Deductions For Standard Expenses

In most cases, taxpayers take the standard deduction instead of itemizing their deductions. Those married couples who fall within that majority can take $25,900 off their taxable income in 2022, up from $25,100 in 2021. A $12,550 standard deduction will be replaced by a $12,950 standard deduction for individuals.

In the 2021 tax year, the standard deduction was $1,700 for a single filer and $2,700 for a couple filing jointly in 2022, it increased to $1,750 and $2,800, respectively.

Does This Extension Also Give Me More Time To Contribute Funds To My Hsa Or Archer Msa For 2019

Yes. Similar to the extended time granted for making retirement account contributions, you may also make contributions to your HSA or Archer MSA by July 15, 2020 for the 2019 tax year. Keep in mind that to ensure accuracy on Form 8889, its often best to make any contributions prior to filing your tax return.

TurboTax Self-Employed will ask you simple questions about your life and help you fill out all the right forms. Perfect for independent contractors and small businesses. Well search over 500 tax deductions to get you every dollar you deserve and help you uncover industry-specific deductions.

What Is The Last Day To File Taxes

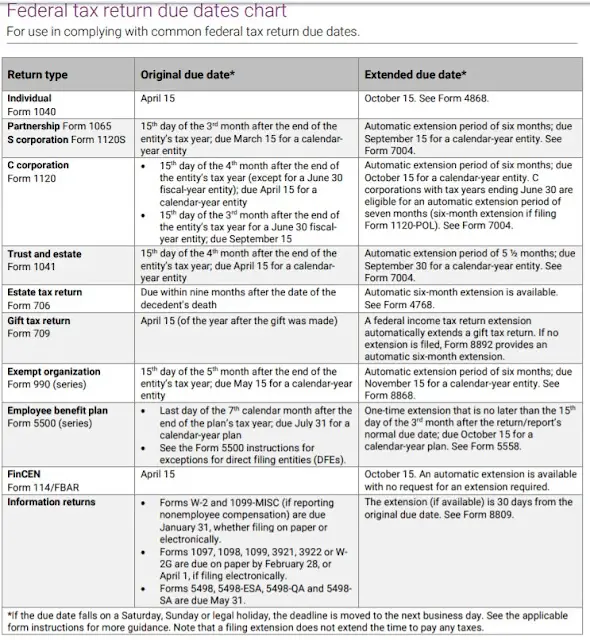

The last day to file taxes for individual federal income tax returns is usually April 15 unless this falls on a Saturday, Sunday or official holiday. Some state-level holidays can extend the tax deadline by another day. You can request a six-month extension by filing Form 4868, making your last day to file individual income taxes October 15, or the next business day if this is a weekend or holiday.

If you also file taxes for your small business as a partnership or S corporation, the last day to file taxes is March 15 or April 15 for C-corporations unless this day falls on a weekend or official holiday. If your business runs on a non-calendar tax year, your federal tax return is generally due by the 15th day of the third month following the end of the company’s fiscal year.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Recommended Reading: How Much Taxes Deducted From Paycheck Md

What If I Don’t Have The Money To Pay Taxes

If you do not have the money to pay your income tax due, then, you generally must file your income tax return without a payment. Once the IRS and state DOR have processed your income tax return, you can request a payment schedule from them by mail-in form or by phone.

Read the most recent Form 1040 instructions booklet for more information.

What’s The Deadline For Filing 2022 Tax Returns

The IRS says it expects to receive more than 168 million individual tax returns this year. The deadline to file for most Americans is Tuesday, April 18, 2023. That’s because April 15 is a Saturday and the next weekday, April 17, is recognized as a holiday, Emancipation Day, in Washington, DC.

According to the IRS, “by law, Washington, D.C., holidays impact tax deadlines for everyone in the same way federal holidays do.”

Residents of California impacted by severe storms have until May 15 to file their taxes.

If you’re serving in the military abroad, including in a combat zone or as part of a contingency operation in support of the US Armed Forces, you may be granted additional time to file your return.

You May Like: Can You File 2 Years Of Taxes At Once

Every Tax Deadline You Need To Know

OVERVIEW

Make sure your calendars up-to-date with these tax deadlines, dates, possible extensions and other factors in play for both individuals and businesses in 2023.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

|

Key Takeaways Individual income tax returns are typically due April 15, unless the date falls on a weekend or holiday or you file Form 4868 seeking an extension until October 15. Independent contractors, gig workers, and self-employed people usually have to make quarterly estimated tax payments are pre-set dates throughout the year. Partnerships and S-Corps filing deadlines are typically either March 15 unless they operate on a fiscal year. A six-month extension to September 15 can be requested using Form 7004. |

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

You May Like: Do Veterans Pay Property Taxes In Florida

Contribute To Your Health Savings Account

This medical account, available to individuals who have a high-deductible health plan, provides a tax-saving way to pay for out-of-pocket costs. You have until the April 18, 2022, tax deadline to contribute to an HSA for the 2021 tax year. The 2021 limits were $3,650 for an individual HSA owner and $7,200 for a family. For 2022, the individual coverage contribution limit is $3,650 and the family coverage limit is $7,300. If you’re 55 or older, you can put an extra $1,000 in your HSA.

» MORE: Learn more about the tax effects of HSAs and flexible savings accounts

When Can I Expect My Refund

Once the IRS begins accepting returns, the agency says taxpayers who file electronically and are due a refund can expect it within 21 days — if they choose direct deposit and there are no issues with their return. By law, the agency cannot issue refunds involving the Earned Income Tax Credit or Additional Child Tax Credit before mid-February, in order to help prevent fraudulent refunds from being issued.

Don’t Miss: Do Teenagers Have To File Taxes

File A Tax Extension Request Online

IRS e-file is the IRS electronic filing program, which allows you to send tax forms, including Form 4868, directly to IRS computers. You can get an automatic extension to file your tax return by filing Form 4868 electronically through IRS e-file on your own, using free or commercial tax software, or with the help of a tax professional who uses e-file.

In any case, you will receive an email acknowledgment you can keep with your tax records.

If your adjusted gross income is below a specified figure$73,000 for 2021you can use brand-name software at no cost from Free Filea free service that provides taxpayers with federal tax preparation and e-file options.

If your income is above the threshold, you can use the IRS Fillable Forms tool. There are also some tax software companies that offer free filing under certain conditions.

You May Like: Do You Have To Claim Stocks On Taxes

Im Retiring Abroad What Do I Need To Know

If retiring abroad in the countryside is your long-term goal, you should first understand how taxes work when retiring abroad:

- Even if you retire abroad you still may have to file a U.S. tax return

- Youll still have to report money in any foreign financial accounts on your FBAR if you meet the requirements

- If you have a foreign pension or retirement account it may be treated differently than in the U.S.

Recommended Reading: When Do You Have To File Taxes 2020

How To Diy Your Expat Taxes With Our Made

If you have a simple situation, you may want to go the DIY-route with our online tax service designed specifically for expats. Heres how to do it:

What If I Owe More Than I Can Pay

Don’t put off filing just because you can’t afford to pay the amount due on the day you need to file your tax return. The IRS starts charging penalties and interest on the day the return is due, no matter when you file. You can minimize failure-to-file penalties by filing as soon as possible, paying as much as you can when you file, and setting up an installment plan for the balance.

Read Also: How Do I Dispute My Property Taxes

Whats The Deadline For Filing 2022 Tax Returns

The IRS says it expects to receive more than 168 million individual tax returns this year. The deadline to file for most Americans is Tuesday, April 18, 2023. Thats because April 15 is a Saturday and the next weekday, April 17, is recognized as a holiday, Emancipation Day, in Washington, DC.

According to the IRS, by law, Washington, D.C., holidays impact tax deadlines for everyone in the same way federal holidays do.

Residents of California impacted by severe storms have until May 15 to file their taxes.

If youre serving in the military abroad, including in a combat zone or as part of a contingency operation in support of the US Armed Forces, you may be granted additional time to file your return.

Read Also: How Much Taxes Are Taken Out Of Check

Tax Deadline : When Is The Last Day To File Taxes

One of the most important things to remember as a taxpayer are the deadlines for filing your taxes. The Canada Revenue Agency sets strict due dates for returns and payments. Filing your return on time helps you avoid any interest or penalties and get your refund earlier. Weve rounded up all the major dates that matter for your taxes to make this season stress-free.

Key Takeaways

Read Also: How Long Do You Need To Keep Tax Records

You May Like: How To File Taxes If Self Employed And Employed

What If I Missed The Us Tax Filing Deadline For 2022

Filingor payinglate taxes can result in penalties. However, if you already missed the deadline, dont panic. You probably have options, with the details depending on your situation. Lets take a look at some of the most common scenarios.

- If you are owed a tax refund, there generally isnt any penalty for filing late. Still, you should file right away to come into compliance with the IRS.

- If you owe taxes, then the IRS may charge additional interest or even impose failure to file and/or failure to pay penalties. The good news is that as an expat, you may qualify to file using the IRS Streamlined Filing Compliance Procedures. If you do, the IRS will likely waive any penalties you might otherwise be subject to.

- If you cant afford to pay the taxes you owe, you should still file as soon as possible. The IRS may agree to let you reduce your tax debt or pay over time through regular installments. Regardless, its always better to file.

Protecting Yourself From Fraud

While tax scams are nothing new, the pandemic gave rise to a new set of fraud cases, specifically around COVID-related support programs, like the Canada Emergency Response Benefit . COVID-19 phishingemail scams gave hackers and con artists the personal and/or banking information to claim the benefits.

If you suspect you are a victim of fraud, collect any relevant documents, and that can include your T4, T4As, bank statements, receipts of any related transactions, as well as any emails, or text messages related to the scam. Immediately report the fraud or the scam to the Canadian Anti-Fraud Centre and to the police. Also change all of your passwords right away for any financial accounts that you think may have been targeted, as well as your email addresses, too.

You May Like: Where Can I Mail My Tax Return

Who Must Pay Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

You may have to pay estimated tax for the current year if your tax was more than zero in the prior year. See the worksheet in Form 1040-ES, Estimated Tax for Individuals, or Form 1120-W, Estimated Tax for Corporations, for more details on who must pay estimated tax.

Recommended Reading: What Is Federal Work Opportunity Tax Credit

Enrollment Will Be Required Automatically

With some exceptions for small businesses, workers will be automatically enrolled into newly created 401, and 403 plans in 2025. A persons automatic enrollment will begin between 3 and 10 percent of their pay scale. Additionally, the savings rate will be increased by 1 percent each year until it reaches 10 to 15 percent.

As a result of these requirements, retirement plan participation rates are expected to rise, particularly among minorities.

Recommended Reading: Does Turbotax File Federal And State Taxes

Forms Filed Annually With A Due Date Of February 28

- File Form 1099-MISC, Miscellaneous Income, with Form 1096, Annual Summary and Transmittal of U.S. Information Returns, with the IRS to report rents, royalties, prizes and awards and other fixed or determinable income paid in the prior calendar year. See instructions for the Form 1099-MISC for all the different types of income that is required to be reported and the applicable dollar amount reporting threshold. Forms 1099-MISC and 1096 may be filed electronically, for more information see Publication 1220PDF. If you file Forms 1099-MISC and 1096 electronically, then the due date is March 31. Generally, Forms 1099-MISC must be furnished to payees by January 31.

- File Form 8027, Employers Annual Information Return of Tip Income and Allocated Tips, with the IRS to make an annual report for the previous year for your receipts from food and beverages and for the tips employees reported to you if you are a large food or beverage establishment. See Publication 15 for more information including the definition of a large food or beverage establishment and see Publication 1239, Specifications for Electronic Filing of Form 8027, Employer’s Annual Information Return of Tip Income and Allocated TipsPDF, for help in electronically filing Forms 8027. If you file Form 8027 electronically, then the due date is March 31.

Quarterly Tax Due Dates

If you earn income that isn’t subject to withholding taxes, you’re typically required to make estimated tax payments to the IRS. You can do this on a quarterly basis or through one annualized estimate. The annualized estimate is due on April 18.

The quarterly payments for 2023 are due by the following dates:

- First payment: April 18

- Third payment: Sept. 15

- Fourth payment: Jan. 16, 2024

Elisabeth Buchwald is a personal finance and markets correspondent for USA TODAY. You can follow her on Twitter @BuchElisabeth and sign up for our Daily Money newsletter here

Don’t Miss: How To Find Out About State Tax Refund

Tax Deadlines: January To March

- : Deadline for employees who earned more than $20 in tip income in December to report this income to their employers on Form 4070.

- :Deadline to pay the fourth-quarter estimated tax payment for tax year 2021.

- : Your employer has until Jan. 31 to send you your W-2 form reporting your 2021 earnings. Most 1099 forms must be sent to independent contractors by this date as well.

- :Deadline for employees who earned more than $20 in tip income in January to report this income to their employers. You can use Form 1070 to do so.

- : Deadline for financial institutions to mail out Form 1099-B relating to sales of stock, bonds, or mutual funds through a brokerage account, Form 1099-S relating to real estate transactions and Form 1099-MISC, unless the sender is reporting payments in boxes 8 or 10.

- : Deadline for businesses to mail Forms 1099 and 1096 to the IRS.

- : Deadline for farmers and fishermen to file individual income tax returns unless they paid 2021 estimated tax by Jan. 18, 2022.

- : Deadline for employees who earned more than $20 in tip income in February to report this income to their employers.

- :Deadline for corporate tax returns for tax year 2021, or to request an automatic six-month extension of time to file for corporations that use the calendar year as their tax year, and for filing partnership tax returns or to request an automatic six-month extension of time to file .

- : Deadline for businesses to e-file Forms 1099 and 1098 to the IRS, except Form 1099-NEC.