What If I Haven’t Recieved My Refund Yet

Refunds will not go out in a particular predictable order, so if you haven’t received yours yet, don’t worry. Eligible taxpayers who have already filed their 2021 tax return and had a tax liability will automatically receive their refund by Dec. 15.

Direct deposits will be labetleed “MASTTAXRFD,” and refunds mailed as checks will include several sentences on the check explaining Chapter 62F and why the recipient is receiving the refund.

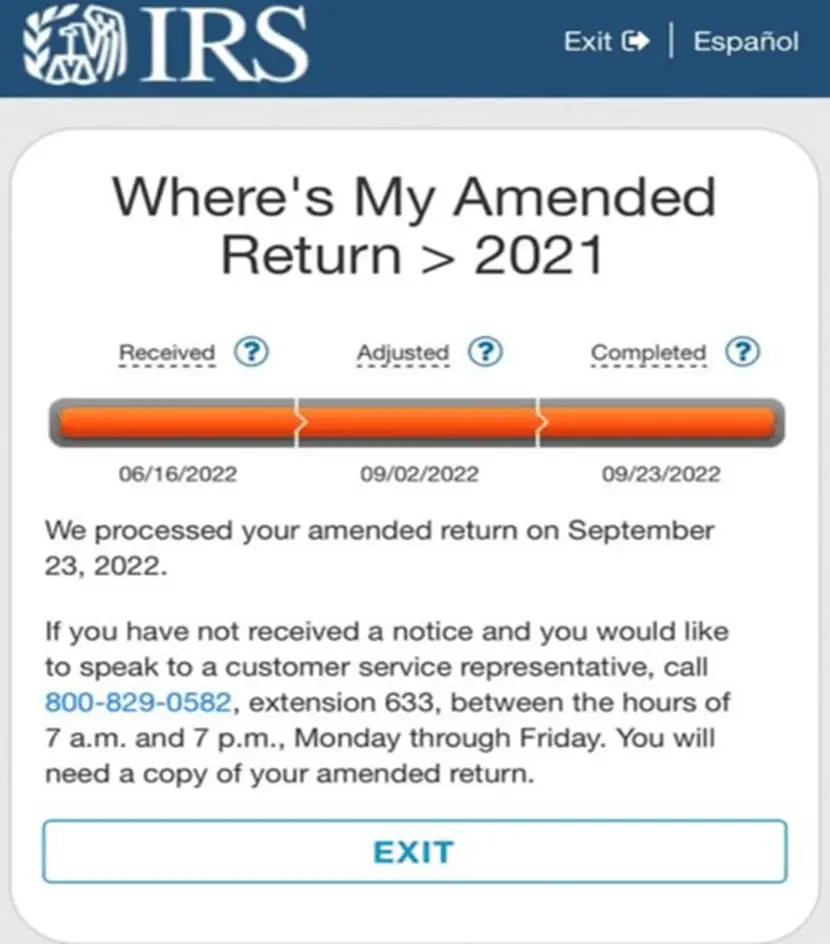

Im Counting On My Refund For Something Important Can I Expect To Receive It In 21 Days

Many different factors can affect the timing of your refund after we receive your return. Even though we issue most refunds in less than 21 days, its possible your refund may take longer. Also, remember to take into consideration the time it takes for your financial institution to post the refund to your account or for you to receive it by mail.

What Can Slow Down Your Refund

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund. Learn more about our refund review process and what we’re doing to protect taxpayers.

- Missing information or documents. If we send you a letter requesting more information, please respond quickly so we can continue processing your return.

- Errors on your return. We found a math error in your return or have to make another adjustment. If the adjustment causes a different refund amount than you were expecting, we will send you a letter to explain the adjustment.

- Problems with direct deposit. If you requested direct deposit, but the account number was entered incorrectly, your bank won’t be able to process the deposit. When this happens, your bank notifies us, and we will manually re-issue your refund as a check. This process could take up to 2 weeks between the time we receive notification from the bank and when you receive the check.

You May Like: Where Do I Pay My Taxes

Wheres My State Tax Refund Illinois

The State of Illinois has a web page called Wheres My Refund, where you can see if the state has already processed your tax return and initiated your refund. The only information you need to enter is your SSN, first name and last name. If the state has not processed your return yet, you can set up an email or text notification to let you know when it does.

Millions In State Tax Refunds Heading To Unclaimed Property If Taxpayers Dont Claim Themcontinue Reading

BATON ROUGE Louisiana taxpayers have until Oct. 6, 2022, to claim millions of dollars in state income tax refunds before they become unclaimed property.

The Louisiana Department of Revenue sent letters to 20,400 individual and business taxpayers advising them to claim their refunds before they are transferred by law to the Unclaimed Property Division of the state treasurers office. More than $36 million in unclaimed refunds is due for transfer if not claimed from LDR.

To claim a refund, complete and return to LDR the voucher in the Notice of Unclaimed Property letter dated Aug. 18, 2022. The department will issue paper checks to all taxpayers submitting completed vouchers by the Oct. 6 deadline.

Any refund not claimed by the deadline remains the property of the taxpayer, and can be retrieved from the Unclaimed Property Division.

Read Also: What’s The Sales Tax In Florida

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once your return goes back to the processing stage, we may select it for additional review before completing processing.

Wheres My State Tax Refund Utah

You can check the status of your refund by going to the states Taxpayer Access Point website. On that page, you can find the Wheres My Refund? link on the right side.

Due to identity protection measures, the Utah State Tax Commission advises that taxpayers should allow 120 days for a refund to get processed. The earliest you can hope for a refund is March 1.

Also Check: How Much Percent Is Income Tax

Wheres My State Tax Refund Kansas

If youre waiting for a tax refund from Kansas, simply visit the Income and Homestead Refund Status page. There you can check the status of income and homestead tax refunds. You can also check your refund status using an automated phone service.

Taxpayers who filed electronically can expect their refund to arrive in 10 to 14 business days. This is from the date when the state accepted your return. If you filed a paper return, you will receive your refund as a paper check. The state advises people that a paper refund could take 16 to 20 weeks to arrive.

Mass Tax Refund Checks Begin Going Out This Week

The Massachusetts State House on Beacon HillAlison Kuznitz/MassLive

Bay Staters will start receiving their tax refund checks in the mail or via direct deposit this week, though a lengthy distribution process will span through mid-December.

The initial batch of refunds will be shipped out on Tuesday, as the Baker administration begins the process of returning nearly $3 billion in excess tax revenues to Bay Staters as required by a 1980s tax cap law known as Chapter 62F.

These refunds will be sent out on a rolling basis through December 15, a spokesperson for Executive Office for Administration and Finance said in a statement.

The distribution is random, meaning refunds will not be issued alphabetically or in any other predictable order, a state official said. Direct deposits will be labeled MASTTAXRFD.

Taxpayers can expect a refund that equates to about 14% of their 2021 personal income tax liability a 1 percentage point jump over earlier estimates from the Baker administration. Refunds might be lower if there are intercepts, including unpaid taxes and childhood support, among other variables, the administration has said.

State officials have long targeted November as the general time frame to issue refunds, but they stopped short of offering concrete dates until Friday afternoon, State House News Service reported.

Don’t Miss: What Are New Market Tax Credits

When You’ll Receive Your Payment

Direct deposit MCTR payments for Californians who received Golden State Stimulus I or II are expected to be issued to bank accounts from October 7, 2022 through October 25, 2022, with the remaining direct deposits occurring between October 28, 2022 and November 14, 2022. We expect about 90% of direct deposits will be issued in October 2022.

MCTR debit cards are expected to be mailed between October 25, 2022 and December 10, 2022 for Californians who received GSS I and II, with the remaining MCTR debit cards mailed by January 15, 2023.

We expect about 95% of all MCTR payments â direct deposit and debit cards combined â to be issued by the end of this year.

Who Is Eligible For A Tax Rebate

To be eligible for a refund, the administration said individuals must have filed a 2021 state tax return on or before Oct. 17, 2022. An individual’s credit may be reduced due to refund intercepts, including for unpaid taxes, unpaid child support and certain other debts.

Please note that:

- Both resident and non-resident filers are eligible

- Non-residents on whose behalf a partnership files on a composite basis are eligible

- Fiduciary filers are eligible

Read Also: Can I File Extension If I Owe Taxes

If I Owe The Irs Or A State Agency Will I Receive My Nc Refund

In some cases debts owed to certain State, local, and county agencies will be collected from an individual income tax refund. If the agency files a claim with the Department for a debt of at least $50.00 and the refund is at least $50.00, the debt will be set off and paid from the refund. The Department will notify the debtor of the set-off and will refund any balance which may be due. The agency receiving the amount set-off will also notify the debtor and give the debtor an opportunity to contest the debt. If an individual has an outstanding federal income tax liability of at least $50.00, the Internal Revenue Service may claim the individual’s North Carolina income tax refund. For more information, see G.S. §105-241.7 and Chapter 105A of the North Carolina General Statutes.

Wheres My State Tax Refund North Carolina

Tracking your refund is possible by visiting the website of North Carolinas Department of Revenue and clicking on Wheres My Refund? You can expect processing of your refund to take, on average, six weeks from the date your return is received. If 12 weeks have gone by and you still havent gotten your refund, you should contact the Department of Revenue.

Read Also: What Is Deadline To File Taxes 2021

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

You Have Not Updated The Status Of My Refund In A While When Will I Receive It

Each return processes through multiple steps. We recommend you file electronically and include all documentation to ensure we can process your return/refund as quickly as possible. Please check back on the status daily. If we require additional information, we will contact you through U.S. Postal Service mail.

Also Check: When Can You File Your 2021 Taxes

Wheres My State Tax Refund New Jersey

New Jerseys Division of Taxation allows taxpayers to check the status of refunds through its Online Refund Status Service. You will need to enter your SSN and the amount of your refund.

You can also check the status of a refund using the automated phone inquiry system. The automated system can tell you if and when the state will issue your refund. It cannot give you information on amended returns. The number is 1-800-323-4400 or 609-826-4400. Both options are available 24 hours a day, seven days a week.

In general, electronic tax returns take at least four weeks to process. Paper returns take significantly longer at a minimum of 12 weeks. If you send a paper return via certified mail, it could take 15 weeks or more to process.

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Read Also: When Do You Have To Have Your Taxes Done By

Court Bars Monroe Man From Working As A Tax Preparer In Louisianacontinue Reading

BATON ROUGE A Monroe man who pleaded guilty to a tax fraud-related felony is barred permanently from working as a tax preparer in Louisiana.

Courtney C. Blockson was arrested in Dec. 2019 for a tax fraud scheme involving state child care tax credits. According to the charging document, Blockson improperly claimed the credits of behalf of hundreds of clients by falsely identifying them as day care center operators. None of the taxpayers involved were aware of Blocksons scheme. The illegitimate credits initially cost the state $131,000 in fraudulent income tax refunds, which the Louisiana Department of Revenue recovered through the collection process.

Blockson pleaded guilty to Filing False Public Records. As a condition of the plea, the court issued an injunction prohibiting him permanently from participating directly or indirectly in the preparation or filing of any Louisiana tax return except his own.

Wheres My State Tax Refund Alabama

You can expect your Alabama refund in eight to 12 weeks from when it is received. In order to check the status of your tax return, visit My Alabama Taxes and select Wheres My Refund? To maintain security, the site requires you to enter your SSN, the tax year and your expected refund amount.

Another thing to note with Alabama is that even if you filed for direct deposit of your refund, the state may send your refund as a physical check. This is an attempt to prevent fraud by sending a paper check to the correct person instead of sending an electronic payment to the wrong persons account.

Don’t Miss: How Many Years Can I Go Back And File Taxes

Im A Nonresident Alien I Dont Have To Pay Us Federal Income Tax How Do I Claim A Refund For Federal Taxes Withheld On Income From A Us Source When Can I Expect To Receive My Refund

To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Nonresident Alien Income Tax ReturnPDF. You must include the documents substantiating any income and withholding amounts when you file your Form 1040NR. We need more than 21 days to process a 1040NR return. Please allow up to 6 months from the date you filed the 1040NR for your refund.

I Have Not Received My Tax Refund Can I File A Second Tax Return

No, you should not file a second tax return if you still have not received your tax refund. Kindly take all the precautionary measures such as waiting for more than 21 days, checking the wheres my refund portal, etc. Before, you make any decisions such as filing form 1040-X to amend your original tax return. Any reaction decision might result in further delay. Kindly be patient, and IRS will return your tax.

Don’t Miss: How Is Inheritance Tax Calculated

Wheres My State Tax Refund Tennessee

Tennessee residents do not pay income tax on their income and wages. The tax only applied to interest and dividend income, and only if it exceeded $1,250 . Taxpayers who made under $37,000 annually were also exempt from paying income tax on investment earnings. The state levied a flat 4% tax rate for 2017 and was phased entirely by January 1, 2021. A refund is unlikely for this income tax.

My Spouse Has Passed Away And My Tax Refund Check Was Issued In Both Names How Can I Get This Corrected

Since a joint return was filed, the refund check must be issued jointly. When presenting the check for payment, you may want to include a copy of the death certificate to show you as surviving spouse. You may return the check to the Department and we will include “Surviving Spouse” and “Deceased” next to the respective names on the check. Should you need to return the check, please mail to: NC Department of Revenue, Attn: Customer Service, P O Box 1168, Raleigh NC 27602-1168.

Recommended Reading: How To Get Tax Form From Unemployment

Are There More Federal Stimulus Checks For 2022

Its important to know that the 2022 Massachusetts tax refund and other 2022 state tax rebate checks and state stimulus payments are different from the three rounds of COVID-19 stimulus payments that you may have received from the federal government in the recent past.

That federal stimulus check program has ended. However, if you did not receive your third COVID stimulus payment of $1,400, or your 2021 child tax credit, theres still time to file your 2021 federal income tax return and get those funds.

Wheres My State Tax Refund Montana

Visit the Department of Revenues TransAction Portal and click the Wheres My Refund link toward the top of the page. From there you will need to enter your SSN and the amount of your refund.

The processing time for your tax return and refund will depend on when you file. The Montana Department of Revenue says that if you file your return in January, it may process your refund within a week. However, you may wait up to eight weeks if you file in April, which is generally when states receive the majority of returns.

You May Like: How To File Previous Years Taxes