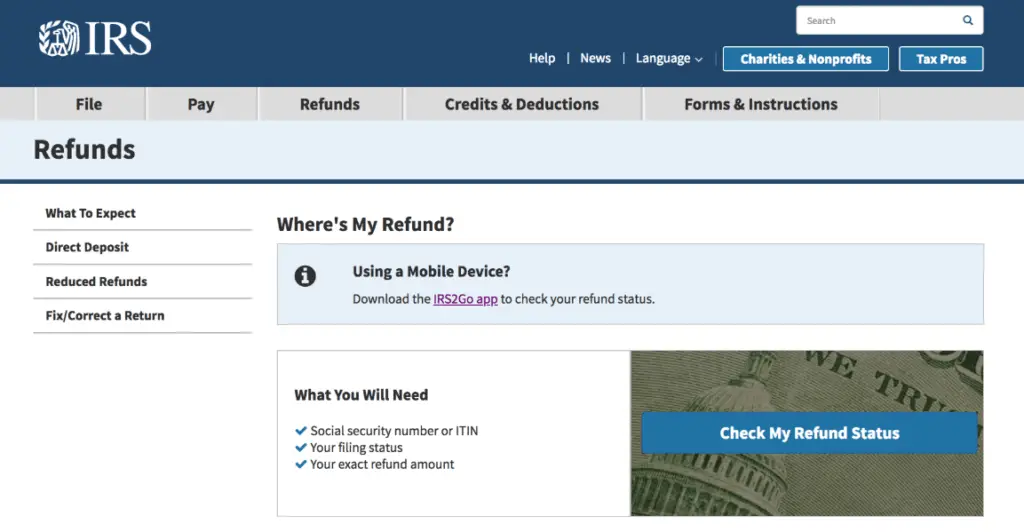

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Watch For Your Income Documents To Arrive

You should receive forms about how much income youve earned from your employers and other income sources in January or February. If you are a full-time employee, you will receive a Form W-2 detailing your earnings, as well as which taxes were withheld. If you work freelance or on a contract, you may receive a Form 1099-NEC detailing what you earned. You may also receive documents showing dividends or interest earned on investments , or student loan interest youve paid . If youre a college student , youll receive a Form 1098-T that shows how much you paid in tuition, as well as any amounts you received from grants or fellowships, to help you figure out deductions and credits related to education expenses.

What Types Of Student Loans Qualify

Nearly every type of federal student loan qualifies for forgiveness, including direct subsidized or unsubsidized loans and graduate or parent PLUS loans.

However, itâs not entirely clear what might happen to Federal Family Education loans and Perkins loans that arenât held by the federal government. If your loans qualified for the federal student loan payment pause, theyâre likely eligible for this forgiveness opportunity.

But if your loans werenât paused and are held by a private lender, the Department of Education is currently working with those third-parties to forgive your debtâthough this plan hasnât been solidified yet.

Private student loans arenât eligible for forgiveness.

Recommended Reading: How Do I Pay Sales Tax In Texas

Requesting An Extension Of Time To File

If you are unable to submit your tax form by the tax deadline, use Form 4868 to apply for an extension of time to file Form 1040 or 1040NR. If you use this form, your deadline to file your tax return will be October 17, 2022.

To get the extra time you must:

- Estimate the amount you owe.

- Enter that amount on Line 4 of Form 4868, and include your payment with the form.

- Mail Form 4868 in time to be postmarked no later than .

To request an extension of time to file the State of Michigan tax form, please follow the instructions for Form 4, Instructions for Application for Extension of Time to File Michigan Tax Returns. Mail Form 4 in time to be postmarked no later than April 18, 2022.

The information contained in this web site is not a substitute for advice obtained from the Internal Revenue Service or a qualified tax professional.

Recommended Reading: How To Access Past Tax Returns

What Counts As Discretionary Income

Discretionary income is the amount you have left after paying for essentials like housing and food costs. In the context of federal student loans, discretionary income is the difference between your annual income and 150% of the poverty guideline for your family size and location.

However, the new repayment plan calculates discretionary income more favorably by raising the amount of income that is protected from repayment. This will guarantee that no borrower earning less than 225% of the federal poverty level will have to make a payment.

Read Also: Do Churches Pay Property Taxes

How To Find And File Your Federal Tax Forms

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Michelle P. Scott is a New York attorney with extensive experience in tax, corporate, financial, and nonprofit law, and public policy. As General Counsel, private practitioner, and Congressional counsel, she has advised financial institutions, businesses, charities, individuals, and public officials, and written and lectured extensively.

If bureaucracies are good at anything, its creating paperwork, and the Internal Revenue Service is the king of all bureaucracies, especially when it comes to tax forms. Most paperwork needed for filing your federal tax return can be completed and submitted electronically, but youll need to acquire some forms, on paper or via the web, to get the job done. Well explain how to find and obtain the forms you need, how often the IRS updates its forms, and the options for filing your tax forms online.

For the 2021 tax year, the U.S. tax season began on Monday, January 24, 2022, which is when the IRS begins accepting and processing 2021 returns.

Save Up To 20% On Federal Filing Compared To Turbotax

| TurboTax |

|---|

TaxAct Costs Less: File for less and percentage savings claims based on comparison with TurboTax federal pricing for paid consumer online 1040 filing products on 07/07/2022.

Maximum Refund Guarantee: If an error in our software causes you to receive a smaller refund or larger tax liability than you receive using the same data with another tax preparation product, we will pay you the difference in the refund or liability up to $100,000 and refund the applicable software fees you paid us. Find out more about our Maximum Refund Guarantee.

$100k Accuracy Guarantee: If you pay an IRS or state penalty or interest because of a TaxAct calculation error, we’ll pay you the difference in the refund or liability up to $100,000. This guarantee applies only to errors contained in our consumer prepared tax return software it doesn’t apply to errors the customer makes. Find out more about our $100k Accuracy Guarantee.

Satisfaction Guarantee: If you are not 100% satisfied with any TaxAct product, you may stop using the product prior to printing or filing your return. We are unable to refund fees after you print or e-file your return.

Edition Pricing: Actual prices are determined at the time of payment, print, or e-file and are subject to change without notice. Add sales tax for applicable orders. Offers may end at any time and promotional offers may not be combined.

Don’t Miss: When Can You File Your Taxes

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Extension Of Time To File

An extension of time to file a return may be requested on or before the due date of the return. The extension is limited to six months. You may receive another 6-month extension if you are living or traveling outside the U.S. You must file the first 6-month extension by the April 15 deadline before applying for the additional extension of time to file by October 15.

Extensions for Members of the US Armed Forces Deployed in a Combat Zone or Contingency Operation. Deadlines for filing your return, paying your taxes, claiming a refund, and taking other actions with OTR is extended for persons in the Armed Forces serving in a Combat Zone or Contingency Operation. The extension also applies to spouses/registered domestic partners, whether they file jointly or separately on the same return. Complete the Military Combat Zone on your Extension of Time to File, FR-127.

Note: Copies of a federal request for extension of time to file are not acceptable.The extension of time to file is not an extension of time to pay. Full payment of any tax liability, less credits, is due with the extension request. If the tax liability is not paid in full with the extension, the request for an extension will not be accepted, and the taxpayer will be subject to a failure-to-pay penalty and interest on any tax due.

Read Also: Where Do I Send My Federal Taxes

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns that we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

The CRA may take longer to process your return if it is selected for a more detailed review. See Review of your tax return by the CRA for more information.

If you use direct deposit, you could get your refund faster.

Asking For A Small Extension

An employer may need to hire someone as soon as possible, so asking for a small extension may be all right, but asking for several weeks may not be acceptable.

A teacher or professor may be willing to grant an extension that is within the timing of the current semester, but not an extension that goes into the summer vacation or next semester.

Here are sample of an extension request letters. It should be sent by certified mail, so the sender has proof of the date it was sent and received.

Any enclosures should be copies, and no original documents should be sent. If the extension is granted, a follow up letter of appreciation should be sent immediately.

City, State, Zip Code

Dear Receivers Name,

I am enrolled in your English Literature 101 class and have been absent for the past five weeks because of injuries I sustained in an automobile accident.

You have kindly accommodated my situation by allowing me to turn in my homework late, and this has helped make it possible for me to remain enrolled in the university and not lose a semester, and I am very grateful to you.

I have been released from the hospital, but still need to walk with crutches for the next month. Because of this inconvenience, it will be very difficult to do the required research for the mid-term paper that is due on DATE.

I would like to ask for an extension of 10 days to complete the paper. It is my intention to submit the paper to you on DATE.

Sincerely,

RE: Request for an extension of loan payments

Recommended Reading: How Do I Get My Tax Return Transcript

Can I File Taxes From 5 Years Ago

How late can you file? The IRS prefers that you file all back tax returns for years you have not yet filed. That said, the IRS usually only requires you to file the last six years of tax returns to be considered in good standing. Even so, the IRS can go back more than six years in certain instances.

How Do I File Quarterly Taxes In Quickbooks Desktop

Make sure you assigned the payment to the correct quarter.

Also Check: How Are S Corporations Taxed

When Are Taxes Due

This year, your federal return is due April 18. April 15, the standard due date, is a Friday and a holiday in Washington, D.C., which pushed back the deadline. Residents of Maine and Massachusetts have until April 19.

Most state tax deadlines are also the 18th, although there are a handful that are later than that, including Virginia on May 2 and Louisiana on May 16. And of course, residents of states with no income tax, including Alaska, Florida, Nevada, Tennessee, Texas and Washington, among others, don’t have to worry about filing a separate return.

You can file for an extension if you need more time, which would shift your deadline to Oct. 17. But if you owe money to the IRS, technically you need to pay that by April 18, even if you request an extension. If you don’t, you’ll be hit with late payment penalties.

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return. Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers. Free File is available in English and Spanish. To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

Also Check: How Can I Check My Income Tax Refund Status

How Much Debt Will Be Forgiven

The amount of debt forgiven depends on whether or not the borrower received a Pell Grant those who did will receive up to $20,000 in debt cancellation. Other borrowers will receive $10,000 in debt cancellation.

If your student loan balance is less than the amount you qualify for, your relief is capped at the amount of your outstanding debt. For example, if you are eligible for $10,000 in relief but have an $8,000 balance, youâll receive $8,000 in relief.

Help Filing Your Past Due Return

For filing help, call or for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 800-TAX-FORM or for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

Don’t Miss: How Much Can You Make And Not File Taxes

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Paying State Estate Taxes

Even if an estate is small enough to use the federal exemption, there may be state tax requirements depending on the state you live in and the estates value. If your state taxes estates, you must know the exemption limit, and if the estate is worth more than the limit, you must complete Form 706 at the state level.

The state tax exemptions for 2021 are as follows:

- Connecticut $7.1 million

- Washington D.C. $4 million

Also Check: How To Find Tax Return Information

When To File Your Return

If you file your return on a calendar year basis, the 2020 return is due on or before . A fiscal year return is due on the 15th day of the 4th month following the end of the taxable year. When the due date falls on a Saturday, Sunday, or holiday, the return is due on or before the next business day. A fiscal year return should be filed on a tax form for the year in which the fiscal year begins. For example, a 2020 tax form should be used for a fiscal year beginning in 2020. See Directive TA-16-1, When a North Carolina Tax Return or Other Document is Considered Timely Filed or a Tax is Considered Timely Paid if the Due Date Falls on a Saturday, Sunday, or Legal Holiday.

Out of the Country: If you are out of the country on the original due date of the return, you are granted an automatic four month extension to file your North Carolina individual income tax return if you fill in the “Out of Country” circle on Page 1 of Form D-400. “Out of the Country” means you live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or you are in military service outside the United States and Puerto Rico. The time for payment of the tax is also extended however, interest is due on any unpaid tax from the original due date of the return until the tax is paid.

Nonresident Aliens: Nonresident aliens are required to file returns at the same time they are required to file their federal returns.

Will My Tax Refund Be Delayed

Some tax returns take longer to process than others, not only because of the two tax credits we just discussed. Here are a few more reasons the IRS says may cause a delay in your tax refund:3

- Your return had errors, or was incomplete.

- You are a victim of tax fraud or identity theft.

- Your return includes Form 8379, Injured Spouse Allocation, which could take about 14 weeks to process. Form 8379 does not have to do with physical injuries, but refers to a situation in which a joint refund is seized because one spouse owes a debt like taxes or child support, even if the other spouse was expected to get a refund. The injured or negatively affected spouse can file Form 8379 to receive their portion of their joint tax refund.4

- Your return needs further review in general, such as if youre being audited.

The IRS will contact you if they need any more information to process your tax return.

Read Also: How Much Money Is Taken Out Of Paycheck For Taxes