When Is Tax Day

While January to April is called âtax season,â the big âtax dayâ is usually April 15. If that falls on a holiday or weekend, it moves to the next business day.

Because April 15 falls on a Saturday and the 17th is the observation of Emancipation Day, this yearâs tax day is April 18, 2023. This is when individual taxpayers, sole proprietors, and C corporations need to file their taxes.

Note that if you are using a fiscal year that isnât the calendar year, your tax filing deadline is different and depends on your business entity and when your fiscal year ends.

When Can I Start Filing My Tax Return For 2020

Early in the month of January of each year, the Internal Revenue Service publishes a statement with the first day that tax returns can be submitted.The formal deadline by which you must submit your taxes is often between the middle and end of January.a status report for January 2021: The Internal Revenue Service has stated that it will begin processing tax returns on February 12.

IR-2022-08, January 10, 2022

WASHINGTON The Internal Revenue Service announced that the nations tax season will start on Monday, January 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns.

The January 24 start date for individual tax return filers allows the IRS time to perform programming and testing that is critical to ensuring IRS systems run smoothly. Updated programming helps ensure that eligible people can claim the proper amount of the Child Tax Credit after comparing their 2021 advance credits and claim any remaining stimulus money as a Recovery Rebate Credit when they file their 2021 tax return.

When Are Taxes Due In Your State

Be sure to find out when your local tax day is. Most taxpayers face state income taxes, and most of the states that have an income tax follow the federal tax deadline. Ask your state’s tax department: When are taxes due?

If you request a tax extension by April 18, you can have until October 17 to file your taxes.

-

However, getting a tax extension only gives you more time to file the paperwork it does not give you more time to pay.

-

If you can’t pay your tax bill when it’s due, the IRS offers installment plans that will let you pay over time. You can apply for one on the IRS website.

If you request a tax extension by April 18, you can have until October 17 to file your taxes.

Read Also: What Is Ca Use Tax

Requirements For Federal Excise Tax

Pay special attention to which types of excise tax forms you may be required to file.

- File Form 720 if you are required to pay quarterly Federal excise tax returns

- File Form 11-C if you need to file for wagering income

- File Form 2290 if your business uses heavy highway vehicles

Furthermore, you must file these forms each quarter of the calendar year, with due dates as follows:

- for first quarter

- for second quarter

- for third quarter

- for fourth quarter of the previous year

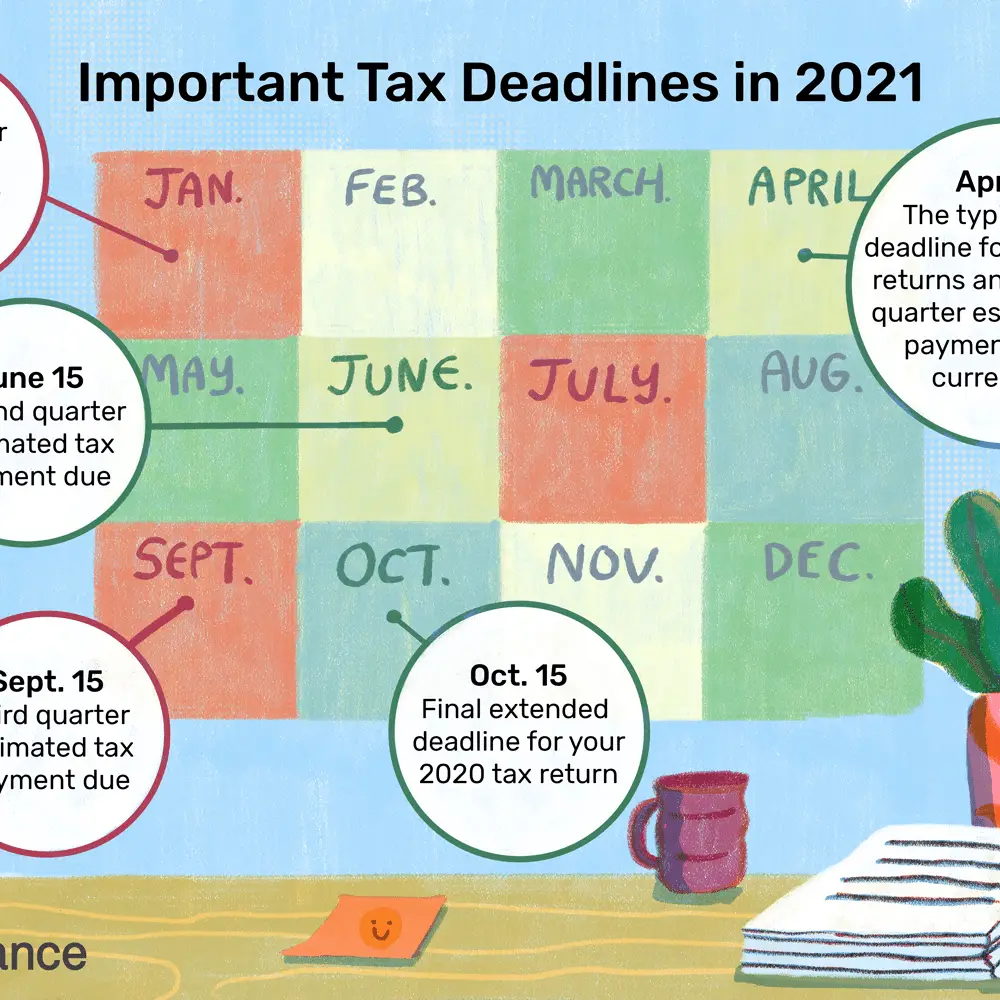

Know The Tax Deadlines That Apply To You So You Dont Get Hit With Irs Penalties Or Miss Out On A Valuable Tax Break

Getty Images

If you miss a tax deadline, the IRS can hit you hard with penalties and interest. For instance, the standard penalty for failing to file your annual tax return on time is 5% of the amount due for each month your return is late. If you pay your taxes late, the monthly penalty is 0.5% of the unpaid amount, up to 25% of what you owe, plus interest on the unpaid taxes. Similar penalties apply for missing other deadlines. And there could also be other negative consequences for being late, like losing out on a valuable tax break.

Its easy to avoid these headaches, though just dont miss the deadline! But we realize that its not always easy keeping track of all the various IRS due dates. So, for those of you who need a little help remembering when to file a return, submit a report or pay a tax, we pulled together a list of the most important 2022 federal income tax due dates for individuals. Theres at least one deadline in every month of the year, so play close attentionwe dont want you to get in trouble with the IRS.

NOTE: Some of the 2022 due dates listed below are extended for victims of recent natural disasters. In addition, several 2021 due dates were extended to January 3, 2022, for other natural disaster victims. For more information on these extensions, see our articles for victims of:

Also Check: How To Submit Payroll Taxes

You May Like: Do I Have To Pay Taxes For Babysitting

Tax Calendar: Important Tax Due Dates And Deadlines

Know the tax deadlines that apply to you, so you don’t get hit with IRS penalties or miss out on a valuable tax break.

If you miss a tax deadline, the IRS can hit you hard with penalties and interest. For instance, the standard penalty for failing to file your annual tax return on time is 5% of the amount due for each month your return is late. If you pay your taxes late, the monthly penalty is 0.5% of the unpaid amount, up to 25% of what you owe, plus interest on the unpaid taxes. Similar penalties apply for missing other deadlines. And there could also be other negative consequences for being late, like losing out on a valuable tax break.

It’s easy to avoid these headaches, though just don’t miss the deadline! But we realize that it’s not always easy keeping track of all the various IRS due dates. So, for those of you who need a little help remembering when to file a return, submit a report or pay a tax, we pulled together a list of the most important 2022 federal income tax due dates for individuals. There’s at least one deadline in every month of the year, so play close attentionwe don’t want you to get in trouble with the IRS.

Has Delaware Extended The Tax Filing Deadline

Asked by: Vernice Jakubowski

The deadline for Delaware taxpayers to file and pay their 2020 personal income tax returns to both federal and state governments has been extended from April 15 to May 17. This extension does not apply to estimated tax payments made quarterly by individuals those payments will still be due by April 30, 2021.

Donât Miss: How To Pay Quarterly Taxes

Recommended Reading: How To Find Your Business Tax Id Number

If You Have Deferred Vat Outstanding Act Now To Avoid A Penalty

Businesses may be charged a 5% penalty and or interest if they have deferred VAT and have not yet paid.

Anyone struggling to pay deferred VAT should contact us as soon as possible. We can look at manageable payments according to individual circumstances.

Businesses that deferred VAT payments due between 20 March 2020 and 30 June 2020 had the option to:

- pay in full on or before 31 March 2021

- join the online VAT deferral new payment scheme on or before 21 June 2021, to spread payments of deferred VAT over smaller, interest free instalments

- contact HMRC, to make an arrangement to pay on or before 30 June 2021

For those customers who do not contact us, whose payments are still outstanding and with no arrangement in place, penalties could apply.

Read more information on deferred VAT and the penalty charge.

File For An Extension By Tax Day

If you can’t finish your return by the April 18 tax deadline, file IRS Form 4868. This will buy most taxpayers until Oct. 17 to file their tax returns. See more about how extensions work.

Note: A tax extension gets you more time to file your return, not more time to pay your taxes. You still must pay any tax you owe, or a good estimate of that amount, by the tax deadline. Include that payment with your extension request or you could face a late-payment penalty on the taxes due.

» MORE:See how to set up an installment plan with the IRS by yourself

Don’t Miss: Where To File Connecticut State Taxes

What Happens If You Miss The Tax Filing Deadline And Are Owed A Refund

If you overpaid for the 2022 tax year, there’s typically no penalty for filing your tax return late. However, you should file as soon as possible.

Generally, you have three years from the tax return due date to claim a tax refund. That means for 2022 tax returns, the window closes in 2025. After three years, unclaimed tax refunds typically become the property of the U.S. Treasury.

Deadline For Filing Your Income Tax Return

The deadline for sending us your personal income tax return is April 30. If you or your spouse carried on a business or earned income as a person responsible for a family-type resource or an intermediate resource, you have until June 15 to file your return.

Any balance due must be paid by April 30.

NoteannonceIncome tax filing deadline extended

Since the regular filing deadline falls on a Saturday this year, you have until May 2, 2022, to file your 2021 income tax return and pay any income tax you may owe. No interest or penalty will be charged.

End of noteNote

Even if you are unable to pay the full amount of your balance due by April 30, file your return no later than the deadline to avoid a late-filing penalty.

End of note

Also Check: When Do We Need To File Taxes

How Much Money Could You Get And Who Is Eligible

There will be two rebates. One is for income taxes and another for property taxes.

Income tax

The income tax rebate calls for a single person to receive $50, while those who file taxes jointly are poised to receive a total of $100, Mendozas office said in a news release. Residents with dependents will receive a rebate of up to $300 $100 per dependent, with a maximum of three.

Income limits of $200,000 per individual taxpayer, or $400,000 for joint filers, will be attached to the checks, according to officials. To qualify, you must have been an Illinois resident in 2021 and meet the income criteria. Those who filled out the 2021 IL-1040 tax form will receive their rebates automatically.

Those who havent filed individual income tax returns and completed the form yet can still claim their rebate by filling out the form online. Residents with dependents must also complete the 2021 Schedule IL-E/EIC form.

Property tax

On top of the income tax rebates, some homeowners may receive more assistance.

Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL-1040 form, with a maximum payment of up to $300. To be eligible, you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be $500,000 or less if filing jointly. If filing alone, your income must be $250,000 or less.

You May Like: How To Find Out Who Claimed You On Their Taxes

What Happens If You Miss The Tax Return Deadline

Missing a deadline isnt the end of the world, as long as you act as soon as you realise you are about to miss it or immediately afterward. However, failure to act as soon as possible can lead to financial penalties.If you are due a tax refund, then theres rarely a penalty for a late filing and any penalty will be debited from your refund total, rather than being removed from your account. If you wish to apply for a refund, you have a period of 3 years from the tax return due date to file as long as all other returns are up to date. This gives you until 2025 to apply for a refund for the 2021 tax year.However, if you miss the deadline and actually owe the IRS some tax, then theyll typically charge interest for every day that its outstanding past the deadline. Its worth moving as quickly as possible to reduce your costs.

Recommended Reading: How To Pay Payroll Taxes

What If I Cannot Complete And File My Return On Time

To avoid a late filing penalty, you must file your return by Oct. 16, 2023. Do not send an incomplete return.

To avoid other penalties and interest, you must pay your tax by the due date. If you do not know your total tax due, you may estimate the amount and pay it by the due date. To see your payment options and make a payment, go to .

For more information, see Minnesota Statute 270C.395.

What Is The Business Tax Deadline For 2022

The main tax date in 2022 will be . Individuals, sole proprietors, and C corporations need to file their taxes by this date. The main tax day usually falls on April 15. However, April 15, 2022, is Emancipation Day.

Residents of Maine and Massachusetts have until , as April 18th is also a legal holiday .¹

Depending on the type of business you run and what your primary source of income is, you may have different business tax filing deadlines.

Read Also: When Is Tax Filing Day

What If You Cant Pay Your Taxes

Even if you cannot pay your taxes for one reason or another, file your return anyway, and immediately apply for a payment plan. The IRS will generally let you pay over time, as long as you make arrangements to do so.

You can also go to IRS Direct Pay and have tax payments withdrawn directly from your bank account if you owe money and dont want to send a check to the IRS via snail mail. This could save you time and money in the long run.

Also Check: Do You Pay Federal Taxes On Unemployment

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: How To File My Taxes For The First Time

Employer Paye New Recurring Direct Debit Functionality

The due date for payment of PAYE liabilities is the 22nd of the month for monthly payers or the 22nd of the appropriate month each quarter for quarterly payers.

Employers now have the functionality to set up recurring Direct Debits which will cover these liabilities on an ongoing basis.

Once set up, the Direct Debit collection process can only commence and conclude on a bank working day.

Initially you will receive a secure message to your inbox within your business tax account showing the Direct Debit amount. This is called the advance notification and it will be issued on the 20th or the next working day if the 20th of the month is not a working day.

Collection from the bank will happen on the 3rd working day after the advance notification is issued therefore. The collection will always be after the 22nd of the month.

As the due date for payment is the 22nd of the month, there may be instances where the charges within the online account are showing as overdue and interest charges may be showing. Once the Direct Debit has been collected, our financial systems will automatically update and remove any interest charges for the short period between the 22nd and the date the payment was received by HMRC.

For example, in December 2022:

- the advanced notification will be issued on 20 December 2022

- the Direct Debit will commence collection on 21 December 2022

- money will be collected from the bank on 23 December 2022

- interest for late payment will be removed by 24 December 2022

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How is this page expert verified?

At Bankrate, we take the accuracy of our content seriously.

Expert verified means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

Arrow Right Arrow Right Arrow Right

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

Recommended Reading: How To File Taxes If Married But Living Separately