Dallas Tax Lawyer Joseph Garza Charged In Billion

A Dallas tax lawyer who exploited his position as an attorney and promoted illegal tax shelters for wealthy Texas clients for several years has been charged with 41 counts of tax and wire fraud.

And the federal indictment indicates charges may be brought against others involved in the fraud scheme.

Federal prosecutors in the Northern District of Texas announced Thursday that they arrested Joseph Garza of the Garza Legal Group with helping mainly high-net-worth business owners use tax shelters to create a circular flow of funds to illegally reduce paying taxes.

Tax attorney Joe Garza has been named in a 41-count indictment on charges of tax and wire fraud.

The 14-page indictment, handed down by a federal grand jury Oct. 18 but kept under seal until Oct. 25, accuses Garza of advising wealthy clients on how to shelter large amounts of otherwise taxable income through participation in an illegal tax shelter and creating a shell investment company that purported to serve as a family investment vehicle.

This attorney allegedly hid more than $1 billion of client income from the IRS, conning the U.S. Treasury out of roughly $200 million and lining his own pockets in the process, said U.S. Attorney Chad Meacham. Our country functions best when every citizen pays his or her fair share. We will aggressively pursue anyone who subverts our tax laws.

A graduate of the Southern Methodist University Law School in 1969, Garza has practiced law in Dallas for five decades.

When Are Texas Property Taxes Due

Property taxes may come in the form of an annual tax statement, but several dates are important for homestead owners to take note of throughout the year. Key Texas property tax due dates include when taxes are due and when penalties and interest will begin to accrue on any delinquent taxes. Continue reading to learn about some key property tax dates and payment options that are available to property owners in the state of Texas.

Calendar Of Texas Sales Tax Filing Dates

Depending on the volume of sales taxes you collect and the status of your sales tax account with Texas, you may be required to file sales tax returns on a monthly, semi-monthly, quarterly, semi-annual, or annual basis.

On this page we have compiled a calendar of all sales tax due dates for Texas, broken down by filing frequency. The next upcoming due date for each filing schedule is marked in green.

Simplify Texas sales tax compliance! We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process.

You May Like: How Much Do They Take Out For Taxes

When Is Sales Tax Due In Texas

Texas Sales Tax Deadlines

- In Texas, you will be required to file and remit sales tax either monthly, quarterly, or annually. Texas sales tax returns are always due the 20th of the month following the reporting period. If the filing due date falls on a weekend or holiday, sales tax is generally due the next business day.

Property Tax Payment Via Your Mortgage

A common property tax payment method used by many with mortgages is to pay through an escrow account that their lender maintains. Each month, a portion of your mortgage payment will go into the escrow account, and your lender will use the accumulated money to pay your property tax when it is due. As this relies on estimating what is owed, it is possible that what you have contributed will not cover all of your property tax according to the approval tax rate, requiring you to pay the difference when the tax is due.

Recommended Reading: How Do You Avoid Capital Gains Tax

Property Taxes Are Due Before Or On January 31st

FRIENDLY REMINDER: PROPERTY TAXES ARE DUE BEFORE OR ON JANUARY 31st.

And there is absolutely NO BETTER parking than what you can find in your own driveway! Since 2013 we have made customer service and minimizing inconvenience as our top operational priorities. Encouraging our citizens to consider paying their property taxes on-line or by mail during peak payment periods has helped alleviate so much lobby congestion at our county wide offices. And that has only made for a far more pleasant experience for those who still wish to conduct their business at our lobby windows. There is a 2.35% convenience fee for on-line payments and a $1.00 fee for making payment by e-check that will require your .

If you choose to make payment by mail we encourage you to please NOT wait until the very last minute to do so, as your mail could possibly NOT be postmarked BEFORE or ON January 31st. Please remember that any and all mail must be postmarked before or on January 31st. Mail that is postmarked Feb. 1st is statutorily delinquent by the Tx. State Property Tax Code.

As always, we appreciate that the overwhelming vast majority of our citizens take pride in their civic responsibility and pay their property taxes in a timely fashion. Last year our offices total aggregate collections totaled $186,646,148.10 equating to a collection rate of $96,408.13 an hour!

Tommy R. Smyth, TAC,MPA,CTOP

Use Txt To Renew Your Vehicle Registration

TxT is your account to officially take care of Texas to-dos like vehicle registration renewal. Sign up and renew now – it’s easy, fast, and secure.

There are several steps to register your vehicle with the Texas Department of Motor Vehicles.

1. Have your vehicle inspected at a certified inspection station.

2. Show insurance coverage for the required minimums per person, per accident, and for property damage.

3. Get your vehicle registration and sticker at your local county Tax Assessor Collector office.

Recommended Reading: What States Have The Lowest Sales Tax

Where Can I Pay My Property Taxes

You may pay property taxes at any of our locations, or you may mail your payment to:

Tax Assessor-CollectorP. O. Box 2810Corpus Christi, Texas 78403

Please make your check payable to Nueces County Tax Assessor-Collector, and if possible, enclose the copy of your tax statement with your payment. If you have any questions concerning property taxes and wish to call this office, our telephone number is 888-0230.

Victims Of Texas Winter Storms Get Deadline Extensions And Other Tax Relief

IR-2021-43, February 22, 2021

WASHINGTON Victims of this month’s winter storms in Texas will have until June 15, 2021, to file various individual and business tax returns and make tax payments, the Internal Revenue Service announced today.

Following the recent disaster declaration issued by the Federal Emergency Management Agency , the IRS is providing this relief to the entire state of Texas. But taxpayers in other states impacted by these winter storms that receive similar FEMA disaster declarations will automatically receive the same filing and payment relief. The current list of eligible localities is always available on the disaster relief page on IRS.gov.

The tax relief postpones various tax filing and payment deadlines that occurred starting on February 11. As a result, affected individuals and businesses will have until June 15, 2021, to file returns and pay any taxes that were originally due during this period. This includes 2020 individual and business returns normally due on April 15, as well as various 2020 business returns due on March 15. Among other things, this also means that affected taxpayers will have until June 15 to make 2020 IRA contributions.

In addition, penalties on payroll and excise tax deposits due on or after February 11 and before February 26 will be abated as long as the deposits are made by February 26.

Also Check: How Much Does The Us Collect In Taxes

How Does Sales Tax Work In Texas

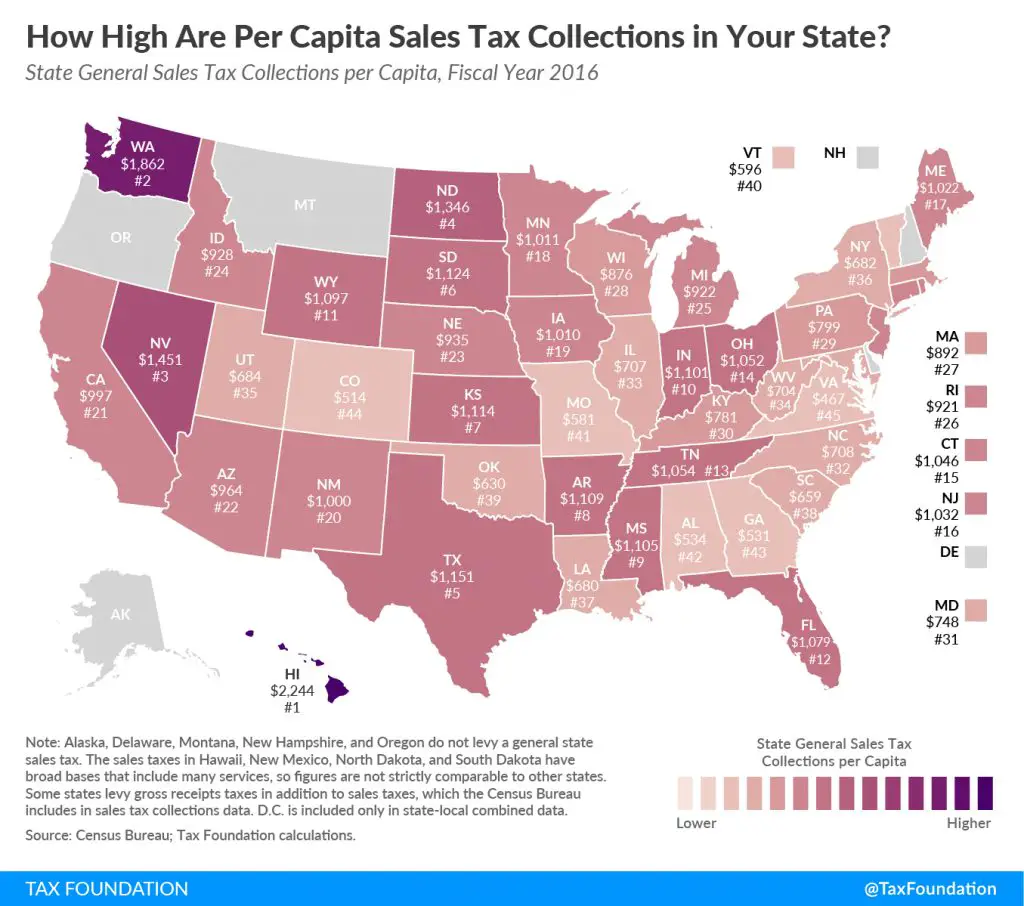

The Texas state sales and use tax rate is 6.25 percent, but local taxing jurisdictions also may impose sales and use tax up to 2 percent for a total maximum combined rate of 8.25 percent. See Purchases/Use Tax for additional information.

The Home Tax Solutions Team Can Help

The Home Tax Solutions team completely understands how overwhelming the property tax process can be when you dont work with these dates and numbers every day like we do. Dont get bogged down in the numbers. If your bill is due, or overdue, and youre struggling to find a way to cover the cost, take a deep breath and give us a call. You can also start the process any time by filling out our simple online property tax application.

Read Also: Can I Efile Old Tax Returns

Tax Deadlines For Certain Texas Taxpayers Postponed

Taxpayers in Texas impacted by the recent winter storms will have until June 15, 2021, to file various federal individual and business tax returns and make tax payments.

The relief postpones various federal tax filing and payment deadlines that occurred starting on February 11. As a result, affected individuals and businesses will have until June 15, 2021, to file returns and pay taxes that were originally due during this period. This includes 2020 individual and business returns normally due on April 15, as well as various 2020 business returns due on March 15. Among other things, this also means that affected taxpayers will have until June 15 to make 2020 IRA contributions.

The June 15 deadline also applies to quarterly estimated income tax payments due on April 15 and the quarterly payroll and excise tax returns normally due on April 30. It also applies to tax-exempt organizations, operating on a calendar-year basis, that have a 2020 return due on May 17.

Payroll tax deposits are not given an extension of time to pay, however, penalties on payroll and excise tax deposits due on or after February 11 and before February 26 will be abated as long as the deposits were made by February 26.

In addition, the Texas Comptrollers office has postponed the due date for 2021 state franchise tax reports from May 15 to June 15. This postponement is automatic and does not require taxpayers to file additional forms.

Related Services

Reporting Due Dates For Taxes Fees And Reports

Due dates on this chart are adjusted for Saturdays, Sundays, and 2022 federal legal holidays. For applicable taxes, quarterly reports are due in April, July, October and January.

Note: When a reporting due date happens to fall on Saturday, Sunday, or a legal holiday, the reporting due date becomes the next business day. For example, for reports normally due on the 25th of the month, the due date is Dec. 26 instead of Dec. 25, which is Christmas Day . If Dec. 26 is a weekend day , then the reporting date becomes the next business day.

You May Like: How Soon Can I File My 2020 Taxes

Final Franchise Tax Reports

Before getting a Certificate of Account Status to terminate, convert, merge or withdraw registration with the Texas Secretary of State:

- A Texas entity, terminating, converting or merging, must file its final tax report and pay any amount due in the year it plans to terminate, convert or merge.

- An out-of-state entity, ending its nexus in Texas, must file its final report and pay any amount due within 60 days of ceasing to have nexus.

I Received My Tax Statement And It Does Not Show My Exemption What Should I Do

Perhaps you have not filed the proper affidavit with the appraisal district. You are entitled to a homestead exemption if you own your home on January 1 and it is your primary residence. You can claim only one homestead exemption as of January 1. In order to receive a homestead exemption, an affidavit must be filed with the Nueces County Appraisal District. All exemptions, such as homestead, over 65, disabled persons, and disabled veterans require execution of an affidavit with the Nueces County Appraisal District. If you so request, we will send the necessary form to you, or you can obtain them directly from NCAD by calling 881-9978.

You May Like: How To File My Own Taxes For Free

How Is My Property Value Determined

The Nueces County Appraisal District identifies property to be taxed, determines its appraised value, whether to grant exemptions, the taxable owner and address, and which taxing jurisdictions may tax the property. For information on values, to file for an exemption, or to report changes in ownership or address, please call the Appraisal District 881-9978. The Appraisal District office is located at 201 N. Chaparral, Corpus Christi, Texas 78401. Nueces County Appraisal District information can also be accessed through their website, the address is www.ncadistrict.com.

I Received A Homestead Exemption For The Current Year But I Sold The Property How Can I Correct This Matter

The exemption goes by its status as of January 1st of each year. If you purchased a new home you need to file for a homestead exemption on your new homestead property with the Nueces County Appraisal District for the next January 1. You may obtain an application for a homestead exemption directly from NCAD by calling 881-9978.

Read Also: How To Solve Sales Tax

Hays Central Appraisal District Rendition Penalty

Q. What is the rendition penalty?

Chapter 22, Texas Tax Code, requires owners of business personal property to file a rendition describing the property with the chief appraiser by April 15 of each year and also prescribes the penalty for failure to comply. The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the Hays Central Appraisal District . The rendition penalty is generally equal to 10% of the amount of property taxes ultimately imposed on the property.

Q. How do I pay the rendition penalty bill I have received?

The Hays Central Appraisal District has contracted with the Hays County Tax Office to collect rendition penalties. Such payments are accepted at any Tax Office location, online by e-Check or credit card, and by mail.

Q. How do I protest my penalty ?

Q. What happens if I pay after the due date?

There is no additional penalty for late payment. However, collection action will be taken.

Q. If I do not pay, what happens?

You will be subject to civil action for collection in the courts.

Q. If I am a vendor, will I be prevented from getting County contracts until the bill is paid?

Yes, unpaid rendition penalty will be treated the same as unpaid property tax for purposes of determining compliance with the Hays County vendors policy.

Q. I want to protest the rendition penalty or request a waiver. How do I do this?

Due Dates For Annual Domestic Employers Report & Payment

For domestic-only employers who have previously elected to report and pay taxes on an annual basis, quarterly reports and taxes become due on January 1 and are required to be reported and paid no later than January 31 on wages for employment paid in the preceding calendar year. For more information on electing to pay annually, see our page on Domestic Employment.

Recommended Reading: What Is The First Day To File Taxes In 2021

Will Tax Deadline Be Extended In 2021

2021 Federal Tax Deadline Extensions The federal tax filing deadline for 2020 taxes has been automatically extended to May 17, 2021. Due to severe winter storms, the IRS has also extended the tax deadline for residents of Texas, Oklahoma and Louisiana to June 15, 2021. This extension also applies to 2020 tax payments.

What Is The Procedure For Purchasing Abandoned Property

Property can be bought for delinquent taxes only after a lawsuit for tax lien foreclosure has been filed, and later a judgment has been granted by the court to sell the property. You will need to contact the law firm that administers delinquent tax sales on behalf of Nueces County. The law firm for Nueces County is Linebarger Goggan Blair & Sampson, L.L.P. Their telephone number is 888-6898.

Don’t Miss: How To File Lyft Taxes Without 1099

Why Am I Getting A Delinquent Tax Bill On A Parcel I Just Purchased

The tax laws require this office to mail delinquent tax bills to the current owner of real estate, rather than to the previous owner. Because a tax lien exists against that parcel, it is in the current owners best interest to have knowledge of that lien. If a lawsuit were filed to foreclose the lien, the current owner risks losing the property to foreclosure.

I Received A Bill For Personal Property Taxes But I Do Not Own Any Real Estate I Just Lease It For My Business Why Am I Receiving A Bill On Property I Do Not Own Should The Property Owner Be Paying This

All businesses are taxed on their personal property, such as furniture, fixtures, machinery, equipment, inventory and vehicles. Most likely, the bill that you received is for your business personal property and not for the real estate itself. The real estate is taxed separately and the tax statement sent to the property owner.

Don’t Miss: Can I Still File Taxes

Discounts Penalties Interest And Refunds

- Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid.

- Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying. See Prepayment Discounts, Extensions and Amendments FAQs.

- A $50 penalty is assessed on each report filed after the due date.

- If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed.

- If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.