Tax Refund Not Applied To 2021 Taxes Owed

I had tax refund of lets say $1000 for year 2020 taxes and I applied that refund towards 2021 taxes. It went fine. But I ended up filing for extension and I got additional $100 refund and I also applied that refund towards 2021 taxes.

I filed for extension for 2021 taxes and have not filed my taxes yet. I recently got $100 + some change check from IRS and I was bit surprised to see that check. It took almost one year for check to arrive and I forgot what it was about. I did some searching and finally figure it out it was refund which came from extension filing portion.

I did check Turbo Tax and in the software it was cleared listed $1100 refund will go towards 2021 taxes but it did not. Then I checked all forms in forms mode and there in form 1040 X- line 22 it was marked $100 will be refunded to me.

But in same extension filing after 1040-X there is regular form 1040 also appear with all new figures. In that form line 34 under refund section clearly list $1100 will be applied towards 2021 taxes and 35a amount refund as $0.

Q. Is how this happened? Software is showing something else and under IRS forms 1040X and 1040 has conflicting information.

Q. Should I deposit this check or send the check back to IRS stating to be applied towards 2021 taxes. I assume this will make it more unnecessarily complicated?

How Much Interest Does The Irs Owe Me

If you filed a proper return on time and the IRS does not issue your refund within 45 days after accepting it, the agency is required to start paying interest on your refund amount.

As of July 1, the interest rate rose from 4% to 5% as a result of the Federal Reserve’s recent decision to raise the federal funds rate. If you electronically filed on time, the 45-day period started on April 18. If you filed a paper return, it began the day that the IRS marked your return as “accepted.”

Of course, any IRS interest you receive with your refund is considered taxable income.

What You Need To Know For The 2021 Tax

Ottawa, Ontario

Canada Revenue Agency

This year, the COVID-19 pandemic may have affected your tax-filing situation and may also affect the way you usually file your income tax and benefit return. Over 30 million returns were filed last season, and the Canada Revenue Agency wants to help you get ready to file your return this year.

Heres what you need to know for this tax-filing season, including filing options, COVID-19 benefits, and whats new.

Don’t Miss: How Much Federal Tax Should I Pay

How Long Does It Take To Receive My Tax Refund

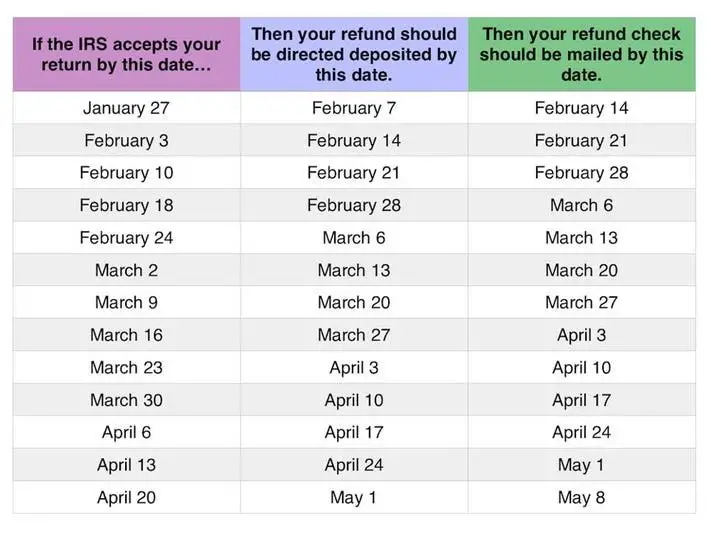

Approximately 90% of taxpayers will receive their refunds in less than 21 days from the day their tax return was accepted by the IRS. Most people receive their refunds in an average of 10-14 days.

Your bank will usually make your payment available within one to three days of receiving the payment from the IRS. Checks may take longer to clear your bank.

How Do I Track My State Refund

To track your state refund, select the link for your state from the list below. If youre looking for your federal refund instead, the IRS can help you.

Important: To help establish your identity, many states will ask for the exact amount of your expected refund in whole dollars. You can find this by signing in to TurboTax, and it’ll be on the first screen. If you’re using the mobile app, you may need to scroll down to find your refund amount.

- Each state handles its own refunds.

- Keep in mind that most dates are estimates and refunds can be delayed for many reasons.

- If you’re concerned, contact your state’s Department of Revenue at the links given.

- State tax webpages may be slow to respond during tax season. If a link doesn’t appear to work, try again during off-hours.

Don’t Miss: How To Apply For Sales Tax Exemption In Georgia

Why Do I See A Tax Topic 151 Tax Topic 152 Or Irs Error Message

Although the Where’s My Refund tool typically shows a status of Received, Approved or Sent, there are a variety of other messages some users may see.

One of the most common is Tax Topic 152, indicating you’re likely getting a refund but it hasn’t been approved or sent yet. The notice simply links out to an informational topic page on the IRS FAQ website explaining the types and timing of tax refunds.

The delay could be an automated message for taxpayers claiming the child tax credit or earned income tax credit sent because of additional fraud protection steps.

Tax Topic 151 means your tax return is now under review by the IRS. The agency either needs to verify certain credits or dependents, or it has determined that your tax refund will be reduced to pay money that it believes you owe. You’ll need to wait about four weeks to receive a notice from the IRS explaining what you need to do to resolve the status.

There are other IRS refund codes that a small percentage of tax filers receive, indicating freezes, math errors on tax returns or undelivered checks. The College Investor offers a list of IRS refund reference codes and errors and their meaning.

How Can I Track My Refund Using The Where’s My Refund Tool

To use the IRS tracker tools, you’ll need to provide your Social Security number or Individual Taxpayer Identification Number your filing status and your refund amount in whole dollars, which you can find on your tax return. Make sure it’s been at least 24 hours before you start tracking your refund, or up to four weeks if you mailed your return.

Go to the Get Refund Status page on the IRS website and enter your personal data, then press Submit. You should be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

Also Check: How Much Do You Have To Make Before Filing Taxes

Why Haven’t I Gotten My Refund Yet

There are numerous reasons why your tax return may not have been completely processed yet, resulting in a delayed refund. Here are the most common.

- Your return had errors or was incomplete

- You owe the IRS money

- Your bank account info was incorrect

- You filed a paper return

- You didn’t properly enter your stimulus payments

- The IRS suspects identity theft

- You filed an amended return

- Your return needs further review

In testimony to the House Ways and Means Committee, IRS Commissioner Charles P. Retting said that, in 2021, the agency received “far more than 10 million returns” in which taxpayers failed to properly reconcile their stimulus payments with their recovery rebate credit, which required a manual review and resolution.

If the delay is due to a necessary tax correction made to a recovery rebate credit, earned income tax or additional child tax credit claimed on your return, the IRS will send you an explanation. If there’s a problem that needs to be fixed, the IRS will first try to proceed without contacting you. However, if it needs any more information, it will write you a letter.

If you’ve requested a paper check for your tax refund, that’ll take longer, too — about six to eight weeks, according to the IRS.

Double Check Your Child Tax Credit And Stimulus Payments Online

During 2021, you may have received a monthly advanced child tax credit or stimulus payments. Depending on how much you received, you may qualify for additional credits on your tax return.

If you received monthly child tax credit payments, the IRS will mail you Letter 6419, which states the total amount of child tax credit payments received for 2021.

But double-check the amount reported on Letter 6419 before filing because the IRS said the letters might contain inaccurate reporting. If the amount of your Letter 6419 is different from what you expected, check the amount reported on your IRS.gov online account and use that number instead.

Also, youll receive Letter 6475 from the IRS, showing the amount of your third stimulus payment . Youll need the information from Letter 6475 to complete the Recovery Rebate Tax Credit, which allows you to request any additional stimulus payments that you may be due.

You May Like: How To Know How Much Taxes You Owe

Tax Filing Season Begins Feb 12 Irs Outlines Steps To Speed Refunds During Pandemic

IR-2021-16, January 15, 2021

WASHINGTON The Internal Revenue Service announced that the nation’s tax season will start on Friday, February 12, 2021, when the tax agency will begin accepting and processing 2020 tax year returns.

The February 12 start date for individual tax return filers allows the IRS time to do additional programming and testing of IRS systems following the December 27 tax law changes that provided a second round of Economic Impact Payments and other benefits.

This programming work is critical to ensuring IRS systems run smoothly. If filing season were opened without the correct programming in place, then there could be a delay in issuing refunds to taxpayers. These changes ensure that eligible people will receive any remaining stimulus money as a Recovery Rebate Credit when they file their 2020 tax return.

To speed refunds during the pandemic, the IRS urges taxpayers to file electronically with direct deposit as soon as they have the information they need. People can begin filing their tax returns immediately with tax software companies, including IRS Free File partners. These groups are starting to accept tax returns now, and the returns will be transmitted to the IRS starting February 12.

Last year’s average tax refund was more than $2,500. More than 150 million tax returns are expected to be filed this year, with the vast majority before the Thursday, April 15 deadline.

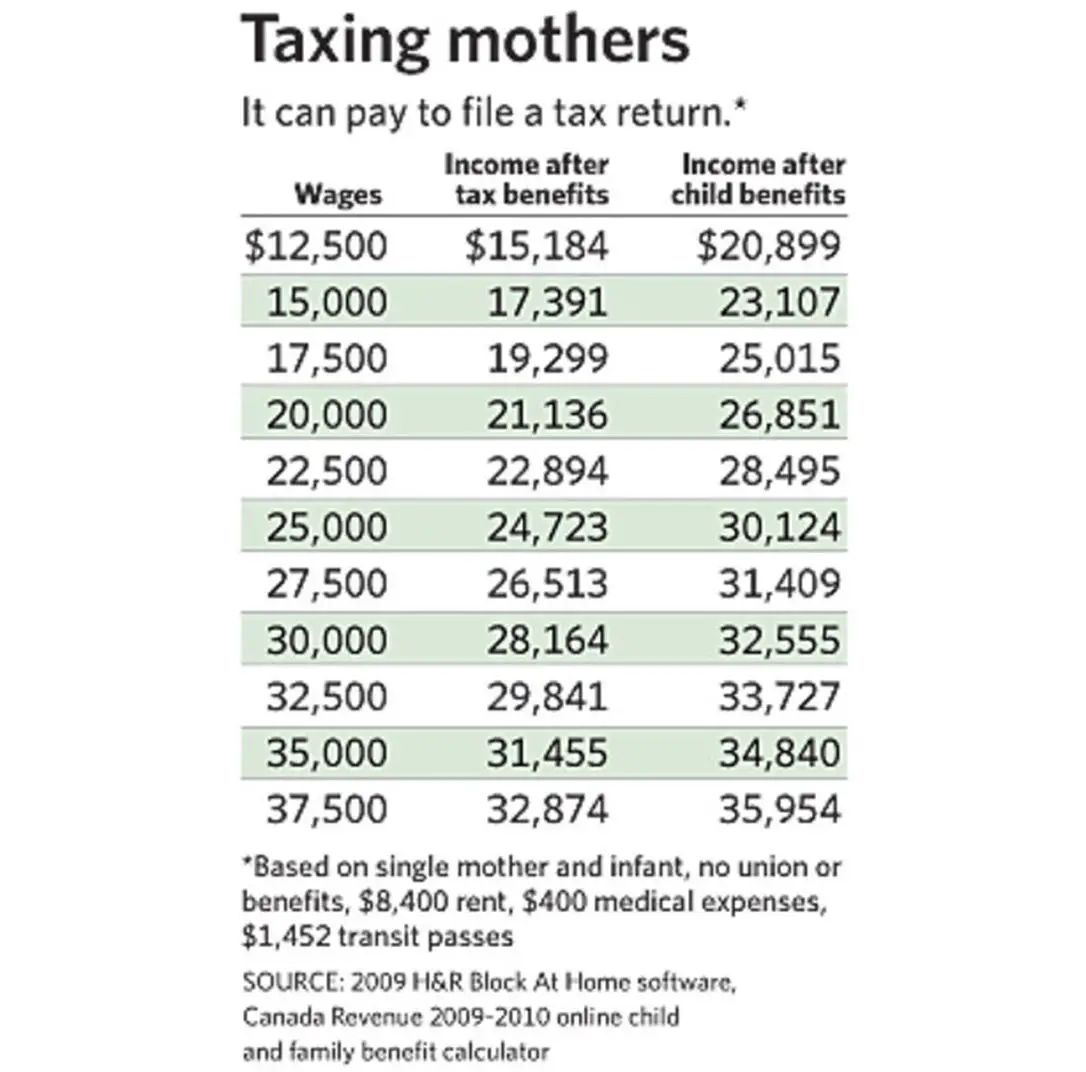

Do Not Risk Having Your Benefits And Credits Interrupted

Doing taxes on time is the best way to ensure your entitlement to benefits and credits, like the Canada child benefit , the Old Age Security pension payments, and the goods and services tax/harmonized sales tax credit, are not interrupted. Even if you owe tax, dont risk having your benefits and credits interrupted by not filing. If you cannot pay your balance owing, the CRA can work with you on a payment arrangement.

Read Also: How Do I Get My Taxes From Last Year

Are There Any Expected Tax Refund Delays

Yes, tax refund delays are common. The IRS is required by federal law to withhold tax refunds for taxpayers who claim Earned Income Tax Credits and Additional Child Tax Credit until at least Feb. 15, 2022. Keep in mind it can still take a week to receive your refund after the IRS releases it. So some people who file early may experience delays while awaiting their refunds. Refunds should be processed normally after this date.

Note: There may be delays for the 2021 tax year. The IRS continues to work through a backlog of tax returns , including those with errors and amended returns.

The IRS recommends filing your tax return electronically for faster processing and tax refund payments.

Also note that new identity theft protections and anti-fraud measures may hold up some refunds, as some federal tax returns may be held for further review.

Why Was My Refund Mailed Instead Of Being Deposited In My Bank Account

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If your bank rejected the deposit for some reason, it may be the next best way to get your refund.

In addition, the IRS can only direct deposit up to three refunds to one account, so if you are getting multiple refund checks they will have to be mailed. If you’re receiving a refund check in the mail, learn how to track it from the IRS to your mailbox.

It’s important to note that direct deposit isn’t always automatic for refunds. To be certain, sign in to your IRS account to check that the agency has your correct banking information.

Read Also: Do I Have To File Taxes To Get Stimulus Check

Estimate Your Income Tax For A Previous Tax Year

Use this service to estimate how much Income Tax you should have paid for a previous tax year.

There are different ways to:

If youre self-employed, use the HMRCself-employed ready reckoner to budget for your tax bill.

You may be able to claim a refund if youve paid too much.

You need details of:

- your earnings, before and after tax – get this from your P60

- any savings – get this from your bank statements or annual statement from your bank or building society

- any Gift Aid donations youve made to charity

Worries Build Among Families And Friends Who Filed Paper Returns

The anxiety has been huge the last few months for those who filed paper returns in 2022.

JoAnn Marino, of Washington Township, began worrying when a few family members called her saying they did not get their federal income tax refunds yet they’re OK with the State of Michigan when she filed paper returns for them back in early April.

A nephew is getting married in November and fears that he won’t get an estimated refund of around $3,600 in time to cover some of those big wedding bills.

His sister is expecting a tax refund of around $1,000 and could use the extra cash now to cover some down payments for a wedding next year.

She retired during the pandemic from her job in financial services and figures she can take up to 12 hours or so early in the year to prepare tax returns for her family, including her mother. Most of them have pretty basic returns she uses a CPA for her own return.

“They’re young, single,” she said of some family members. “My nephew doesn’t even own a home.”

“We’ve always filed some of them by paper and it’s never been an issue,” she said. “All of the e-filed returns have been processed.”

The IRS doesn’t post information for paper returns at “Where’s My Refund?” until those returns are processed. “Wheres My Refund?” does not explain any status delays, reasons for delays, where returns stand in the processing pipeline, or what action taxpayers need to take, according to the National Taxpayer Advocate’s report.

You May Like: How To Get Tax Info From Unemployment

Who Cannot Get An Estimate Online

You cannot get an estimate online if you:

- are entitled to claim

- were born on or before 5 April 1938 and get the higher allowances

- have other taxable income, for example from dividends and trusts

- are a higher rate taxpayer and want to estimate your Gift Aid tax relief

You can check youve paid the right tax by contacting HMRC or by getting help from an accountant.

If Your Refund Isnt What You Expected

If your refund amount isnt what you expected, it may be due to changes we made to your tax return. These may include:

- Corrections to any Recovery Rebate Credit or Child Tax Credit amounts

- Payments on past-due tax or debts, offset from all or part of the refund amount

For more details, see Tax Season Refunds Frequently Asked Questions.

You May Like: How Do Tax Liens Work

How To Track Your Tax Refund Status With The Irs

If you expect a tax refund this year, you can track your tax refund status with the IRS Wheres My Refund online tool or the IRS2Go mobile app.

Youll need to input your Social Security number, filing status and your expected refund amount. The IRS updates your tax refund information within 24 hours after e-filing and updates the tool daily. If you filed your tax return by mail, expect longer processing times and delays.

If you dont have access to online tools, you can also contact the IRS by phone at 800-829-1040 to obtain the status of your refund.

Get A Larger Tax Refund Next Year

If you want a bigger tax refund next year, then there are a few ways you can increase the amount of money the government will give you as a tax refund. One of the easiest ways is by contributing to a tax-deferred retirement plan such as a 401, the Thrift Savings Plan, or by opening a Traditional IRA, which allows you to deduct up to an additional $5,500 on your taxes each year . You can open an IRA in a variety of locations, including banks, brokerage firms, independent advisors and more.

Recommended Reading: Do Nonprofits File Tax Returns

How Long Should It Take

On Wednesday, after the release of the National Taxpayer Advocate report, the IRS took issue with the backlog inventory numbers in report, stating that the numbers are “neither the most accurate nor most recent figures.”

“Newer numbers through June 10 demonstrate that the IRS is ahead of tax return processing compared to a year ago,” the IRS said, stating that the agency continues to make substantial progress.

The IRS said 19.13 million paper returns amended and original returns awaited processing as of June 10. That’s down slightly from 19.88 million paper returns in the pipeline at the same time a year ago.

Of the total, however, IRS numbers indicated that 11.2 million individual paper returns awaited processing as of June 10, up from 9.6 million similar returns at the same time last year.

The tax deadline was extended until May 17 during the 2021 season and April 18 last year.

Efforts have been helped, the IRS said, by hiring more workers, adding new contractor support, shifting existing staff, providing mandatory employee overtime and developing efficiency improvements.

Only one number matters to taxpayers, of course, and it is the one that shows up in their bank account for their tax refund. And tax refunds are not arriving quick enough for many who filed paper returns.

In general, the IRS issues refunds within a few weeks to a month. Paper returns take longer than electronically filed returns, even if there are no mistakes or issues.