Will Calling You Help Me Get My Refund Any Faster Or Give Me More Information

IRS representatives can research the status of your return only if:

- It’s been more than 21 days since you received your e-file acceptance notification,

- It’s been more than 6 months since you mailed your paper return, or

- The Where’s My Refund? tool says we can provide more information to you over the phone.

American Opportunity Tax Credit

The American Opportunity Tax Credit is a credit for qualified education expenses paid by an eligible student who is the taxpayer, the taxpayer’s spouse, or the taxpayer’s dependent. The maximum annual credit is $2,500 per eligible student. To qualify, the student must be enrolled at an eligible educational institution at least half time for at least one academic term for the given tax year. In some cases, this credit may be partially refundable. If the credit reduces the tax liability to zero, an additional 40% of the unused otherwise allowable credit, up to $1000, is refundable to the taxpayer.The amount of the American Opportunity Tax Credit is phased out if your MAGI exceeds $80,000 if single . You can’t claim an American Opportunity Tax Credit if your MAGI is $90,000 or more if single .

If you are eligible for any of these tax credits, they can substantially reduce or even eliminate the amount of taxes that you owe. They may also increase the amount of your tax refund. In some cases, taxpayers may be eligible for a refund even if there were no taxes withheld from their income for the year due to these tax provisions.

Why Do I See Irs Treas 310 In My Bank Statement

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed in the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of electronic payment. You may also see TAX REF in the description field for a refund.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

Don’t Miss: What Is My Tax Id Number For My Business

Do You Have An Eligible Child

You have an eligible child if all the following conditions are met at the beginning of the payment month:

- your child is under 19 years of age

- your child lives with you

- you are primarily responsible for the care and upbringing of your child

- your child is registered for the Canada child benefit

If you are eligible for the Canada child benefit, a credit for each eligible child will be included in the calculation of the CAIP.

If you have not registered your child for the Canada child benefit, go to Canada child benefit – How to apply.

If you and your ex-spouse share custody of your child/children, if entitled, you will receive payments equal to 50% of the amount you would have received if the child resided with you full-time.

Can I Claim The Eitc Child Tax Credit And Child And Dependent Care Tax Credit

Provided you meet the qualifications for these tax credits, you can claim all three to the extent that you meet the requirements. Even if you don’t owe taxes for 2021, you should nevertheless file a tax return if you qualify for any of these tax credits because all three are refundableany credit amount that exceeds your tax liability is paid to you if claimed on your tax return.

Recommended Reading: Who Has Free Tax Filing

Research All Your Potential Tax Deductions

Tax deductions are qualified expenditures that can reduce your taxable income. For example, some losses and expenditures, student loan interest, and up to $3,000 of capital losses are deducted from your gross income when determining your adjusted gross income . Other expenditures, such as state and local taxes and charitable contributions, can be claimed as itemized deductions from AGI in determining taxable income. Most taxpayers tend to focus on the most well-known deductions. However, there are a number of lesser-known tax deductions that you may qualify to take.

Tax Credits For Education Expenses

Two types of tax credits, the Lifetime Learning Credit and the American Opportunity Tax Credit, provide tax benefits for qualified educational expenses for postsecondary education. The rules for these credits differ. The IRS provides a comparison chart online. It also provides an extensive list of FAQs to help you determine which credit to claim.

Read Also: How To Get Last Year’s Tax Return

Child And Dependent Care Tax Credit

The Child and Dependent Care Tax Credit is a credit that helps taxpayers cover the expenses of caring for a child who is age 12 or under as of the year’s end, a disabled spouse, or a qualified dependent while working or looking for work. The credit is a percentage of a taxpayer’s earned income and phases out for taxpayers with AGIs above $400,000. No credit is allowed at an AGI of $438,000 and higher.

For 2021, the ARPA generally increased the amount of the CDCTC and made it fully refundable.

The rate of the credit increased for low- and moderate-income workers but decreased for higher-income ones. The changes are the same for all taxpayers regardless of filing status. For workers with AGIs below $125,000, the percentage is 50% for AGIs between $125,000 and $183,000, the CDCTC phases out by one percentage point per $2000 above $125,000, until it reaches 20 % at AGI of $183,000. Between AGIs of $183,000 and $400,000, the percentage remains 20%. Above an AGI of $400,000, the CDCTC phases out by one percentage point per $2000 until it reaches 0% at an AGI of $438,000.

The 2021 enhancements to the CDCTC apply for one year only. Unless extended by Congress, the CDCTC for 2022 will be nonrefundable and revert to its prior rules: lower expense ceilings, a 35% rate for AGIs under $15,000, and a phaseout to 20% at an AGI of $43,000.

How Much Interest Does The Irs Owe Me

If you filed a proper return on time and the IRS does not issue your refund within 45 days after accepting it, the agency is required to start paying interest on your refund amount.

As of July 1, the interest rate rose from 4% to 5% as a result of the Federal Reserve’s recent decision to raise the federal funds rate. If you electronically filed on time, the 45-day period started on April 18. If you filed a paper return, it began the day that the IRS marked your return as “accepted.”

Of course, any IRS interest you receive with your refund is considered taxable income.

Also Check: Am I Eligible For Child Care Tax Credit

Request Direct Deposit Of Your Refund

According to the IRS, eight out of ten taxpayers use direct deposit to receive their tax refunds faster. This option is available to you whether you file online or by paper tax return.

If you dont have a bank account, you may want to consider other options, such as a prepaid debit cardthe IRS can issue your refund to one of these cards. But be warned: prepaid debit card providers can charge a lot of fees for everyday services like reloading the card, so shop around before deciding whether this is a good option for you.

Your Tax Return Is Approved Or Rejected

So if the tax return was approved, then you will simply progress to the next stage which is getting your refund sent.

But if your tax return was rejected, if it was REJECTED, then you got to start all the way over.

And this is just going to make getting your tax refund in 2021 much longer.

So here are the two reasons why we see your tax return may be rejected:

a. A typo in the area of the first name, last name, date of birth, or Social Security number.

If the IRS cannot verify who you are within the tax return, it is likely going to get rejected. Well, not even likely, it will get rejected.

b. You claim something like a child that someone else has already claimed.

So if someone like a family member or a spouse claims a dependent and then files their taxes before you, then they are going to be the ones that get the tax credit or deduction.

And, you are going to get rejected.

Weve actually seen this happen before, actually many times. So, if this does happen to you, were sorry theres really nothing you can do, at least immediately.

You just have to go to the person who claimed the dependent that you were planning on claiming and then work something out between the two of you.

Or, file what is called an amended tax return.

This by the way, if you happen to have to file an amended tax return, the process for getting your tax refund in 2021 can take eight weeks or even more.

So if youre looking to get your tax refund fast, that should be your last option.

Recommended Reading: How Much Does Unemployment Take Out For Taxes

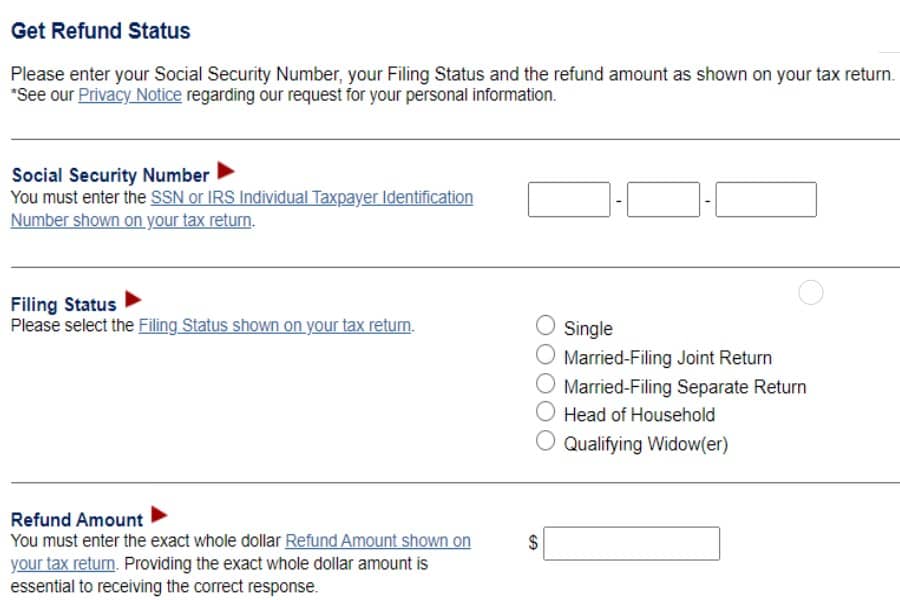

How To Contact The Irs If You Haven’t Received Your Refund

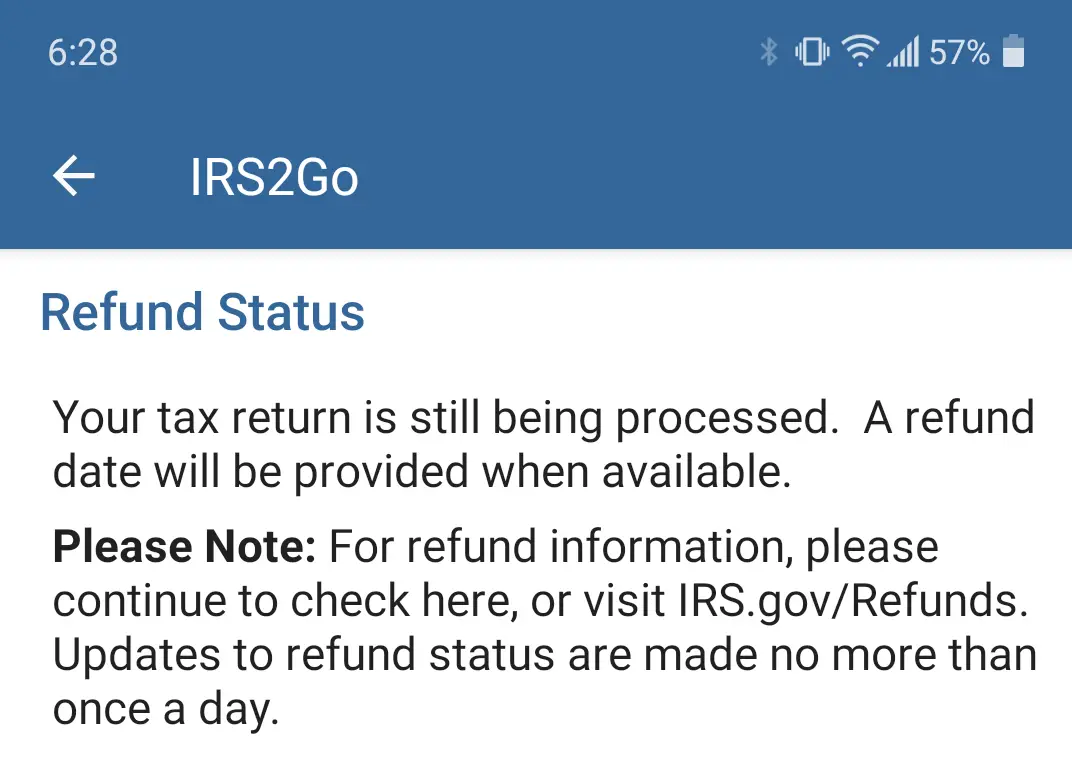

- In most cases, you’ll get your tax refund within 21 days of e-filing, though it can take longer.

- Check the status of your return online, then call the IRS if there seems to be a problem.

- Be prepared to follow up, too, because the IRS isn’t necessarily keeping track of your case.

I am a money nerd. I love adding the finishing touches to my tax return and generating pages that neatly summarize my income for a year. Some years, that also comes with the good news that a tax refund is headed my way.

I wasn’t sure what to expect for 2018, the first filing year under the new rules of a major tax overhaul. My results were much better than expected, but my refund was months late. I had to hunt down the steps to follow if your refund doesn’t show up as planned.

In most cases, taxpayers can expect to get their refund within 21 days of filing. If it has been longer, follow these steps to track down your refund.

Your Tax Refund Has Been Sent

If you get this status then that means your refund has been sent to you either via mail or directly deposited into your bank account.

But weve seen people get this status and they still dont have their refund. So what exactly is going on?

Two big things that we see when you have this status and you dont have your refund.

a. If You Chose to Get Your Refund Via Mail

If the IRS says your tax refund for 2021 has been sent and you filed by mail, then try to give it about 7 to 10 days to actually come to your mailing address.

Again, there have been some major mail delays that have been going on.

Now after 10 days, you still dont have it then go back to your tax return and make sure you gave the IRS the correct address.

Weve seen before with our clients that sometimes they gave the IRS an old address or a secondary address like a family members house.

If this is the case then you will want to go to the IRS website, log into your account and update your address.

If these two things dont help you then keep reading to see if it could be something else.

b. If You Chose to Get Your Refund Via Direct Deposit

If you chose to get your refund direct deposited and you dont see it in your account and your status is refund sent, heres what you need to look at.

First, and just hasnt cleared yet.

That will help a lot of the time. If it doesnt, then go back to your tax return and make sure you gave the IRS the correct bank account number.

You May Like: How To File Multiple Tax Returns On Turbotax

How Long Does It Take To Get Your Tax Refund

Many Americans look forward to receiving their tax refund each year to help make important personal finance decisions, and you may be wondering how soon youll get yours. The time it takes to receive your tax refund can vary based on several factors, including when and how you file your tax return.

According to the IRS, the best way to avoid delays on your tax refund is to file an accurate tax return using e-file software to file electronically and opting to receive your refund via direct deposit. Most filers who use this method should receive their refunds within 21 days of submitting their return online.

If you mail your return, you can expect to receive your refund in about six to eight weeks from the date the IRS receives your return. You can choose to receive your refund as a check in the mail, but keep in mind that you will likely receive your refund anywhere from a few days to a few weeks later than you would have with direct deposit due to transit time.

Whether filed electronically or on paper, all returns are opened and processed by the IRS in the order they are received, so the earlier you file your taxes, the earlier youll receive a refund.

How Should You Request To Receive Your Refund

The IRS gives you three options for receiving your refund:

- Direct deposit

- Paper check

- Deposit into U.S. Savings Bonds

You can also apply a refund to any future taxes owed. This is a popular choice among some small business owners who are required to pay estimated taxes.

Of the three refund options available to you, direct deposit is the fastest and safest option. You can receive your refund via an ACH bank transaction in as little as a few days. Paper checks, however, can take over a week to process, several days to travel via the postal system, and several days to clear your bank.

*Note:Some tax software companies also offer the option of receiving a tax refund on a prepaid debit card. Im not particularly fond of this option, but it is available to some tax filers. In this case, the refund is first sent to the tax preparation company, then they issue you the prepaid debit card.

You May Like: How To Do My Taxes By Myself

What To Do With Your Tax Refund

Through Feb. 4, 2022, over 4.3 million people have received their tax refund at an average of $2,201 per person, according to the IRS. And with many Americans unable to afford a $1,000 emergency, a refund of that size is extremely helpful.

If you receive a tax refund, here are some starting points of where you can send those funds:

You May Face A Delay If You Claim These Tax Credits

There are a couple of issues that could cause delays, even if you do everything correctly.

The IRS notes that it can’t issue a refund that involves the Earned Income Tax Credit or the Child Tax Credit before mid-February. “The law provides this additional time to help the IRS stop fraudulent refunds from being issued,” the agency said this week.

That means if you file as soon as possible on January 24, you still might not receive a refund within the 21-day time frame if your tax return involves either of those tax credits. In fact, the IRS is informing those who claim these credits that they will most likely receive their refunds in early March, assuming they filed their returns on January 24 or close to that date.

The reason relates to a 2015 law that slows refunds for people who claim these credits, which was designed as a measure to combat fraudsters who rely on identity theft to grab taxpayer’s refunds.

With reporting by the Associated Press.

Recommended Reading: How To Keep Track Of Miles For Taxes

Can I Call The Irs To Get Answers

While you could try calling the IRS to check your status, the agency’s live phone assistance is extremely limited.

The IRS is directing taxpayers to the Let Us Help You page on its website and to get in-person help at Taxpayer Assistance Centers around the country. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if you’re eligible for assistance by calling: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if it’s been 21 days or more since you filed your taxes online, or if the Where’s My Refund tool tells you to. You can call 800-829-1040 or 800-829-8374 during regular business hours. If you have not received a refund yet, you shouldn’t file a second tax return.

When You Will Receive Your 2021 Tax Refund And How To File Electronically

The IRS states in its FAQ section that most refunds are issued within 21 calendar days. However, there’s a disclaimer stating that due to processing issues caused by the pandemic, it may take longer to deliver your refund.

Additionally, how you file your taxes can affect how long it takes to track the status of your refund. If you file electronically like the vast majority of Americans do you can start tracking your tax refund status within 24 hours of filing on the Where’s My Refund site. However, if you file by mail, your processing time extends to at least four weeks to see your payment status on the site.

So if you haven’t filed your taxes yet, you may want to consider filing electronically with a tax service like TurboTax or H& R Block to avoid issues like waiting for months to receive your refund or even losing your tax files altogether. Select ranked TurboTax as the best overall tax-filing software and as the best free tax software. These services can help you maximize deductions and increase your refund.

Also keep in mind that you can file your taxes online for free through the IRS if your adjusted gross income was less than $73,000 in 2021.

Also Check: How To Pay Tax By Phone