Keep Your Cra Information Up

File your taxes online or by paper, or find other options such as having someone else complete them for you:

File your tax return online or mail us your completed tax return to your tax centre

Security Of Personal Information

We accept responsibility for the security of information once we receive it. We take precautions to ensure that there is no unauthorized access to your data, and ensure the confidentiality of data you send using NETFILE. We use sophisticated security and encryption to protect this website and your personal information.

We are also responsible for making sure personal and financial information is sent in an encrypted format between your computer and our servers. This ensures that computer hackers and other Internet users cant view or alter the data you send to us.

Tax software companies whose products are certified for NETFILE are not representatives of the CRA. You are not obliged to send personal information directly to the tax software company when you ask for software assistance. Email is not a secure method of communication. Sending personal information by email is a big concern and increases the risk of identity theft.

When Will I Get My Refund From The Irs

Ah, the critical question! The IRS estimates people who file as soon as tax season opens will get their refunds by the first week of March. The organization is hoping to issue them as quickly as possible in the pandemic to help people whose jobs were impacted last year.

The IRS says more than nine out of every 10 refunds are issued within three weeks of the day the return is filed. The best place to track where things stand is with the Wheres My Refund? tool, which updates the status of tax refunds daily.

Don’t Miss: Where Can I Get Tax Refund Advance

Tax Deduction Vs Tax Credit

A and a both work to reduce the total amount of tax you pay.

Deductions reduce the amount of your income that is taxable. For example, the renters deduction in Indiana reduces the taxable income of a person who pays rent for his home by a maximum of $3,000. The renter would subtract the amount he paid for rent, or $3,000 from his income. .

Once you have determined the taxable income you received for the year, you may be able to apply tax credits. Tax credits reduce the amount of the tax you must pay. For example, if you made a charitable contribution to an Indiana college or university , you can subtract one-half of the contribution or $100whichever is lessfrom the amount of the Indiana adjusted gross income tax that you owe for the year. .

Many Taxpayers Have Been Getting Letters From The Income Tax Department About Tax Calculation Differences But Not All Such Letters Demand Additional Payment

Now that you have filed your income tax return and we hope that you did by July 31you need to check your mailboxphysical and digitalto see if you have received any messages from the income tax department.

Since the I-T department processing is now fully automated, your post-filing returns are processed at the departments centralised processing centre . That means that most communications are computerised. During the process, you may receive intimations and notices from the department under different sections.

Remember, it can just be an intimation, where you may not have to do anything, but in certain cases you may have to be proactive.

Why does the I-T department send an intimation?

After filing your ITR, you need to either e-verify it or send the signed copy of ITR-V to the CPC within 120 days of the date of filing to complete the process from your end.

Once you verify the return, you get an email confirming the receipt of return. Following this, the processing is initiated and in the first step, the submitted return is checked for mistakes and discrepancies.

There is a limit to sending such notices. The intimation letter under Section 143 cannot be sent after expiry of nine months from the end of financial year, said Yeeshu Sehgal, head of tax markets, AKM Global, a tax and consulting firm.

Act, reply or just keep quiet?

You are not required to act or reply on each and every intimation.

Don’t Miss: Can I File My State Taxes Separately

See What Tax Deductions You Qualify For

Everyday business expenses arent the only deductions self-employed workers can take to reduce their taxable income. If you contribute to a traditional IRA, SEP-IRA or SIMPLE IRA, those payments may also be deductible. The same goes for payments to a health insurance plan for yourself and any dependents.

Is There A One Time Tax Forgiveness

One-time forgiveness, otherwise known as penalty abatement, is an IRS program that waives any penalties facing taxpayers who have made an error in filing an income tax return or paying on time. This program isn’t for you if you’re notoriously late on filing taxes or have multiple unresolved penalties.

Also Check: How To Fill Out Tax Forms

What Do You Need When You File Your 2021 Taxes

Before you begin filing your taxes, gather all of the documentation youll need to successfully complete your filing. Information you need in order to file your taxes include:

- A copy of your 2020 tax return

- Social Security numbers or Individual Taxpayer Identification Numbers for you, your spouse, and any dependents

- Documentation and receipts for your 2021 income, including:

- Social Security benefits

“Not sure what documents you need to bring? A tax pro can help you determine which forms apply to you. Rest assured that many forms will be sent to you automatically by January 31 of the tax filing season. For example, employers are required to send W-2 forms by January 31.

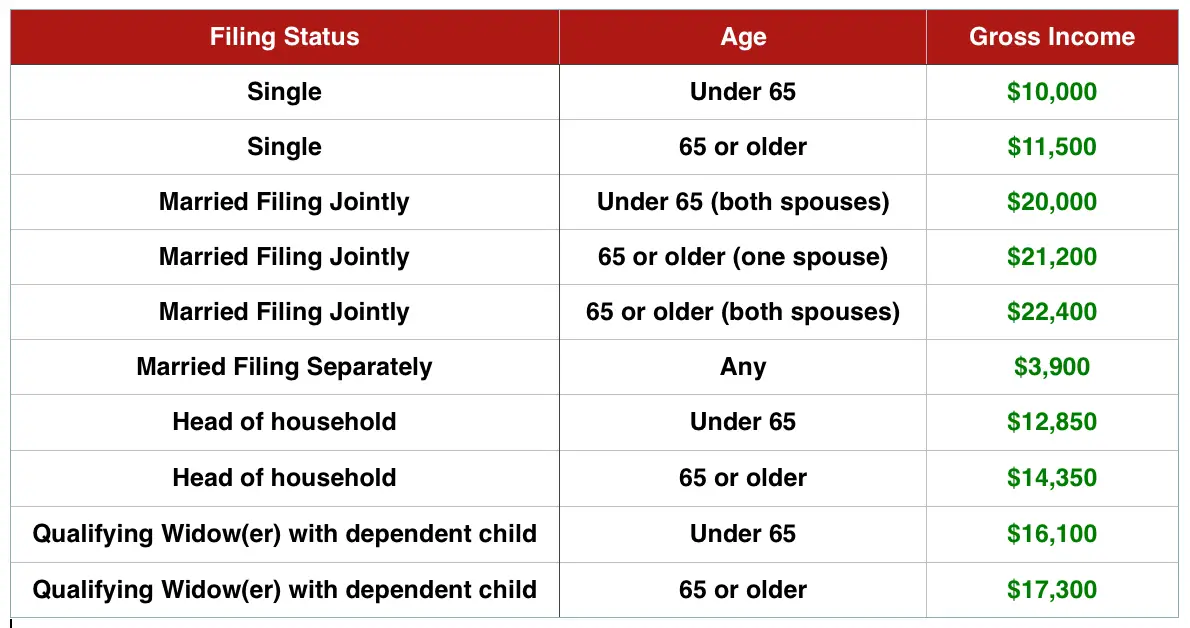

Do You Need To File This Year

First things first, lets figure out if you even need to file. This will depend on your income, age and filing status. For instance, if youre not married, younger than 65 and your gross income was less than $12,400, you dont need to file this year. On the other hand, if that income was from self-employment, this would be considered a special situation, and youd be required to file your tax return.

Not sure if you need to file? The IRS has a convenient tool to help you determine that. Just answer a few simple questions.

You May Like: When Do I Have To Pay My Taxes By

Watch For Your Income Documents To Arrive

You should receive forms about how much income youve earned from your employers and other income sources in January or February. If you are a full-time employee, you will receive a Form W-2 detailing your earnings, as well as which taxes were withheld. If you work freelance or on a contract, you may receive a Form 1099-NEC detailing what you earned. You may also receive documents showing dividends or interest earned on investments , or student loan interest youve paid . If youre a college student , youll receive a Form 1098-T that shows how much you paid in tuition, as well as any amounts you received from grants or fellowships, to help you figure out deductions and credits related to education expenses.

Members Of The Military

If youre stationed outside the United States or Puerto Rico on May 1, you have until to file your return and pay any taxes you owe.Enclose a statement explaining that you were out of the country, and write Overseas Rule on the top of your return and on the envelope.

Combat ZoneIf youre serving in a combat zone, you receive the same filing and payment extensions allowed by the IRS, plus an additional 15 days, or a 1-year extension from the original due date. If you claim this extension, write Combat Zone on the top of your return and on the envelope. For more information, see Tax Bulletin 05-5. Extensions also apply to the spouses of military members who are serving in combat zones.Military Deployment Outside the United States Combat or NoncombatIf youre deployed to military service outside the U.S., youre allowed a 90-day filing extension following the completion of deployment. If youre using this extension, write Overseas Noncombat on the top of your return and the envelope.Note: If youre deployed in combat service, you can use whichever extension is more beneficial for you .

Don’t Miss: How To Calculate Taxes Taken Out Of Paycheck

Chat With Charlie Unread Messages

The Educator School Supply Tax Credit and the Return of Fuel Charge Proceeds to Farmers Tax Credit have received Parliamentary approval. This means that the CRA can now process your 2021 income tax and benefit return if you claimed these credits. Contact Us if you have questions.

Find out what’s new for the 2021 tax season and your filing and payment due dates. Begin by gathering your documents to report income and claim deductions, and choose how you want to file and send your completed tax return to the CRA.

Is It Worth Itemizing Charitable Deductions This Year

Charitable donations, for a while, seemed like a major headache when it came to reducing your tax liability after the sweeping tax law changes of 2018. The CARES Act, though, makes them worth considering once more. The legislation allows you to deduct up to 100% of your adjusted gross income, though you will need to itemize the deductions.

If youre taking a standard deduction, you can write off up to $300 in cash deductions.

Also Check: When Do I Pay Taxes On Stocks

What Is Irs Forgiveness Program

The IRS debt forgiveness program is an initiative set up by the Internal Revenue Services to facilitate repayments and to offer tools and assistance to taxpayers that owe money to the IRS. Only certain people are entitled to tax debt forgiveness, and each person’s financial situation needs to be assessed.

Get An Extension When You Make A Payment

You can also get an extension by paying all or part of your estimated income tax due and indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System , or a . This way you wont have to file a separate extension form and you will receive a confirmation number for your records.

Recommended Reading: How Do I File My Taxes With Turbotax

Recommended Reading: How Much Is Tax In Georgia

How And When To Pay Your Bill

You dont need to pay your Self Assessment tax bill immediately.

The deadline for paying any tax you owe in addition to tax you may have paid through your 2021 to 2022 Payments on Account and your first 2022 to 2023 Payment on Account is 31 January 2023.

If you file your tax return early, you will know how much you owe and can then choose a payment option that works for you.

You can now make Self Assessment payments quickly and securely through the HMRC app. You can also check if a repayment is due by checking your personal tax account.

Get Your Federal Tax Refund Fast

Not only have we tried to make it as painless as possible to prepare and file your return, filing electronically will also get your tax refund much faster. After all, it’s your money. Why wait any longer than necessary to get it back.

At E-file.com, we work to get your federal tax refund as fast as possible thanks to the electronic filing program with the IRS. Filing electronically with the IRS and selecting to have your refund direct deposited to your bank allows you to get your refund as fast as possible.

Don’t Miss: How Many Years Of Taxes To Keep

Do My Stimulus Checks Count As Taxable Income

The government sent out checks of $1,200 and $600 to millions of Americans in 2020 as the pandemic shut down most of the country. The good news is those IRS payments do not count as taxable income. The bad news? They are being treated like a refundable tax credit, so theyre similar to an advance on money you would have received as part of your refund.

What Is The Last Day To File Taxes

The last day to file taxes for individual federal income tax returns is April 15, or as late as April 18 in the event Tax Day falls on a Saturday, Sunday or official holiday. Some state-level holidays can extend the tax deadline by one day further. You can request a six-month filing extension through filing Form 4868, making your last day to file individual income taxes October 17, 2022.

If you also file taxes for your small business as a partnership, LLC or S Corp, the last day to file taxes is March 15 unless it falls on a weekend or official holiday. If your business runs on a non-calendar tax year, your federal tax return is generally due by the 15th day of the third month following the end of the tax year.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Also Check: What Is The Penalty For Paying Taxes Late

When Are My 2020 Taxes Due

Youve now got until May 17 to file your taxes, a roughly one month extension from the usual deadline.

Not ready when the deadline comes around? You can file for an extension before that date. Special rules apply to people serving in the Armed Forces who are in a combat zone or contingency operation, or have been hospitalized owing to an injury sustained in such an area. Those individuals have 180 days after they leave the area to file and pay taxes.

A File Taxes Online With Tax Software

If youve used tax software in the past, you already know how to prepare and file taxes online. Many major tax software providers offer access to human preparers, too.

TurboTax, H& R Block, TaxAct and TaxSlayer, for example, all offer software packages or support options that come with on-demand, on-screen or online access to human tax pros who can answer questions, review your return and even file taxes online for you.

The IRS Free File program can get you free online tax preparation software from several tax-prep companies, including major brands. You must have $73,000 or less of adjusted gross income to qualify.

» MORE:See our picks for the year’s best tax filing software

Recommended Reading: How To Get Your Unemployment Tax Form

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Happens To My Tax Deadlines If I Live In An Area Impacted By A Natural Disaster

If you need more time because you live in an area hit by a natural disaster, you might qualify for tax relief from the IRS. The IRS often postpones the tax filing deadline for taxpayers who live in or have a business within a federally declared disaster area.

For example, the IRS announced it would postpone tax filing and tax payment deadlines for taxpayers affected by the September 2020 California wildfires. Taxpayers in that area who extended their 2019 tax returns to October 15, 2020, now have until January 15, 2021, to file those returns.

Recommended Reading: How To File Taxes On Crypto Gains

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

What If I Owe More Than I Can Pay

This year, many people are dealing with financial troubles due to the pandemic, job loss, and other factors. If you’re one of them, you may not have the funds available to pay your tax bill by the deadline. But don’t put off filing just because you can’t afford to pay the amount due on the day you need to file your tax return. The IRS starts charging penalties and interest on the day the return is due, no matter when you file. You can minimize failure-to-file penalties by filing as soon as possible, paying as much as you can when you file, and setting up an installment plan for the balance.

Don’t Miss: What Are My Taxes On My Property