How Much Will Your Benefits Be

Once you file for unemployment and are approved, you will begin to receive benefits. Your benefits might come in the form of a check, but more often they will come in the form of a debit card or direct deposit to your bank account. It varies by state. You typically can file weekly online, by email, or by phone.

The amount you receive depends on your weekly earnings prior to being laid off and on the maximum amount of unemployment benefits paid to each worker. In many states, you will be compensated for half of your earnings, up to a certain maximum.

State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits for a lower number of weeks, and maximum benefits also vary based on where you live. In times of high unemployment, additional weeks of unemployment compensation may be available.

Regardless of how much you make, you never can collect more than the state maximum.

Also Check: How To File For Unemployment In Louisiana

Get Refunds Fast With Direct Deposit

Taxpayers should prepare to file electronically and choose Direct Deposit for their tax refund its the fastest and safest way to file and get a refund. Even when filing a paper return, choosing a direct deposit refund can save time. For those who do not have a bank account, the FDIC website offers information to help people open an account online.

Individual Income Tax Return Payment Options

Use these options if you’re paying after you’ve filed your return. You can also pay at the time of filing through approved electronic filing options, and schedule your payment for any day up to the filing deadline.

Online, directly from your bank account

- Log in to your online services account.

- Dont have an account? Create one now.

Not ready to create an account?

You can pay using eForms.

- Individual return payment: 760PMT eForm

- Qualifying farmers, fishermen, and merchant seamen: 760PFF eForm

Make a return payment through Paymentus. A service fee is added to each payment you make with your card.

Check or money order

Mail the 760-PMT voucher with check or money order payable to Virginia Department of Taxation to:

Virginia Department of Taxation

Include your Social Security number and the tax period for the payment on the check.

Qualifying farmers, fishermen, and merchant seamen should use the 760-PFF voucher.

Note: If you filed a paper return with your local Commissioner, mail the voucher and check to the same place you sent your return and make the check payable to the local Treasurer.

Payment Fee – Returned Payments

If your financial institution does not honor your payment to us, we may impose a $35 fee . This fee is in addition to any other penalties and interest you may owe.

Don’t Miss: Is It Too Late To Do My Taxes

How Much Money Can You Make Donating Plasma

Youll typically be paid between $20 and $50 for each donation, and depending on how often you go, you can earn as much as $300 per month donating plasma.

Overall, that might work out to around $20-30 an hour.

Why does plasma donation pay and blood donation not? The plasma procedure pays because it is more involved and requires more time.

The actual amount depends on how much you are being paid and how often you are making your donations.

Before you make a donation, look on the Internet to see if you can find any coupons for first-time donors. Some of the centers provide coupons as an additional incentive to make a donation:

Tip #: Keep Receipts For Costs Related To Your Job Search

Travel expenses for a job interview, the costs of résumé preparation and mailing and outplacement agency fees are just some of the expenses you may be able to deduct. Moving expenses may also qualify if your move is closely related to the start of your work and you meet the distance and time requirements.

Read Also: Can The Government Tax Cryptocurrency

I Heard I Can Get A Refund On Past Payments Is That True

You could qualify for a refund depending on your situation. Heres how it works. Say you made payments after March 2020 and the current balance on your loan is below the amount of debt relief you will receive. Those payments qualify for a refund of the difference between what you paid and what you were eligible to receive through the relief program. March 2020 was when the federal administrative forbearance went into place. If you made payments on your loans or paid them off during the pandemic, you can request a refund on these payments up to the amount of forgiveness you are eligible for from your servicer.

For example, take the situation of someone who is eligible to receive $20,000 in debt relief. This borrower originally had $15,000 in loans but paid $5,000 between March 2020, leaving a current loan balance of $10,000. That balance is below the $20,000 in debt relief the person is eligible for, so this borrower qualifies for a $5,000 refund of the payments made during that time period and up to $15,000 loan forgiveness.

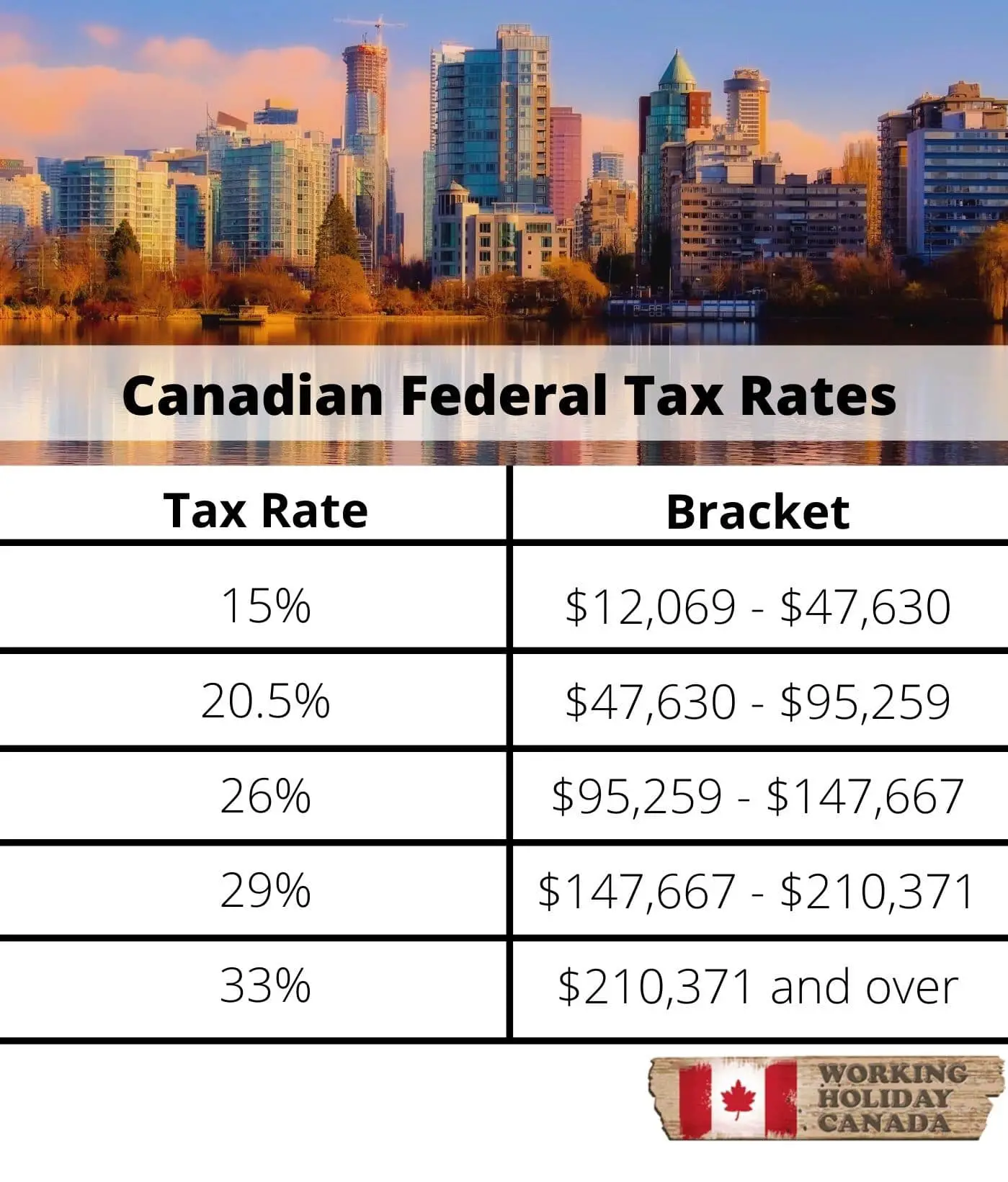

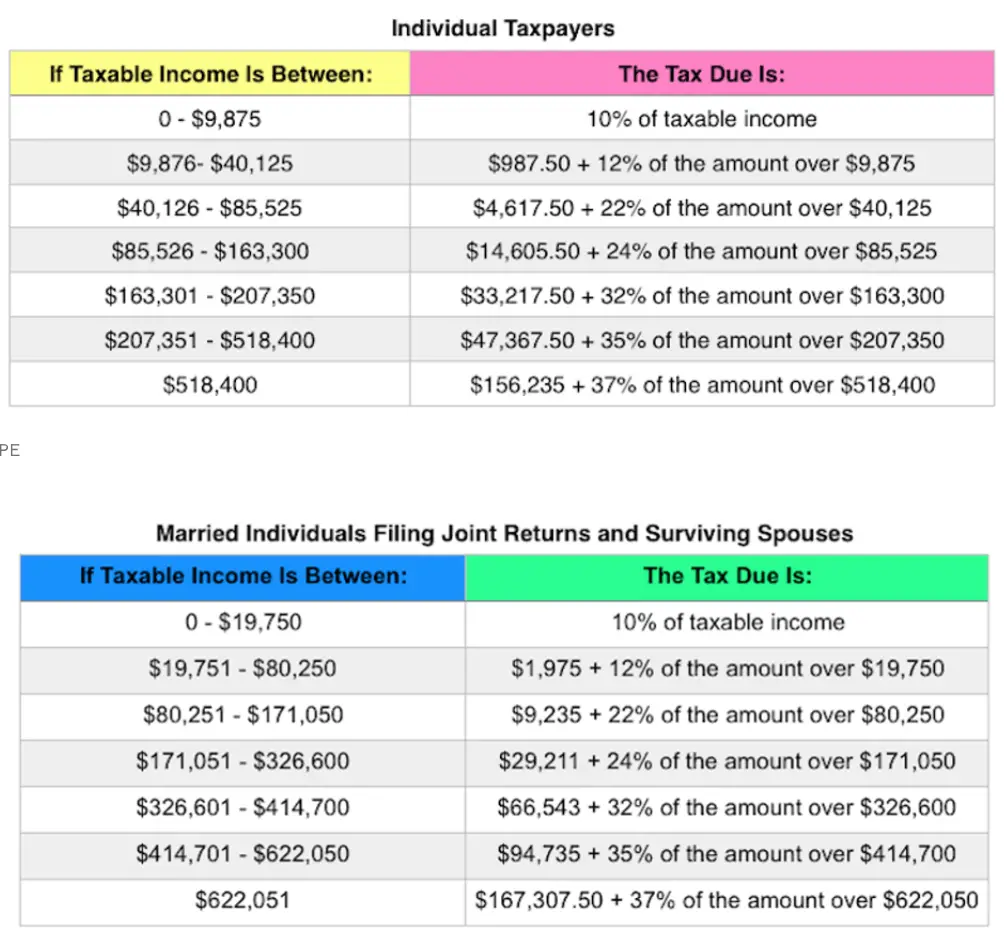

How Are Unemployment Benefits Taxed

Unemployment benefits are designed to replace a portion of your regular wages. As such, the IRS treats them like any other wages and taxes them at your ordinary income tax rate.

Whether youll actually owe taxes on unemployment benefits, and the rate youll pay, depends on your overall tax situation and tax bracket.

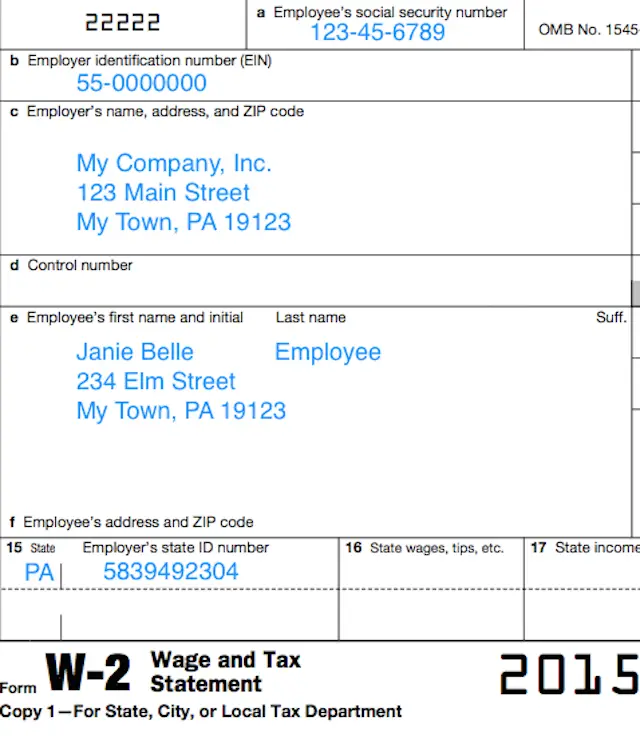

The state that paid your unemployment benefits should send you a Form 1099-G showing how much unemployment income you received and how much taxes it withheld.

In March 2021, the American Rescue Plan provided some relief for people who received unemployment benefits in 2020. Taxpayers with modified adjusted gross income under $150,000 could exclude up to $10,200 of unemployment benefits from their taxable income. For this exclusion, your MAGI is your adjusted gross income minus your unemployment compensation.

Read more: What Is Adjusted Gross Income ?

However, this unemployment tax break applied only to 2020 tax returns. So if you collected unemployment benefits in 2021, you should expect 100% of your benefits to be included in your taxable income when you file your 2021 tax return.

In March, when the American Rescue Plan passed, many people had already filed returns and paid taxes on all of their benefits. Fortunately, the IRS didnt require taxpayers to file amended returns. It automatically sent unemployment tax refunds to eligible taxpayers who filed a tax return before the legislation was enacted.

You May Like: How Do I Apply For Unemployment

You May Like: When Do People Get Tax Returns

Renew Expiring Tax Id Numbers

Taxpayers should ensure their Individual Tax Identification Number hasnt expired before filing a 2022 tax return. Those who need to file a tax return, should submit a Form W-7, Application for IRS Individual Taxpayer Identification Number now, to renew their ITIN. Taxpayers who fail to renew an ITIN before filing a tax return next year could face a delayed refund and may be ineligible for certain tax credits. Applying now will help avoid the rush as well as refund and processing delays in 2023.

How Will This Affect Me

The IRS wont suspend interest and penalty charges, even if it stops trying to collect the balance due.

The IRS may keep your tax refunds and apply them to your debt.

You can still make voluntary payments.

The IRS can issue a levy to satisfy a tax debt when you dont respond to notices informing you of the debt and asking for payment.

The IRS may file a Notice of Federal Tax Lien even if your account is placed in CNC status. The filing of an NFTL can affect your credit rating, and your ability to sell property or other assets.

The IRS is required by law to notify the State Department if you are certified as owing a seriously delinquent debt. But, the IRS has discretion to exclude debts from passport certification that are CNC.

Also Check: What Happens If I File Taxes Late

When To Pay Estimated Taxes

For estimated tax purposes, the year is divided into four payment periods. You may send estimated tax payments with Form 1040-ES by mail, or you can pay online, by phone or from your mobile device using the IRS2Go app. Visit IRS.gov/payments to view all the options. For additional information, refer to Publication 505, Tax Withholding and Estimated Tax.

Using the Electronic Federal Tax Payment System is the easiest way for individuals as well as businesses to pay federal taxes. Make ALL of your federal tax payments including federal tax deposits , installment agreement and estimated tax payments using EFTPS. If its easier to pay your estimated taxes weekly, bi-weekly, monthly, etc. you can, as long as youve paid enough in by the end of the quarter. Using EFTPS, you can access a history of your payments, so you know how much and when you made your estimated tax payments.

Corporations must deposit the payment using the Electronic Federal Tax Payment System. For additional information, refer to Publication 542, Corporations.

How To Pay Your Federal And Provincial Business Taxes Online

With your Online Tax Payments & Filing account, you have the ability to pay over 40 federal and provincial business taxes with ease.

Your Online Tax Payments & Filing account allows you to create multiple users and administrators, as well as set controls, such as payment limits, and create segregation of duties, such as approvals. Administrators have the ability to manage the company profile as well as add and manage users and their approval limits . But, administrators cannot schedule tax payments. They must either add a separate user ID for themselves, or assign an employee with a user ID.

If a user has an approval limit below the transaction amount, another user with a sufficient approval limit will have to approve the payment. These two different account types, when used strategically, can create a tax payment process with various checkpoints verifying that everything is done correctly.

Don’t Miss: Are State Taxes Dischargeable In Chapter 7

Get Ready By Gathering Tax Records

When filers have all their tax documentation gathered and organized, theyre in the best position to file an accurate return and avoid processing or refund delays or receiving IRS letters. Nows a good time for taxpayers to consider financial transactions that occurred in 2022, if theyre taxable and how they should be reported.

The IRS encourages taxpayers to develop an electronic or paper recordkeeping system to store tax-related information in one place for easy access. Taxpayers should keep copies of filed tax returns and their supporting documents for at least three years.

Before January, taxpayers should confirm that their employer, bank and other payers have their current mailing address and email address to ensure they receive their year-end financial statements. Typically, year-end forms start arriving by mail or are available online in mid-to-late January. Taxpayers should carefully review each income statement for accuracy and contact the issuer to correct information that needs to be updated.

How Do I Earn Review And Use Igive Rewards Credits

It is possible to earn iGive Rewards® credits by completing donation forms or surveys, as well as participating in special campaigns and deals.

Selecting the My Donations button in your iGive Rewards® donor loyalty account will allow you to access all of your credit history .

If you go to the Online Store, youll be able to select from a range of incentives. The checkout process is as simple as redeeming your points and completing your purchase. Your reloadable prepaid card is reloaded within 24 48 business hours after you place a Fast Cash order. Within 4 to 6 weeks of placing an order, all tangible things are sent. In the absence of specific instructions, orders are shipped to your designated CSL Plasma donation location.

Your preferred CSL Plasma donation location is the best place to modify your address if you need to. Your iGive Rewards® profile will be updated with your new address in 24-72 hours after you make the change.

Read Also: When Are 2021 Federal Taxes Due

What If I Receive Military Retirement Pay And Va Disability Pay

Unlike VA disability pay, military retirement pay is taxable at the federal and state level. That said, the amount of military retirement pay you receive can be reduced by any VA disability payments you get. The amount of this reduction depends on your circumstances, so its best to speak with a tax professional if you have questions about how these two types of income will affect your taxes.

If you receive CRDP and are switched over to CRSC, you may be eligible for a federal tax refund .

High Credit Utilization Rate

Paying taxes with a credit card can also potentially have a negative impact on your credit score. Charging high tax payments to a credit card can cause a spike in your credit utilization rate, which is the total percentage of your credit you use.

To calculate your utilization rate, simply divide your total credit card balance by your total available credit. So if you have two credit cards with a combined $3,000 balance and a total $10,000 credit limit, your utilization would be 30%. Adding a $2,000 tax payment to that would increase your utilization rate to 50%, which is high.

Credit score calculations weigh your credit utilization rate and it’s ideal to keep it as low as possible. FICO found that “high-achievers” maintain utilization rates below 15%.

You May Like: How Do I Pay Sales Tax In Texas

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Coronavirus Tax Relief For Self

Coronavirus Aid, Relief, and Economic Security Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020. This means that 50% of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27, 2020, and ending December 31, 2020, is not used to calculate the installments of estimated tax due. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

Also Check: How To Do Taxes Freelance

From Your Bank Account Using Eftpsgov

You can schedule payments up to 365 days in advance for any tax due to the IRS when you register with the Electronic Federal Tax Payment System . As with Direct Pay, you can cancel or change payments up to two business days before the transmittal date.

EFTPS is a good choice if:

- You want to schedule all of your estimated tax payments at the same time

- Your payments are particularly large

- Payments are related to your business

The Treasury Department operates EFTPS. It doesnt charge any processing fees. It can handle any type of federal tax payment, including:

- 1040 balance due payments

- Corporate taxes

You must enroll with EFTPS, but the site saves your account information. You dont have to keep re-entering it each time you want to make a payment. Youll receive an email with a confirmation number for each transaction. EFTPS saves your payment history for up to 16 months.

You May Like: Navy Federal Internal Credit Score 100 To 450

Is There A One Time Tax Forgiveness

One-time forgiveness, otherwise known as penalty abatement, is an IRS program that waives any penalties facing taxpayers who have made an error in filing an income tax return or paying on time. This program isn’t for you if you’re notoriously late on filing taxes or have multiple unresolved penalties.

Read Also: How To Find Tax Id Number For Llc

Escape The Underpayment Penalty

You may be liable for an underpayment penalty if you pay less than 100% of your tax liability by the tax filing deadline. You can avoid the penalty if you meet one of the exceptions below:

Filing Your Tax Return And Va Disability Pay

The IRS doesnt require you to declare your VA disability as part of your gross income when filing your previous years federal tax return. You dont need to include any documentation with your taxes to prove that your disability pay is tax-free.

There are a few situations when you want to include documentation from the VA, specifically when filing a federal tax refund.

If either of these applies to you, you may be eligible for a federal tax refund:

- An increase in your rating with a retroactive determination

- If you receive Combat-Related Special Compensation after youve been awarded Concurrent Retirement and Disability

You can file an amended federal tax by filing IRS Form 1040X. However, if you receive a 1099-R from the Defense Finance and Accounting Service , you likely dont need to file any additional documents with the IRS, as adjustments have already been made.

Make sure to include any relevant documentation from the VA explaining why youre filing an amended federal return. Its best to sit down with a qualified tax professional if you have any questions about amending a tax return.

Also Check: How Do I Find Out About My Tax Return