Estimated Irs Refund Tax Schedule For 2021 Tax Returns

In prior years, the IRS issued its refund tax schedule to provide a timeline of when you can expect to receive your tax refund. While the IRS no longer publishes a refund tax schedule, we put together an estimate of when you might expect to receive your tax refund based on previous years.

|

Date the IRS received your return |

Estimated direct deposit refund date |

Estimated check refund date |

|

May 13 |

How To Estimate Your Tax Refund

More than half of all tax filers in the United States received a tax refund in 2021 for the 2020 tax year, according to the IRS. Figuring out what youll get back on your tax return can help you plan for the impact your refund will have on your personal finances. You can estimate your tax refund easily with a few key pieces of information and a bit of math.

Before diving into the math, its important to understand the difference between your tax return and your tax refund. A tax return is the form you file annually that outlines your income, expenses, investments and other tax-related information. The information on your tax return will determine whether you receive a tax refund.

You get a tax refund when you pay more taxes to your state government or the federal government than your actual tax liability. A refund is a check from the government for the amount you overpaid.

The first step in estimating your tax refund is to calculate your taxable income. Taxable income can be calculated as your gross income minus all deductions. There are two types of tax deductions: standard and itemized.

Once you find out your taxable income, the next step to estimating your refund is to apply your tax bracket. Your tax bracketdetermines what percent of your taxable income the government collects. So if you earn a higher income, youll pay a higher percentage of that income in taxes. That progressively increasing percentage is your marginal tax rate.

You May Face A Delay If You Claim These Tax Credits

There are a couple of issues that could cause delays, even if you do everything correctly.

The IRS notes that it can’t issue a refund that involves the Earned Income Tax Credit or the Child Tax Credit before mid-February. “The law provides this additional time to help the IRS stop fraudulent refunds from being issued,” the agency said this week.

That means if you file as soon as possible on January 24, you still might not receive a refund within the 21-day time frame if your tax return involves either of those tax credits. In fact, the IRS is informing those who claim these credits that they will most likely receive their refunds in early March, assuming they filed their returns on January 24 or close to that date.

The reason relates to a 2015 law that slows refunds for people who claim these credits, which was designed as a measure to combat fraudsters who rely on identity theft to grab taxpayer’s refunds.

With reporting by the Associated Press.

Recommended Reading: Where To File Federal Tax Return In California

How To Maximize Your Tax Refund

There are several ways you can get a bigger refund on your taxes this year. Here are just a few of the best ways to maximize your refund.

Top 5 Tips to Get Your Maximum Tax Refund

Figuring out how to maximize your refund can involve some pretty in-depth knowledge. If the process seems a bit overwhelming, talking to a CPA or tax professional can help make sure you dont miss anything.

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Read Also: Where Can I File An Amended Tax Return For Free

Looking For Information About Your Tax Refund

E-file and sign up for Direct Deposit to receive your refund faster, safer, and easier! You can check the status of your refund using IRS Wheres My Refund?

Not using e-file? You can still get all the benefits of Direct Deposit by getting your tax refund deposited into your account. Simply provide your banking information to the IRS at the time you are submitting your taxes.

Convenience, reliability and security. No more special trips to your institution to deposit your check a nice feature if you are busy, ill, away from home, located far from a branch or in a place where parking is hard to find. You no longer need to wait for your check to arrive in the mail. Your money will always be in your account on time. If you move without changing financial institutions, you will not have to wait for your check to catch up with you. You do not have to worry about lost, stolen or misplaced checks.

We issue most refunds in less than 21 calendar days.

Use the IRS2Go mobile app or the Wheres My Refund? tool. You can start checking on the status of your tax return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return.

The Treasury Bureau of the Fiscal Service’s Kansas City Regional Financial Center will be disbursing all tax refund direct deposits on behalf of the IRS. Information in the ACH Batch Header Record can be used to identify an IRS tax refund, as follows:

Direct Deposit

How To Check Your Tax Refund Status

You can check your tax return status online using the IRS Wheres My Refund? tool. To use this tool, youll need the following information:

- Your Social Security number or ITIN

- Your filing status

- Your exact refund amount

The tool can tell you the status of your refund from 24 hours after you e-file, or four weeks after you mail your return. The system is updated each day, usually overnight.

You can also call the IRS TeleTax System at 1-800- 829-4477 to check the status of your refund over the phone. Be aware that the volume of calls trying to reach IRS representatives is at an all-time high, and the IRS recommends that you do not attempt to call until 21 days after you e-file or four weeks after you mail your return.

Recommended Reading: What Do You Need To Do Your Taxes On Turbotax

Do You Even Have To File Taxes

Whether you have to file a tax return this year depends on your income, tax filing status, age and other factors. It also depends on whether someone else can claim you as a tax dependent.

Even if you dont have to file taxes, you might want to do it anyway: You might qualify for a tax break that could generate a refund. So give tax filing some serious consideration if:

-

You qualify for certain tax credits.

How To Call The Irs If Youre Waiting On A Refund

Its best to locate your tax transcript or try to track your refund using the Wheres My Refund tool . The IRS says that you can expect a delay if you mailed a paper tax return or had to respond to the IRS about your electronically filed tax return. The IRS makes it clear not to file a second return.

The IRS says not to call the agency because it has limited live assistance. The agency is juggling the tax return backlog, delayed stimulus checks and child tax credit payments. Even though the chances of speaking with someone are slim, you can still try. Heres the best number to call: 1-800-829-1040.

Dont Miss: What Do Tax Accountants Do

Read Also: When Is Tax Filing Deadline 2021

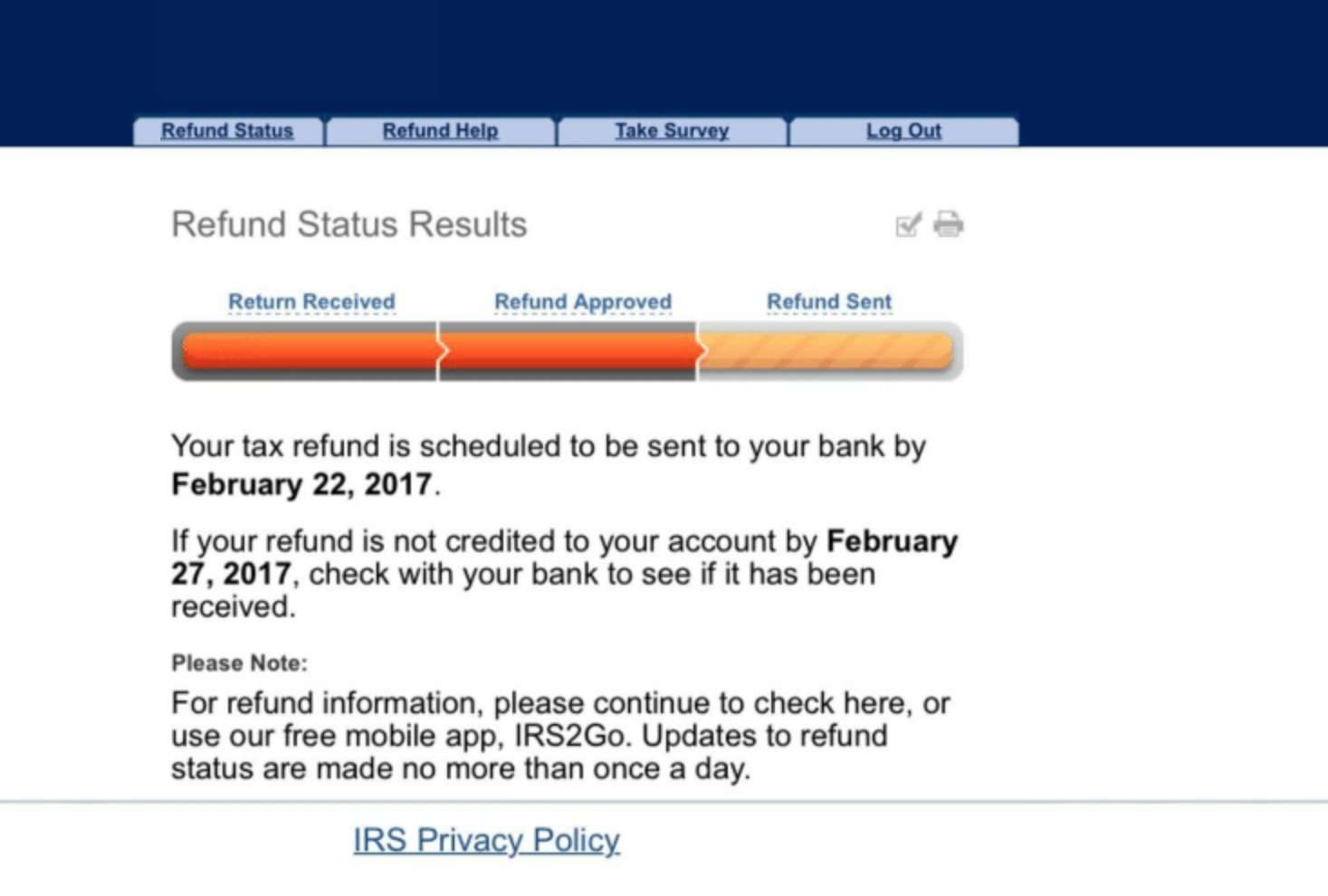

Checking Status Of Your Refund

Taxpayers can check the status of their refund at the IRS site “Where’s My Refund?”

People will need to know their Social Security number or their Individual Taxpayer Identification Number, their filing status and their exact refund amount.

The IRS says people can start checking the status of their refund within 24 hours after an electronically filed return is received by the agency, or four weeks after a taxpayer mails a paper return.

The tool will provide information about three phases of processing: Alerting the taxpayer when their return is received, when their refund is approved and when the refund is sent.

Getting Refunds Within 21 Days Of Filing

If all goes well, though, taxpayers who e-file can receive their refunds via direct deposit as quickly as one week after filing based on previous years’ processing time, according to trade publication CPA Advisor.

It’s important to note that processing time typically slows down as the tax season gets underway and the IRS handles more returns, the publication added.

In the meantime, tax experts say there are some steps that taxpayers can take to help ensure a quick tax refund, which is even more important this year given that the IRS is starting with a backlog. National Taxpayer Advocate Erin M. Collins issued a report to Congress in January that warned she is “deeply concerned about the upcoming filing season” given the backlog, among other issues.

“The first thing you know if you are going to cook a meal, you have to have the kitchen cleaned up from the last meal,” said Mark W. Everson, vice chairman at Alliantgroup and former Commissioner of the IRS. “It just snowballs into a terrible situation.”

Delays in processing tax returns count as one of the agency’s most pressing problems, Collins said in her report, which described an agency in crisis.

Americans are hearing the message: Potential IRS processing delays ranked second among the three top concerns of people who are expecting a refund from the IRS this year, according to a Bankrate.com poll of almost 2,500 people released February 22.

You May Like: How Do You Do Taxes

Gather Tax Filing Information

Youll need to do this whether youre hiring a tax preparer or doing the tax filing yourself. The goal is to gather proof of income, expenses that might be tax-deductible or win you a tax credit, and evidence of taxes you already paid throughout the year. Our tax prep checklist has more guidance, but heres a short version of what to round up:

-

Social Security numbers for yourself, as well as for your spouse and dependents, if any.

-

W-2 form, which tells how much you earned in the past year and how much you already paid in taxes.

-

1099 forms, which are a record that some entity or person not your employer gave or paid you money.

-

Retirement account contributions.

-

State and local taxes you paid.

-

Educational expenses.

How Do Tax Credits Work

A tax credit is subtracted directly from the amount of tax you owe, so it reduces your total tax liability dollar for dollar, and the value of the credit is the same for everyone who is eligible to receive it. This is different from tax deductions, which subtract from your taxable income.

The value of a tax deduction depends on your marginal tax rate, so the more income you earn, the less a deduction is potentially worth. Here are a few examples of the most common tax credits claimed by taxpayers each year.

Most Common Tax Credits

- Earned Income Tax Credit

- The earned income tax credit helps low- to moderate- income workers and families who meet certain requirements reduce their tax liability.

- Child Tax Credit

- You could increase your tax refund by thousands of dollars by claiming the child tax credit for each child you claim as a dependent. If you received an advance payment of part of your 2021 CTC under the American Rescue Plan, you can claim the rest of the CTC when you file your tax return for the 2021 tax year.

- Savers Credit

- Putting away money for retirement may entitle you to a savers credit on your tax return. If you contributed to an IRA this year, the retirement savings contribution credit will reduce your tax liability by between 10% and 50% of the amount of your contributions, depending on your income.

- Education Credits

- The IRS offers credits for qualifying education expenses, such as the American opportunity tax credit and the lifetime learning credit.

Also Check: How Much To File Taxes

Important Notice For Tax Time

Did you know that identity theft, especially around tax season, is running rampant? People’s credit information was stolen at Target, Home Depot, even The State of California. Now’s a great time to make sure that your credit is safe.

Credit Karma: Second, now is a great time to check your credit report and make sure that there are no issues. You should be checking your credit at least once per year, and tax time is a great time to do it. We recommend using because its free! Plus, has a lot of great tools to help you improve your credit if you need to, and they can help you monitor your credit over time.

How To Get Your Tax Refund Faster

No matter how you plan on using your tax refund, youre probably anxious to receive it. Here are a few steps you can take to improve your chances of getting your tax refund quickly:

File early: In general, the sooner you file, the sooner you will get your refund. But returns claiming certain tax credits might not get processed any earlier than late February. Specifically, taxpayers taking advantage of the Earned Income Tax Credit and/or the Additional Child Tax Credit may have to go through this wait.

Check your return for errors or omissions: When the IRS needs to contact you for additional information, it slows down how quickly you receive your refund.

Opt to use e-file to have your refund directly deposited into your bank account: With direct deposit, it might take a few days for the refund to show up in your account, depending on your financial institution. If you prefer, you can even spread out your refund among two to three bank accounts, including an IRA. The paper return with a check is a much slower process, which can take up to four weeks.

Make sure your direct deposit account is in your name: The IRS can only deposit a check into an account in your name, your spouses name or a joint account. If your account has others named on it or is in someone elses name, the IRS will mail a paper check to you instead.

Don’t Miss: When Will Irs Accept 2021 Tax Returns

Tax Refund Schedule For Extensions And Amended Tax Returns

The refund schedule should be the same if you filed for a tax extension however, there is no official schedule for tax refunds for amended tax returns. The above list only includes dates for e-filing an original tax return. Amended tax returns are processed manually and often take eight-12 weeks to process. If you do not receive an amended tax return refund within eight weeks after you file it, then you should contact the IRS to check on the status.us.

When Is The Earliest I Can File

Because so many of our clients are excited to get their refunds, we get asked all the time, When is the earliest I can file my federal tax return?

You cannot technically file your federal taxes until the IRS starts accepting returns. However, you can begin to prepare your return with a pay stub, and complete it when you have your W-2 form or other necessary tax documents. Tax-preparation services can also help with this.

You can prepare and submit your return as soon as you receive your W-2s from your employers and have all the relevant information and documents. Most W-2s arrive in mid-January, but employers have until January 31, 2020 to send W-2s and Forms 1099, so you could receive yours as late as early February.

Also Check: How To Lower Taxes With Ira

Tax Refund Frequently Asked Questions

Direct Deposit is a safe, reliable, and convenient way to receive Federal payments. The Department of the Treasury’s Bureau of the Fiscal Service and the Internal Revenue Service both encourage direct deposit of IRS tax refunds. Direct Deposit combined with IRS e-file provides taxpayers with the fastest and safest way to receive refunds.

This resource page of frequently asked questions about IRS tax refunds provides financial institutions with useful information for reference while assisting customers during the tax filing season.

For other FAQs about Direct Deposit, .

Bottom Line On Tax Returns

An accurate income tax return estimator can keep you from banking on a refund thats bigger in your mind than the real refund that hits your bank account. It can also give you a heads-up if youre likely to owe money. Unless youre a tax accountant or someone who follows tax law changes closely, its easy to be surprised by changes in your refund from year to year. Use the tool ahead of time so you arent already spending money you may never see. You can also run the numbers through a tax refund calculator earlier in the year to see if you want or need to make any changes to the tax withholdings from your paycheck.

You May Like: Can I File Taxes Late