Filing Using Turbotax Self

- When you prepare your tax return, you will just enter all of your businesss details into the self-employed section of TurboTax Self-Employed.

- All the business-related information is entered into the;T2125, Statement of Business Activities, which informs the CRA of your self-employment income and deductions as well as deductions.

- The T2125 is sent to the CRA along with your other tax forms which make up your T1 General return.

- If you own your unincorporated business with a partner , the same T2125 is filled out, however, there is some additional information relating to the partners which is required, and TurboTax Self-Employed takes care of that too.

If, on the other hand, you have chosen to incorporate your business, then you are required to file a separate return, a Corporation Tax Return, or T2, for the business itself.; All of your personal income and credits stay on your return and the businesss income and credits stay on its own return.

Choosing your businesss structure is an important decision. Incorporating has its advantages and disadvantages. To learn more about choosing a business structure, check out our tax tip Taking the Leap from Employee to Owner.

Are Property Taxes Deductible In Wisconsin 2020

School Property Tax Credit: Available if you paid rent during 2020 for living quarters that was used as your primary residence OR you paid property taxes on your home. Itemized Deduction Credit: If the total of your itemized deductions exceed your WI standard deduction, you can claim the itemized deduction credit.

Income Tax Deadline Extension

The individual income tax payment and filing deadline has been extended by 32 days to May 17, 2021, without penalties and interest, regardless of the amount owed. This extension will be similar to the Internal Revenue Service extension.;

Individuals will have the option to pay any 2020 income tax payments that would normally be due on April 15, 2021, by May 17, 2021, without penalty or interest. This extension applies to money owed by individual taxpayers only for the 2020 income tax year.;

Individual taxpayers do not need to file any forms or call the Colorado Department of Revenue to qualify for this automatic state tax payment relief. Individual taxpayers who need additional time to file beyond the May 17 deadline are automatically granted a filing extension until Oct. 15, but that does not grant an extension of time to pay taxes due. Individual taxpayers should pay their state income tax due by May 17, 2021, to avoid interest and penalties.;

Individuals that received unemployment benefits in 2020 and already filed their federal return should continue to monitor guidance from the IRS in the coming days with the recent passage of the American Rescue Plan.;

You May Like: What Does Agi Mean For Taxes

Tax Day For Individuals Extended To May 1: Treasury Irs Extend Filing And Payment Deadline

IR-2021-59, March 17, 2021

WASHINGTON The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17, 2021. The IRS will be providing formal guidance in the coming days.

“This continues to be a tough time for many people, and the IRS wants to continue to do everything possible to help taxpayers navigate the unusual circumstances related to the pandemic, while also working on important tax administration responsibilities,” said IRS Commissioner Chuck Rettig. “Even with the new deadline, we urge taxpayers to consider filing as soon as possible, especially those who are owed refunds. Filing electronically with direct deposit is the quickest way to get refunds, and it can help some taxpayers more quickly receive any remaining stimulus payments they may be entitled to.”

Individual taxpayers can also postpone federal income tax payments for the 2020 tax year due on April 15, 2021, to May 17, 2021, without penalties and interest, regardless of the amount owed. This postponement applies to individual taxpayers, including individuals who pay self-employment tax. Penalties, interest and additions to tax will begin to accrue on any remaining unpaid balances as of May 17, 2021. Individual taxpayers will automatically avoid interest and penalties on the taxes paid by May 17.

What Do I Do About Missing Tax Forms

If you haven’t received your income forms, you should first contact the employer and request a copy or ask that it be re-sent. If that doesn’t work, you can then contact the IRS at 800-829-1040 . You’ll need to provide the following information:

- Name, address, Social Security number, and phone number

- Your employer’s name, address, and phone number

- Dates you worked for your employer

- An estimate of your paid wages and federal income tax withheld during 2020

Read Also: How To Determine Taxes On Paycheck

Contribute To Or Open An Ira By Tax Day

Contributions to a traditional IRA can be tax-deductible. You have until the May 17, 2021, tax deadline to;contribute to an IRA, either Roth or traditional, for the 2020 tax year. The maximum contribution amount for either type of IRA is $6,000 or $7,000 if you’re age 50 or older.;See all the rules here.

» MORE:;Learn how IRAs work and where to get one

Amounts Received During The Fiscal Period

If the organization prepares its financial statements using the accrual method, you can report amounts on lines 100 to 106 using this method.

Line 100 Membership dues, fees, and assessments

Report the total amount of membership dues, fees, and assessments the organization received from members in the fiscal period. For example, report club memberships, professional association dues, or membership fees.

Line 101; Federal, provincial, and municipal grants and payments

Report the total amount of grants or payments the organization received from any level of government or governmental agency in the fiscal period. For example, include grants to assist agriculture and industry, or grants to promote the arts.

Line 102; Interest, taxable dividends, rentals, and royalties

Interest

Report the total interest the organization received for the fiscal period. For example, include interest from bank accounts, mortgages, bonds, or loans. Also include interest received from non-arm’s length transactions. Include these amounts whether or not your organization received an information slip for this income.

Taxable dividends

Report the amount of taxable dividends the organization received from:

- corporations residing in Canada

- foreign corporations not residing in Canada

Rentals

Report the total receipts from property rentals the organization received in the fiscal period. Do not deduct related rental expenses.

Royalties

Note

Example

| $14,370 |

Notes

Line 105; Gifts

Line 106 Other receipts

You May Like: How To Look Up Employer Tax Id Number

Special Tax Extensions For Winter Storm Victims

The IRS is giving victims of the winter storms in Texas, Oklahoma and Louisiana until June 15, 2021 to file taxes and make tax payments. The May 17 filing and payment extension relief does not affect this special consideration.

The following states are also offering relief to winter storm victims:

- Idaho is offering relief to the entire states of Texas and Oklahoma through June 14.

- Indiana is extending certain tax deadlines to residents of Texas, Louisiana and Oklahoma who were impacted by severe winter storms to June 15.

- Louisiana is granting automatic filing and payment extensions to eligible taxpayers in Louisiana and Texas to June 15.

- New Jersey taxpayers impacted by Texas storms have until June 15 to file their New Jersey tax returns and submit payments, including 2021 estimated payments. Affected taxpayers must write in black ink “Presidential Disaster Relief Area” at the top center of their New Jersey tax return and/or their payment.

- Oklahoma announced a payment deadline extension until June 15 for both 2020 taxes and 2021 estimated income taxes. Return due dates are not extended. Late penalties and interest for taxes owed will be waived up to $25,000.

- Texas extended its tax due date to June 15.

Qualifying Rules If You Can Be Claimed As A Dependent

You must file a tax return for 2020 under any of the following circumstances if you’re single, someone else can claim you as a dependent, and you’re not age 65 or older or blind:

- Your unearned income was more than $1,100.

- Your earned income was more than $12,400.

- Your gross income was more than $1,100, or $350 plus your earned income up to $12,050, whichever is greater.

Married dependents who are not age 65 or older or blind are subject to these filing requirements plus one more: They must file if their gross income was at least $5, and their spouse files a separate return and itemizes deductions.

Don’t Miss: Is Heloc Interest Tax Deductible

Previous Years Tax Brackets

Taxes were originally due April 15, but as with a lot of things, it changed in 2020. The tax deadline was extended to July 15 in order to let Americans get their finances together without the burden of a due date right around the corner.

Here is a look at what the brackets and tax rates were for 2019:

2019 Tax Brackets| Tax rate |

|---|

Max Out Your 401 By Dec 31

Contributions to a traditional 401 reduce your total taxable income for the year.

For example, lets say you make $65,000 a year and put $19,500 into your 401. Instead;of paying income taxes on the entire $65,000 you earned, youll only owe on $45,500 of your salary. In other words, saving for the future lets you shield $19,500 from taxes . Many employers offer to match a portion of what you save, meaning that if you contribute enough to your account, you’ll also nab;some free money.

» MORE:;Estimate your tax bill with our free tax calculator

Don’t Miss: How To Buy Gold Without Paying Sales Tax

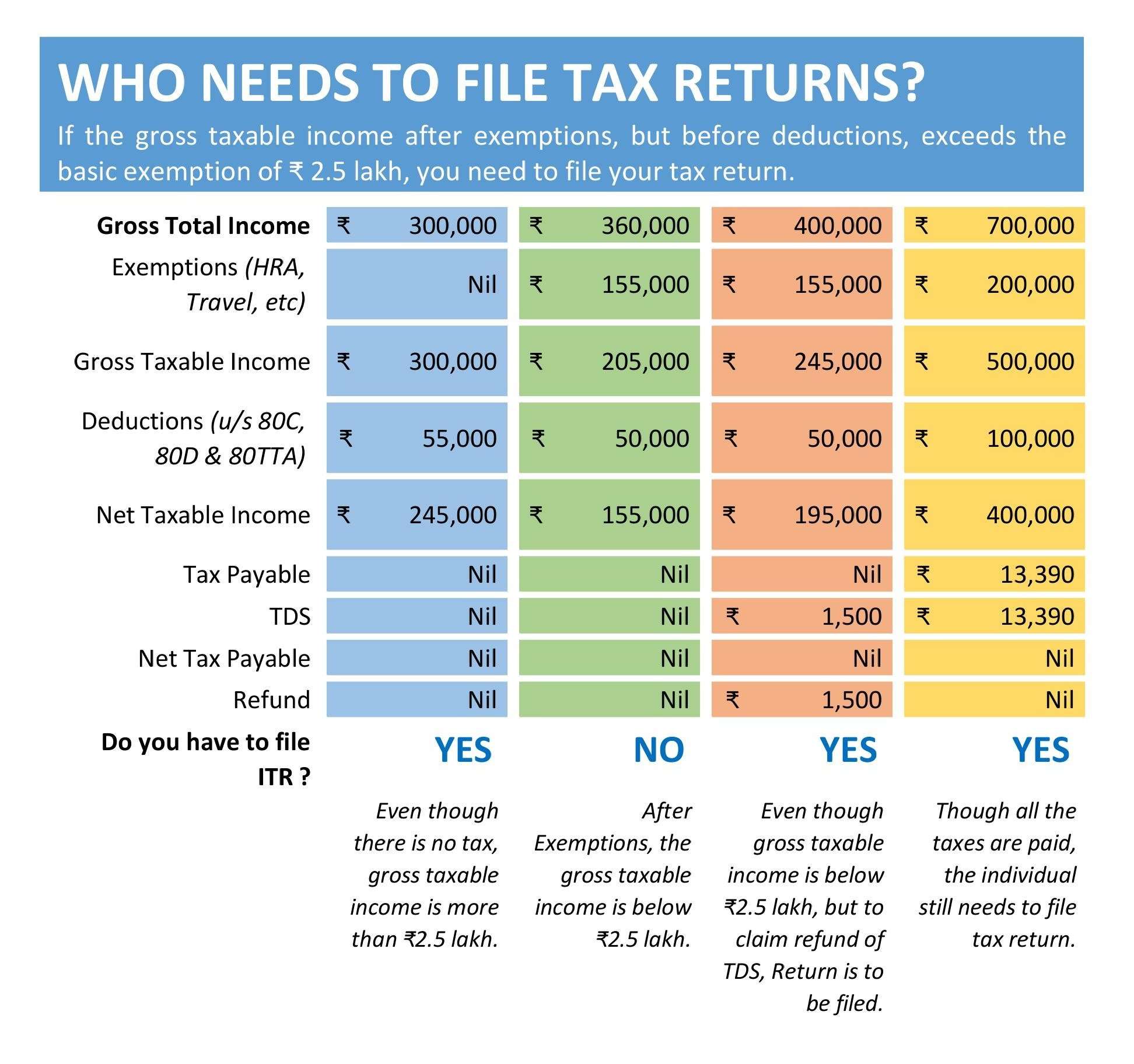

Consider Your Gross Income Thresholds

Most taxpayers are eligible to take the standard deduction. The standard tax deduction amounts;that you’re eligible for are primarily determined by your age and filing status. These amounts are set by the government before the tax filing season and generally increase for inflation each year.

The standard deduction, along with other available deductions, reduces your income to determine how much of your income is taxable. As long as you don’t have a type of income that requires you to file a return for other reasons, like self-employment income, generally you don’t need to file a return as long as your income is less than your standard deduction.

For example, in 2020, you don’t need to file a tax return if all of the following are true for you:

- Under age 65

- Don’t have any special circumstances that require you to file

- Earn less than $12,400

Information Returns Elections Designations And Information Requests Deadlines

| Filing date for 2020 information returns under the Enhanced International Information Reporting and the Common Reporting Standard of the Income Tax Act |

May 1, 2021 Generally, the information return for 2020 has to be filed on or before May 1, 2021. However, because the due date falls on a Saturday, the information return is considered on time if it is received or postmarked on or before May 3, 2021. To avoid late-filing penalties and interest, you must ensure the information return is filed by May 3, 2021. |

|---|---|

| Filing date for the 2020 Partnership Information Return |

This due date applies to partnerships if throughout the fiscal period, all partners are individuals. Please submit the partnership information return by March 31, 2021. 5 months after the end of the partnerships fiscal period if, throughout the fiscal period, all partners are corporations, including end members of tiered partnership. In all other cases, the earlier of March 31, 2021 and the day that is five months after the fiscal period the partnership ended. |

| Filing date for the 2020 Statement of Amounts Paid or Credited to Non-Residents of Canada information return |

The NR4 information return is due on or before the last day of March following the calendar year to which the information return applies. No later than 90 days after the end of the estates or trusts tax year in the case of estate or trust. |

Recommended Reading: How Can I Make Payments For My Taxes

What Happens If I Dont File Taxes

Individuals who owe federal taxes will incur interest and penalties if they dont file and pay on time. The penalty for not filing your taxes on time is 5% of your unpaid taxes for each month that the return is late, maxing out at 25%. For every month you fail to pay, the IRS will charge you 0.5%, up to 25%.

How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRAs website for filing deadlines.

Recommended Reading: Does Llc Pay Self Employment Tax

Contribution To Ira Health Savings Account Deadline

In extending the deadline to file Form 1040 series returns to May 17, the IRS automatically postponed the date for individuals to make 2020 contributions to their individual retirement arrangements , health savings accounts , Archer Medical Savings Accounts , and Coverdell education savings accounts .

All contributions are due by May 17.

Winter Storm Disaster Relief For Louisiana Oklahoma And Texas

Earlier this year, following the disaster declarations issued by the Federal Emergency Management Agency , the IRS announced relief for victims of the February winter storms in Texas, Oklahoma and Louisiana. These states have until June 15, 2021, to file various individual and business tax returns and make tax payments. This extension to May 17 does not affect the June deadline.

For more information about this disaster relief, visit the disaster relief page on IRS.gov.

Don’t Miss: How Do I Pay My State Taxes In Missouri

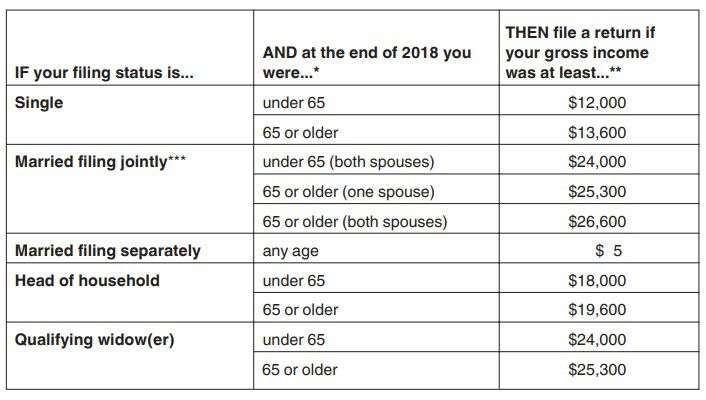

How Much Money Do You Have To Make To Not Pay Taxes

The amount that you have to make to not pay federal income tax depends on your age, filing status, your dependency on other taxpayers and your gross income. For example, in the year 2018, the maximum earning before paying taxes for a single person under the age of 65 was $12,000.

If your income is below the threshold limit specified by IRS, you may not need to file taxes, though its still a good idea to do so.

What this article covers:

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

Why Filing Early Can Make Sense

Even though many taxpayers file their tax returns on or by about April 15 every year, there is no need to put it off until the last minute. Indeed, filing an early tax return can make sense for a variety of reasons.

The IRS will begin processing tax returns for the 2020 tax year on Feb. 12, 2021. Even if you don’t file early, there are reasons to begin preparation as soon as you can.

Starting your filing process early gives you the time you need to collect the evidence needed to claim all of your deductions. You will avoid the headache of the middle of the night stress over figures and receipts. Your accountant will have a more flexible schedule and will probably be able to start working on your accounts immediately. Also, by filing early, you will short circuit would-be identity thieves.

Also Check: Are Debt Settlement Fees Tax Deductible

Contribute To Your Health Savings Account

This medical account, available to individuals who have a high-deductible health plan, provides a tax-saving way to pay for out-of-pocket costs. You have until the May 17, 2021, tax deadline to;contribute to an HSA for the 2020 tax year. The;2020 limits were $3,550 for an individual HSA owner and $7,100 for a family.;For 2021,;the individual coverage contribution limit is $3,600 and the family coverage limit is $7,200.;If you’re 55 or older, you can;put an;extra;$1,000 in your HSA.

» MORE:;Learn more about the tax effects of HSAs and flexible savings accounts

Where Do I Send My Taxes

If you file online, there’s nothing to print out or mail, but we recommend you save an electronic copy for your records regardless. This could be especially useful if a third stimulus check is approved, since for the first two rounds of checks,;your eligibility was based on your tax returns.

Otherwise, you’ll need to mail your return to the IRS. The specific mailing address depends on which tax form you use and which state you live in. The IRS has published a list of where to file paper tax returns this year here. Be warned, however: The IRS says that due to staffing issues, processing paper returns could take several weeks longer this year.;

Read Also: What Are The Different Tax Forms

Need Help With Your Taxes Or Have Tax Questions

If you have a modest income and a simple tax situation, a volunteer may be able to do your taxes for free through the Community Volunteer Income Tax Program. This year, volunteers may be able to complete and file your taxes virtually by videoconference, by phone, or through a document drop-off arrangement.

To get answers to frequently asked questions about filing your taxes, go to canada.ca/cra-questions-answers.;