What Is The 2022 Tax Extension Deadline Youll Need Irs 4868 Form

April 18 also is the deadline for requesting a tax extension, which gives taxpayers until Oct. 17 to file their returns for 2021. However, there is no extension on payments so if you think you will owe money, it is recommended that you send a payment by April 18 to avoid interest and other penalties.

The IRS estimates that 15.2 million taxpayers will file for an extension, which is Form 4868, in 2022. Nearly 11.6 million taxpayers filed Form 4868 in 2020, based on the most recent data and an estimated 13.56 million filed for an extension in 2021.

Recommended Reading: Taxes With Doordash

Tax Filing Season Begins Jan 24 Irs Outlines Refund Timing And What To Expect In Advance Of April 18 Tax Deadline

IR-2022-08, January 10, 2022

WASHINGTON The Internal Revenue Service announced that the nation’s tax season will start on Monday, January 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns.

The January 24 start date for individual tax return filers allows the IRS time to perform programming and testing that is critical to ensuring IRS systems run smoothly. Updated programming helps ensure that eligible people can claim the proper amount of the Child Tax Credit after comparing their 2021 advance credits and claim any remaining stimulus money as a Recovery Rebate Credit when they file their 2021 tax return.

“Planning for the nation’s filing season process is a massive undertaking, and IRS teams have been working non-stop these past several months to prepare,” said IRS Commissioner Chuck Rettig. “The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays. Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year. And we urge extra attention to those who received an Economic Impact Payment or an advance Child Tax Credit last year. People should make sure they report the correct amount on their tax return to avoid delays.”

Irs Announces Tax Relief For Puerto Rico Victims Of Hurricane Fiona

PR-2022-10, September 19, 2022

WASHINGTON Victims of Hurricane Fiona beginning September 17, 2022, now have until February 15, 2023, to file various individual and business tax returns and make tax payments, the Internal Revenue Service announced today.

Following the recent disaster declaration issued by the Federal Emergency Management Agency, the IRS announced today that affected taxpayers in certain areas will receive tax relief.

Individuals and households affected by Hurricane Fiona that reside or have a business in all 78 municipalities in Puerto Rico qualify for tax relief. The declaration permits the IRS to postpone certain tax-filing and tax-payment deadlines for taxpayers who reside or have a business in the disaster area. For instance, certain deadlines falling on or after September 17, 2022, and before February 15, 2023, are postponed through February 15, 2023.

This means individuals who had a valid extension to file their 2021 return due to run out on October 17, 2022, now have until February 15, 2023, to file. The IRS noted, however, that because tax payments related to these 2021 returns were due on April 18, 2022, those payments are not eligible for this relief.

Penalties on payroll and excise tax deposits due on or after September 17, 2022, and before October 3, 2022, will be abated as long as the tax deposits are made by October 3, 2022.

You May Like: How Tax Loss Harvesting Works

Income Tax Audit Due Date Extension Possible

This is the high time of Income Tax Audit season. The Chartered Accountant, Tax Advocates, Tax Practitioners and Accountants are most busiest inn Tax Audit Report filing. The due date of Tax Audit Report of AY 2022-23 is 30th September 2022. Income Tax Return due date for audit cases is 31st October 2022.

This time Income Tax Portal is working fine and smoothly. Very less glitches are faced by the portal users. But still some tax professionals are seeking for Extension of Tax Audit Report due date for FY 2021-22 which is the need of hour for atleast 15 Days due to work pressure. There is very less possibility of Tax Audit Report due date extension.

Some Professionals are demanding Tax Audit Due date extension while some are not in favour of any extension. Everyone has there own reason. Dont know what will happen next. When the New e filing portal will start throwing new technical glitches. The CBDT will be forced to extend the tax audit due date.

Tax Audit Report is the report prepared by a Chartered Accountant in practice after auditing the books of accounts of the taxpayer. A detailed report in Form 3CD complying with various provisions of the Income Tax Act is provided. The last date of Filing Tax Audit Report for AY 2022-23 is 30th September 2022.

Tax Year Vs Calendar Year

Not all taxpayers use Jan. 1 through Dec. 31 as their tax year. Some use a fiscal year, which is a 12-month period ending on the last day of any month except December, according to the IRS. In general, companies are the only ones that use a fiscal year for tax purposes, but if you are an individual and you keep your financial records on the basis of an adopted fiscal year, you can apply to use the fiscal year instead. If you want to change your tax year, and thus your tax return due date, you must apply for that via the IRS.

Also Check: How Much Can You Get Back In Taxes

Protecting Yourself From Fraud

While tax scams are nothing new, the pandemic gave rise to a new set of fraud cases, specifically around COVID-related support programs, like the Canada Emergency Response Benefit . COVID-19 phishingemail scams gave hackers and con artists the personal and/or banking information to claim the benefits.

If you suspect you are a victim of fraud, collect any relevant documents, and that can include your T4, T4As, bank statements, receipts of any related transactions, as well as any emails, or text messages related to the scam. Immediately report the fraud or the scam to the Canadian Anti-Fraud Centre and to the police. Also change all of your passwords right away for any financial accounts that you think may have been targeted, as well as your email addresses, too.

Reasons To File A Tax Deadline Extension

You may want to file a tax deadline extension for a number of reasons. For the majority of people, it makes more sense to just file your taxes on time. This is because you will either delay receiving a refund if youre getting one, or you could end up paying penalties and fees if you owe tax and didnt pay on time. Here are the top reasons you may consider filing an extension:

- Your returns arent done: If you havent had enough time to thoroughly go through your return and make sure its accurate and has taken advantage of all the possible deductions, then you may want to file an extension.

- Missing information: If you havent received information from an employer, for example, you wont be able to file on time.

- You know youre receiving a refund: If you know youre getting a refund and want to push receiving it until the fall, then filing an extension might work well for you.

- Your business filed an extension: If you have business taxes that are falling to your personal tax return and the business filed an extension, then youll likely be forced to file one for your personal returns as well.

Keep in mind that you should be very careful about filing an extension if you think youre going to owe tax to the government. You dont want to be hit with penalties or fees for not paying on time. You also want to be careful that if you are extending to make sure you file the proper paperwork so that you dont receive a no-file penalty as well.

Read Also: How To Pay Taxes On Etsy Sales

Does This Extension Also Give Me More Time To Contribute Funds To My Hsa Or Archer Msa For 2019

Yes. Similar to the extended time granted for making retirement account contributions, you may also make contributions to your HSA or Archer MSA by July 15, 2020 for the 2019 tax year. Keep in mind that to ensure accuracy on Form 8889, its often best to make any contributions prior to filing your tax return.

TurboTax Self-Employed will ask you simple questions about your life and help you fill out all the right forms. Perfect for independent contractors and small businesses. Well search over 500 tax deductions to get you every dollar you deserve and help you uncover industry-specific deductions.

Winter Storm Disaster Relief For Louisiana Oklahoma And Texas

Earlier this year, following the disaster declarations issued by the Federal Emergency Management Agency , the IRS announced relief for victims of the February winter storms in Texas, Oklahoma and Louisiana. These states have until June 15, 2021, to file various individual and business tax returns and make tax payments. This extension to May 17 does not affect the June deadline.

For more information about this disaster relief, visit the disaster relief page on IRS.gov.

Recommended Reading: What States Do Not Tax Retirement Income

When Are Taxes Due If I File An Extension

If you file Form 4868 and receive the automatic six-month extension, you will have until Oct. 17, 2022, to submit your 2021 tax return.

If you already know that youll need an extension, plan on filing Form 4868 sooner rather than later. That way, if anything goes wrong with your application, youll have plenty of time to fix any errors and resubmit it ahead of the April 18 tax deadline. This also ensures you have time to get your documents together for your extended deadline in October. The IRS website has all the forms, deadlines and information youll need.

Awaiting Processing Of Previous Tax Returns People Can Still File 2021 Returns

Rettig noted that IRS employees continue to work hard on critical areas affected by the pandemic, including processing of tax returns from last year and record levels of phone calls coming in.

“In many areas, we are unable to deliver the amount of service and enforcement that our taxpayers and tax system deserves and needs. This is frustrating for taxpayers, for IRS employees and for me,” Rettig said. “IRS employees want to do more, and we will continue in 2022 to do everything possible with the resources available to us. And we will continue to look for ways to improve. We want to deliver as much as possible while also protecting the health and safety of our employees and taxpayers. Additional resources are essential to helping our employees do more in 2022 and beyond.”

The IRS continues to reduce the inventory of prior-year individual tax returns that have not been fully processed. As of December 3, 2021, the IRS has processed nearly 169 million tax returns. All paper and electronic individual 2020 refund returns received prior to April 2021 have been processed if the return had no errors or did not require further review.

Taxpayers generally will not need to wait for their 2020 return to be fully processed to file their 2021 tax returns and can file when they are ready.

Recommended Reading: What Is The Deadline To File Your Tax Return

What’s The Fastest Way To File My Tax Return

The fastest way to file your tax return is to file electronically.

E-filing your tax return to the IRS is more secure than paper filing. Because the tax return is electronically transmitted to the IRS, you don’t have to worry about it getting lost in the mail or arriving late. You’ll also get confirmation right away that the IRS has received your return and has started processing it.

If you’re waiting for a tax refund, the fastest way to get your money is to have it electronically deposited into your bank account. The IRS typically issues 90% of refunds in less than 21 days when taxpayers combine direct deposit with electronic filing.

Fastest Way To Get A Refund

The IRS advises filing taxes electronically and having the refund direct deposited into a financial account. The IRS says refunds can be deposited directly into bank accounts, prepaid debit cards or mobile apps as long as a routing and account number is provided, the IRS said.

SAVE BETTER, SPEND BETTER: Money tips and advice delivered right to your inbox. Sign up here

You May Like: How To File Quarterly Ifta Taxes

Providing Additional Income Support To Canadians

The Government of Canada has indicated from the outset that there would be no penalties or interest in cases where CERB needs to be repaid. However, we recognize that, for some individuals, repaying the CERB could present a significant financial hardship. For this reason, we will give Canadians more time and flexibility to repay based on their ability to pay. We will work with impacted individuals on a case-by-case basis. There is no deadline to repay COVID-19 emergency benefit payments.

If you mistakenly received COVID-19 emergency benefit payments, or your situation has changed since you first applied for one of these benefits, you can repay the CRA via My Account, online banking, or mail.

Newly announced on February 9, 2021, targeted interest relief is being provided to Canadians who received COVID-related income support benefits. Once individuals have filed their 2020 income tax and benefit return, they will not be required to pay interest on any outstanding income tax debt for the 2020 tax year until April 30, 2022.

Self-employed individuals who applied for the CERB and would have qualified based on their gross income will not be required to repay the benefit, provided they also met all other eligibility requirements. The same approach will apply whether the individual applied through the CRA or Service Canada.

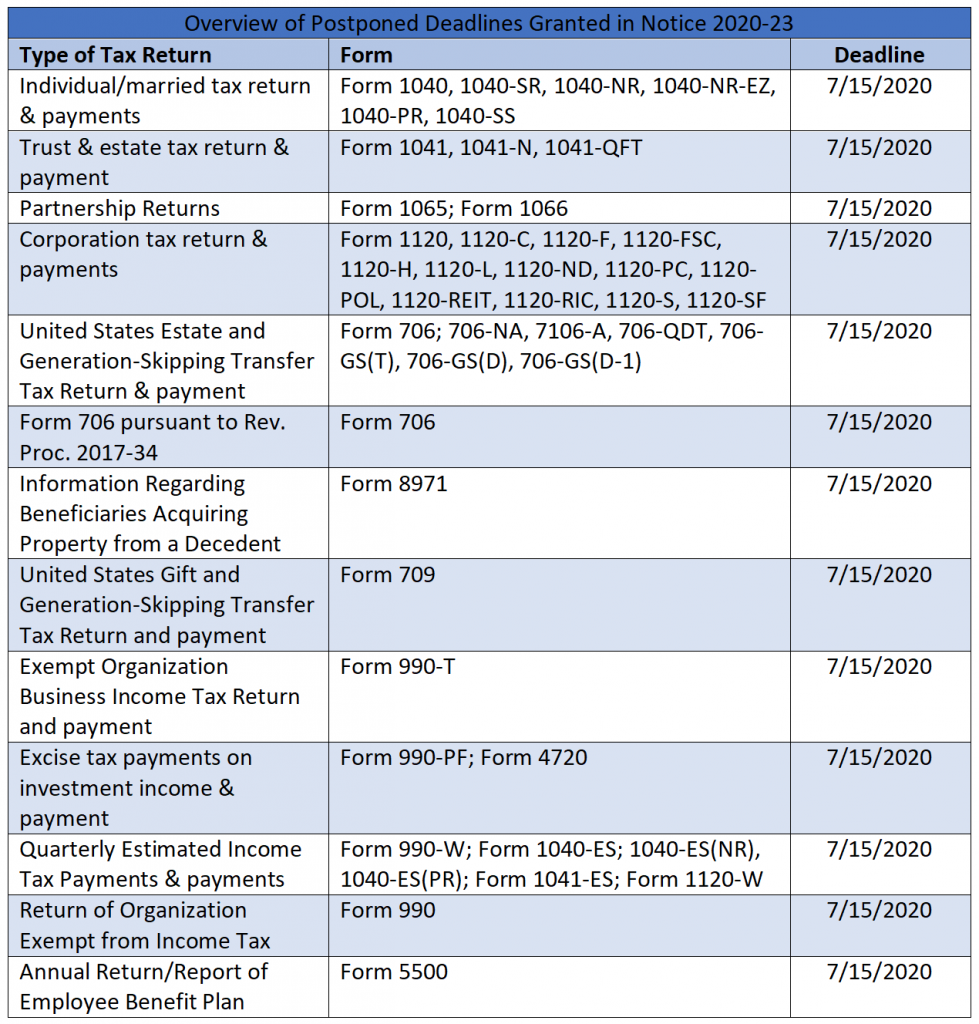

Extended Due Date Of First Estimated Tax Payment

Pursuant to Notice 2020-18PDF, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to Notice 2020-23, the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

Don’t Miss: How To Pay Nc Taxes Online

When Are 2022 Tax Extensions Due

You have right up until tax day to file for an extension. For individuals, that means you can still file for a tax extension right on April 18, 2022. The same goes for businesses: S corps and partnerships can still get an extension on March 15, and the last day for C corps to file for an extension is April 18.

When Are Taxes Due For 2021 Tax Year Dates You Need To Know

Tax season is full of questions concerning your wages, your claims, your filing status and how to report pandemic-related stimulus and unemployment payments on your returns. But even after those are answered, one burning question remains: When are taxes due?

You might not like paying taxes, but you certainly wont like paying interest, late filing fees and late payment fees if you miss the deadline to file taxes for tax year 2020. The Internal Revenue Service has several deadlines to file taxes and pay your taxes due so its important you are aware of all applicable dates.

Read Also: Where To Send My 1040 Tax Return

What Is The Best Way To File My Tax Returns And Other Documents

More than 87% of all returns filed in Vermont are e-filed. Electronic filing through a commercial software vendor or your tax preparer is a secure way to file federal and Vermont returns. On average, e-filers get their refunds about two weeks faster than filers using paper forms because returns transmitted electronically get to the department more quickly, with fewer errors, and are more easily processed.

The Department continues to make improvements to make online filing easier for all taxpayers. You may use commercial tax software or a tax preparer to e-file Vermont personal income tax, but some filings may be made for free through myVTax as follows:

- Homestead Declaration

- An extension to file personal income tax

Tax Year: Fiscal Year Vs Calendar Year

For partnership or corporation business tax returns, you should select an accounting method for your tax year. This can be a calendar year or a fiscal year.

A fiscal year refers to a 12-months period that you designate as the business year for your LLC.

For instance, you have your fiscal year running from March 30 to April 1.

Alternatively, you can choose a calendar year. If you select a calendar year, your company will operate with a business year from January 1 to December 31.

You can file an application to adopt, retain or change tax year if you wish to change your business year. This enables you to switch from a calendar year to a fiscal year or vice versa.

Recommended Reading: How Much Percent Tax Do I Pay

Contribute To Or Open An Ira By Tax Day

Contributions to a traditional IRA can be tax-deductible. You have until the April 18, 2022, tax deadline to contribute to an IRA, either Roth or traditional, for the 2021 tax year. The maximum contribution amount for either type of IRA is $6,000 or $7,000 if you’re age 50 or older. See all the rules here.

» MORE: Learn how IRAs work and where to get one