claim a refund has also been extended to May 17, 2021. The law provides a three-year window of opportunity to claim a refund. If taxpayers do not file a return within three years, the money becomes property of the U.S. Treasury. The law requires taxpayers to properly address, mail and ensure the tax return is postmarked by the May 17, 2021, date.

Additionally, foreign trusts and estates with federal income tax filing or payment obligations, who file Form 1040-NR, now have until May 17, 2021.

Read Also: Where Do I Pay Property Taxes

Estimated Tax Payment Due April 15

Notice 2021-21, issued today does not alter the April 15, 2021, deadline for estimated tax payments these payments are still due on April 15. Taxes must be paid as taxpayers earn or receive income during the year, either through withholding or estimated tax payments. In general, estimated tax payments are made quarterly to the IRS by people whose income isn’t subject to income tax withholding, including self-employment income, interest, dividends, alimony or rental income. Most taxpayers automatically have their taxes withheld from their paychecks and submitted to the IRS by their employer.

Tax Filing Deadline For Individual Tax Returns

The tax filing deadline for your 2022 tax return is May 1, 2023. .

The Canada Revenue Agency usually expects individual taxpayers to submit their income tax returns by April 30 of every year. If April 30 falls on a weekend, the CRA extends the deadline to the following business day.

If you want to file early, the CRA will open its NETFILE service in February 2023 to electronically receive submitted returns .

Mailed responses must be received or postmarked by the due date, and electronically submitted returns must be submitted by midnight local time of the date they are due.

Don’t Miss: Is Private School Tuition Tax Deductible

Individuals Living Abroad Or Traveling Outside The United States

If youre living or traveling outside the U.S. or Puerto Rico on May 1, you have until to file your return. You must still pay any tax you expect to owe by the May 1 due date.

Enclose a statement explaining that you were out of the country, and write Overseas Rule on the top of your return and on the envelope.

When Are Taxes Due In Your State

Be sure to find out when your local tax day is. Most taxpayers face state income taxes, and most of the states that have an income tax follow the federal tax deadline. Ask your state’s tax department: When are taxes due?

If you request a tax extension by April 18, you can have until October 17 to file your taxes.

-

However, getting a tax extension only gives you more time to file the paperwork it does not give you more time to pay.

-

If you can’t pay your tax bill when it’s due, the IRS offers installment plans that will let you pay over time. You can apply for one on the IRS website.

If you request a tax extension by April 18, you can have until October 17 to file your taxes.

Recommended Reading: When Is Tax Filing Day

What If Im Self

As a small business owner, you may be required to file additional returns, such as those for payroll and GST/HST remittances and withholdings. Failure to meet the CRAs payroll obligations results in penalties and interest there are several types of penalties for payroll accounts. Failure to deduct can result in a penalty of 10% for the first failure, and will go up to 20% with any additional failures. Late filing or non-payment penalties start at 3% and will go up to 20%.

What Is Not Covered By The Extension:

- The extension does not apply to federal tax returns and payments that are not due on April 15, 2020, which means estimated tax payments for the second quarter of 2020 are still due on June 15, 2020, and tax returns and payments for taxpayers who use a fiscal year rather than the calendar year generally will not be eligible for the extension.

- The extension is generally not available to S corporations, partnerships, and LLCs treated as partnerships because their tax returns were generally due on March 16, 2020.

- The extension does not apply to information returns, payroll tax deposits, excise taxes, or any other taxes other than federal income taxes, but the IRS has similarly extended the due date for filing 2019 gift and generation-skipping transfer tax returns and making payments that were otherwise due April 15, 2020.

- The extension does not apply to claims for refund that are required to be filed by April 15, 2020.

- The extension does not apply to state tax filing and payment deadlines, but many states have issued their own form of relief in response to the federal extension.

The facts, laws, and regulations regarding COVID-19 are developing rapidly. Since the date of publication, there may be new or additional information not referenced in this advisory. Please consult with your legal counsel for guidance.

Also Check: When Will The Irs Start Processing 2021 Tax Returns

Due Dates For Installment Payments

If you make installment payments throughout the year so that you can avoid a large bill at tax time, you have four due dates throughout the year. Whether you are self-employed or employed by someone else, you must submit your installment payments by March 15, June 15, September 15, and December 15 of each year.

Your taxes are done right, however you choose.

Filing on your own, with live help or handing off your taxes to an expert, with TurboTax you can be confident that your taxes are done right.

Due Date For 2021 Tax Returns & Payments Is May 2 2022

Personal income tax returns, except for those ofindividuals with self-employment income, are normally due by April 30th, as is any amount owing. Penalties and interest may be charged for late returns or late payments.

New:See below re interest relief for some 2020 recipients of COVID-19 relief benefits, and Quebec’s extension of the tax return/payment due date.

Read Also: Do You Have To File Your Unemployment On Your Taxes

What Happens If You File Personal Taxes Late

Filing your taxes late when you have earned a refund or dont owe any further tax will not result in any fees or penalties. However, if you owe money and file late, the CRA charges you a penalty on the taxes owed equal to five percent plus an additional percent for each month late up to 12 months. Taxes owed to the CRA are due the day your tax return is due for individuals. If you cannot pay the full amount, the CRA will accept late payments but charges compound daily interest on all amounts due.

For example, if you owe the CRA $10,000 and you file your tax return 5 months late, the CRA will apply a 10 percent penalty and your tax bill is increased to $11,000.

Tax Deadlines: April To June

- :Deadline for employees who earned more than $20 in tip income in March to report this income to their employers.

- : Deadline for household employers who paid $2,300 or more in wages in 2021 to file Schedule H for Form 1040.

- : All individuals must file their 2021 personal tax returns, or Form 1040 or Form 1040-SR by this date. This is also the deadline to request an automatic extension for an extra six months to file your return, and for payment of any tax due.

- : Deadline for filing 2021 personal tax returns if you live in Maine or Massachusetts.

- May 10, 2022: Deadline for employees who earned more than $20 in tip income in April to report this income to their employers.

- : Deadline for employees who earned more than $20 in tip income in May to report this income to their employers.

- :Deadline for second-quarter estimated tax payments for the 2021 tax year.

- :Deadline for U.S. citizens living abroad to file individual tax returns or file Form 4868 for an automatic four-month extension.

Also Check: How Much Taxes Deducted From Paycheck Ct