Unemployment Federal Tax Break

The latest COVID-19 relief bill , gives a federal tax break on unemployment benefits. This means that you dont have to pay federal tax on the first $10,200 of your unemployment benefits if your adjusted gross income is less than $150,000 in 2020. The $150,000 income limit is the same whether you are filing single or married.

For paper filers, the IRS published instructions on how to claim the unemployment tax break: New Exclusion of up to $10,200 of Unemployment Compensation. For online filers, the IRS has stated that tax software companies have updated their systems to reflect the unemployment federal tax break. If you file your taxes online and havent filed for 2020 yet, you may want to make sure your tax software is updated before filing your tax return.

If you filed your 2020 tax return before this new law change, the IRS is asking you not to file an amended return and not to take any additional steps. The IRS will automatically issue refunds starting in May and into the summer to those who qualify. If you claimed tax credits such as the Earned Income Tax Credit and Child Tax Credit , the IRS will also automatically issue refunds if you qualify for a higher amount because the tax break changed your income level.

If your state decides to give you a state tax break and you already filed your state return, you should check to see if you are newly eligible for any state tax credits.

Update On The Federal Unemployment Benefits Deduction For Taxpayers Who Filed Prior To The Enactment Of The American Rescue Plan Act

On April 6, 2021, the Department of Taxation issued the tax alert Ohio Income Tax Update: Changes in how Unemployment Benefits are taxed for Tax Year 2020. This tax alert provided guidance related to the federal deduction for certain unemployment benefits.

For taxpayers who filed federal and Ohio tax returns without the unemployment benefits deduction and are now waiting for the IRS to issue a refund based on the deduction, the Department said it would issue additional guidance when more details were available from the IRS. Recently, the IRS has issued additional guidance related to this topic.

Accordingly, the Department would like to issue the following guidance to taxpayers who filed federal and Ohio tax returns without the unemployment benefits deduction and are now waiting for the IRS to issue a refund. After the IRS makes the adjustment, the taxpayer must do all of the following:

When completing the Reasons and Explanation of Corrections form, check the Federal adjusted gross income decreased box and list Federal unemployment deduction refund in the Detailed explanation section.

What To Know About The Unemployment Tax Break

The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021. The tax break is for those who earned less than $150,000 in adjusted gross income and for unemployment insurance received during 2020. At this stage, unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

The $10,200 tax break is the amount of income exclusion for single filers, not the amount of the refund . The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits. So far, the refunds have averaged more than $1,600.

However, not everyone will receive a refund. The IRS can seize the refund to cover a past-due debt, such as unpaid federal or state taxes and child support. One way to know if a refund has been issued is to wait for the letter that the IRS is sending taxpayers whose returns are corrected. Those letters, issued within 30 days of the adjustment, will tell you if it resulted in a refund or if it was used to offset debt.

As the IRS continues issuing refunds, they will go out as a direct deposit if you provided bank account information on your 2020 tax return. A direct deposit amount will likely show up as IRS TREAS 310 TAXREF. Otherwise, the refund will be mailed as a paper check to whatever address the IRS has on hand.

You May Like: Is Medicare Part B Premium Tax Deductible

How To Use The Wheres My Refund Tool On The Irs Site

To check the status of your 2021 income tax refund using the IRS tracker tools, youll need to provide some personal information: your Social Security number or Individual Taxpayer Identification Number your filing status and your refund amount in whole dollars, which you can find on your tax return. Make sure its been at least 24 hours before you start tracking your refund.

Using the IRS tool Wheres My Refund, go to the Get Refund Status page, enter your personal data, then press Submit. If you entered your information correctly, youll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, youll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

Wheres My Refund has information on the most recent tax refund that the IRS has on file within the past two years, so if youre looking for return information from previous years youll need to check your IRS online account for more information. Through your own personalized account, youll be able to see the total amount you owe, your payment history, key information about your most recent tax return, notices youve received from the IRS and your address on file.

You May Like: Doordash Taxes How Much

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

The IRS has issued more than 11.7 million special unemployment benefit tax refunds totaling $14.4 … billion for tax year 2020.

getty

For folks still waiting on the Internal Revenue Service to deliver their special tax refunds for the unemployment compensation tax exclusion for 2020, dont count on the money for the holidays. The IRS updated its IRS Operations During Covid-19 web page, as of December 20, with a new section showing the status of unemployment compensation exclusion corrections. It says it plans to issue another batch of these special refunds before the end of the year. But it notes, that as it continues to review more complex returns, the process will continue into 2022.

The update says that to date the IRS has issued more than 11.7 million of these special refunds totaling $14.4 billion. Thats the same data the IRS released on November 1 when it announced that it had recently sent approximately 430,000 refunds totaling more than $510 million. In that batch of corrections, the average special refund was $1,189. The IRS says it has identified more than 16 million taxpayers who may be eligible for the special refunds. Some taxpayers will get refunds, while for others, the IRS will apply the overpayment to taxes due or other debts.

Also Check: Can I Track My Unemployment Tax Refund

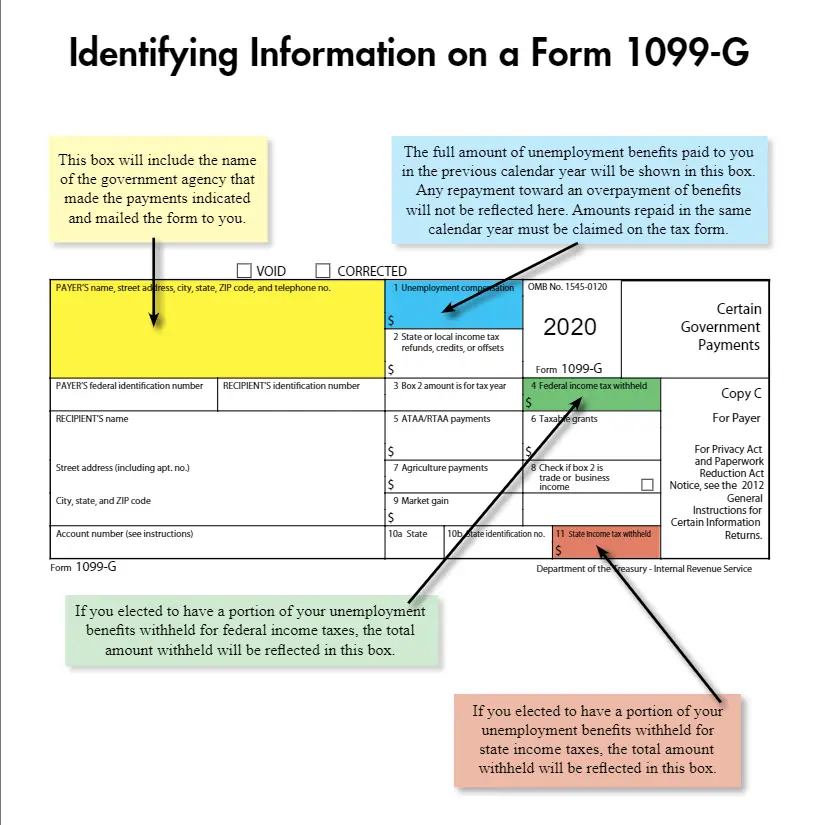

Frequently Asked Questions About 1099

Q – My tax preparer/program requires the state ID for box 10b. What number should I use?

A – All state withholding taxes were paid to the state of Michigan. If required, enter “MI’ in box 10a, and 38-6000134 in box 10b.

Q – Why is my overpayment, which I repaid, not reported on my Form 1099-G?

A – Please refer to the back of your 1099-G RE: Restitution, Penalties and Interest – Monies repaid to the UIA during tax year 2021 are not deducted from the amount shown in Box 1. Refer to your federal 1040 instruction booklet for further information.

Q – If I repaid an overpayment during the tax year, will I have to repay the taxes that were withheld?

A – Yes, UIA paid taxes on your behalf to the federal and state taxing authority at the time your benefit payment was created or issued. Because it was determined that you were not entitled to the payment, the tax withholding paid on your behalf is also considered to have been overpaid. As a result, you must also repay UIA for the federal and state taxes paid on your behalf.

Q – Are PUA amounts included in the 1099-G?

A – Yes. Your 1099-G will include a combined total of benefits paid on any program a claimant was on including UI, PEUC, EB, PUA, TRA or DUA. This will also include additional amounts such as Pandemic Unemployment Compensation and Lost Wages Assistance .

Q – How can I get a duplicate 1099-G?

Q – I paid back part or all of the amount reported on my 1099-G, Box 2. How do I get a corrected form?

/21/: New Webpage Highlights Differences Between Massachusetts And Federal Tax Law

As many of you know, Massachusetts generally follows the Internal Revenue Code as of January 1, 2005 for personal income tax. When the federal tax law changes, taxpayers may need to adjust federal amounts when filing their Massachusetts return. Weve recently posted a new webpage that will help you identify many of the common differences between Massachusetts and federal tax law. Comments and suggested additions to the page may be sent to .

You May Like: How To Pay Back Taxes To Irs

Irs Readies Nearly 4 Million Refunds For Unemployment Compensation Overpayments

IR-2021-151, July 13, 2021

WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes on unemployment compensation received last year.

The American Rescue Plan Act of 2021, which became law in March, excluded up to $10,200 in 2020 unemployment compensation from taxable income calculations. The exclusion applied to individuals and married couples whose modified adjusted gross income was less than $150,000.

Refunds by direct deposit will begin July 14 and refunds by paper check will begin July 16. The IRS previously issued refunds related to unemployment compensation exclusion in May and June, and it will continue to issue refunds throughout the summer.

To ease the burden on taxpayers, the IRS has been reviewing the Forms 1040 and 1040SR that were filed prior to the laws enactment to identify those people who are due an adjustment. For taxpayers who overpaid, the IRS will either refund the overpayment, apply it to other outstanding taxes or other federal or state debts owed.

For this round, the IRS identified approximately 4.6 million taxpayers who may be due an adjustment. Of that number, approximately 4 million taxpayers are expected to receive a refund. The refund average is $1,265, which means some will receive more and some will receive less.

Taxpayers should file an amended return if they:

How And When Do I Get The Unemployment Tax Refund

People started seeing the refunds hit their bank accounts in May of this year. They continued through the summer.

The more complex returns took longer to process.

4 million refunds had been sent by the middle of July.

Those receiving the refunds by check mostly saw them after July 16.

More checks and direct deposits were sent at the end of July, and no payments were announced for Aug., Sept., or Oct.

Payments were sent in Nov. though, another 430,000 to be exact.

Another batch has been announced, but not when or how many.

Letters are sent to filers on behalf of the IRS to let them know a return was corrected.

The letters go out within 30 days of a correction.

There is no tool to track it, but you can check your tax transcript with your online account through the IRS.

Choose the federal tax option and the 2020 Account Transcript.

If you see a Refund issued then youll likely see a refund soon.

Don’t Miss: Where To Find Adjusted Gross Income On Tax Return

Irs Continues Unemployment Compensation Adjustments Prepares Another 15 Million Refunds

IR-2021-159, July 28, 2021

WASHINGTON The Internal Revenue Service reported today that another 1.5 million taxpayers will receive refunds averaging more than $1,600 as it continues to adjust unemployment compensation from previously filed income tax returns.

The American Rescue Plan Act of 2021, which became law in March, excluded up to $10,200 in 2020 unemployment compensation from taxable income calculations. The exclusion applied to individuals and married couples whose modified adjusted gross income was less than $150,000.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. This is the fourth round of refunds related to the unemployment compensation exclusion provision.

Since May, the IRS has issued over 8.7 million unemployment compensation refunds totaling over $10 billion. The IRS will continue reviewing and adjusting tax returns in this category this summer.

The IRS effort focused on minimizing burden on taxpayers so that most people won’t have to take any additional action to receive the refund. The IRS review means most taxpayers affected by this change will not have to file an amended return because IRS employees have reviewed and adjusted their tax returns for them. For taxpayers who overpaid, the IRS will either refund the overpayment or apply it to other outstanding taxes or other federal or state debts owed.

Taxpayers should file an amended return if they:

Will I Get A Tax Refund From Unemployment

Will I get a tax refund from unemployment? What Are the Unemployment Refunds? In a nutshell, if you received unemployment benefits in 2020 and paid taxes on that money, youll be getting some or all of those taxes back via direct deposit or the mail.

Hereof, How long is unemployment on Covid?

Under the CARES Act states are permitted to extend unemployment benefits by up to 13 weeks under the new Pandemic Emergency Unemployment Compensation program.

Similarly How much taxes do you pay on unemployment? If you had taxes withheld on jobless benefits, the federal taxes are withheld at a 10% rate. On $10,200 in jobless benefits, were talking about $1,020 in federal taxes that would have been withheld. Thats money that could go to cover what income taxes you owe or possibly lead to a bigger federal income tax refund.

Don’t Miss: Who Gets The Child Tax Credit 2021

When Will You Get Your Refund

The refunds sent by direct deposit this week will begin arriving in accounts on July 14 and refunds by paper check will be sent starting July 16, according to the IRS.

If you think youre eligible for an additional refund because of unemployment in 2020 but havent gotten your money yet, dont fret, the agency said it plans to continue issuing additional rounds of refunds throughout the summer.

Will I Get An Unemployment Tax Refund

Asked by: Mr. Ryan Carroll

Dont expect a refund for unemployment benefits. A tax break isnt available on 2021 unemployment benefits, unlike aid collected the prior year. The federal tax code counts jobless benefits as taxable income. The American Rescue Plan Act had waived federal tax on up to $10,200 of benefits collected in 2020.

Recommended Reading: What Is The Maximum Unemployment Benefit In Minnesota

Read Also: How Much Is Federal Payroll Tax

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger

Michigan unemployment officials say 1.2 million residents about 25 percent of the states labor force should receive a 1099 tax form by the end of February, a month late, so they can file annual income taxes.

But even as workers await the document, the state has yet to decide whether thousands of jobless workers will have to repay up to $5.7 billion in unemployment benefits the state says it paid in error during the pandemic.

That could leave some taxpayers saddled with reportable income on 2021 federal and state taxes that they may later have to return to the state.

Related:

Some question how many residents may face garnishment of their wages or tax refunds if they are later ordered to repay overpayments, even if they obtained benefits in good faith and requested a repayment waiver.

If I were somebody who collected benefits in 2021 I would be very upset and very confused, said David Blanchard, an Ann Arbor attorney who has filed a class-action lawsuit against the Unemployment Insurance Agency for changing benefit eligibility rules a year after payments were made.

The state thinks you owe it back, but you have to record it on your taxes as money received, he said. And then it might be waived, too.

UIA received a federal extension in January, allowing it to delay distribution of 1099-G forms which report income received from a government entity for one month.

Most Don’t Have To File An Amended Return

Most taxpayers don’t need to file an amended return to claim the exemption. If the IRS determines you are owed a refund on the unemployment tax break, it will automatically correct your return and send a refund without any additional action from your end.

The only reason to file an amended return is if the calculations now make you eligible for additional federal credits and deductions not already included on your original tax return, like the Additional Child Tax Credit or the Earned Income Tax Credit. The IRS said it will be sending notices in November and December to people who didn’t claim the Earned Income Tax Credit or the Additional Child Tax Credit but may now be eligible for them.

If you think you’re now eligible for deductions or credits based on an adjustment, the most recent IRS release has a list of people who should file an amended return.

The average IRS refund for those who paid too much tax on jobless benefits is $1,686.

Also Check: How Do I Get My Taxes From Last Year