S Corporation Tax Deadlines And Forms

The IRS tax return deadline for S corporations, also known as S-corp, is due on March 15, 2022. â

Forms include the U.S Income Tax Return for S Corporations known as the Form 1120S and Schedule K-1 . â

These tax forms need to be submitted to the International Revenue Service so that S Corporations can understand their tax liability, find out how much business tax they owe, and report each partyâs share of the corporation’s income, deductions, credits, etc.

Additional Links for S corporation

Llc Tax Return Extension Due Date: Everything You Need To Know

An LLC tax return extension due date may give you six additional months to file or make your business tax payment if you submit Form 7004.3 min read

An LLC tax return extension due date may give you six additional months to file or make your business tax payment if you submit Form 7004. However, business owners must pay any estimated taxes by the original deadline to avoid interest and penalties on overdue tax payments.

Requirements For Sole Proprietor Filing

The IRS considers your LLC a totally separate owner if you decide to be taxed as a sole proprietor. In this arrangement, any taxes and filings due become your personal responsibility. You need to accompany your personal income tax return with a Schedule C. This document reports earnings and deductions caused by business operations.

Recommended Reading: Are Charitable Contributions Still Tax Deductible

May 17 New Deadline For Most Small Business Tax Returns

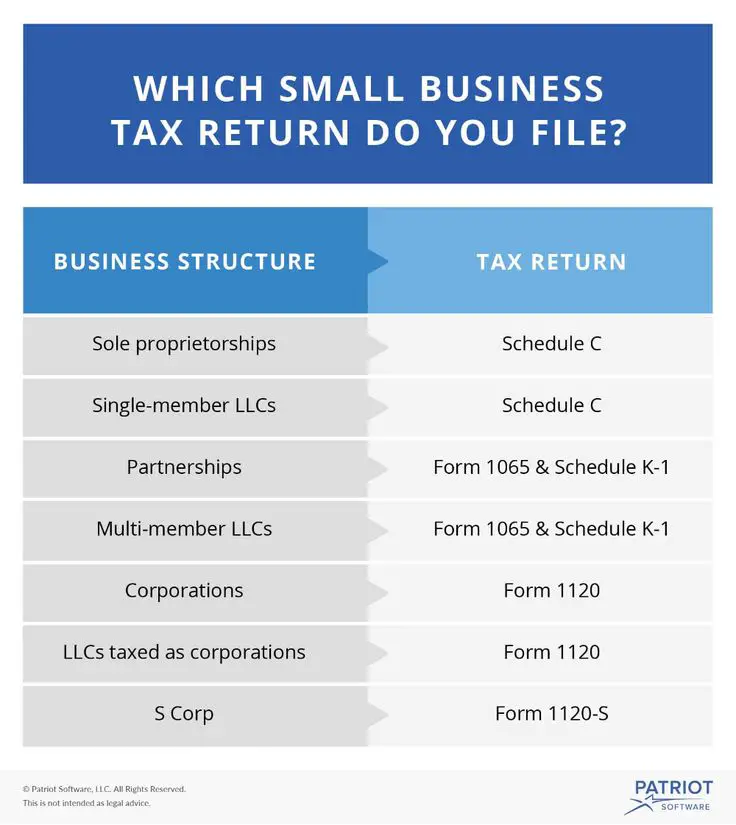

Tax returns, payments, and forms for all types of businesses for the 2020 tax year are due in 2021 and tax dates can shift by a day or two from year to year. Different types of business entities file tax returns in different ways.

The IRS announced an extension to May 17, 2021, of the deadline for filing individual income tax returns, including those who pay self-employment taxes. This extension does not affect estimated quarterly taxes, which are still due April 15, 2021, for non-employee income.

- The IRS has announced that it is extending the April 15, 2021, tax filing and payment deadlines for victims of February 2021 winter storms in Texas, Oklahoma, and Louisiana, beginning February 11, 2021, to June 15, 2021. This extension applies to the entire state of Texas and other states that include . The extension also applies to:

- 2020 business and personal tax returns due April 15

- 2020 IRA contributions due April 15

- 2021 Quarterly estimated income tax payments due April 15

- 2021 Quarterly payroll and excise tax returns normally due on April 30

- 2020 Tax-exempt organization returns normally due May 17

When Are Taxes Due

The due dates and intervals for payments are usually routine from year to year but they are affected by weekends and legally observed holidays. For example, Emancipation Day in the District of Columbia is April 16. When it falls on a Saturday, it is observed on April 15, which pushes the April 15 federal tax due date to April 18.

There are also exceptions for state-observed holidays and emergency orders. State holidays adjust the due dates only for specific states while emergency orders may extend the time for the whole country or specific areas that are affected by weather events or other emergencies that could cause postal delays. This allows residents more time to recover and collect their financial records.

Read Also: How To File Federal Tax Return

How To Apply For A Tax Extension

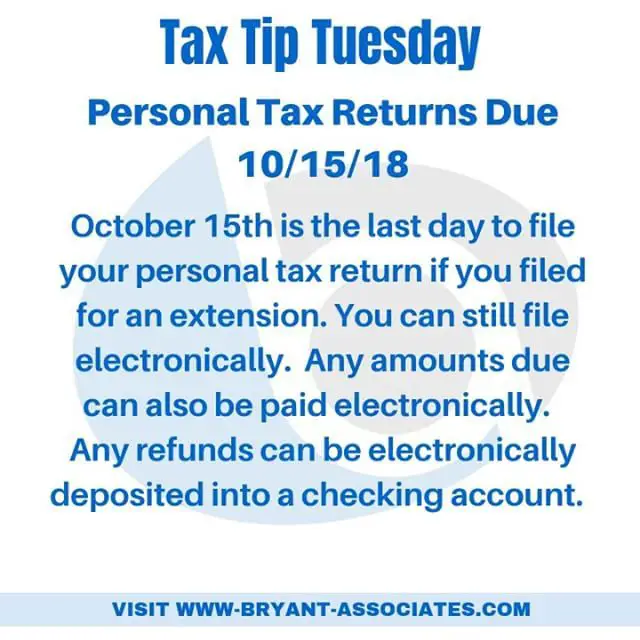

Not going to make the filing deadline? You can apply for an extension completely online. Just remember that youâre only getting an extension on your tax filing. The payment due date wonât change, and late payments can result in fines and penalties.

Sole proprietors follow the same steps all individual taxpayers do. Youâll be granted an automatic six month extension if:

- Youâre an individual working in a combat zone in support of the U.S. Armed Forces

- Youâre a member of the military serving outside of the U.S.

- Youâre a U.S. citizen living and working abroad

- Youâre a U.S. citizen living in parts of the country that have been hit by severe natural disasters

If none of the above apply to you, you can apply for an extension using IRS Form 4868. This form only applies to sole proprietors or your individual income tax return. If you plan on paying electronically, you may be able to apply for an extension directly through the IRS payment portal.

All other business types must use IRS Form 7004. This can be done using the IRSâ e-file service. You need to file a Form 7004 for each return you will be filing late.

The deadline to apply for an extension is the same as the filing deadline. Partnerships and S corporations must apply for an extension by March 15, 2022. Sole proprietors and C corporations must apply for an extension by April 18, 2022.

Fiscal Year Vs Calendar Year

For an LLC that files either corporation or partnership tax returns, the business can choose to operate on either a fiscal year or a calendar year. If you have chosen to operate on a calendar year, the tax year will follow the same structure as personal income taxes, from January 1 to December 31. If you choose to operate on a fiscal year, your tax year can follow any 12 month structure, for example the year can be from September 1 to August 31 of the following year. The year on which the LLC operates can be changed over time, by filing an Application to Adopt, Retain or Change a Tax Year with the IRS.

You May Like: What School District Am I In For Taxes

Quarterly Payroll Taxes For Employers

If you employ one or more people in your business, you should file Form 941, Employers Quarterly Federal Tax Return. Then deposit your taxes on the following dates:

- for first quarter

- for third quarter

- for fourth quarter of the previous calendar year

The IRS gives you an additional 10 calendar days to file your return if you deposit all your taxes before they are due.

Dont Miss: How Is Property Tax Paid

Business Tax Return Due Dates

Here are the tax return due dates for small business taxes:

- Sole proprietorship and single-member LLC tax returns on Schedule C with the owner’s personal tax return: April 18, 2022

- Partnership tax returns on Form 1065: March 15, 2022

- Multiple-member LLC returns filing partnership returns on Form 1065:March 15, 2022

- S corporation returns on Form 1120 S: March 15, 2022

- All other corporations with fiscal years ending other than December 31: the 15th day of the fourth month after the end of the fiscal year.But for 2021 tax returns, the due date was April 18, 2022.

Don’t Miss: What Is The Tax Deadline This Year

When Are Taxes Due For An Llc

CONTENTS

Taxes are an essential aspect of running a company. If you fail to pay them when they’re due, you might end up in some serious legal trouble with the IRS.

When taxes are due for an LLC is a question that many people ask when they start their own business.

The answer to this question varies depending on when you formed your limited liability company and what type of taxation election you made when you formed it.

Llcs Owned By One Person

If an LLC is owned by only one person, the IRS treats the business entity as a sole proprietorship. The LLC does not pay taxes or file a return. Instead, the owner of the LLC must report all of the profits and losses of the LLC on Schedule C and file it with their 1040 tax return. You will also probably have to pay income tax on any money that you leave in your business bank account for future business spending.

Also Check: When Do I Get My Tax Return 2021

Filing Form 7004 For Business Tax Return Extensions

Form 7004 is a pretty short form, and you only have to provide the following:

- Your business name and address.

- Your business tax ID number.

If you had a short tax year, indicate it on the form, along with your reason for having a short year.

Show what you estimate the total tax to be, although you don’t have your return done yet. You’ll have to do some calculations to figure what this amount will be.

Show any credits and the total payments applied to your account and subtract this from the tentative tax.

Lastly, show your balance due. You can pay using a business credit or debit card. You’ll refer to the IRS chart for where to file your form, depending on your business’s location and the return being filed.

You can file for an extension online using tax preparation software, or a tax preparer can file online for you.

Get Help Getting Ready For Business Or Corporate Tax Return Due Dates

Above, we listed a lot of corporate tax return deadlines Can you keep them all in mind throughout the year? If not, we get it. It can be hard to stay on top of taxes alone, so thats why were here to help.

If you need help organizing your receipts, expenses, and other documents, use our Year-End Tax Filing Readiness service. Our tax pros can get your paperwork in order, helping you avoid missed deductions for just $50 per hour.

In general, you can always rely on our team of small business certified tax pros to get your taxes right and keep your business on track.

Haide was so supportive, this is my second year working with her specifically. Last year was a complex multiple country return and this year an LLC. She went out of her way to answer my questions and provide support. She made filing my taxes easier because of the confidence she gave me that it was done correctly and I got all the credits and write-offs available for me.

Phillip Yarbrough, Sequential Consulting | April 2021

Also Check: Can I File My Taxes Twice

Individual Income Tax Filing Due Dates

- Typically, most people must file their tax return by May 1.

- Fiscal year filers: Returns are due the 15th day of the 4th month after the close of your fiscal year.

If the due date falls on a Saturday, Sunday, or holiday, you have until the next business day to file with no penalty.

Filing Extensions

Can’t file by the deadline? Virginia allows an automatic 6-month extension to file your return . No application is required. You still need to pay any taxes owed on time to avoid additional penalties and interest. Make an extension payment.

What Does An Llc File Its Taxes As

LLCs are unique because theyâre created at the state level. When you opt to become an LLC, your state sees your business as a corporation. But to the IRS, youâre still a sole proprietorship if the business is owned by one individual or partnership if the business has multiple owners.

Both sole proprietorships and partnerships are considered disregarded or pass-through entities because the profits âpass throughâ to the owners to report on their personal tax returns. Simply put, these business entities donât pay corporate income tax. By filing as one of these entities, LLCs benefit from the liability protection of corporations while avoiding double taxation.

But an LLC doesnât have to go through tax filing as a sole proprietorship or partnership. They can also file as an S corporation or C corporation.

Which choice is right for you depends on multiple factors. Choosing to file as a corporation, for example, can save you money on self-employment taxes but requires stricter reporting.

When determining what your LLC should file as, discussing your options with a CPA or tax professional ensures youâre making the best choice. With a premium Bench subscription, you get access to unlimited, on-demand consultations with a tax professional to talk through every detail.

Further reading:The Complete Guide to LLC Taxes

Also Check: Do My Taxes Myself Online

Know Which Returns To File

What form an LLC will file is contingent on a variety of circumstances. If the LLC is owned by only one person, Form 1040 must be filled out and accompanied with either Schedule C, E, or F. For LLCs owned by several people as well as for partnerships, Form 1065 needs to be filled out. For S Corporations, file Form 112S and for C Corporations, file Form 1120. If you still need assistance figuring out which tax forms to report profits and losses on, take a look at the IRS Publication 3402 Tax Issues for Limited Liability Companies for more information.

How To File An Extension For Llc Tax Return

When the owners of an LLC feel that they cannot meet the deadline for filing their tax returns, they should file for extensions. It is important to know that the extension due date is the same as the deadline for the original tax return. If the deadline for the tax return is changed for a certain year because it occurs on a weekend or holiday, the extension deadline will change as well.

A multi-member LLC that is paying taxes as a partnership can get an automatic extension by filing IRS Form 7004. As for a single-member LLC, personal tax return extensions can be obtained by filing Form 4868, which includes information from the Schedule C form. Automatic extension times vary for different types of businesses. A single-member LLC filing as a sole proprietorship will get a six-month extension, while a multi-member LLC will be given a five-month extension.

Read Also: How Much Do Charitable Donations Reduce Taxes 2020

Tax Deadlines For Small Businesses In The Uk

While the UK tax year runs April to April, the deadlines for filing small business taxes differ for limited companies. Below are HMRCs guidelines for small businesses that operate as a limited company:

- First years tax return: 21 months after the date it registered with Companies House

- Subsequent tax returns: 9 months after the companys financial year ends

- Corporation tax filing: 12 months after the accounting period ends

- Corporation tax payments: 9 months and one day after the accounting period ends

If your annual turnover surpasses £85,000, you may also have to pay Value Added Tax each quarter of your accounting period. Deadlines to file and pay a VAT return are one month and seven days after the quarter ends. If your quarter ends on March 31, for example, your VAT deadline would be May 7.

Company directors and self-employed people in the UK are also required to pay both income tax and national insurance. This is calculated and filed through a self-assessment tax return:

- Self-assessment filing deadline: October 31 for paper tax returns January 31 for online tax returns.

- Income tax payments: January 31 in the year following the tax return.

- Payment on account: July 31 in the year following the tax return. This acts as a contribution for your tax payments the following year.

Recomputation Of Estimated Tax

If, after paying any installment of estimated tax, the taxpayer determines that a new estimate is required, the payment amounts for the remaining installments may be increased or decreased, as the case may be. The amount required by the new estimate is computed by calculating the difference between the previous estimated tax amount and the new estimated tax amount and dividing that difference between the number of installments remaining to be paid.

Also Check: Where To Get Taxes Done For Free

Tax Deadlines For Sole Proprietorships

LLCs taxed as sole proprietorships need to file Form 1040 , the deadline to file taxes is May 17. Form 1040 should be filed with Schedule C, and it serves to pay federal income tax that covers all income, losses, and annual expenses of a single-member LLC.

The LLC itself is not doesn’t file any business tax because it is not a separate legal entity.

Members Of The Military

If youre stationed outside the United States or Puerto Rico on May 1, you have until to file your return and pay any taxes you owe.Enclose a statement explaining that you were out of the country, and write Overseas Rule on the top of your return and on the envelope.

Combat ZoneIf youre serving in a combat zone, you receive the same filing and payment extensions allowed by the IRS, plus an additional 15 days, or a 1-year extension from the original due date. If you claim this extension, write Combat Zone on the top of your return and on the envelope. For more information, see Tax Bulletin 05-5. Extensions also apply to the spouses of military members who are serving in combat zones.Military Deployment Outside the United States Combat or NoncombatIf youre deployed to military service outside the U.S., youre allowed a 90-day filing extension following the completion of deployment. If youre using this extension, write Overseas Noncombat on the top of your return and the envelope.Note: If youre deployed in combat service, you can use whichever extension is more beneficial for you .

You May Like: When Is Tax Refund 2021

When Is Llc Tax Return Due

Update: 2021 Income Tax Filing Deadline Moved to May 17 This year, individual taxpayers, including sole proprietors and single-owner LLCs, who normally have to file their tax return by April 15 will have until May 17, 2021 to file their 2020 taxes.

What is the deadline for filing a LLC?

- Sole proprietorships and single-owner LLCs: May 17,2021

- Partnerships: March 15,2021

- C Corporations: April 15,2021