When Can I File My Taxes 2021 Turbotax

The IRS announced today that they will begin processing tax returns on Friday, February 12, 2021. You can get started now with TurboTax and be first in line for your tax refund! TurboTax is already accepting tax returns and will securely hold them for transmission to the IRS and States once they begin accepting e-file.

Irs Tax Stimulus Checks For 2022 Perhaps With Recovery Rebate Credit

Some people might want to file returns even though they’re not required to do so to claim a Recovery Rebate Credit or the 2021 stimulus payments.

According to the IRS, individuals who didn’t qualify for a third Economic Impact Payment or got less than the full amount may be eligible to claim the Recovery Rebate Credit. For those who got some money, the IRS says youll need to know the total received to calculate the correct rebate credit to avoid processing delays.

The IRS will send Letter 6475 starting in late January with the total amount of the third Economic Impact Payment received. Economic impact payment amounts also can be viewed on IRS online accounts.

Tax Season Opens Soon

The IRS has announced that tax season will open Monday, January 24, 2022.

Some folks have suggested that a January start date is earlybut Im guessing they have a short memory. Its true that tax season opened a little later in 2021on February 12, 2021but thats an outlier due to the pandemic. The January 24, 2022, tax season open is on par with the open dates for the past few yearsJan. 27 in 2020, Jan. 28 in 2019, and Jan. 29 in 2018. In fact, other than last year, the agency has opened tax season in late January for more than a decade.

Read Also: Do You Pay Taxes On Inherited Money

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Will I Have To Pay Taxes On My Stimulus Checks

If you received an Economic Impact Payment , aka a stimulus check, in 2020 it may affect your tax return for the 2020 tax year. The EIP was based on an individuals 2018 or 2019 tax return and paid as an advanced tax credit on that taxpayers 2020 tax return. The IRS has stated that the stimulus payment is not includable in your gross income, meaning you wont be taxed on it.

If your economic situation in 2020 made you eligible for an EIP but you didnt qualify for a payment due to your AGI earnings in 2018 or 2019, you may be able to claim a Recovery Rebate Credit. On the other hand, if your situation in the 2020 tax year made you ineligible for a stimulus check but you received one you can rest easy. There is so far no provision that would require you to pay back the EIP if your tax situation changed in the 2020 fiscal year.

Protect yourself and your loved ones — #IRS encourages you to share information with friends and family about the IP PIN program. To learn more or to sign up visit:

You May Like: How To Pay Zero Taxes

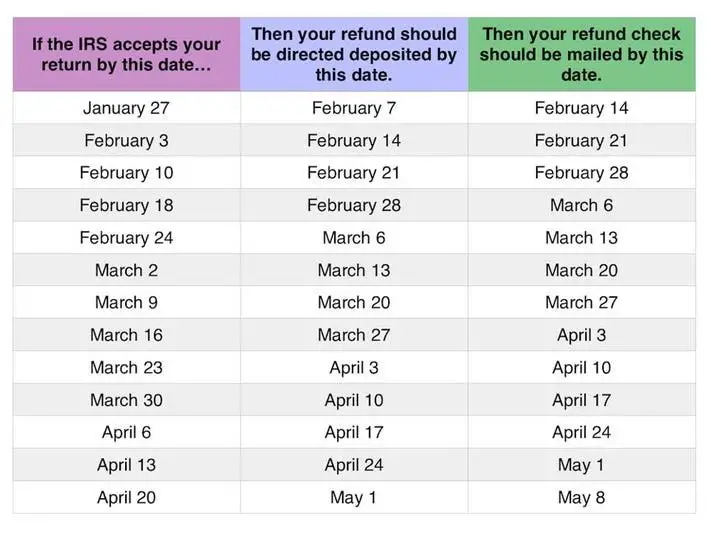

How To Get A Fast Tax Refund

When tax season rolls in, you can start preparing your tax return online. Once you have it completed, you will be among the first of taxpayers who have their returns processed and their refunds issued.

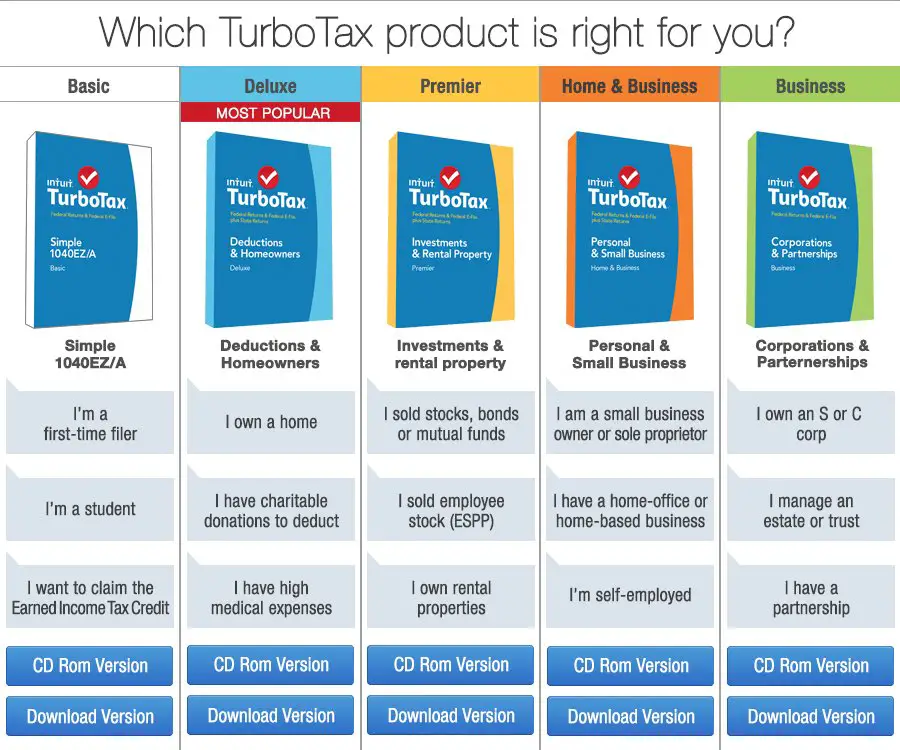

Keep in mind when you file your taxes with TurboTax or H& R Block, the process is easy. They provide you with the largest refund possible by ensuring that they ask the right questions to find out which deductions and credits you qualify for.

You can also use their free tax refund calculators to see how much your tax refund will be. When you file your taxes online, there is no way that you can go wrong, and many taxpayers can file their federal tax returns free or at a discount.

Do I Qualify For Irs Free File

If your adjusted gross income was $73,000 or less in 2021, you can use free tax software to prepare and electronically file your tax return, according to IRS instructions online for the 2021 tax season.

Taxpayers who earned more can use Free File Fillable Forms, the electronic version of the federal tax forms, to file their tax returns online. Go to IRS.gov to learn more.

Also Check: Do You Pay Taxes On Life Insurance Payment

When Are 2022 Taxes Due

Each year, the IRS sets the due date for filing your federal tax return for April 15 if youre a calendar year filer. Generally, most individuals are, though if you have a business that uses a fiscal year that differs from a calendar year, your return is due on or before the 15th day of the fourth month after the close of your fiscal year. In instances where this due date falls on a Saturday, Sunday, or legal holiday, the due date is moved to the next business day.

The last day of tax filing for 2021 taxes was April 18, 2022, unless you lived in Maine or Massachusetts, where your last day of tax filing was April 19, 2022, because of holidays. Likewise, you could have submitted Form 4868 to request an extension to file later this year.

The last day to do taxes isnt the only important tax deadline to know, however. There are several other important tax deadlines for the 2022 tax year you should know, or for the taxes youll file in 2023. If you’re wondering, “When are taxes due, anyway?” Here are the important dates at a glance.

Income Tax Return Filing Dates

- 1 July 2022 to 24 October 2022

- Taxpayers who file online

- Taxpayers who cannot file online can do so at a SARS branch

If you are being auto-assessed, see all the info you need to know on our How does the Auto-Assessment work webpage. If you are not in the auto-assessment group and need to submit a return, see our info for provisional and non-provisional taxpayers on the 2022 Tax Filing Season media release.

You May Like: Why Is My Child Tax Credit Only 500

Dont Be Surprised By Delays

While every tax season is busy for the IRS, pandemic-induced backlogs from the past two years coupled with limited fundingwill make the current tax season even more so.

The IRS has 6 million individual returns from last year that still need to be processed, or 11 million in total including unprocessed business and other returns.

The return processing and tax assistance delays arose as the agency was administering several Covid-19 relief efforts passed by Congress. Those included issuing three rounds of Economic Impact Payments, creating a system to send out advance monthly payments of the Child Tax Credit and making changes to the Earned Income Tax Credit.

One example: Last year, the agency was unable to answer more than two-thirds of the calls it received.

This year is likely to be just as frustrating. Thats why tax filers are encouraged to first use the online tools provided on IRS.gov to get answers to their questions before reaching out to the agency directly.

Expect phones lines to be jammed up for the forseeable future, Rettig said.

Claiming Business Income Tax Credits

For tax years beginning after December 31, 2012, you must file your tax return electronically in order to claim a business tax credit unless you submit a waiver from the electronic filing requirement. To request a waiver from filing the Form 500CR electronically, you must submit a completed Form 500CRW Waiver Request For Electronic Filing of Form 500CR and it must be attached to Form 500CR in the filing of your return.

Beginning with Tax Year 2015 certain individual taxpayers may elect to claim the Community Investment Tax Credit and/or the Endow Maryland Tax Credit on Maryland Form 502CR, and thus avoid the electronic filing requirement. Read instructions to Form 502CR to see if you qualify for this election.

Business income tax return dates vary. See Filing Extensions and Deadlines for Corporations

Read Also: What Is Advanced Premium Tax Credit

Federal Income Tax Returns Were Due April 18 For Most Of Us But Some People Have Some Extra Time To File Are You One Of Them

Getty Images

Most Americans had to file their federal tax return for the 2021 tax year by April 18, 2022. Note that we said “most Americans.” Taxpayers in two states had until April 19 to submit their 1040s to the IRS. Victims of certain natural disaster also get more time to file, with varying dates depending on when the disaster hit.

If for some reason you weren’t able to file your federal tax return on time, hopefully you requested an automatic six-month tax extension to October 17, 2022, by filing Form 4868 or making an electronic tax payment. To get the extension, you had to act by the original due date for your return, whether that was April 18, April 19, or some other date. Keep in mind, however, that an extension to file doesn’t extend the time to pay your tax. If you didn’t pay up by your original due date, you’ll owe interest on the unpaid tax and could be hit with additional penalties for filing and paying late.

Also note that special tax extension rules apply for Americans living abroad and people serving in a combat zone or contingency operation. As a result, they might have more time beyond April 18 to file their 2021 tax return and pay whatever tax they are expected to owe, and they could receive an extension past October 17.

What About My State Tax Refund

What weve covered so far applies to federal tax refunds. As you might expect, every state does things a little differently when it comes to issuing tax refunds and its not possible to say for sure when everyone will receive their state tax refunds. Although, state refunds often come faster than those being processed through the federal system. This isnt always the case, but it often is.

Generally, you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. If you filed a paper tax return, it may take as many as 12 weeks for your refund to arrive. To find out the status of your refund, youll need to contact your state tax agency or visit your states Department of Revenue website.

Also Check: Can You File For Tax Return Late

Tax Day For Maine And Massachusetts Residents

Residents of Maine and Massachusetts got an extra day this year until April 19 to file their federal income tax return. Why? Because Patriots’ Day, an official holiday in Maine and Massachusetts that commemorates Revolutionary War battles, fell on April 18 this year. So, for the same reason Tax Day was moved from April 15 to April 18 for most people , the IRS couldn’t set the tax filing and payment due date on April 18 for taxpayers in those two states. As a result, the deadline was moved to the next business day for Maine and Massachusetts residents, which was April 19.

Tax Filing Season Begins Feb 12 Irs Outlines Steps To Speed Refunds During Pandemic

IR-2021-16, January 15, 2021

WASHINGTON The Internal Revenue Service announced that the nation’s tax season will start on Friday, February 12, 2021, when the tax agency will begin accepting and processing 2020 tax year returns.

The February 12 start date for individual tax return filers allows the IRS time to do additional programming and testing of IRS systems following the December 27 tax law changes that provided a second round of Economic Impact Payments and other benefits.

This programming work is critical to ensuring IRS systems run smoothly. If filing season were opened without the correct programming in place, then there could be a delay in issuing refunds to taxpayers. These changes ensure that eligible people will receive any remaining stimulus money as a Recovery Rebate Credit when they file their 2020 tax return.

To speed refunds during the pandemic, the IRS urges taxpayers to file electronically with direct deposit as soon as they have the information they need. People can begin filing their tax returns immediately with tax software companies, including IRS Free File partners. These groups are starting to accept tax returns now, and the returns will be transmitted to the IRS starting February 12.

Last year’s average tax refund was more than $2,500. More than 150 million tax returns are expected to be filed this year, with the vast majority before the Thursday, April 15 deadline.

You May Like: What Taxes Do Employers Pay For Employees

Child Tax Credit Payments: Do I Need Irs Letter 6419 To File Taxes

Some families may want to hold off a bit when it comes to filing a return until they spot the IRS letter 6419, which can help them file an accurate return and avoid delays. Others who don’t want to wait may need to review their own records and check their specific information at the “Child Tax Credit Update Portal Site” at IRS.gov/ctcportal.

DON’T THROW THIS IRS DOCUMENT AWAY:Why IRS Letter 6419 is critical to filing your 2021 taxes and the child tax credit.

Irs Expects To Finish Processing 2021 Tax Return Backlog This Week

The IRS is rounding the corner on its pandemic-era backlog of tax returns.

The agency announced Tuesday that it expects to finish processing the backlog of individual tax returns the agency received in 2021 this week.

As of June 10 this year, the IRS processed more than 4.5 million of the 4.7 million individual paper tax returns it received in 2021.

The agency said its also successfully processed the vast majority of tax returns taxpayers

The IRS is rounding the corner on its pandemic-era backlog of tax returns.

The agency announced Tuesday that it expects to finish processing the backlog of individual tax returns the agency received in 2021 this week.

As of June 10 this year, the IRS processed more than 4.5 million of the 4.7 million individual paper tax returns it received in 2021.

The agency said its also successfully processed the vast majority of tax returns taxpayers filed this year. The IRS said more than 143 million returns have been processed overall, with $298 billion in refunds being issued.

To work to address the unprocessed inventory by the end of this year, the IRS has taken aggressive, unprecedented steps to accelerate this important processing work while maintaining accuracy, the agency said in a press release Tuesday.

The COVID-19 pandemic and staffing limitations led to the IRS starting 2022 with a larger than usual inventory of paper tax returns and correspondence filed during 2021.

Read Also: How To Not Pay Income Tax

Important Changes To The Auto

If you agree with the auto-assessment, after viewing your assessment, you do not need to do anything further, the return will be regarded as submitted and final.

If you are not in agreement with the assessment, you can access your tax return via eFiling or SARS MobiApp, complete the return, and file it. This must be done within 40 business days from the date that your assessment was issued to you.

You can view the auto-assessment by:

File Your Tax Return Electronically

Combining both direct deposit and electronic filing can greatly speed up your tax refund. Since filing electronically requires the use of a tax software program, it can flag errors that may cause processing delays by the IRS. These errors may include incorrect Social Security numbers, dependents dates of birth, and misspelling of names.

You can electronically file your tax return for free using the IRS Free File Program if your adjusted gross income is less than $72,000. Most simple tax returns can also generally be filed for free, although you may be charged to file your state taxes.

If your tax situation is more complicated if you sold property, paid business expenses or earned investment or business income, for exampleyou should consider hiring a tax professional. Having a knowledgeable tax professional, such as an enrolled agent, certified public accountant or other tax professional can help review your tax return and identify any mistakes that may slow down the processing of your tax refund.

Also Check: Do You Pay Sales Tax On Out Of State Purchases

What Is The Last Day To File Taxes

The last day to file taxes for individual federal income tax returns is April 15, or as late as April 18 in the event Tax Day falls on a Saturday, Sunday or official holiday. Some state-level holidays can extend the tax deadline by one day further. You can request a six-month filing extension through filing Form 4868, making your last day to file individual income taxes October 17, 2022.

If you also file taxes for your small business as a partnership, LLC or S Corp, the last day to file taxes is March 15 unless it falls on a weekend or official holiday. If your business runs on a non-calendar tax year, your federal tax return is generally due by the 15th day of the third month following the end of the tax year.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.