What Could Cause A Refund Delay

There are countless reasons your tax refund could be delayed. Weve outlined some common instances where a delay could occur:

- If you file a paper return, the IRS says you should allow about six weeks to receive your refund.

- If the IRS mails you a physical check, you will receive a check through the mail.

- If you file Form 8379, Injured Spouse Allocation, it could take up to 14 weeks to process your tax return.

- If your identity has been stolen and another return was filed with your social security number, it could take longer for the IRS to sort out the situation.

- If you owe a debt, like unpaid child support, your refund could be offset to pay part or all of it.

Each of the possibilities above could cause a delay or prevent receiving the refund altogether. Its important to note that each individuals tax scenario is unique and no two filings are handled exactly the same.

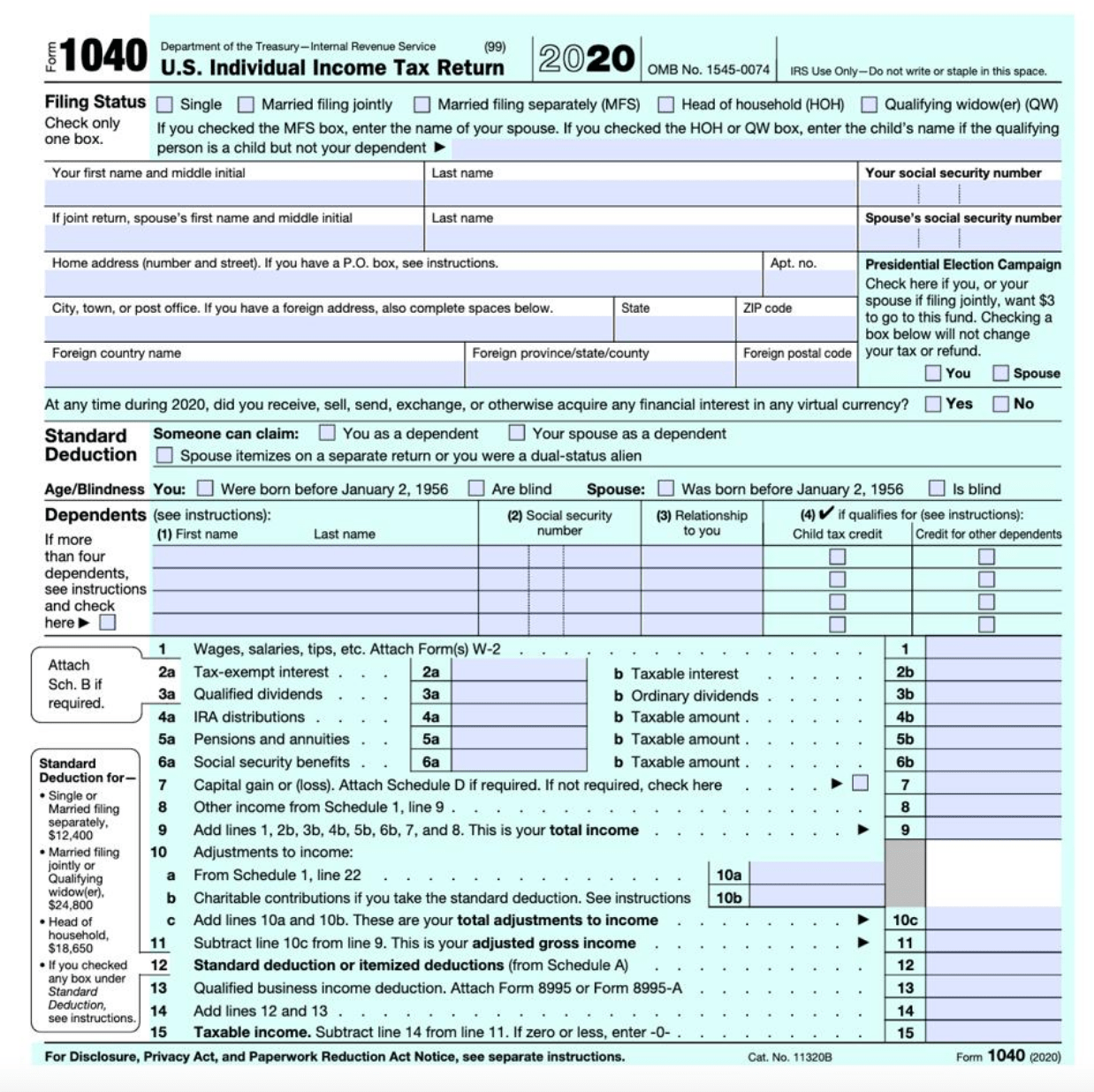

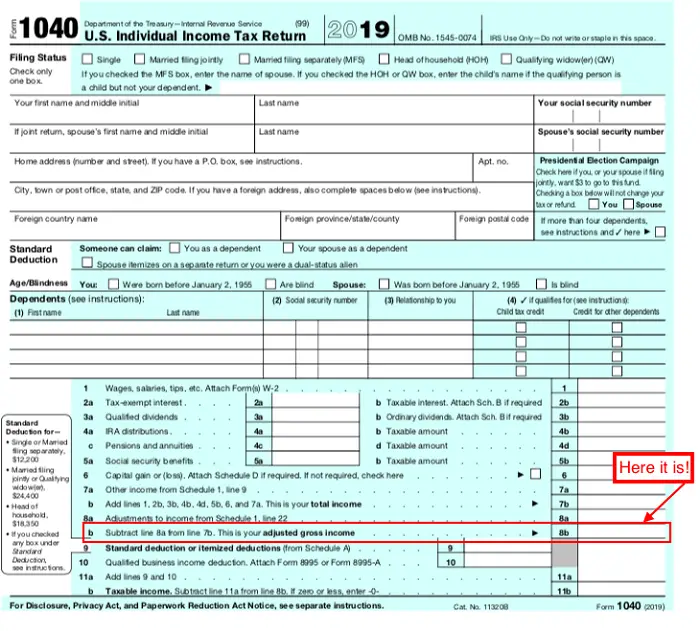

Unemployment Compensation Exclusion Worksheet Schedule 1 Line 8

a. Yes. Stop You canât exclude any of your employment compensationb. No. Go to line 8

Penalties For Not Paying Your Taxes

Even if you file an extension to submit your tax return, you must pay any estimated tax you owe by April 15, 2022. If you do not pay your taxes, you will be charged a penalty and owe interest on any unpaid balance.

The penalty for failing to pay your taxes by the due date is 0.5 percent of your unpaid tax for each month or part of a month that your return is late. This penalty is capped at 25 percent of late unpaid taxes. If you file your return on time and request to pay by an installment agreement, the penalty drops to 0.25 percent for each month or part of a month of the installment agreement.

Youre also charged interest on the unpaid balance, which compounds daily. The rate is set each quarter and is based on the federal short-term rate, plus an additional 3 percent.

If you owe taxes and dont file your return on time, youll be charged a penalty for failing to file. This is usually 5 percent of the tax owed for each month or part of a month your return is late. This penalty is also capped at 25 percent.

You May Like: Who Has To File Federal Income Tax

Should I File A Tax Return Even If It Is Not Required

If you could get a benefit by filing a tax return, you should consider filing a tax return even when not legally required to do so. If you had some tax withholding, you may want to file a tax return to get those benefits back. If you are in the position that you have no filing requirement each year, it may be wise to set all tax withholding to zero.

For the 2021 tax return, there may be two other reasons to file a tax return even if not required:

Another time to file when not legally obligated to is if you are required to file your state return and you want to file it electronically. Sometimes state tax returns will not be processed electronically if a federal tax return is not processed first.

Filing An Amended Return

If you file your income tax return and later become aware of any changes you must make to income, deductions, or credits, you must file an amended Louisiana return. To file a paper amended return:

- Mail an amended return that includes a payment to the following address: Louisiana Department of Revenue

Don’t Miss: Do You Have To File State Taxes In Florida

Help Filing Your Past Due Return

For filing help, call or for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 800-TAX-FORM or for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

What If Someone Else Can Claim You As A Dependent

Different income thresholds apply if someone else can claim you as a dependent, as well as the type of incomeearned or unearned. Your total income might be less than the standard deduction for your filing status. However, you will still need to file a tax return if one of the below situations applies for tax year 2021:

| Unearned Income |

|---|

| 65+ | Yes |

For example, let’s say you’re single, 16 years old, not blind, and your parents claim you as a dependent. You had $13,000 in earned income last year. You would have to file a tax return because that’s more than the threshold of $12,550 for tax year 2021. If all else was the same, but you were blind, you would not have to file because that’s less than the threshold/standard deduction of $14,250 for 2021.

You must also file a tax return if either your unearned or your earned income exceeds the applicable amount for your circumstances. For example, you would have to file a return if you had $1,101 in unearned income, even though you only had $10,000 in earned income, were single and under 65 last year, and someone claimed you as a dependent. You may also have to file if your gross income is greater than the threshold computed for your circumstances. The $5 rule for married taxpayers filing separate returns still applies, as well.

Read Also: Do You Have To File Taxes By April 15th

Why Is It Up To For Greater Than $25000 Or $32000

There is a calculation to determine the exact amount that is taxable above those base amounts.

You can find the exact amount of social security that is taxable by using the IRSs Interactive Tax Assistant, but that doesnt indicate whether or not you have to file a tax return nor does it tell you what you may owe in taxes. You can determine what you may owe in taxes by using an online estimator or by filing a tax return.

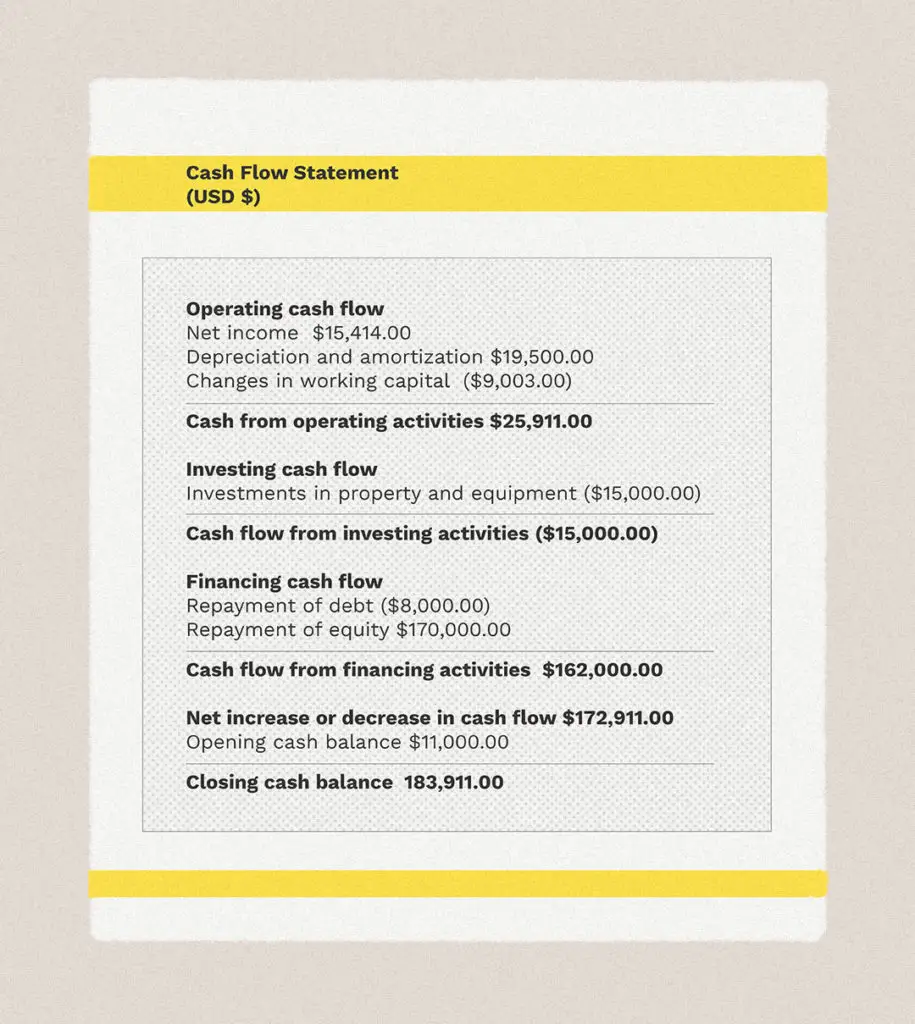

What Are Llc Taxes

Nothing is certain but death and taxes. With a Limited Liability Company, just like any other business entity, you have to pay taxes on your taxable income. This includes all sources of revenue minus money spent on marketing, research, expenses, and the like. How you choose to set up your LLC plays a major role in what you pay during tax time.

LLCs do not have a defined tax structure and instead borrow a tax identity from other business types. This also grants you as a business owner the flexibility to change classifications, although the government typically only allows a switch once every five years.

Read Also: How Does Mileage Work For Taxes

Collect These Documents Before You Start Your Tax Return

The Good Brigade / Getty Images

The challenge of gathering everything you need to file your annual tax return can be either minimal and yawn-worthy or aggravating and time-consuming. How you feel about doing your taxes can depend on your financial situation. You can probably yawn if youre single, rent your home, and work one job, but youll have to dedicate some time to the filing process if youre married, are a single parent with at least one of your children living at home, have investments, are self-employed, or work multiple jobs.

Each of the latter scenarios will require gathering multiple documents.

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

Read Also: How To Pay My State Taxes Online

Do Kids Have To Pay Taxes On Alaska Pfd

PdF money is taxable income, despite the fact that it is not subject to federal income taxes. It is your responsibility to report all profits from your and your minor childs sales tax in order to pay all taxes associated with it.

Pfds And Your Taxes: What You Need To Know

You should know a few things about filing a statement of feild on your taxes. Taxes must be paid on them by either an adult or a child. If you have a federal income tax return, you must include a report of personal financial data. Attach Form 1040 or Form 1040-SR to Line 8f of Schedule 1 PDF and attach Form 1040 or Form 1040-SR to Line 8f of Schedule 1 .

How Much Tax Is Taken Out Of Unemployment Compensation

You can choose whether or not to withhold federal taxes at a rate of 10% if you collect unemployment benefits. Some states may allow you to withhold 5% for state taxes. You may have to pay estimated quarterly payments or pay taxes when you file your annual tax return if you dont have taxes taken out of your unemployment checks. Either way, your unemployment income is considered taxable income, just like any other wages or salaries you receive.

Dont Miss: Can I Check My Property Taxes Online

You May Like: Where Can I File Back Taxes For Free

Earned Income Tax Credit

The earned income tax credit, or EITC, is a federal income tax credit for working people with low to moderate income. If you earned money through wages or self-employment work before losing your job, you might qualify for this credit in the tax year in which you had eligible income.

But unemployment benefits dont count as earned income for the purpose of the EITC, so if you didnt have any earned income in the tax year, you wont be able to claim this credit. Eligibility also depends on other factors, including your filing status, the number of qualifying children you can claim, and the amount of your earned income.

The credit is refundable, meaning that, in addition to reducing the amount you owe, it could give you a refund over the amount of tax you paid in.

Filing Requirements For An Llc Partnership

An LLC that is taxed as a partnership is subject to the same federal income tax return filing requirements as any other partnership. The LLC must file an informational partnership tax return on tax form 1065 unless it did not receive any income during the year AND did not have any expenses that it will claim as deductions or credits.

Thus, an LLC with no business activity that is taxed as a partnership is not required to file a partnership tax return unless there are expenses or credits that the LLC wants to claim.

Recommended Reading: Where To File Taxes Online

What Tax Documents Do I Need If I Bought A House

If you bought a house, keep documents like your closing costs paperwork, mortgage statements, home improvement invoices and receipts , property tax statements, and more. For example, if you were issued a qualified Mortgage Credit Certificate by a state or local government unit or agency, you may be able to a mortgage interest credit.

What If I Owe More Than I Can Pay

This year, many people are dealing with financial troubles due to the pandemic, job loss, and other factors. If you’re one of them, you may not have the funds available to pay your tax bill by the deadline. But don’t put off filing just because you can’t afford to pay the amount due on the day you need to file your tax return. The IRS starts charging penalties and interest on the day the return is due, no matter when you file. You can minimize failure-to-file penalties by filing as soon as possible, paying as much as you can when you file, and setting up an installment plan for the balance.

Don’t Miss: What Bank Does Liberty Tax Use

Can Someone Owe Taxes On Unemployment

People who havent saved or withheld money from their unemployment income to pay their 2020 income taxes may owe 10% of that income to the IRS on demand, Nexstar reported.

Waiver Of Premium,Waiver Of Premium Definition:Waiver Of Premium means, If the insurer is unable to act as an insurer due to an accident or injury, the insurers are subject to certain insurance contracts that allow the insurance company to waive premium collection as long as the policy is in force. Disability premium exemption is valid as long as the insured is disabled.Literal Meanings of Waiver Of PremiumWaiver:Meanings of Waiver:Cases or cases for waiving rights or claâ¦

Filing Wage Reports And Paying Unemployment Taxes

Tax reports or tax and wage reports, and unemployment tax payments can be filed and paid through our free and efficient online systems, or by submitting our original paper forms.

Employer Account Management Services or EAMS for Single Filers can be used to file tax reports and wage reports online. You will need to set up your online account in advance.

ePay can be used to pay unemployment taxes online. Avoid last-minute setup or compatibility issues by taking time to get familiar with ePay before using it to pay unemployment taxes.

Don’t Miss: How Are S Corps Taxed

Get Ready For Whats New For Tax Year 2022

With the end of the year approaching, time is running out to take advantage of the Tax Withholding Estimator. This online tool is designed to help taxpayers determine the right amount of tax to have withheld from their paycheck. Some people may have life changes like getting married or divorced, welcoming a child or taking on a second job. Other taxpayers may need to consider estimated tax payments due to non-wage income from unemployment, self-employment, annuity income or even digital assets. The last quarterly payment for 2022 is due on January 17, 2023. The Tax Withholding Estimator can help wage earners determine if there is a need to adjust their withholding, consider additional tax payments, or submit a new W-4 form to their employer to avoid an unexpected tax bill when they file.

As taxpayers gather tax records, they should remember that most income is taxable. This includes unemployment income, refund interest and income from the gig economy and digital assets.

Credit amounts also change each year like the Child Tax Credit , Earned Income Tax Credit and Dependent Care Credit. Taxpayers can use the Interactive Tax Assistant on IRS.gov to determine their eligibility for tax credits. Some taxpayers may qualify this year for the expanded eligibility for the Premium Tax Credit, while others may qualify for a Clean Vehicle Credit through the Inflation Reduction Act of 2022.

Save Up To 20% On Federal Filing Compared To Turbotax

| TurboTax |

|---|

TaxAct Costs Less: File for less and percentage savings claims based on comparison with TurboTax federal pricing for paid consumer online 1040 filing products on 07/07/2022.

Maximum Refund Guarantee: If an error in our software causes you to receive a smaller refund or larger tax liability than you receive using the same data with another tax preparation product, we will pay you the difference in the refund or liability up to $100,000 and refund the applicable software fees you paid us. Find out more about our Maximum Refund Guarantee.

$100k Accuracy Guarantee: If you pay an IRS or state penalty or interest because of a TaxAct calculation error, we’ll pay you the difference in the refund or liability up to $100,000. This guarantee applies only to errors contained in our consumer prepared tax return software it doesn’t apply to errors the customer makes. Find out more about our $100k Accuracy Guarantee.

Satisfaction Guarantee: If you are not 100% satisfied with any TaxAct product, you may stop using the product prior to printing or filing your return. We are unable to refund fees after you print or e-file your return.

Edition Pricing: Actual prices are determined at the time of payment, print, or e-file and are subject to change without notice. Add sales tax for applicable orders. Offers may end at any time and promotional offers may not be combined.

Read Also: How To Do Taxes For Doordash