How To File 2017 Taxes

If you choose to use TurboTax to file a 2017 tax return then you will need to purchase, download and install on a personal computer one of the 2017 desktop editions from this website –

A 2017 tax return can only be printed and mailed, it cannot be e-filed.

Help Filing Your Past Due Return

For filing help, call or for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 800-TAX-FORM or for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

Time Matters With Tax Refunds

May 17, 2021 is the last day to file your original 2017 tax return to claim a refund. If you received an extension for the 2017 return then your deadline is October 15, 2021.

If you miss the deadline, any excess in the amount of tax you paid every paycheck or sent as quarterly estimated payments in 2017 goes to the U.S. Treasury instead of to you. You also lose the opportunity to apply any refund dollars to another tax year in which you owe income tax.

Under certain conditions the IRS will withhold your refund check. It can be used to pay:

- past-due student loans,

- child support and

- federal tax debt you owe.

The IRS can also hold refund checks when the two subsequent annual returns are missing. That means you should file returns for 2018 and 2019 as soon as possible. For the 2018 tax year, with a filing deadline in April of 2019, the three-year grace period ends April 15, 2022.

Also Check: How To Complete K1 Tax Form

General Information About Individual Income Tax Electronic Filing

Filing electronically is a fast growing alternative to mailing paper returns. The Missouri Department of Revenue received more than 2.8 million electronically filed returns in 2021. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response…

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterday’s audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldn’t have asked for more. I cannot thank you enough for your help.

Mary C.Freshfield, Liverpool, UK

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

You May Like: When Will I Receive My Child Tax Credit

Welcome To Maine Fastfile

Maine Revenue Services solution to fast and secure tax filing. The Maine Fastfile service provides three options:

Modernized e-File e-File using tax preparation softwareThis service is offered through the IRS and provides one stop processing of federal and state returns. This is the do it yourself option through the purchase of tax preparation software either over-the-counter or online, prepare your own return and press send to e-file. Your return is sent through safe and secure channels, not via e-mail. Prices do vary so shop around .

OR e-File through a paid tax professional

Find a tax professional you trust to prepare and e-file your return. Nearly all tax preparers use e-file now and many are now required by law to e-file. But its still a good idea to tell your tax preparer you want the advantages of e-file your refund in half the time, or if you owe, more payment options.

Maine i-File i-File free for Maine taxpayersThis service is available for filing your individual income tax return including the Maine property tax fairness credit. The advantages of Maine i-File are:

Certain restrictions apply. See the directions page of the i-File application for more information.

Filing Past Due Tax Returns

File all tax returns that are due, regardless of whether or not you can pay in full. File your past due return the same way and to the same location where you would file an on-time return.

If you have received a notice, make sure to send your past due return to the location indicated on the notice you received.

You May Like: Are Refinance Closing Costs Tax Deductible

Efile For A Fee Other Available Efile Options

If you don’t qualify for free electronic filing, please visit the listing of the approved software productsto determine which software product will meet your filing needs.

- Be sure the product that you select supports the forms you want to file

- If the product that you select does not offer payment options, you can use our website to pay your taxes online

To find out if you qualify to use free software, review the eFile for Free options listed above.

Can I Still File My 2016 Taxes And Get A Refund

Asked by: Lilliana Koelpin

To collect refunds for tax year 2016, taxpayers must file their 2016 tax returns with the IRS no later than this years extended tax due date of July 15, 2020. The IRS estimates the midpoint for the potential refunds for 2016 to be $861 that is, half of the refunds are more than $861 and half are less.

Recommended Reading: What Is The Sales Tax In Georgia

How Do I File Returns For Back Taxes

OVERVIEW

When would someone file back taxes, and what does this process typically look like?

Should you file back taxes? It may not be too late to file a previous year’s tax return to pay what you owe or claim your refund. Learn more about why one may choose to file back taxes and how to start this process.

Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

Recommended Reading: How To Report Bitcoin Loss On Taxes

Update Your Tax Software

Tax software must be certified by NETFILE every year.

Check the software list above to confirm that your software is certified for the year you need. If you are using uncertified software or an older version of the software, you may need to update or download a certified version from the developer.

Information on how to update your software is available on the developer’s website or from within the software itself.

When Can You File Your 2016 Tax Return

When did I last file my taxes?

- Tax Day 2019, the last day to file your 2018 tax return, is Monday, April 15. The new tax law is in effect, so there are a few changes to be aware of when filing your taxes. Tax refunds typically arrive within three weeks of filing, and the IRS recommends receiving it via direct deposit.

Read Also: How Much Am I Going To Get Back In Taxes

You May Like: What Is Bidens Tax Plan

Can I Still File My 2017 Taxes

A 2017 tax return can be e-filed using TurboTax at any time on or before October 15, 2018. After that date the 2017 can return can only be printed and mailed.

To access your current or prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on

A 2017 tax return can only be printed and mailed, it cannot be e-filed.

Print, sign, date and mail the tax return to the IRS. Include with the mailed return any forms W-2 and 1099 which have taxes withheld. Go to this IRS website for mailing addresses

There are no penalties for filing a tax return after the due date if filing for a tax refund or there are no taxes owed.

Read Also: Do I Pay Taxes On Social Security

Can I Still File My 2017 Taxes And Get A Refund

Asked by: Jerry Bernhard

For 2017 tax returns, the three-year window closes May 17, 2021. The law requires taxpayers to properly address and mail the tax return to the IRS. It must be postmarked by the May deadline. The IRS may hold the 2017 refunds of taxpayers who have not filed tax returns for 2018 and 2019.

Don’t Miss: Where To Mail Federal Tax Return 2021

Electronic Filing Options For Individual Income And Business Taxes

Being sensitive to the changing economic climate, the Kansas Department of Revenue no longer produces and distributes a large number of paper documents. Instead, instructions, sample tax forms, and schedules can be accessed on the Department’s website by going to the forms and publications page. The Department also offers the following alternative electronic reporting and filing options.

How To File Tax Returns For Previous Years

Filing a tax return for a previous year isn’t as hard as you may think, but it does require a few steps.

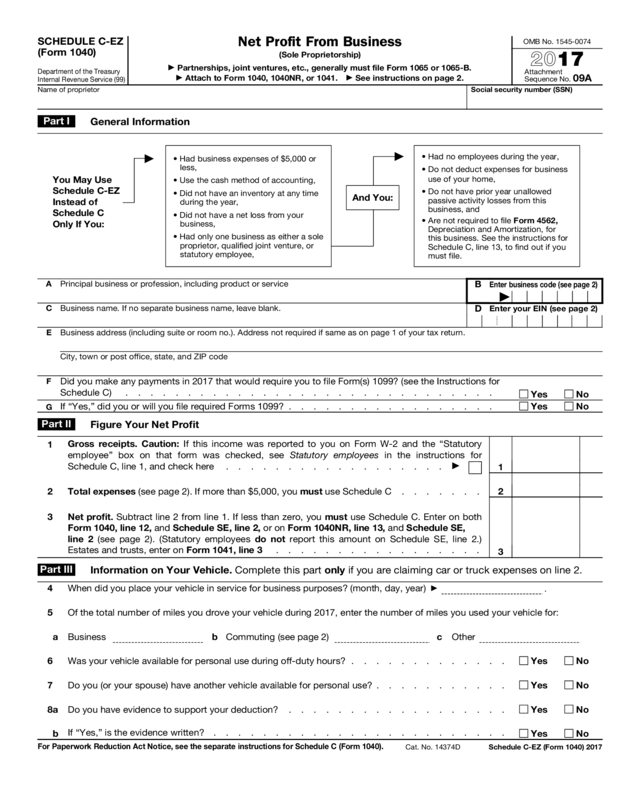

1. Gather information

The first step is gathering any information from the year you want to file a tax return for. Pull together your W-2s, 1099s, and information for any deductions or credits you may qualify for. Look on the tax forms you gather for the year of the tax return you’re filing to make sure you use the right ones.

2. Request tax documents from the IRS

Finding documents from previous years may be challenging for some. Thankfully, the IRS has a form you can fill out to request any tax information they have on file for you for a given year. Form 4506-T allows you to request a transcript of your tax return information, even if you haven’t filed a tax return. You can request information from the last 10 tax years.

The IRS will send the information it has on record, including information found on forms such as W-2s, 1099s, and 1098s. It won’t have information about deductions and credits you may qualify for, though, so you’ll still need to do some work on your own.

3. Complete and file your tax return

Once you have all the forms you need, be sure to use the tax forms from the year you’re filing. For instance, you must use 2018 tax return forms to file a 2018 tax return. You can find these documents on the IRS website. Patience is important when filling out a tax return by hand. And thankfully, you can also file tax returns from previous years using TurboTax.

You May Like: Are Nonprofit Organizations Tax Exempt

What Is Irs Free File

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry companies who provide their online tax preparation and filing for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Guided Tax Preparation provides free online tax preparation and filing at an IRS partner site. Our partners deliver this service at no cost to qualifying taxpayers. Taxpayers whose AGI is $73,000 or less qualify for a free federal tax return.

- Free File Fillable Forms are electronic federal tax forms, equivalent to a paper 1040 form. You should know how to prepare your own tax return using form instructions and IRS publications if needed. It provides a free option to taxpayers whose income is greater than $73,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

IRS Free File Program offers the most commonly filed forms and schedules for taxpayers.

Other income

File Up To 20 Returns

You may file up to 20 returns per computer or online account using NETFILE-certified tax software in Canada for each tax year. Tax software companies must respect this limit to be certified for NETFILE.

The Canada Revenue Agency does not look at the privacy policies of software developers. It is your responsibility to research these policies before buying or using a software product or web application.

Use of the software, and any omission or error in the information provided, is the responsibility of the user and the software developer. The CRA cannot be held responsible if programming errors affect the calculation of income tax and benefits payable.

The CRA respects the Official Languages Act and the relevant Treasury Board policies, and it is committed to making sure all information and services on this site are available in English and French. However, users should be aware that some information from external sources that do not have to follow the Official Languages Act is offered only as a convenience and is available only in the language in which it was provided to the CRA.

Don’t Miss: How To Calculate Tax On Salary

File Electronically In Just Minutes And Save Time

We know that filing your taxes can sometimes be unpleasant. That is why our helpful online tax preparation program works with you to make the filling process as pain-free as possible. Many filers can use our online tax software to electronically file their taxes in less than 15 minutes.

To use the E-file software, a visitor simply needs to create a free account , enter their taxpayer information, income figures, then any deductions they may have, and our software will calculate and prepare the return. Once a user has completed preparing their return they will be provided the option of either e-filing or printing and mailing. It’s as simple as that.

Efile Information: Ncfreefile And Efile For A Fee

The following lists of eFile provider websites have been approved for the preparation and online electronic filing of state and federal individual income tax returns. The product names and details* below are given by eFile providers and are subject to change. These lists are updated as new information or additional approved eFile products become available.

Don’t Miss: Where Do I Get Federal Tax Forms

We Provide Qualified Tax Support

E-file’s online tax preparation tools are designed to take the guesswork out of e-filing your taxes. Our program works to guide you through the complicated filing process with ease, helping to prepare your return correctly and if a refund is due, put you on your way to receiving it. Should a tax question arise, we are always here help and are proud to offer qualified online tax support to all users.

If you’ve ever tried calling the IRS during the tax season, you probably know that telephone hold times at peak periods can be hours long. Our dedicated support team enables customers to get their questions answered just minutes after a question is sent, even during peak times. Simply send us a “help” request from within your account and our experts will begin working on your problem and get you an answer as quickly as possible. Prefer to call us? We also provide full telephone support to all taxpayers filing with our Deluxe or Premium software.

Filing Information For Individual Income Tax

Whether you file electronically using our free iFile service, hire a professional preparer, have us prepare it for free, or complete a paper return, filing a Maryland tax return is easy.

For those in a hurry, some quick links to everything you need to know about

Follow the links to sort out all the details quickly and make filing your tax return painless!

Read Also: How To Pay City Taxes

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.