Do You Need To Repay Cerb And Other Covid Benefits By The Tax Deadline

You do not. If youve received financial assistance you werent eligible for, youll have to return the money to the government. However, that process is separate from your tax return. So far, the CRA has not specified when repayments of federal COVID-19 benefits received in 2020 are due.

Still, unless you paid back the funds before the end of 2020, any income support you received last year will show on your tax slips. Youll have to report the income on your 2020 tax return and may have to pay income tax on it. This raises the possibility youll pay tax on 2020 benefits that youll eventually have to pay back. If this happens, the CRA will eventually make you whole but you may have to wait until you file your 2021 tax return in the spring of 2022 until that happens.

Any repayments made in 2021 will be recognized on a T4A slip for 2021, which will allow the individual to claim a deduction on the 2021 income tax and benefit return, the CRA told Global News via email.

The process is based on general tax rules in the Income Tax Act that apply to repayments of taxable income, the CRA has previously told Global News.

READ MORE: How much could you save with the Liberals $400 home office deduction?

The Taxation And Revenue Department Encourages You To File Electronically Whenever You Can

Electronic filing is safe and secure, and it offers the fastest service for a refund. Access online filing to file over the internet at no charge . You may choose to file electronically through your tax preparer or by using approved software on a personal computer. Individuals who both file and pay their income tax electronically using our website, a personal computer or a tax professional have an extended filing deadline of April 30. If April 30th is on a Saturday, Sunday or legal state or national holiday, the due date is the next business day.

The Department offers two ways to file a return electronically, both allowing you to file either a refund return or a tax-due return. File electronic returns through the Departments internet website or the Federal/State Filing Program. Certain restrictions on who may file and the types of returns eligible for electronic filing depend upon the electronic filing program used by the Taxation and Revenue Department and Internal Revenue Service websites contain information about the electronic filing options.

You may pay taxes over the internet with Visa, MasterCard, Discover or American Express cards. A convenience fee covers the costs that the companies bill the state when a credit card is used. There is no charge if you pay by electronic check. An electronic check authorizes the Department to debit a checking account in the amount and on the date specified.

For additional information refer to our forms and publications.

Latest News

You May Want To File Even If Youre Not Required To

If youll receive a tax refund, you should file a tax return even if youre not required to.

If youre not required to file taxes but you withheld taxes throughout the year, you can get that money back when you file your tax return.

You may also be eligible for refundable tax credits that will give you a tax refund even if you dont owe taxes. These credits include the Earned Income Tax Credit, the Child Tax Credit, and the American Opportunity Tax Credit.

If you didnt receive your first, second, or third stimulus checks or didnt get the full amount that youre eligible for, you can claim the stimulus checks when you file a tax return.

If youre not sure if you withheld taxes or qualify for tax credits, you may want to file a tax return anyway to avoid missing out. You have up to three years to file previous years taxes and/or claim past tax credits.

Don’t Miss: Do I Have To Pay Taxes On Social Security Income

How Can I Speak To Someone From The Irs

You can from 7 a.m. to 7 p.m. local time, Monday through Friday, at 800-829-1040 for individuals. Hearing-impaired individuals can call the IRS at 800-829-4059. You should be prepared with your Social Security number and birthdate , your filing status , a prior year’s tax return, the tax return you’re calling about , and any mail you’ve received from the IRS.

The IRS can only handle certain topics by phone, with some areas, including depreciation, capital gains and losses, education, health care, trusts, and specific forms being excluded from phone correspondence. See the full list here of topics that the IRS cannot address by phone.

Rettig warned, “Our phone volumes continue to remain at record-setting levels. We urge people to check IRS.gov and establish an online account to help them access information more quickly. We have invested in developing new online capacities to make this a quick and easy way for taxpayers to get the information they need.”

Related: 50 Accounting Puns for CPAs, Accountants, and Anyone Who Needs a Laugh During Tax Season

Is The Irs Doing Paper Returns

While the IRS will accept paper tax returns for 2021 taxes, they warn that because of COVID-19, e-filing will be easier and more efficient for everyone involved.

“The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays,” IRS Commissioner Chuck Rettig said in a statement. “Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year. And we urge extra attention to those who received an Economic Impact Payment or an advance Child Tax Credit last year. People should make sure they report the correct amount on their tax return to avoid delays.”

Read Also: How Much Do You Make To Have To File Taxes

Why You May Owe More Taxes This Year:

The first round of emergency benefits Ottawa rolled out during the pandemic did not have any tax withheld at source. If you received either the CERB or the Canada Emergency Student Benefit , youll have to include 100 per cent of those payments in your 2020 tax return.

How much tax youll actually end up paying depends on your overall income for 2020. For example, if you made $27,000 from work in 2020 and received $8,000 worth of CERB, your taxable income for the year would be $35,000. Both the income you received from CERB and your job would be taxed in the same way.

Its possible you wont have to pay any tax at all.

If youre under $12,000 in total income for the year, you dont have to worry about any income taxes next year, Frank Fazzari, a chartered professional accountant at Vaughan, Ont.-based Fazzari + Partners, previously told Global News.

READ MORE: It didnt seem right Class-action lawsuit proposed over CERB repayments

With the second round of COVID-19 benefits that became available in September the CRB, the Canada Recovery Sickness Benefit , and the Canada Recovery Caregiving Benefit the government has been withholding 10 per cent in tax at source. This, however, may be insufficient to cover your tax liability, Jamie Golombek, managing director of tax and estate planning with CIBC Private Wealth Management, has warned.

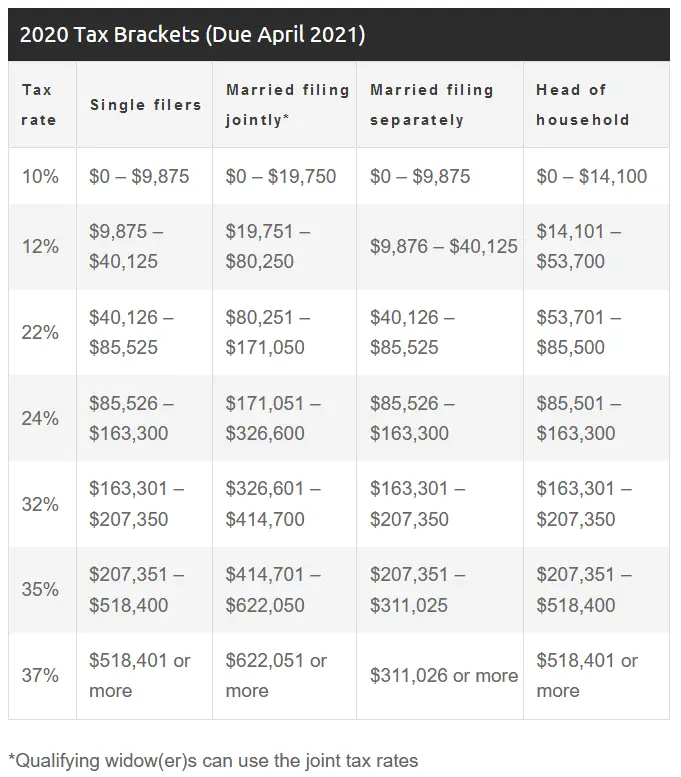

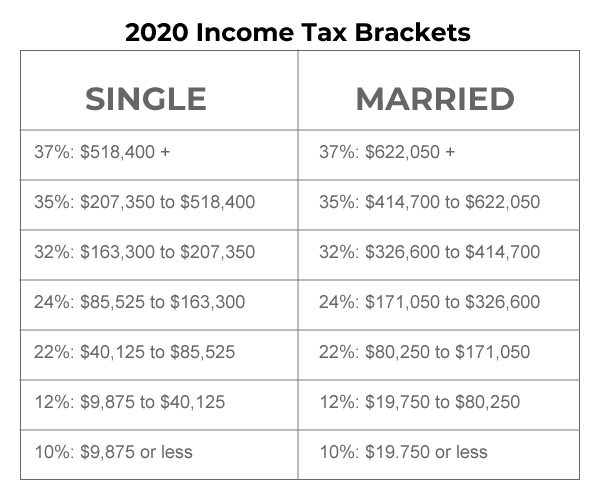

Understand How Your Taxes Are Determined

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

The progressive tax system in the United States means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

Also Check: Where To Mail Your Federal Tax Return

Individual Income Tax Filing Due Dates

- Typically, most people must file their tax return by May 1.

- Fiscal year filers: Returns are due the 15th day of the 4th month after the close of your fiscal year.

If the due date falls on a Saturday, Sunday, or holiday, you have until the next business day to file with no penalty.

Filing Extensions

Can’t file by the deadline? Virginia allows an automatic 6-month extension to file your return . No application is required. You still need to pay any taxes owed on time to avoid additional penalties and interest. Make an extension payment.

About The 2022 Delaware Relief Rebate Program

The 2022 Delaware Relief Rebate Program was created by House Bill 360. This legislation created a relief rebate, which is a one-time direct payment of $300 per adult Delaware resident. This relief is intended to promote the general welfare of Delawareans emerging from the Covid pandemic and facing higher prices at the grocery store and gas pump.

In May of 2022, the Delaware Department of Finance began issuing one-time payments of $300 to individuals who had already filed their 2020 Delaware resident personal income taxes by the due date. Throughout the Summer and early fall, over 780,000 payments were made to adult residents who timely filed 2021 tax returns and to other individuals, age 18 and older identified via other State agency data.

You May Like: Do I Have To Report Stimulus Check On Taxes

What Happens To My Tax Deadlines If I Live In An Area Impacted By A Natural Disaster

If you need more time because you live in an area hit by a natural disaster, you might qualify for tax relief from the IRS. The IRS often postpones the tax filing deadline for taxpayers who live in or have a business within a federally declared disaster area.

For example, the IRS announced it would postpone tax filing and tax payment deadlines for taxpayers affected by the September 2020 California wildfires.

Child Tax Credit 2021 Recovery Rebate Credit And Other Tax Benefits

IRS Free File is the fastest and easiest way for taxpayers to claim the child tax credit, 2021 recovery rebate credit, and other tax benefits such as the earned income tax credit.

People who received one or more advance child tax credit payments in 2021 should carefully review their tax return for accuracy before filing to avoid processing delays. Families who received advance payments will need to compare the advance payments they received with the amount they can properly claim on their 2021 tax return.

In late December, the IRS started sending Letter 6419, 2021 Advance CTC, to taxpayers who received an advance child tax credit payment. The letter contains the total payment amount that the individual needs to file accurately and avoid a processing delay. People who received advance payments can also view their payment amounts on their IRS online account available on IRS.gov.

The IRS is sending Letter 6475, Your Third Economic Impact Payment, to individuals who received a third Economic Impact Payment in 2021, including initial and “plus-up” payments. Most eligible people already received their Economic Impact Payments. This letter will help them determine if they are eligible to claim the 2021 recovery rebate credit for missing third payment. If so, they must file a 2021 tax return to claim this credit. Individuals can also securely access IRS online account to view the total amount of their third Economic Impact Payment.

Also Check: Are 2020 Tax Forms Available

When Can I File My 2021 Taxes

FILING tax returns on time and correctly is a hugely important task.

Last year, the deadline was extended from April 15 to July 15 because of the ongoing coronavirus pandemic. No such extension has been granted for this year’s filing date, however.

To make sure you get your return in on time this year, here’s everything you need to know about completing the document.

Capital Gains And A Strong Stock Market

The bulk of the couples income, $4,290,501, was from capital gains, which typically are declared if a claimant sold an asset such as a stock or bond.

James Lawrence, a partner at Traphagen & Traphagen CPAs, an accounting firm in Oradell, said “the three biggest” ways to acquire capital gains are: investments in the stock market which is the traditional way of earning it” selling a house or property, or selling a business.

Is that a normal amount? No, not for normal people. This is a big amount,” he said of Murphy’s tax returns. “He could just have a huge portfolio of investments thats generating capital gains on an annual basis.

Related:Phil Murphy’s income dropped during the COVID-19 pandemic, avoiding millionaires tax

Lawrence went on to say that based on the dividends displayed on the return he assumes the governor owns a lot of stock, since 2021 was one of the best years on record for the stock market.

“Everyone had capital gains, so he probably had the same issue, just at a larger level,” Lawrence said.

According to a summary provided by Murphys office, the governor had a taxable income of $947,826 in 2020, the lowest amount he earned since taking office in 2018. One of the reasons for the drop-off was fewer sales of assets such as stocks that would lead to income gains, Murphy’s office said at the time.

Lawrence said that steep increase in income last year, roughly $4 million, is most likely attributable to the stock market.

Read Also: What Investments Are Tax Free

The 2021 Tax Deadline Extension: Everything You Need To Know

OVERVIEW

In response to the Coronavirus pandemic, the Treasury and IRS issued new instructions that call for a tax deadline extension, moving the customary April 15 deadline to May 17, 2021. Read more to learn about the relevant details and how they impact your situation.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Tax Day For Maine And Massachusetts Residents

Residents of Maine and Massachusetts got an extra day this year until April 19 to file their federal income tax return. Why? Because Patriots Day, an official holiday in Maine and Massachusetts that commemorates Revolutionary War battles, fell on April 18 this year. So, for the same reason Tax Day was moved from April 15 to April 18 for most people , the IRS couldnt set the tax filing and payment due date on April 18 for taxpayers in those two states. As a result, the deadline was moved to the next business day for Maine and Massachusetts residents, which was April 19.

Also Check: Can I Get Tax Credit For Leasing Solar Panels

Income Tax Return Filing Dates

- 1 July 2022 to 24 October 2022

- Taxpayers who file online

- Taxpayers who cannot file online can do so at a SARS branch

If you are being auto-assessed, see all the info you need to know on our How does the Auto-Assessment work webpage. If you are not in the auto-assessment group and need to submit a return, see our info for provisional and non-provisional taxpayers on the 2022 Tax Filing Season media release.

You May Like: Why Is My Child Tax Credit Only 500

Tax Filing Season Begins Feb 12 Irs Outlines Steps To Speed Refunds During Pandemic

IR-2021-16, January 15, 2021

WASHINGTON The Internal Revenue Service announced that the nation’s tax season will start on Friday, February 12, 2021, when the tax agency will begin accepting and processing 2020 tax year returns.

The February 12 start date for individual tax return filers allows the IRS time to do additional programming and testing of IRS systems following the December 27 tax law changes that provided a second round of Economic Impact Payments and other benefits.

This programming work is critical to ensuring IRS systems run smoothly. If filing season were opened without the correct programming in place, then there could be a delay in issuing refunds to taxpayers. These changes ensure that eligible people will receive any remaining stimulus money as a Recovery Rebate Credit when they file their 2020 tax return.

To speed refunds during the pandemic, the IRS urges taxpayers to file electronically with direct deposit as soon as they have the information they need. People can begin filing their tax returns immediately with tax software companies, including IRS Free File partners. These groups are starting to accept tax returns now, and the returns will be transmitted to the IRS starting February 12.

Last year’s average tax refund was more than $2,500. More than 150 million tax returns are expected to be filed this year, with the vast majority before the Thursday, April 15 deadline.

Also Check: Where Can I Get Taxes Done For Free

How Does The Jackson Hewitt Refund Advance Loan Work

The Jackson Hewitt Loan Advance for 2022, 2023 works with MetaBank to issue refund advances. So depending on your expected refund, you could take out a Holiday, Christmas, or emergency loan for as little as $200 or a loan thats worth as much as $4,000.

It typically takes just a few hours to get your money if youre loading it onto a prepaid debit card. However, take note that direct deposits could take up to five business days.

To be eligible, you must make sure that you have your taxes prepared at Jackson Hewitt, and you must have some form of income verification. The Jackson Hewitt Refund Advance Loan option starts on December 14th and ends on January 17th.