Key Information To Help Taxpayers

The IRS encourages people to use online resources before calling. Last filing season, as a result of COVID-era tax changes and broader pandemic challenges, the IRS phone systems received more than 145 million calls from January 1 May 17, more than four times more calls than in an average year. In addition to IRS.gov, the IRS has a variety of other free options available to help taxpayers, ranging from free assistance at Volunteer Income Tax Assistance and Tax Counseling for the Elderly locations across the country to the availability of the IRS Free File program.

“Our phone volumes continue to remain at record-setting levels,” Rettig said. “We urge people to check IRS.gov and establish an online account to help them access information more quickly. We have invested in developing new online capacities to make this a quick and easy way for taxpayers to get the information they need.”

Last year’s average tax refund was more than $2,800. More than 160 million individual tax returns for the 2021 tax year are expected to be filed, with the vast majority of those coming before the traditional April tax deadline.

Overall, the IRS anticipates most taxpayers will receive their refund within 21 days of when they file electronically if they choose direct deposit and there are no issues with their tax return. The IRS urges taxpayers and tax professionals to file electronically. To avoid delays in processing, people should avoid filing paper returns wherever possible.

What Is The Best Way To File My Tax Returns And Other Documents

More than 87% of all returns filed in Vermont are e-filed. Electronic filing through a commercial software vendor or your tax preparer is a secure way to file federal and Vermont returns. On average, e-filers get their refunds about two weeks faster than filers using paper forms because returns transmitted electronically get to the department more quickly, with fewer errors, and are more easily processed.

The Department continues to make improvements to make online filing easier for all taxpayers. You may use commercial tax software or a tax preparer to e-file Vermont personal income tax, but some filings may be made for free through myVTax as follows:

- Homestead Declaration

- An extension to file personal income tax

How Do I Avoid Estimated Tax Penalty

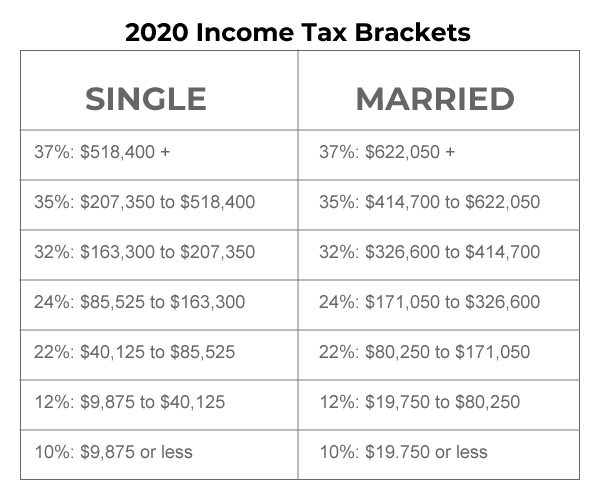

Generally, most taxpayers will avoid this penalty if they either owe less than $1,000 in tax after subtracting their withholding and refundable credits, or if they paid withholding and estimated tax of at least 90% of the tax for the current year or 100% of the tax shown on the return for the prior year, whichever is

Don’t Miss: Why Do I Owe Taxes When I Make So Little

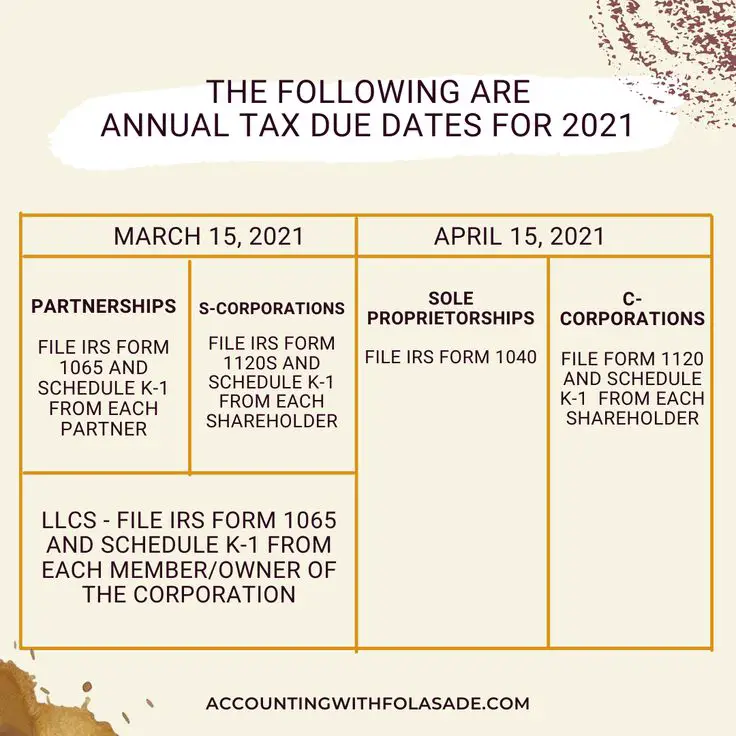

Deadlines For December Tornado Victims

Following the disaster declarations issued by the Federal Emergency Management Agency , the IRS announced relief for victims of the December tornadoes, severe storms and flooding in parts of Kentucky, Illinois and Tennessee.

Affected individuals and businesses in certain areas of these states will have until May 16, 2022, to file returns and pay any taxes that were originally due on or after Dec. 10, 2021. This includes 2021 individual income tax returns due on April 18, as well as various 2021 business returns normally due on March 15 and April 18. As a result, affected taxpayers will also have until May 16 to make 2021 IRA contributions.

The May 16 deadline also applies to the quarterly estimated tax payments normally due on Jan. 18 and April 18, as well as the quarterly payroll and excise tax returns originally due on Jan, 18. As a result, taxpayers can skip making their Jan. 18 payment and simply include it with their 2021 return. Additionally, the quarterly payroll and excise tax returns that were originally due on Jan. 31, 2022 and May 2, 2022 now can be filed by May 16, 2022.

Does The New Deadline Apply To All Taxes

No. This applies to all individual tax filers, and it does not include trusts, estates, corporations and other noncorporate tax filers. Quarterly estimated taxes for individuals are still due April 15, 2021, too.

Theres a good chance the new deadline applies to your state taxes. As of April 2021, most states have either followed the IRS lead and delayed their tax deadlines until May 17, or have extended their deadline further. But each state is different. Here is an updated list of how each state has approached its 2021 tax deadlines in response to the coronavirus.

You May Like: Who Can I Call About My Tax Refund

Irs Postpones 2021 Tax Deadline From April 15 To May 17

For the 2021 tax year, the IRS has postponed the regular April 15th deadline to May 17th to give Americans more time to prepare and file during the ongoing Coronavirus pandemic.

The extension also gives taxpayers the chance to incorporate changes from the American Rescue Plan Act, which was passed in the middle of tax season. This year, its especially important for expats to get their US taxes done correctly because its the only way to reclaim stimulus checks that you were eligible for but didnt receive.

This extension is automatic. You do not need to file any additional forms or call the IRS to request it.

Despite the date change, the IRS is still urging Americans to file as soon as they are able. In particular, if youre owed a refund or youre entitled to stimulus payments, you should file electronically with direct deposit to get these funds as quickly as possible.

The IRS has not issued any statements regarding the June 15, 2021 tax filling deadline for Americans living abroad. If you intended to file by this deadline, you should still make plans to complete your return by this dateor sooner if possible.

In addition, quarterly estimated payments are still due on April 15, 2021.

Update: Notice On The Status Of The City Of Detroit Individual Income Tax Due Date Extended To May 17

Date: April 26, 2021

The Department issued Notice on the Status of the City of Detroit Individual Income Tax Return Deadline on March 25, 2021. At the time that the Notice was issued, the Internal Revenue Service had extended the filing deadline for individual 2020 returns from April 15, 2021 to May 17, 2021. The Departments Notice advised City of Detroit individual taxpayers that there was no statutory authority to similarly extend the deadline for City of Detroit 2020 income tax returns.

On April 22nd, 2021 PA 7 was enacted. The new law extends the filing deadline for individuals under the City Income Tax Act to match the federal filing deadline. Therefore, individuals who file a City of Detroit income tax return now have until May 17, 2021 to file without incurring penalty or interest.

Additional 2020 City of Detroit individual income tax filing information:

- Extensions beyond May 17, 2021. Individual taxpayers who need additional time to file beyond the May 17th deadline can request a filing extension until October 15th by filing a CITY Income Tax Return Application for Extension of Time to File by May 17th. An extension of time to file does not extend the time to pay tax. Tax is due by May 17, 2021.

- Estimated payments for 2021. This relief does not apply to 2021 estimated tax payments that are due on April 15, 2021. These payments are still due on April 15th.

Recommended Reading: How To Calculate Paycheck After Taxes

Recap Of 2020 Irs Tax Deadline Changes Due To Coronavirus

On March 21, 2020, in response to the growing concern over the Coronavirus pandemic, the IRS announced that it had extended the deadline for Federal income tax returns from April 15, 2020 to July 15, 2020.

Based on this change, all taxpayersincluding individuals, trusts and estates, corporations, and those who pay self-employment taxwere able to automatically defer tax payments penalty-free in 2020, regardless of the amount due.

Individual Income Tax Filing Due Dates

- Typically, most people must file their tax return by May 1.

- Fiscal year filers: Returns are due the 15th day of the 4th month after the close of your fiscal year.

If the due date falls on a Saturday, Sunday, or holiday, you have until the next business day to file with no penalty.

Filing Extensions

Can’t file by the deadline? Virginia allows an automatic 6-month extension to file your return . No application is required. You still need to pay any taxes owed on time to avoid additional penalties and interest. Make an extension payment.

Recommended Reading: What Do You Claim On Your Taxes

File Your 2018 Tax Return

The IRS estimates that unclaimed refunds from 2018 may total up to $1.5 billion. If you were due a refund for the 2018 tax year but didn’t file a tax return, you only have until April 18 to submit that old Form 1040 and claim your money. So if you havent filed, get to work! Miss the tax deadline, and the U.S. Treasury gets to keep your money.

State Tax Deadlines For Filing 2021 Individual Returns

Most states require individual taxpayers to file their state income taxes by Tax Day. Thats easy to remember because it is the same deadline as the federal tax deadline. However, there are several states that impose different deadlines and nine states that have no income tax. You can see the deadline for each state and the District of Columbia in the table below.

| 2022 State Income Tax Deadlines |

| State |

Read Also: How Much Tax Will I Pay On 15000 Self Employed

Unclaimed Refunds Deadline Extended To May 17

For tax year 2017 Federal income tax returns, the normal April 15 deadline to claim a refund has also been extended to May 17, 2021. The law provides a three-year window of opportunity to claim a refund. If taxpayers do not file a return within three years, the money becomes property of the U.S. Treasury. The law requires taxpayers to properly address, mail and ensure the tax return is postmarked by the May 17, 2021, date.

Additionally, foreign trusts and estates with federal income tax filing or payment obligations, who file Form 1040-NR, now have until May 17, 2021.

May 2022 Tax Due Dates

|

Date |

|

|---|---|

|

Tips for April 2022 Reported to Employer |

|

|

May 16 |

Arkansas, Illinois, Kentucky and Tennessee Storm, Tornado and Flooding Victims’ Extended Deadline for Filing and Payment Obligations from January 1 to May 15 |

|

May 16 |

Colorado Wildfire Victims’ Extended Deadline for Filing and Payment Obligations from January 1 to May 15 |

After a busy April, things slow down considerable in May for most people. There’s the typical deadline for employees to report tips received in April to their boss. That’s due by May 10.

In addition, victims of certain natural disasters also have extended due dates on May 16. First, victims of the severe storms, tornadoes and flooding in Arkansas, Illinois, Kentucky and Tennessee that began on December 10, 2021, can wait until May 16 to file federal returns or pay federal taxes that were supposed to be due between December 10 and May 15. People impacted by the Colorado wildfires that started on December 30, 2021, also have until May 16 to file returns and pay taxes originally due from December 30 to May 15.

Recommended Reading: Can I Pay My Pa State Taxes Online

Can I Avoid Paying Estimated Taxes

Probably not without incurring those penalties. Some classes of workers particularly those whose income is exceptionally modest, inconsistent or seasonal are exempt from having to make quarterly payments to Uncle Sam, however:

- If your net earnings were $400 or less for the quarter, you dont have to pay estimated taxes but you still have to file a tax return even if no taxes are due.

- If you were a US citizen or resident alien for all of last year, your total tax was zero and you didnt have to file an income tax return.

- If your income fluctuates drastically throughout the year , you may be able to lower or eliminate your estimated tax payments with an annualized income installment method. Refer to the IRSs 2-7 worksheet to see if you qualify.

Can You Pay Estimated Taxes Anytime

You can do this at any time during the year. Remember, the schedule set by the IRS is a series of deadlines. You can always make a payment before a set date, and you can cover your entire liability in one payment if you want to. You dont have to divide up what you might owe into a series of four quarterly payments.

Also Check: When Will The First Tax Refunds Be Issued 2021

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

File Electronically And Choose Direct Deposit

To speed refunds, the IRS urges taxpayers to file electronically with direct deposit information as soon as they have everything they need to file an accurate return. If the return includes errors or is incomplete, it may require further review that may slow the tax refund. Having all information available when preparing the 2021 tax return can reduce errors and avoid delays in processing.

Most individual taxpayers file IRS Form 1040 or Form 1040-SR once they receive Forms W-2 and other earnings information from their employers, issuers like state agencies and payers. The IRS has incorporated recent changes to the tax laws into the forms and instructions and shared the updates with its partners who develop the software used by individuals and tax professionals to prepare and file their returns. Forms 1040 and 1040-SR and the associated instructions are available now on IRS.gov. For the latest IRS forms and instructions, visit the IRS website at IRS.gov/forms .

Read Also: How Do I Claim Mileage On My Taxes

Greenback Team Is Here To Help

The Greenback Team is fortunate to be a 100% remote team distributed around the world 11 countries and 12 states to be exact. And as many of us are expats ourselves, were here to keep you up-to-date and help you navigate all the changes related to your taxes.

We currently recommend that you file your expat taxes as soon as possible, particularly if you think you may be owed a refund. If you do owe taxes, you can file now and hold off on making a payment until the new extended deadline. Planning ahead will help you manage finances and reduce stress during this uncertain time.

Events and circumstances have been changing rapidly, and it is best to stay on top of taxes to take advantage of potential benefits coming your way. Were here to answer any questions you may have during this confusing time, especially regarding US tax deadline in 2021 for citizens living abroad. Please get in touch with us today.

Federal Income Tax Deadline In 2022

After the COVID-19 pandemic pushed back the filing deadline for federal income taxes two years in a row, taxes for the 2021 tax year will once again be due in April.

Circle April 18, 2022, on your calendar because thats the one general date by which most filers need to get returns into the IRS. While taxes are typically due on April 15, this years Tax Day falls on Emancipation Day, a legal holiday observed in Washington, D.C. As a result, most filers will have until the next business day, April 18, to submit their tax returns.

However, you may have a different deadline if you filed for an extension or if you are a corporation. Heres a rundown of all the deadlines you need to keep track of.

Given fluid tax filing rules its important to ensure your investments are protected. A financial advisor can help you make sure your tax filings dont unnecessarily hurt your assets.

You May Like: Why Do I Owe Taxes This Year 2021

Estimated Tax Payment Deadlines For Us Citizens Overseas

If you’re living outside the U.S. and usually owe U.S. taxes, you may need to make quarterly estimated tax payments to the IRS. An expat tax expert can help you figure those quarterly payments so you can avoid end-of-year penalties.

Quarterly Income and Expat Self Employment Tax Deadlines

| 1st installment quarterly income and self-employment taxes |

| 4th installment quarterly income and self-employment taxes |

How Are Individuals Affected By The Tax Deadline Extension

The tax extension deadline generally applies to all calendar year tax-paying entities, including individuals, self-employed persons, and trusts and estates. The Treasury and IRS announced the deferment of filing your federal tax return as well as specific federal tax payments. This delay in payment comes interest- and penalty-free, for 90 days, until July 15, regardless of the amount owed.

Furthermore, anyone who needs to make quarterly estimated tax payments also has until July 15 to submit these payments. This means your 2020 tax year first and second quarter estimated tax payments, previously due on April 15 and June 15, are now both deferred until July 15.

Recommended Reading: How To Know If Your Taxes Are Filed