Every Tax Deadline You Need To Know

OVERVIEW

Make sure your calendars up-to-date with these tax deadlines, dates, possible extensions and other factors in play for both individuals and businesses in 2022.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

|

Key Takeaways Individual income tax returns are due April 15, unless the date falls on a weekend or holiday or you file Form 4868 seeking an extension until October 15. Independent contractors, gig workers, and self-employed people must also meet quarterly estimated tax filing deadlines. Small businesses must file their tax return either by March 15 or the 15th day of the third month following the close of their tax year, unless the date falls on a weekend or holiday or you file Form 7004 seeking an extension until September 15 . |

Will My Refund Be Issued By Paper Check Or Electronically

Previously, the Department might have issued you a paper check, even if you selected to receive your refund by direct deposit or prepaid debit card. This protection helped the Department avoid sending your money to an account or debit card that is controlled by a criminal.

While the Department honors taxpayer requests to issue a refund electronically, there may be situations in which we will determine its safer to issue a paper check. In some cases, we may send a letter requesting verification of taxpayer identity instead of automatically changing your request to a paper check. The letter instructs you to go to myVTax, select Return filing verification, and enter the verification code included on the letter. This verifies your request and allows us to proceed with processing your refund.

The Irs Recommends Filing Your Taxes Early

According to the IRS, you should file your taxes early so you can avoid delays when waiting for your tax refund. This means youll get your tax refund the fastest way possible!

With an estimated 153 million tax returns expected to be filed, 80% of which will be submitted through online tax software, its always better to start as soon as possible and avoid any system downtime or painful delays.

Recommended Reading: When Are Llc Tax Returns Due

What Is The Tax Year 2020

A list of tax season 2021 e-filing Tax Day deadlines are below the dates are for Tax Year 2020 income tax returns or ITRs.

What happens if taxes are late?

Late-filing penalties can mount up at a rate of 5% of the amount due with your return for each month that youre late. If youre more than 60 days late, the minimum penalty is $100 or 100% of the tax due with the return, whichever is less. Filing for the extension wipes out the penalty.

Is it better to claim 1 or 0?

Gather Tax Filing Information

Youll need to do this whether youre hiring a tax preparer or doing the tax filing yourself. The goal is to gather proof of income, expenses that might be tax-deductible or win you a tax credit, and evidence of taxes you already paid throughout the year. Our tax prep checklist has more guidance, but heres a short version of what to round up:

-

Social Security numbers for yourself, as well as for your spouse and dependents, if any.

-

W-2 form, which tells how much you earned in the past year and how much you already paid in taxes.

-

1099 forms, which are a record that some entity or person not your employer gave or paid you money.

-

Retirement account contributions.

-

State and local taxes you paid.

-

Educational expenses.

Recommended Reading: Do Puerto Ricans Pay Federal Income Tax

When Can I File My Taxes

Each year, the IRS issues a statement in early January with the first day to file taxes.

Typically, the official date when you can file taxes falls in mid to late January.

The IRS announced it will start processing tax returns Feb. 12. Worried about waiting weeks for your refund? We can do your taxes now and when you file at Block, you could get a Refund Advance up to $3,500 today. No waiting on the IRS. No loan fees and 0% interest.

My Girlfriend Was A Waitress While In School She Graduated And Became A Nurse In April 2021 The Change In Income Made It So She No Longer Qualified For Marketplace But Forgot To Cancel Irs Is Asking For $4000 For The Months She Used Marketplace With Higher Income Anything We Can Do

While we were studying, both of us were waiters. She graduated and became a nurse in April 2021. She qualified for health care marketplace because of her income when waitressing. When she became a nurse, she started earning a lot more and no longer qualified. Her 2021 tax return is penalizing her for using marketplace for months April – December when her income was ~5k per month. Tax bill is $360 * 9, the 9 months she wasn’t qualified. Bill is coming to about $3,500.

Note: Her tax return was extended and then it took more time due to Hurricane Ian and other things. We are okay on time, says the IRS.

I generally wanted to see if anything could be done about this. It was an accident and she was paying for health care through her employer, as well. Right now, I want to try and help her avoiding having to essentially pay twice for health care. Turbo tax and a family friend tax employer said the same thing about the bill.

I realize it was our mistake but it doesn’t seem fair that she would have to pay for health care twice, neither of which she used, and also because we forgot to consider this during transitioning from in school to graduated with a new job.

Also Check: Will The Tax Deadline Be Extended

Its Better To File Late Than Not At All

You might be thinking, âIf Iâve already missed the deadline, whatâs a few more weeks?â But the sooner you submit your tax return, the better . So do your best to file the next day or soon thereafter.

If you earn $72,000 or less per year, you can file your return online using one of the IRSâ free federal tax filing options, which provide complimentary tax preparation software. If you earn more than $72,000, you can still file online using the IRSâ free electronic forms, but youâll need some tax-prep knowledge if you choose to go this route.

How Do I File A 2021 Tax Return On Efiling

How to use SARS eFiling to File Income Tax Returns

Recommended Reading: How Much Taxes Do You Pay On Slot Machine Winnings

What Forms Are Required With An Electronically Filed Amended Return

The electronic Form 1040, 1040-SR, and 1040-NR Amended Returns will require submission of ALL necessary forms and schedules as if it were the original submission, even though some forms may have no adjustments.

The Form 1040-SS/PR Corrected returns will require submission of ALL necessary forms and schedules as if it were the original submission, even though some forms may have no adjustments. Note that Form 1040-X will not be attached to Form 1040-SS/PR.

After You File Your Tax Return

Get your notice of assessment, find out the status of your refund, or make a change to your tax return

To provide feedback on your filing experience or any other CRA service, go to Submit service feedback – Canada.ca

To formally dispute your notice of assessment or reassessment, credit or benefit decision, you may want to file a notice of objection. To find out if this option is right for you, go to File an objection

Recommended Reading: How Long To Keep Tax Records

Amended Returns Must Be Filed By Paper For The Following Reasons:

When Can I Do My Taxes For 2021

Even though taxes for most taxpayers are due by April 15, 2021, you can e-file your taxes earlier. The IRS likely will begin accepting electronic returns anywhere between Jan. 15 and Feb. 1, 2021, when taxpayers should have received their last paychecks of the 2020 fiscal year.

Is Tax Day Extended 2021?

The federal tax filing deadline for 2020 taxes has been automatically extended to May 17, 2021.

What is the due date for federal income tax this year?

Though last year the IRS extended the deadline from April 15 to July 15, this year the agency granted us one extra month, and for most people, 2020 taxes came due on May 17, 2021. If you requested an extension and were approved, your last day to file is Oct. 15, 2021.

Recommended Reading: Where Can I File Taxes For Free

Can I Pay My Tax By Credit Card

Yes, you can pay your tax bill with credit in a variety of ways. Credit card and bank loans are both payment options. You can apply for a bank loan, home equity loan or take a cash advance on a credit card to pay your tax bill.

Third party providers like Official Payments Corporation are also available to facilitate using a credit card to pay your tax bill.

- These companies charge a convenience fee for their service.

- That fee is in addition to any interest and finance charges your credit card company may charge you.

Always Start At Irsgov:

- From the homepage, select File Your Taxes for Free.

- Use the IRS Free File Lookup Tool to narrow the list of providers or the Browse All Offers page to see a full list of providers.

- Follow the link to the chosen IRS Free File provider’s website.

Taxpayers who requested the six-month filing extension should complete their tax returns and file on or before the October 17 deadline.

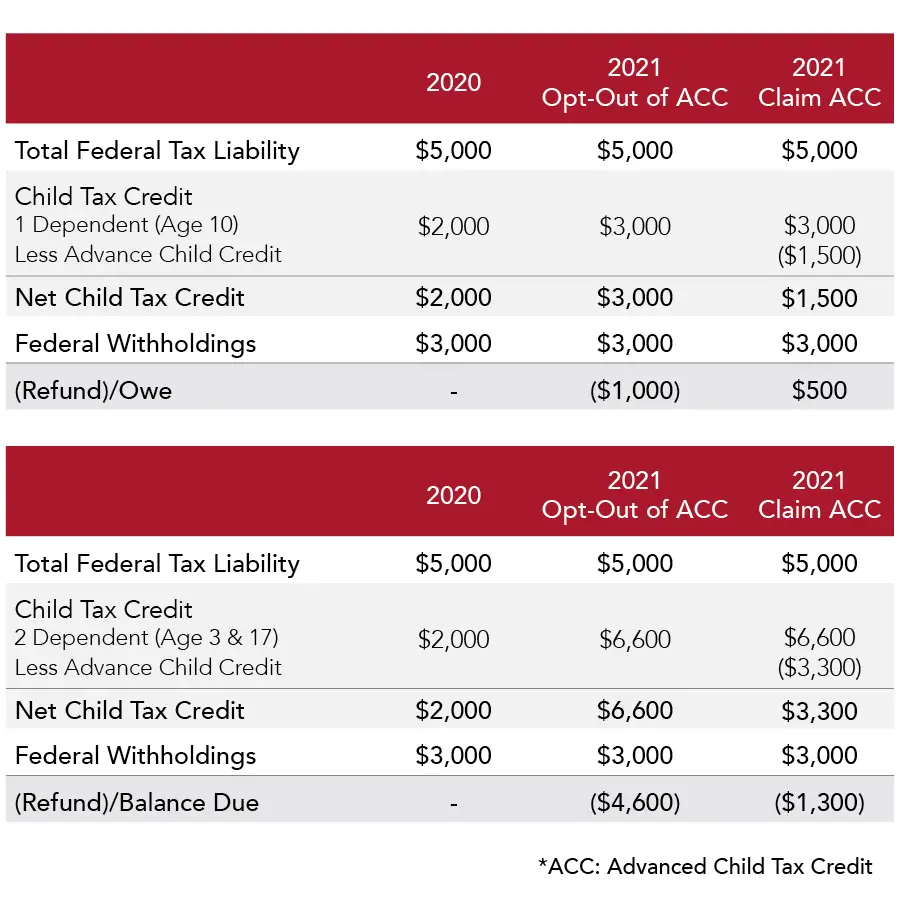

The IRS Free File program gives eligible taxpayers an opportunity to file their taxes and claim the 2021 Recovery Rebate Credit, their full Child Tax Credit, the Earned Income Tax Credit or other valuable credits for which they qualify. The IRS reminds taxpayers that the fastest way to get a tax refund is to file electronically and choose direct deposit.

Prior year returns can only be filed electronically by registered tax preparers for the two previous tax years. Otherwise, taxpayers must print, sign and mail prior year returns.

The IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications lists qualified local preparers.

Recommended Reading: Can I File My Taxes For Free

Irs Reminds Taxpayers Of Upcoming Filing Extension Deadline Free File Remains Open Until Nov 17

IR-2022-179, October 14, 2022

WASHINGTON The Internal Revenue Service reminds taxpayers today that those who requested an extension of time to file their 2021 income tax return that the deadline is Monday, October 17. IRS Free File remains open until November 17 for those who still need to file their 2021 tax returns. This includes those who qualify for the Child Tax Credit, Recovery Rebate Credit or Earned Income Tax Credit but haven’t yet filed a 2021 tax return to claim them.

IRS Free File is a public-private partnership between the IRS and tax preparation software industry leaders who provide their brand-name products for free. There are eight Free File products available in English and two in Spanish.

IRS Free File provides two ways for taxpayers to prepare and file their 2021 federal income tax return online for free:

- IRS Partner Sites. Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. Individual taxpayers whose adjusted gross income is $73,000 or less qualify for any IRS Free File partner offers. Free File lets individuals electronically prepare and file their federal income tax online using guided tax preparation.

What If I Made A Mistake And Need To Re

It happens. You file your tax return, then realize you forgot to report some income or claim a certain tax credit. You don’t need to redo your whole return. Along with filing an amendment using Form 1040-X, youll also need to include copies of any forms and/or schedules that youre changing or didnt include with your original return.

IRS Form 1040-X is a two-page form used to amend a previously filed tax return. TurboTax can walk you through the amendment process to correct your tax return.

To avoid delays, make sure you only file Form 1040-X after youve already filed your original Form 1040. If youre filing a Form 1040-X to collect a tax credit or refund from a previous year, youll need to file within three years after the date you timely filed your original return, or within two years after the date you paid the tax, whichever is later.

Also Check: Does Florida Tax Retirement Income

What To Prepare Before Filing Starts

Now is a good time to get your tax matters ready to ensure a smooth filing experience! Make sure that you have received your IRP5/IT3s and other tax certificates like medical certificate, retirement annuity fund certificate and any other 3rd party data that are relevant in determining your tax obligations. Reset your eFiling username and password if you have forgotten them. Update your personal information such as banking details, address and contact details online on eFiling or the SARS MobiApp.

Follow us on Social Media for daily Tax Tips or keep an eye on this webpage for all the information.

Whats The Fastest Way To Receive My Refund

Step 1: E-file your taxes. That gets the information into the IRS system a lot faster than paper filings. Also, if you were eligible for an economic impact payment but didnt receive it youll have to file a tax return to claim the recovery rebate credit, even if you arent normally required to file.

Step 2: Make sure youve signed up for direct deposit, as the IRS says that can significantly speed up your refund. It also adds more flexibility. Your refund can be split into up to three separate accounts, including individual retirement accounts.

You May Like: Are Refinance Points Tax Deductible

What Is The Penalty For Failing To Pay Taxes

The failure-to-pay penalty is 0.5% of the unpaid taxes per month, with a full monthly charge even if the taxpayer pays before the end of the month. For individual taxpayers, if a return is filed on time with an approved installment agreement the penalty is 0.25% during the agreement period. However, if tax is not paid within 10 days of a notice of intent to levy or seize property the penalty is 1%. The penalty will be recurring until the tax is fully paid or until the maximum of 25% is reached.

In addition to the penalties, the IRS will start charging interest on any unpaid balance of taxes owed which will accrue and compound daily from 17 May until the balance is paid in full. The current interest rate for underpayments is 3% which is calculated using the federal short-term rate plus three percentage points. Any outstanding penalties will also accrue interest while they remain outstanding so it is vital that you complete your tax return on time.

#TaxDay Goooaaalll: Use your head by filing electronically and choosing Direct Deposit. If your goal is to get extra time, file for an extension by midnight tonight to get until October 15. And thanks to all the accountants on and off the field!

IRSnews May 17, 2021

Incomes Above $7: Free Fillable Forms

Want to do things the old-fashioned waybut with digital conveniences?

The IRS also offers Free Fillable Forms. Absolutely everyone can use these with no income limit.

These are exactly what they sound like: Electronic copies of the IRSs standard paper tax forms. These forms will do some basic math calculations for you when you plug in numbers, but thats all the help youll get. Theres no user-friendly interview process that will walk you through everything.

However, these are still easier than dealing with standard paper forms. When youre done, you can e-file right from the IRSs website. You dont have to print or mail anything.

Note that the IRS only offers federal tax forms. Youre on your own for state tax forms. Your state tax agencys website may offer its own free fillable forms on its website, but thats up to your state.

A few of these electronic forms have some minor limitations that will affect people in rare situations. For example, the electronic version of Form W-2G for certain gambling winnings will only let you insert 30 W-2Gsno more. If you need to enter more, youll have to use a different program or do it on paper. Heres a list of available forms and limitations on the IRSs website.

This guide is similar to our guide for filing 2019s taxes last year. Not a lot has changed. But every year, we especially like to highlight the IRS Free File Program and remind people that you can do your taxes for freeif you know the secret. Pass it on.

Read Also: How Much Does H& r Block Cost To File Taxes