How Can I Make Sure I Get My Refund As Fast As Possible

Each tax filing is as unique as the individual it represents. To help expedite the tax refund process, consider one or more of the following tips:

- Visit us at any H& R Block office to ensure your return is ready to file when e-file opens.

- Consider e-filing versus traditional paper filing.

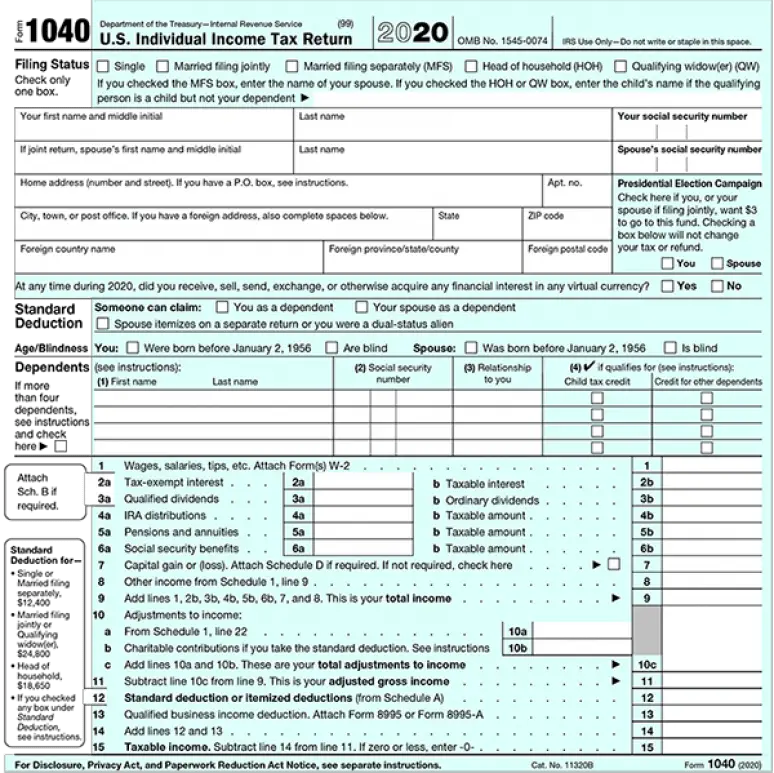

- Complete a tax return that is free of any errors or miscalculations. This means carefully reviewing personal information such as your name, social security number, home address and bank information, if applicable.

Do I Have To Pay Taxes On My Unemployment Benefits

As unemployment rates soared during the early days of the pandemic, millions of people received unemployment benefits to help them get by. You might have to pay taxes on that money, but the recently passed American Rescue Plan makes it a lot more unlikely.

The bill, signed into law by President Joe Biden on March 11, made the first $10,200 of unemployment income tax-free for people with adjusted gross income of less than $150,000 in 2020.

If you had already filed your taxes before that date and paid taxes on unemployment, the IRS is working on a fix that will save people the effort of filing an amended tax return and still refund them what they paid for unemployment benefits.

Keep Your Cra Information Up

File your taxes online or by paper, or find other options such as having someone else complete them for you:

File your tax return online or mail us your completed tax return to your tax centre

Don’t Miss: Have Not Filed Tax Returns For Years

What If I Need More Time

Don’t let a looming tax deadline force you to rush through the tax filing process and make a mistake on your return. Simply request an extension.

The IRS grants an automatic six-month extension of the tax filing deadline to anyone who requests it. You can request an extension electronically with TurboTax or use Form 4868.

Just keep in mind, the tax extension gives you more time to file your return, not more time to pay the tax you owe. You’ll need to estimate the amount you owe and make your payment by the tax filing deadline.

Are My Unemployment Benefits Taxable

Yes, but for households with modified adjusted gross income below $150,000 last year, the first $10,200 in unemployment benefits for each taxpayer in a household will be exempt from federal income tax, thanks to a provision in the latest Covid relief package signed into law by President Joe Biden.

Also, when figuring out whether you are eligible for the $10,200 exclusion, you do not have to count any income from your unemployment benefits as part of your calculations of modified AGI, according to Mark Luscombe, principal federal tax analyst at Wolters Kluwer Tax & Accounting.

For anyone who filed their tax return before the latest Covid relief package went into effect in mid-March, the IRS said there is no need to file an amended return unless the exclusion would make you newly eligible for more tax credits and deductions that were not claimed on your original return. Otherwise, the agency said it will refigure your taxes by incorporating the $10,200 exclusion and either refund you any resulting overpayment or apply it to other taxes you owe.

Of course, if you live in a state with an income tax that also taxed unemployment compensation, you also should check your state revenue departments web site to see if your state has decided to follow the IRS and exclude the first $10,200 from state income tax as well.

Read Also: Where Can I Get Utah State Tax Forms

File A 2020 Tax Return If Youre Missing Stimulus Payments And Think Youre Eligible For More Money

I know many people have questions about tax law changes related to the American Rescue Plan Act of 2021. I urge you to start with IRS.gov Coronavirus Tax Relief to find the most updated information when its available. If youre looking for general information, the best place to start is IRS.gov. It will save you time because our employees wont be able to provide much more information if you call.

Economic Impact Payments, also known as stimulus payments, are different from most other tax benefits. Thats because people can get them even if they have little or no income, and even if they dont usually file a tax return. This is true as long as you are not being claimed as a dependent by someone else and you have a Social Security number. When it comes to missing stimulus payments, its critical that you file a 2020 tax return even if you dont usually file to provide information the IRS needs to send the payments for you, your eligible spouse and eligible dependents.For anyone who missed out on the first two rounds of payments, its not too late. If you didn’t get a first and second Economic Impact Payment or got less than the full amounts, you can get that missing money if youre eligible for it, but you need to act. All first and second Economic Impact Payments have been sent out by IRS. If your 2019 tax return has not been processed yet, the IRS wont send you the first or second payment when it is.

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

Uncover industry-specific deductions, get unlimited tax advice, & an expert final review with TurboTax Live Self-Employed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: When You File Taxes Is It For The Previous Year

After You File Your Tax Return

Get your notice of assessment, find out the status of your refund, or make a change to your tax return

To provide feedback on your filing experience or any other CRA service, go to Submit service feedback – Canada.ca

To formally dispute your notice of assessment or reassessment, credit or benefit decision, you may want to file a notice of objection. To find out if this option is right for you, go to File an objection

Who Should File A Tax Return

Most U.S. citizens and permanent residents who work in the United States need to file a tax return if they make more than a certain amount for the year.

You may want to file even if you make less than that amount, because you may get money back if you file. This could apply to you if you:

- Have had federal income tax withheld from your pay

- Made estimated tax payments

- Qualify to claim tax credits such as the Earned Income Tax Credit and Child Tax Credit

Read Also: Is Property Tax Paid Monthly

Did States Overcome That Salt Cap

Short answer: No.

Sure, some states including New Jersey and Connecticut have tried to engineer workarounds to ease the pain for taxpayers who face higher federal tax bills because of the new $10,000 federal limit on individual taxpayer deductions for state and local taxes, known as the SALT cap.

But taxpayers aren’t in the clear, as much legal haggling has surrounded such efforts. The IRS put a stop to one workaround, which was attempted in New York and elsewhere, that would have reclassified tax payments as charitable contributions since charitable donations remain fully tax deductible.

Lately, states have been focusing on a potential strategy for re-engineering their small business taxes to workaround some issues brought up by the $10,000 SALT limit.

“States do have discretion on how they set up their own tax system,” said Frank Sammartino, a senior fellow at the Urban-Brookings Tax Policy Center.

The U.S. House also voted for a two-year elimination of the SALT cap late in 2019 but the odds remain against the effort getting any traction in the GOP-controlled Senate.

While taxpayers remain angry in many states, it’s unlikely a quick resolution will be reached.

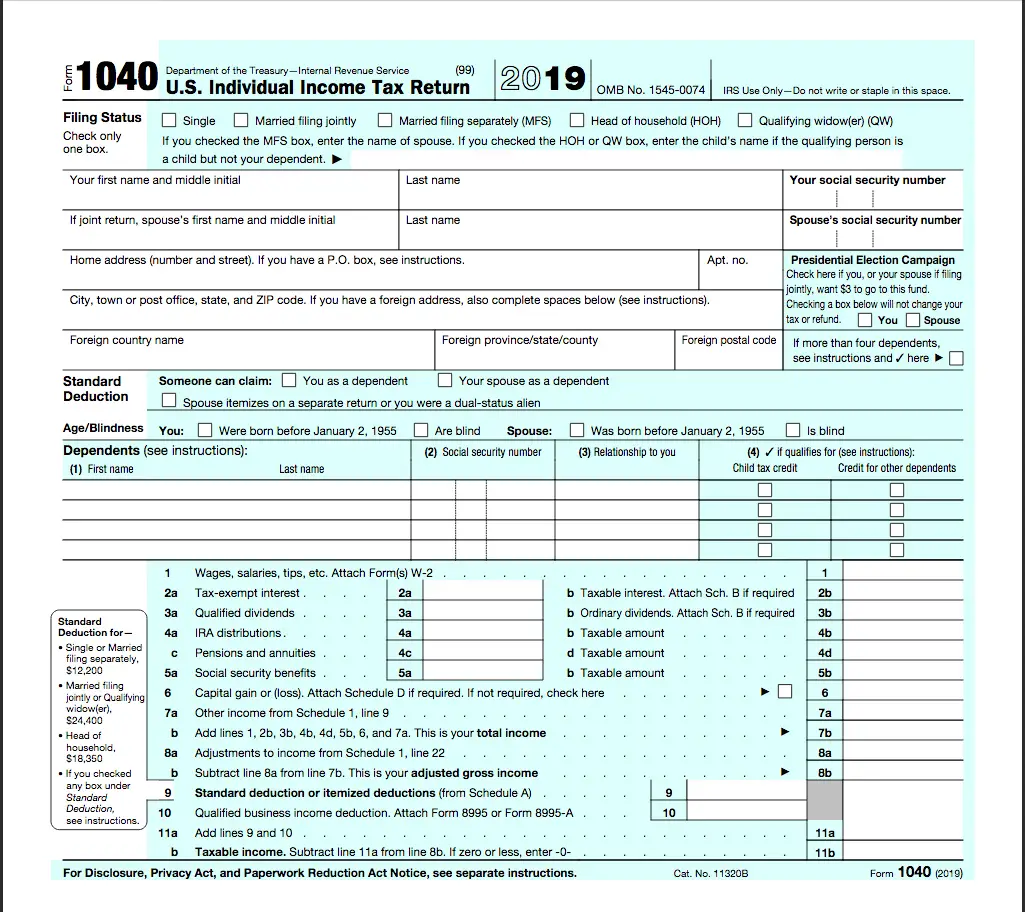

And individuals have to realize that “you can’t really work around it” on the 2019 tax returns, Sammartino said.

The $10,000 limit applies to both married and single homeowners. So there is a “marriage penalty” because typically a limit would be twice as high for a married couple, Sammartino said.

Where To File Your Return

Taxpayers using eFile will have their returns processed electronically once they are submitted.

For taxpayers filing using paper forms:

- If you expect a refund, be sure to mail your return to the North Carolina Department of Revenue, PO Box R, Raleigh, NC 27634-0001.

- If you owe taxes, mail your return and payment to the North Carolina Department of Revenue , PO Box 25000, Raleigh, NC 27640-0640. Make your check or money order payable to the NC Department of Revenue. Important: The Department will not accept a check, money order, or cashier’s check unless it is drawn on a U.S. bank and the funds are payable in U.S. dollars.

Read Also: How You Do Your Own Taxes

Finding The Amounts Of Your First Second And Third Stimulus Checks

To find the amount of stimulus payment youve received, you can:

- Refer to the IRS notices that were mailed to you. IRS Notice 1444shows how much you received from the first stimulus check. IRS Notice 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you received from the third stimulus check.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank statements. They should be labeled as IRS TREAS 310 and have a code of either TAXEIP1 , TAXEIP2 , or TAXEIP3 .

- Request an account transcript. You can request an account transcript sent electronically or by mail using Get Transcript. You can also call the IRS automated phone transcript service at 800-908-9946 or mail in Form 4506-T to have your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse will need to sign into their own account to see the other half of the stimulus check amounts.

To create an account, you will need:

File A Tax Return To Claim Refundable Tax Credits And Taxes Paid

For 2021, you should consider filing a tax return to claim certain refundable tax credits.

If you think youre owed stimulus money, you may need to file a tax return to claim the Recovery Rebate Credit. Consumers who are eligible for the Recovery Rebate Credit and didnt receive the third round of stimulus payments must file a 2021 tax return to claim their missing cash.

You should also file a return if youre expecting a tax refund or if youll receive one of the many credits available, such as refundable credits, earned income credit, additional child tax credit, American opportunity credit, recovery rebate credit or credits for sick and family leave, says Brent Lipschultz, a partner and CPA at New York-based tax and accounting firm EisnerAmper.

Those who wouldnt typically file a return will likely qualify to file for free using IRS Free File, a public-private partnership between the IRS and several tax preparation and software filing companies.

There are two versions: One for people who made an adjusted gross income of $73,000 or less and those who also need to file state taxes. The benefit of using the Free File tool is that the online form will do the calculations for you. Theres another free version for people who made more than $73,000 and doesnt offer the option to file state taxes. This version also only conducts basic calculations with a limited amount of guidance.

Also Check: How Is My Tax Refund Calculated

Can You File 2021 If You Didn’t File 2020

Asked by: Boris Hickle IV

Some had wondered early on if they should wait to file 2021 federal income tax return until the 2020 moved through the IRS pipeline. No, the IRS said, you do not have to wait to have your 2020 return processed before you file the 2021 return. But you must take some extra steps if you want to file electronically.

First And Second Stimulus Check

You will need to file a tax return for Tax Year 2020 . The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021.

If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

Read Also: Can Closing Costs Be Deducted From Taxes

What Happens If I Miss The Tax Deadline

If you’re owed a refund, there is no penalty for filing federal taxes late, though it may be different for your state taxes. Still, it’s best to e-file or postmark your individual tax return as early as possible.

If you owe the IRS money, however, penalties and interest start to accrue on any remaining unpaid taxes after the filing deadline. The late filing penalty is 5% of the taxes due for each month your return is behind, with fees increasing to up to 25% of your due balance after 60 days have passed.

You may also incur a late-payment penalty, which is 0.5% of the taxes due for each month your return is late, with penalties increasing to up to 25% of your unpaid tax, depending on how long you take to file.

What Could Cause A Refund Delay

There are countless reasons your tax refund could be delayed. Weve outlined some common instances where a delay could occur:

- If you file a paper return, the IRS says you should allow about six weeks to receive your refund.

- If the IRS mails you a physical check, you will receive a check through the mail.

- If you file Form 8379, Injured Spouse Allocation, it could take up to 14 weeks to process your tax return.

- If your identity has been stolen and another return was filed with your social security number, it could take longer for the IRS to sort out the situation.

- If you owe a debt, like unpaid child support, your refund could be offset to pay part or all of it.

Each of the possibilities above could cause a delay or prevent receiving the refund altogether. Its important to note that each individuals tax scenario is unique and no two filings are handled exactly the same.

Don’t Miss: Can Medical Expenses Be Deducted From Taxes

Student Loan Interest Deduction

When you make monthly payments to your student loans, that includes your principal payment as well as any accrued interest payments. Whether you have private or federal student loans, the student loan interest deduction lets you reduce your taxable income, depending on how much interest you paid. For 2021, this reduction went up to $2,500 a year.

You’re eligible for the deduction if you paid student loan interest in the given tax year and if you meet modified adjusted gross income requirements , For 2021, you qualified if your MAGI was less than $70,000 . Partial deductions were offered for those with MAGI between $70,000 and $85,000 .

With federal student loan repayments on pause and interest at 0%, you might not have paid any interest over the past year. That said, you should log into your student loan portal and check form 1098-E for any eligible interest payments.

If eligible, this deduction will lower your taxable income, which could reduce how much you owe the IRS or increase your tax refund. You might even get placed in a lower tax bracket, which could qualify you for other deductions and credits.

Every Tax Deadline You Need To Know

OVERVIEW

Make sure your calendars up-to-date with these tax deadlines, dates, possible extensions and other factors in play for both individuals and businesses in 2022.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

|

Key Takeaways Individual income tax returns are due April 15, unless the date falls on a weekend or holiday or you file Form 4868 seeking an extension until October 15. Independent contractors, gig workers, and self-employed people must also meet quarterly estimated tax filing deadlines. Small businesses must file their tax return either by March 15 or the 15th day of the third month following the close of their tax year, unless the date falls on a weekend or holiday or you file Form 7004 seeking an extension until September 15 . |

You May Like: How To Start Filing Taxes On Turbotax