Register With The Department Of Revenue

Apart from your EIN, you also need to establish a North Carolina withholding tax account with the North Carolina Department of Revenue . You set up your account by registering your business with the DOR using Form NC-BR, Business Registration Application for Income Tax Withholding, Sales and Use Tax, and Machinery and Equipment Tax. You can submit Form NC-BR online or by regular mail. If you register online youll receive your withholding tax number instantly. If you register by mail, you should receive your number within 10 days. There is no fee to register your business with the DOR.

Special Tax Extensions For Winter Storm Victims

The IRS is giving victims of the winter storms in Texas, Oklahoma and Louisiana until June 15, 2021 to file taxes and make tax payments. The May 17 filing and payment extension relief does not affect this special consideration.

The following states are also offering relief to winter storm victims:

- Idaho is offering relief to the entire states of Texas and Oklahoma through June 14.

- Indiana is extending certain tax deadlines to residents of Texas, Louisiana and Oklahoma who were impacted by severe winter storms to June 15.

- Louisiana is granting automatic filing and payment extensions to eligible taxpayers in Louisiana and Texas to June 15.

- New Jersey taxpayers impacted by Texas storms have until June 15 to file their New Jersey tax returns and submit payments, including 2021 estimated payments. Affected taxpayers must write in black ink Presidential Disaster Relief Area at the top center of their New Jersey tax return and/or their payment.

- Oklahoma announced a payment deadline extension until June 15 for both 2020 taxes and 2021 estimated income taxes. Return due dates are not extended. Late penalties and interest for taxes owed will be waived up to $25,000.

- Texas extended its tax due date to June 15.

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 2021 filing season based on the Trump Tax Plan.

Read Also: How To File State Only Taxes

North Carolina Property Tax Rates

Property taxes are collected on a county level, and each county in North Carolina has its own method of assessing and collecting taxes. As a result, its not possible to provide a single property tax rate that applies uniformly to all properties in North Carolina.

Instead, Tax-Rates.org provides property tax statistics based on the taxes owed on millions of properties across North Carolina. These statistics allow you to easily compare relative property taxes across different areas, and see how your property taxes compare to taxes on similar houses in North Carolina.

The statistics provided here are state-wide. For more localized statistics, you can find your county in the North Carolina property tax map or county list found on this page.

While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free North Carolina Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across North Carolina.

If you would like to get a more accurate property tax estimation, choose the county your property is located in from the list on the left. Property tax averages from this county will then be used to determine your estimated property tax.

will send you a bill detailing the exact amount of property tax you owe every year.

Also Check: Do I Need W2 To File Taxes

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Also Check: Where’s My Income Tax

What Do I Need To Do To Claim The Tax Extension

The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area. Taxpayers do not need to contact the IRS to get this relief. However, if an affected taxpayer receives a late filing or late payment penalty notice from the IRS that has an original or extended filing, payment or deposit due date falling within the postponement period, the taxpayer should call the number on the notice to have the penalty abated.

The current list of eligible localities is always available on the disaster relief page on IRS.gov.

Does This Tax Relief Measure Cover Anything Else

The new February 15, 2023, deadline also includes quarterly estimated income tax payments originally due January 17, 2023, as well as the excise tax and quarterly payroll returns originally due on October 31, 2022, and January 31, 2023. If your business had an original or extended due date, you also have more timeincluding calendar-year corporations whose 2021 extensions expire October 17, 2022. Tax-exempt organizations with 2021 calendar-year returns with extensions expiring November 15, 2022, are also eligible for the Hurricane Ian extension.

For detailed information surrounding penalties on payroll and excise tax deposits, please visit the IRS disaster relief section of their website.

Read Also: How To Reduce Taxes On Stock Gains

Nc State Offer In Compromise

North Carolinas DOR has an Offer In Compromise program for qualifying and financially distressed taxpayers. With this tax resolution, a taxpayer can pay a lump sum to settle their tax liabilities in full. The OIC tax program may also be an excellent alternative for taxpayers who cannot comply with an installment payment agreement. Taxpayers can read more about this tax resolution option here.

North Carolina Sales Tax

The base sales tax in North Carolina is 4.75%. In addition to that statewide rate, every county in North Carolina collects a separate sales tax, which ranges from 2% to 2.25% in most counties. In Durham and Orange counties specifically, there is an additional 0.5% tax which is used to fund the Research Triangle Regional Public Transportation Authority. In sum, that means sales tax rates in North Carolina range from 6.75% to 7.50%. Below are the sales tax rates for all the counties in North Carolina.

Read Also: Where Can I Get My Taxes Done By Aarp

Deductions You Can Itemize

For the 2019 tax year, North Carolina filers have access to several itemized tax deductions.

- Qualified mortgage interest and real estate property taxes: You can deduct up to $20,000 in qualified mortgage interest and real estate property taxes.

- Charitable contributions: North Carolina generally follows federal tax code regulations on deducting charitable contributions.

- Medical and dental expenses: The state follows federal tax code for rules governing deductions for medical and dental expenses.

- Claim of right deduction: If you reported and paid taxes on income in a previous year, and then had to pay that income back, you may be able to take a deduction for all or part of the repaid income.

You May Like: Oregon Tax Preparer License Renewal

When To File Your Return

If you file your return on a calendar year basis, the 2020 return is due on or before . A fiscal year return is due on the 15th day of the 4th month following the end of the taxable year. When the due date falls on a Saturday, Sunday, or holiday, the return is due on or before the next business day. A fiscal year return should be filed on a tax form for the year in which the fiscal year begins. For example, a 2020 tax form should be used for a fiscal year beginning in 2020. See Directive TA-16-1, When a North Carolina Tax Return or Other Document is Considered Timely Filed or a Tax is Considered Timely Paid if the Due Date Falls on a Saturday, Sunday, or Legal Holiday.

Out of the Country: If you are out of the country on the original due date of the return, you are granted an automatic four month extension to file your North Carolina individual income tax return if you fill in the “Out of Country” circle on Page 1 of Form D-400. “Out of the Country” means you live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or you are in military service outside the United States and Puerto Rico. The time for payment of the tax is also extended however, interest is due on any unpaid tax from the original due date of the return until the tax is paid.

Nonresident Aliens: Nonresident aliens are required to file returns at the same time they are required to file their federal returns.

Read Also: How To Check If Tax Return Was Filed

Overview Of North Carolina Taxes

North Carolina now has a flat state income tax rate of 5.25%. The average effective property tax rate for the state is below the national average. There is a statewide sales tax and each county levies an additional tax.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2020 2021 filing season.

You May Like: How Much Is Payroll Tax In Louisiana

Other States That Made Changes To Deadlines

- Alabamamade a sort of hybrid tax extension: The state will automatically waive late-payment penalties for payments remitted by May 17. However, interest on taxes owed will still accrue from April 15.

- Idaho introduced a bill to push its state income tax filing deadline back to May 17, but the legislature did not come to an agreement before adjourning March 19. The legislature reconvenes on April 6.

Also Check: Is Plasma Donation Money Taxable

Recommended Reading: How To Do Your Own Taxes

Fraud Negligence Frivolous Tax Return Penalties

- Negligence penalties and Large tax deficiency If a taxpayer understates their taxable income, in an amount equal to 25% or more of gross income, the 25% large individual income tax deficiency or other large tax deficiency penalty will be assessed. If the taxpayer understates their income by less than 25%, a 10% negligence penalty may be applied. If the taxpayer had an accuracy penalty assessed for federal income tax purposes, DOR will assess the 10% negligence penalty for State income tax purposes, unless a larger deficiency penalty applies.

- Fraud If a taxpayer received a fraud penalty from the federal government and their state return was based on that fraudulent return, they will also be assessed a 50% fraud penalty for state purposes. If taxation authorities assess a fraud penalty, the state cannot also assess a taxpayer for negligence, large tax deficiency, or failure to file for that same deficiency.

- Frivolous return If a taxpayer files a frivolous return, the state may assess up to a $500 penalty. A frivolous tax return is one that both fails to provide sufficient information to permit a determination that the tax return is correct and positively indicates the tax return is incorrect and evidences the intent to delay, impede or negate the State or purports to adopt a position that lacks seriousness.

Where To Send Your North Carolina Tax Return

| Express Delivery |

You can save time and money by electronically filing your North Carolina income tax directly with the . Benefits of e-Filing your North Carolina tax return include instant submission, error checking, and faster refund response times. Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

To e-file your North Carolina and Federal income tax returns, you need a piece of tax software that is certified for eFile by the IRS. While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

The two most popular tax software packages are H& R Block At Home, sold by the H& R Block tax preparation company, and TurboTax Federal & State, sold by the Intuit software company. Both companies produce multiple editions for simple to very complex tax returns, so be sure to carefully compare the features offered by each package.

Recommended Reading: How Much Do You Get Back From Tax Write Offs

Is There An Extension For Nc State Taxes

If you cannot file your North Carolina Individual Income Tax Return, Form D-400, by the original due date of the return, you may apply for a six-month extension of time to file the return. An extension of time may be granted even if the application for extension is not accompanied by a payment of the tax due.

Irs Provides Tax Relief For Victims Of Hurricane Ian

Hurricane Ian, which began on September 23, barreled through the state of Florida, North Carolina, and South Carolina leaving millions without power and in a state of disaster. If you were impacted by Hurricane Ian we want you to know TurboTax is here for you, and we want to keep you up to date with important tax relief information that may help you in this time of need.

The Federal Emergency Management Agency declared the recent events as a disaster and the IRS announced that victims of Hurricane Ian anywhere in the state of Florida and in the Carolinas have until February 15, 2023 to file various individual and business tax returns and make certain tax payments. Currently tax relief is available to the entire state of Florida, North Carolina, and South Carolina. Taxpayers in certain Ian-impacted localities designated by FEMA will automatically receive the same filing and payment relief. The current list of eligible localities is available on the disaster relief page on IRS.gov.

Read Also: How Does Donation Tax Write Off Work

Guilford County Tax Department

| THE GREENSBORO & HIGH POINT TAX OFFICES ARE OPENED TO THE PUBLIC |

|

The Guilford County Tax Offices in Greensboro and High Point are fully opened to the public for face-to-face services. The following contact information listed below may be used to communicate electronically or by telephone with any division of the Tax Department. Here are the Alternative Ways to Access Our Services Pay your taxes with American Express, Discover Card, MasterCard, VISA, or e-Check.1. 2. Call: 336-203-7795 3. Mail your check or money order to: PO Box 71072, Charlotte, NC 28272-1072 4. 24/7 Drop Box located at 400 W. Market Street Greensboro 5. 24/7 Drop Box located at 325 E Russell Avenue High Point The Guilford County Tax Department uses a service called Payit that allows you to pay tax bills online, by phone, or in person. Payit collects processing and/or transaction fees to deliver quality services more efficiently with no upfront costs to Guilford County. The Guilford County Tax Department does not collect or benefit from the transaction/processing fees. – Web/Mobile and Phone payments: 1.85% of transaction amount processing fee + $2.00 transaction fee – ACH/e-Check payments: $1.25 per transaction amount processing fee + $2.00 transaction fee – Point of Sale payments: 2.35% of transaction amount processing fee |

|

Apply for an elderly, disabled or disabled veteran exclusion? |

|

How do I purchase a county foreclosure property? |

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Taxes can really put a dent in your paycheck. But with a Savings or CD account, you can let your money work for you. Check out these deals below:

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

You May Like: How To File Simple Taxes

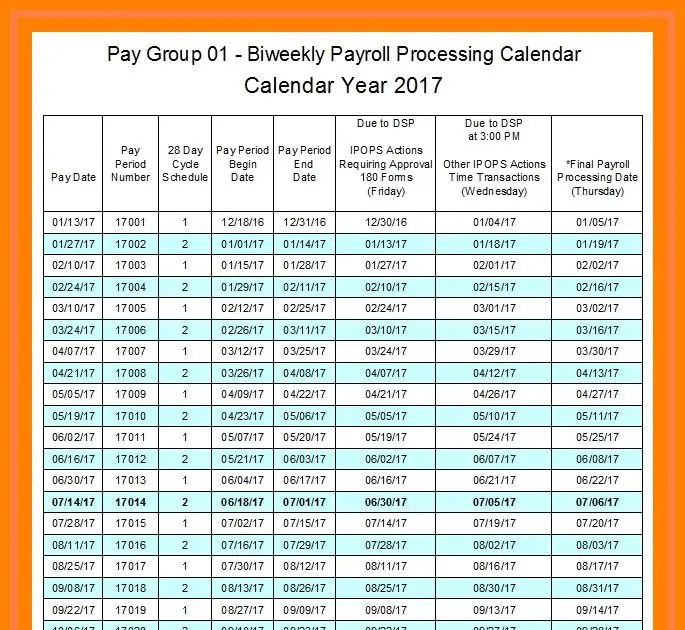

Calendar Of North Carolina Sales Tax Filing Dates

Depending on the volume of sales taxes you collect and the status of your sales tax account with North Carolina, you may be required to file sales tax returns on a monthly, semi-monthly, quarterly, semi-annual, or annual basis.

On this page we have compiled a calendar of all sales tax due dates for North Carolina, broken down by filing frequency. The next upcoming due date for each filing schedule is marked in green.

Simplify North Carolina sales tax compliance! We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process.