Why Might A Tax Extension Request Be Rejected

Nine times out of 10, if you file on time and fill out the form correctly, you should have no issue getting an extension.

In most cases, applications are rejected for minor problems that can easily be fixed. If it comes down to a misspelling or providing information that doesnt align with IRS records, the tax authority will usually give you a few days to sort out those errors and file the form againthis time accurately.

The IRS tends to take less kindly to unrealistic tax liability estimates. If it disagrees with your figures, your application for an extension may be denied and you could even be hit with a penalty.

Every Tax Deadline You Need To Know

OVERVIEW

Make sure your calendars up-to-date with these tax deadlines, dates, possible extensions and other factors in play for both individuals and businesses in 2022.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

|

Key Takeaways Individual income tax returns are due April 15, unless the date falls on a weekend or holiday or you file Form 4868 seeking an extension until October 15. Independent contractors, gig workers, and self-employed people must also meet quarterly estimated tax filing deadlines. Small businesses must file their tax return either by March 15 or the 15th day of the third month following the close of their tax year, unless the date falls on a weekend or holiday or you file Form 7004 seeking an extension until September 15 . |

What Is The Best Way To Make Sure That I Am Withholding The Right Amount Of Taxes

The Department recommends reviewing federal and state Form W-4s at the beginning of the year or when your status changes . All Vermont employees should complete the W-4VT to make sure the right amount of Vermont tax is withheld from each paycheck. Completing only the federal Form W-4 may result in the wrong amount of Vermont tax being withheld.

Recommended Reading: Do You Have To File State Taxes In Florida

Can I File An Extension

As in past years, you can request an extension if you need more time to prepare and file your 2021 return. Before the April 18, 2022, deadline, you must fill out and submit Form 4868, the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. At the time you file Form 4868, you must also pay the estimated income tax you owe to avoid penalties and interest, the IRS says.

Generally, taxpayers are granted an automatic six-month extension to file, or two months if theyre out of the country, in which case the extension also applies to payment of taxes owed.

To qualify for an extension, you must file Form 4868 before April 18, 2022. You will not be notified unless your request is denied.

File Their Tax Return Or Request An Extension Of Time To File By The May 17 Deadline

IR-2021-67, March 29, 2021

WASHINGTON The Internal Revenue Service today announced that individuals have until May 17, 2021 to meet certain deadlines that would normally fall on April 15, such as making IRA contributions and filing certain claims for refund.

This follows a previous announcement from the IRS on March 17, that the federal income tax filing due date for individuals for the 2020 tax year was extended from April 15, 2021, to May 17, 2021. Notice 2021-21 PDF provides details on the additional tax deadlines which have been postponed until May 17.

Also Check: How To Look Up My Taxes

Dates Set In 2021 For 2020 Returns

-Income tax returns of individuals: April 15 falls on a business day in 2021, and this year is not a holiday, so the deadline to file your 2020 personal tax return is April 15 April 2021.

-Estimated tax payments for tax year 2020 : For 2020, they were due on July 15 and September 15. There would normally have been two additional payments for the first and second quarters on April 15 and June 15, but the IRS declined them due to the coronavirus pandemic. The fourth and final estimated payment for fiscal year 2020 is due on January 15, 2021.

-Association Returns : These are due March 15, 2021. Deadline is September 15, 2021 extended.

-C Corporation Income Tax Returns : These are due on April 15, 2021 for C corporations operating in a calendar year. The extended deadline is October 15, 2021. The deadline for C corp. it is the 15th day of the fourth month following the end of the corporations fiscal year if the corporation operates in a fiscal year, rather than a calendar year .

-S Corporation Returns : These returns are due March 15, 2021 for corporations operating in a calendar year. The extended deadline is September 15, 2021. The deadline for company and S company returns is the 15th of the fourth month following the end of the tax year, if it is a tax year instead of a calendar year.

-The declarations of foreign companies: expire on the same date as the declarations of other companies on March 15, 2021.

-Trust, inheritance and gift tax returns are due April 15, 2021.

Chaotic Irs Filing Season Shows The Perils Of Running Social Policy Through The Tax Code

Inflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a hidden tax, as it leaves taxpayers less well-off due to higher costs and bracket creep, while increasing the governments spending power.

A pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates.

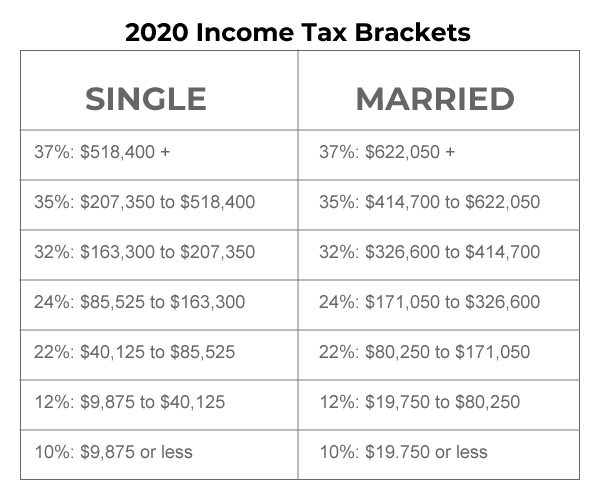

A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets the federal corporate income tax system is flat.

A tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the IRS, preventing them from having to pay income tax.

The standard deduction reduces a taxpayers taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

Don’t Miss: How To Find Real Estate Taxes Paid

Deadline For Hurricane Ida Victims

Tax filing deadlines for residents of six different states impacted by Hurricane Ida have also been moved back. Victims of Hurricane Ida who live in Connecticut, Louisiana, Mississippi, New Jersey, New York and Pennsylvania now have until Feb. 15, 2022, to file various individual and business tax returns and make tax payments.

The IRS has postponed various tax filing and payment deadlines that occurred starting on dates that vary by state:

Individuals and businesses impacted by the storm will have until Feb. 15, 2022, to file returns and pay any taxes that were originally due during these periods. The extension also applies to quarterly estimated income tax payments that were due on Sept. 15, 2021, and Jan. 18, 2022. As a result, taxpayers in these areas can now skip making their estimated tax payments for the third and fourth quarters of 2021 and simply include them when they file their 2021 return.

Will The Tax Deadline Be Extended Again In 2021

Due to the COVID-19 pandemic, the federal government extended this year’s federal income tax filing deadline from April 15, 2021, to May 17, 2021. In addition the IRS further extended the deadline for Texas, Oklahoma and Louisiana residents to June 15. These extensions are automatic and applies to filing and payments.

Read Also: When Should I Get My Tax Refund 2021

Are Inheritance Taxes Due On The Date Of Death Or When The Inheritance Is Received

While some states do impose an inheritance tax, the federal government only imposes an estate tax. Estate taxes are imposed on the estate itself rather than on the individuals inheriting assets from the estate. Estate taxes aren’t necessarily imposed on the date of death, but they will have been assessed by the time an heir officially receives assets.

When To Get Started On Your 2021 Taxes

The Canada Revenue Agency does not typically make the new annual tax return available until sometime in January, and you may not receive all the tax slips you need to file your return until the end of February. However, there is at least one tax-related task Simmons would like to see every Canadian do before the year is out: Take 20 minutes to figure out your potential tax bill.

Use an online tax calculator to figure that out, she says. So, if you have a big bill, it wont come as a shock and youve got four months to prepare for it. Plus, she says, it will help you work past the fear of owing money to the CRA, which makes tax season scary and is the main reason people procrastinate on their returns. You can also check your annual income against our tax bracket guide, too.

In the meantime, Im personally hoping for that 15% home appliance repair tax credit. Ive already paid a plumber $900 to fix my kitchen sinkand that doesnt include the cost of parts or the takeout I ordered because I had nowhere to wash dishes. The credit would at least give me a little buffer for the next thing that breaks down. Im looking at you, fridge.

Also Check: What Do You Claim On Your Taxes

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners.Heres an explanation forhow we make money.

Deadlines For December Tornado Victims

Following the disaster declarations issued by the Federal Emergency Management Agency , the IRS announced relief for victims of the December tornadoes, severe storms and flooding in parts of Kentucky, Illinois and Tennessee.

Affected individuals and businesses in certain areas of these states will have until May 16, 2022, to file returns and pay any taxes that were originally due on or after Dec. 10, 2021. This includes 2021 individual income tax returns due on April 18, as well as various 2021 business returns normally due on March 15 and April 18. As a result, affected taxpayers will also have until May 16 to make 2021 IRA contributions.

The May 16 deadline also applies to the quarterly estimated tax payments normally due on Jan. 18 and April 18, as well as the quarterly payroll and excise tax returns originally due on Jan, 18. As a result, taxpayers can skip making their Jan. 18 payment and simply include it with their 2021 return. Additionally, the quarterly payroll and excise tax returns that were originally due on Jan. 31, 2022 and May 2, 2022 now can be filed by May 16, 2022.

You May Like: Do You Have To Claim Stocks On Taxes

Tax Year 2021 Filing Season Update Video

View the tax year 2021 Filing Season Update Video to learn about a wide range of topics including:

- Detailed updates related to personal income tax filings

- The expansion of electronic filing and payment requirements for a number of tax types

- A summary of the COVID relief efforts for small businesses

- Trustee tax return changes for 2022

- A review of important webpages and DOR contact information, and

- A brief overview of operations at DOR in response to the current pandemic.

Tax Filing Season Begins Jan 24 Irs Outlines Refund Timing And What To Expect In Advance Of April 18 Tax Deadline

IR-2022-08, January 10, 2022

WASHINGTON The Internal Revenue Service announced that the nation’s tax season will start on Monday, January 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns.

The January 24 start date for individual tax return filers allows the IRS time to perform programming and testing that is critical to ensuring IRS systems run smoothly. Updated programming helps ensure that eligible people can claim the proper amount of the Child Tax Credit after comparing their 2021 advance credits and claim any remaining stimulus money as a Recovery Rebate Credit when they file their 2021 tax return.

“Planning for the nation’s filing season process is a massive undertaking, and IRS teams have been working non-stop these past several months to prepare,” said IRS Commissioner Chuck Rettig. “The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays. Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year. And we urge extra attention to those who received an Economic Impact Payment or an advance Child Tax Credit last year. People should make sure they report the correct amount on their tax return to avoid delays.”

Also Check: How Do College Students File Taxes

Will Student Loans Take My Tax Refund 2021

Keep in mind that private student loans cannot take your tax refund. … If you qualify, any money withheld from your tax return will be refunded to you. Hardship options: If you’re in danger of defaulting, you can request deferment or forbearance, both of which temporarily pause your student loan payments.

Estimated Tax Payment Due April 15

Notice 2021-21, issued today does not alter the April 15, 2021, deadline for estimated tax payments these payments are still due on April 15. Taxes must be paid as taxpayers earn or receive income during the year, either through withholding or estimated tax payments. In general, estimated tax payments are made quarterly to the IRS by people whose income isn’t subject to income tax withholding, including self-employment income, interest, dividends, alimony or rental income. Most taxpayers automatically have their taxes withheld from their paychecks and submitted to the IRS by their employer.

Don’t Miss: How To Figure Out Tax Deductions From Paycheck

When Are Federal Taxes Due In 2021 Irs Under Pressure To Extend Income Tax Return Deadline

UPDATE: The IRS announced Wednesday that it was moving the tax filing deadline to May 17. See the latest story here.

Should CPAs and taxpayers get an extra two months to file their federal income taxes? Does the tax season, which started late anyway, need to be extended until June 15?

The idea of a one-time, across-the-board extension makes a great deal of sense when you consider the extra long list of challenges and changes relating to the filing of 2020 tax returns, which remain due April 15.

One tax professional told me earlier this year that there’s absolutely nothing clear and simple about this tax season.

The COVID-19 pandemic continues to put a limit on office hours and in-person appointments for tax preparation. Fortunately, a great deal of tax preparation can be done remotely. So that’s a help.

Can I File A Tax Extension Electronically Free Of Charge

Yes, you can. If your adjusted gross income falls below the annual threshold, you can use the IRS Free File program to electronically request an automatic tax-filing extension. Higher earners can use the IRS Free Fillable forms, assuming they are comfortable handling their taxes. If thats not the case, there are several tax-software companies that offer free filing under certain conditions.

Also Check: How To File Estate Taxes

Expanded Penalty Waiver Available If 2018 Tax Withholding And Estimated Tax Payments Fell Short Refund Available For Those Who Already Paid 2018 Underpayment Penalty

The IRS lowered to 80 percent the threshold required for certain taxpayers to qualify for estimated tax penalty relief if their federal income tax withholding and estimated tax payments fell short of their total tax liability in 2018. In general, taxpayers must pay at least 90 percent of their tax bill during the year to avoid an underpayment penalty when they file. On January 16, 2019, the IRS lowered the underpayment threshold to 85 percent and on March 22, 2019, the IRS lowered it to 80 percent for tax year 2018.

This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding, quarterly estimated tax payments or a combination of the two.

Taxpayers who have not filed yet should file electronically. The tax software was updated and uses the new underpayment threshold and will determine the amount of taxes owed and any penalties or waivers that apply. This penalty relief is also included in the revision of the instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

Recommended Reading: Does Roth Ira Get Taxed