What You Can Do To Help Us Stop Fraud

If we suspect fraud is being committed against you, we will send you a letter requesting verification of your identification. Please respond to our letter as soon as possible. The quickest way to respond is to visit myVTax and click Respond to Correspondence.

Learn more about identity theft and tax refund fraud, how to detect it, how to avoid it, and how to report it if you believe you are a victim.

Can I Call The Irs To Get Answers

While you could try calling the IRS to check your status, the agency’s live phone assistance is extremely limited.

The IRS is directing taxpayers to the Let Us Help You page on its website and to get in-person help at Taxpayer Assistance Centers around the country. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if you’re eligible for assistance by calling: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if it’s been 21 days or more since you filed your taxes online, or if the Where’s My Refund tool tells you to. You can call 800-829-1040 or 800-829-8374 during regular business hours. If you have not received a refund yet, you shouldn’t file a second tax return.

You Have Not Updated The Status Of My Refund In A While When Will I Receive It

Each return processes through multiple steps. We recommend you file electronically and include all documentation to ensure we can process your return/refund as quickly as possible. Please check back on the status daily. If we require additional information, we will contact you through U.S. Postal Service mail.

Also Check: How Much Is Tax In Washington State

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns that we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

The CRA may take longer to process your return if it is selected for a more detailed review. See Review of your tax return by the CRA for more information.

If you use direct deposit, you could get your refund faster.

When To Expect A Tax Refund To Arrive

You will usually receive your refund within three weeks of the date when the IRS receives your return, even faster if you choose to have it directly deposited into your checking or savings account.

Though theres a notice on the IRS advice website that states that theyre having some staffing issues, so processing paper tax returns could take several weeks longer. Taxpayers and tax professionals are encouraged to file electronically.

When and how you file your tax return will also affect the timeline for the rebate, as well as the waht the refund will be sent to you. With the above caveat in mind, here are some possible timelines for when you can expect to see your money returned to you.

- Filing online, refund by direct deposit 1-3 weeks

- Paper filing, refund by direct deposit 3 weeks

- Filing online, refund check by mail 6-8 weeks

- Paper filing, refund check by mail 6-8 weeks

Heres Cnets calculator for how much you might get in a rebate.

The IRS warns of delays and a challenging 2021 tax season, here are 10 tax tips for filing your 2020 tax return

Forbes

Also Check: How Much Taxes Do You Pay For Doordash

You May Like: How To Find Tax Return Information

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response…

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterday’s audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldn’t have asked for more. I cannot thank you enough for your help.

Mary C.Freshfield, Liverpool, UK

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

Tax Filing Season Begins Jan 24 Irs Outlines Refund Timing And What To Expect In Advance Of April 18 Tax Deadline

IR-2022-08, January 10, 2022

WASHINGTON The Internal Revenue Service announced that the nations tax season will start on Monday, January 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns.

The January 24 start date for individual tax return filers allows the IRS time to perform programming and testing that is critical to ensuring IRS systems run smoothly. Updated programming helps ensure that eligible people can claim the proper amount of the Child Tax Credit after comparing their 2021 advance credits and claim any remaining stimulus money as a Recovery Rebate Credit when they file their 2021 tax return.

Planning for the nations filing season process is a massive undertaking, and IRS teams have been working non-stop these past several months to prepare, said IRS Commissioner Chuck Rettig. The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund dont face processing delays. Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year. And we urge extra attention to those who received an Economic Impact Payment or an advance Child Tax Credit last year. People should make sure they report the correct amount on their tax return to avoid delays.

Recommended Reading: How Do I Claim Mileage On My Taxes

Also Check: When Do You File Taxes This Year

What Is A Tax Refund

A tax refund is a reimbursement for any excess tax you pay during the year. When you start working for a company, you are required to fill out a Form W-4. The information you provide determines how much your employer withholds to cover federal income taxes.Withholding too much of your salary results in a tax refund. If you come up short, you will owe taxes.

While most workers prepay their federal income taxes through their paycheck, others do so by filing quarterly estimated taxes. The Internal Revenue Service provides a schedule for estimated tax payments, which are divided into quarterly due dates:

You may also receive a tax refund if you claim a refundable tax credit, such as the Earned Income Tax Credit . Most federal income tax credits are non-refundable and only reduce the amount you owe in taxes. However, if you claim a refundable tax credit that is greater than the amount you owe, you will receive the difference as a tax refund.

If you are a independent contract worker, you are considered both an employee and an employer. As such, you must pay your own taxes on a quarterly basis rather than completing a Form W-4.

How Long Will My Tax Refund Take

The IRS sends over 9 out of 10 refunds to taxpayers in less than three weeks.

Unfortunately, a 21-day delivery of your tax refund isnt guaranteed. There are a number of factors including the choices you make when you file that could impact how long it takes for you to receive your tax refund.

Find out what other factors affect the timing of your refund in 15 minutes or less with our new video series.

You get to choose how you want to receive any refund the IRS owes you. Here are your options:

- Direct deposit into your bank account .

- Paper check sent through the mail.

- Debit card holding the value of the refund.

- Purchase up to $5,000 in U.S. Savings Bonds.

- Split your refund among up to three financial accounts in your name, including a traditional IRA, Roth IRA or SEP-IRA.

The delivery option you choose for your tax refund will affect how quickly you receive your funds. According to the IRS, the fastest way to receive your refund is to combine the direct deposit method with an electronically filed tax return.

Don’t Miss: When Do I File My Taxes

Minnesota Property Tax Refunds Can Be Expected Within A Few Days

For renters who become mobile home owners by mid-August or within 60 days of submitting your request, you can expect your refund if the department receives your completed and properly completed returns and all enclosures are correct and complete, otherwise the refund is due no later than mid-August.

Wheres My State Tax Refund West Virginia

Check on your state tax return by visiting the West Virginia State Tax Departments website. On the right side of the page, you will see a link called Wheres My Refund? This link will take you to the refund status page. Enter your SSN, the tax year and the amount of your refund in order to check your status.

Don’t Miss: How To Avoid Property Tax

So When Will I Receive My Tax Refund

The IRS is looking to speed up the time it takes to process refunds. The IRS aims to provide nearly all taxpayers with their refunds within 21 days of receiving their tax returns.

The IRS also has a way that you can track the status of your refund. Just go to the IRS website and look for the Wheres My Refund? page. Here you can enter your tax information and receive an update on where your refund is.

This facility is also available through the IRS2GO app on your mobile device.

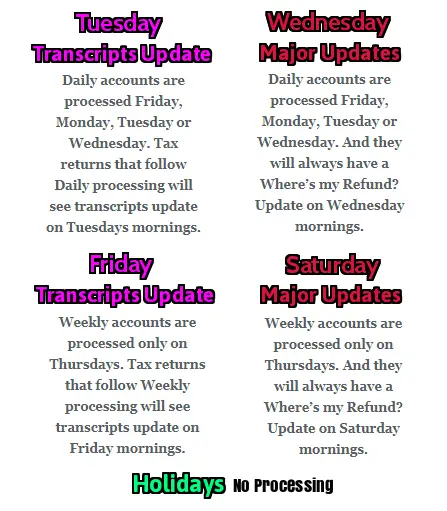

Updates are made daily, according to the IRS. Youll be able to begin tracking your refund 24 hours after using an e-filing service and four weeks after mailing a paper return.

The fastest way to receive your tax refund is to make sure you use an e-filing service and opting for direct deposit as your payment method of choice.

Why Is Your Refund Different Than You Expected

Errors or missing information

If your tax return had one or more errors, we may need to adjust your return leading to a different refund amount than you claimed on your return. We will send you a letter explaining the adjustments we made and how they affected your refund. If you have questions about the change, please call Customer Services.

Tax refund offsets – applying all or part of your refund toward eligible debts

- If you owe Virginia state taxes for any previous tax years, we will withhold all or part of your refund and apply it to your outstanding tax bills. We will send you a letter explaining the specific bills and how much of your refund was applied. If you have questions or think the refund was reduced in error, please contact us.

- If you owe money to Virginia local governments, courts, other state agencies, the IRS, or certain federal government agencies we will withhold all or part of your refund to help pay these debts. We will send you a letter with the name and contact information of the agency making the claim, and the amount of your refund applied to the debt. We do not have any information about these debts. If you think a claim was made in error or have any questions about the debt your refund was applied to, you’ll need call the agency that made the claim.

If you have a remaining refund balance after your debts are paid, we will send a check to the address on your most recent tax return. We cannot issue reduced refunds by direct deposit.

Recommended Reading: What Is Homeowners Property Tax Exemption

Request Direct Deposit Of Your Refund

According to the IRS, eight out of ten taxpayers use direct deposit to receive their tax refunds faster. This option is available to you whether you file online or by paper tax return.

If you dont have a bank account, you may want to consider other options, such as a prepaid debit cardthe IRS can issue your refund to one of these cards. But be warned: prepaid debit card providers can charge a lot of fees for everyday services like reloading the card, so shop around before deciding whether this is a good option for you.

What Can Slow Down Your Refund

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund. Learn more about our refund review process and what we’re doing to protect taxpayers.

- Missing information or documents. If we send you a letter requesting more information, please respond quickly so we can continue processing your return.

- Errors on your return. We found a math error in your return or have to make another adjustment. If the adjustment causes a different refund amount than you were expecting, we will send you a letter to explain the adjustment.

- Problems with direct deposit. If you requested direct deposit, but the account number was entered incorrectly, your bank won’t be able to process the deposit. When this happens, your bank notifies us, and we will manually re-issue your refund as a check. This process could take up to 2 weeks between the time we receive notification from the bank and when you receive the check.

Recommended Reading: How To Calculate Taxes For Business

I Received A Form 1099

If you claimed itemized deductions on your federal return and received a state refund last year, you will receive a postcard size Form 1099-G statement. This form shows the amount of the state refund that you received last year but does not mean that you will receive an additional refund. Generally, your State income tax refund must be included in your federal income for the year in which your check was received if you deducted the State income tax paid as an itemized deduction on your federal income tax return. Please view the Frequently Asked Questions About Form 1099-G and Form 1099-INT page for additional information about Form 1099-G and Form 1099-INT.

Also Check: Have My Taxes Been Filed

Tax Refund Schedule For Extensions And Amended Tax Returns

The refund schedule should be the same if you filed for a tax extension however, there is no official schedule for tax refunds for amended tax returns. The above list only includes dates for e-filing an original tax return. Amended tax returns are processed manually and often take eight-12 weeks to process. If you do not receive an amended tax return refund within eight weeks after you file it, then you should contact the IRS to check on the status.us.

Also Check: Do You Have To Claim Stocks On Taxes

What If I’m Looking For Return Info From A Previous Year

The Where’s My Refund tool lists the federal refund information the IRS has from the past two years. If you’re looking for return details from previous years, you’ll need to check your IRS online account.

From there, you’ll be able to see the total amount you owe, your payment history, key information about your most recent tax return, notices you’ve received from the IRS and your address on file.

How Quickly Will I Get My Refund

We issue most refunds in less than 21 calendar days. However, if you filed on paper and are expecting a refund, it could take six months or more to process your return. Wheres My Refund? has the most up to date information available about your refund.

It is also taking the IRS more than 21 days to issue refunds for some tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

Don’t Miss: Are Charitable Contributions Made From An Ira Tax Deductible

I Claimed The Earned Income Tax Credit Or The Additional Child Tax Credit On My Tax Return When Can I Expect My Refund

According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/Additional CTC related refunds to be available in taxpayer bank accounts or on debit cards by March 1, if they chose direct deposit and there are no other issues with their tax return. However, some taxpayers may see their refunds a few days earlier. Check Wheres My Refund for your personalized refund date.

Wheres My Refund? on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 19.