Where Can I Find My 1098 Mortgage

You can get your mortgage info by going to your lenders website. Other documents, like your monthly mortgage bills and your Closing Disclosure , will also have some of this info. Your lender should send you a 1098 by January 31. If you havent received one by then, contact them for the info you need.

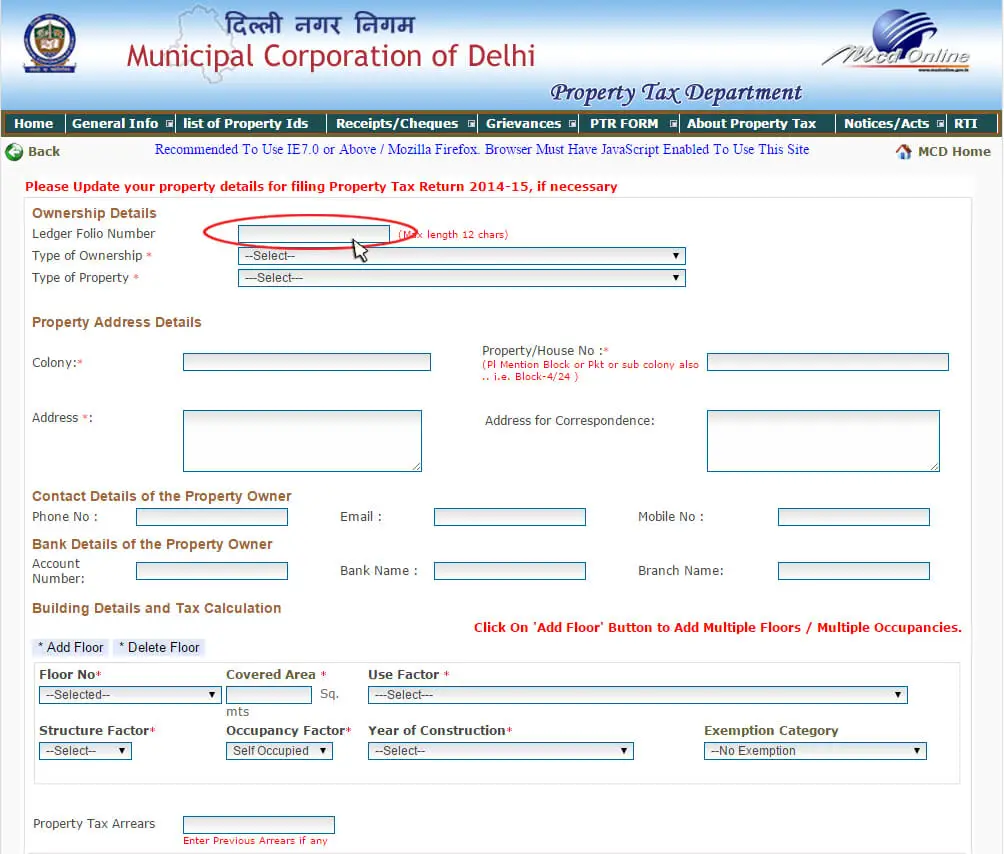

How Do I Find My Pmc Property Tax Bill

6 Simple Steps To Get Property Tax Receipt Online

Check Your Escrow Account

If your property tax payments are made through an escrow account, youll get a 1098 statement from your lender. The statement will likely show the amount of deductible mortgage interest you paid for the year, but it will also provide a breakdown of the property tax payments the lender has made on your behalf.

Again, youll deduct only the taxes paid out in the tax year at hand.

Recommended Reading: What Is The 3600 Child Tax Credit

How Does The Property Tax Deduction Work

The most important rule to remember is that you can only claim the property tax deduction if you choose to itemize your taxes. If you claim the standard deduction, youre not eligible to also claim your property taxes.

Its up to you to figure out which decision makes the most financial sense. Depending on your personal situation, the standard deduction could be higher than what you would save by itemizing, so be sure to do the math and choose wisely.

What Is Lake County Doing To Lower My Bill

Lake County has more than 200 individual entities that levy property taxes, which is why the Lake County Board is pursuing partnerships and looking for consolidation opportunities to reduce this number. Consolidation efforts are centered around partnerships that will enhance efficiency, accountability, and cost savings.

- Learn how the County Board has kept the tax levy flat for Fiscal Years 2020 and 2021.

- Learn more about consolidation efforts and how your property tax dollars are used to help make Lake County a great place to live, work and visit.

Don’t Miss: How To Get Last Year’s Tax Return

Instructions For Form 1098

Future Developments

For the latest information about developments related to Form 1098 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form1098.

Whats New

Continuous-use form and instructions.

Form 1098 and these instructions have been converted from an annual revision to continuous use. Both the form and instructions will be updated as needed. For the most recent version, go to IRS.gov/Form1098.

Reminders

General instructions.

In addition to these specific instructions, you should use the current General Instructions for Certain Information Returns. Those general instructions include information about the following topics.

-

When and where to file.

-

Electronic reporting.

-

Other general topics.

You can get the general instructions at General Instructions for Certain Information Returns, available at IRS.gov/1099GeneralInstructions, or IRS.gov/Form1098.

Online PDF fillable Copies B and C.

To ease statement furnishing requirements, Copies B and C are fillable online in a PDF format, available at IRS.gov/Form1098. You can complete these copies online for furnishing statements to recipients and for retaining in your own files.

Recommended Reading: Do Retirees Have To File Taxes

How Do I Find My Tax Statement

Order a Transcript

Where do I find my 1098 form?

Your student loan servicer will send you a copy of your 1098-E via email or postal mail if the interest you paid in 2020 met or exceeded $600. Even if you didnt receive a 1098-E from your servicer, you can download your 1098-E from your loan servicers website.

What do I do if I dont have a 1098 form?

No Form 1098 Received If you didnt receive a Form 1098, you can still claim the mortgage interest you paid as a deduction on your taxes. Instead of reporting the mortgage interest on line 10 of Schedule A, report the interest paid on line 11.

How to find my 1098?

Login to ACES

Read Also: How Much Is Sales Tax In Kansas

Are Property Taxes In Escrow Deductible

Yes, your property taxes are still deductible if you pay them through via an escrow account. You will find the amount of property taxes paid through escrow on your Form 1098. It shows how much mortgage interest, points, and PMI you paid during the previous year.

What Is Form : Mortgage Interest Statement

Form 1098: Mortgage Interest Statement is an Internal Revenue Service form that is used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the amount totals $600 or more. Related expenses include points paid on the purchase of the property. Points refer to prepaid interest made on a home loan to improve the rate on the mortgage offered by the lending institution.

Form 1098 serves two purposes:

- Lenders use it to report interest payments in excess of $600 they received for the year. The IRS collects this information to ensure proper financial reporting for lenders and other entities that receive interest payments.

- Homeowners use it to determine the total amount of interest they paid for the year when figuring their mortgage interest deduction for their annual tax returns.

Also Check: How To Figure Out Tax Percentage

The Bottom Line: The Standard Deduction Could Save You More

Owning a home comes with a lot of financial benefits especially come tax season. The property tax deduction can be a great way for homeowners to save money, but its critical to understand exactly what can be deducted and how the capped amount compares to what you could save with the standard deduction.

With the standard deduction rising each year, more and more people are finding that it outweighs the benefit that comes with itemized deductions. So look at your financials carefully and be sure to choose the option that will save you the most! As always, we recommend consulting a tax professional before making any decisions regarding your taxes.

And if you dont yet own a home, but youre looking into the financial benefits of purchasing, now is a great time to start the mortgage approval process and get the ball rolling.

Get approved to buy a home.

Apply online with Rocket Mortgage®.

Property Taxes Not Included

Its a common condition for taking out a mortgage for you to include 1/12 of your annual property tax bill along with your monthly mortgage check. The money goes into an escrow account your lender uses to pay the tax bill. That guarantees your house the banks collateral wont be taken for unpaid property taxes. Your lender should send you an annual statement detailing the amount of taxes paid, but it doesnt have to be part of the 1098.

Recommended Reading: Do You Claim Unemployment On Your Taxes

Avoid The Line Pay Online

Using your MyPropertyAccount you can register your property tax, utilities and dog licensing accounts for eBilling. Pay via online or phone banking with your financial institution.

Sign up for eBilling

Log in to MyPropertyAccounts and change your bill delivery method to email by May 1st of the year to get your bill online.

How Much Can Be Deducted

The total amount you can deduct is dependent on the changes to the Tax Cuts and Jobs Act, which was passed at the end of 2017. This affects both itemized and standard deductions.

Lets unpack that a little bit.

Itemized Property Tax Deduction

The Tax Cuts and Jobs Act capped the deduction for state and local taxes, including property taxes, at $10,000 . This means that if the amount of taxes youve paid out over the course of the year exceeds those amounts, youre not able to claim the full amount of your property taxes.

Plus, this cap is on a combination of taxes not just your home. In addition to property taxes, the cap includes state and local income and sales taxes , so youll likely exceed that capped amount quickly.

Standard Deduction

While the Tax Cuts and Jobs Act capped the deduction for property taxes, it also nearly doubled the amount of the standard deduction. It should be noted that standard deduction amounts are indexed annually for inflation, so theyre further on the rise.

Standard deduction amounts for 2020 and 2021

|

Filing Status |

|

$18,800 |

Recommended Reading: How To Calculate Property Tax

Rules For Deducting Mortgage Interest

Whether or not you need Form 1098 depends on whether or not you plan to itemize your deductions on the Schedule A Form. Claiming a deduction for mortgage interest paid when can reduce your total taxable income. However, there are a few rules to know about deducting mortgage interest.

- You must be the primary borrower and be making payments on the loan.

- Youre limited to deducting interest on total mortgage debt of $750,000 or less, if the debt originated on or after Dec. 16, 2017.

If all of these apply to you, then you would need Form 1098 to deduct the mortgage interest you paid for your home loan for the current tax year. If you have more than one qualified mortgage, then you will receive a separate Form 1098 for each one.

All copies of Form 1098 are available on the IRS website.

Why Does My 1098 Not Show Property Taxes Paid

Your lender sends one copy to you and one to the Internal Revenue Service. If you take the mortgage interest write-off, the form gives you and the government a record of how much interest you paid. But, even if your lender handles your property tax payments, that information may not appear on your 1098.

Recommended Reading: How Much Is Sales Tax In Texas

Does A 1098 Increase Refund

Your 1098-T may qualify you for education-related tax benefits like the American Opportunity Credit, Lifetime Learning Credit, or the Tuition and Fees Deduction. If the credit amount exceeds the amount of tax you owe, you can receive up to $1,000 of the credit as a refund.

Open Records & Archives

Records up to 5 years old, including the current tax roll, are available in the Johnson County Treasurers Office at 111 South Cherry Street, Suite 1500, Olathe, KS from 8 a.m. to 5 p.m. Monday through Friday, except holidays. Records older than 5 years are archived and due to age, deterioration, and off site storage, must be researched by our personnel. Three business days are required for research. If a request cannot be done in three business days a written explanation will be sent with an estimated date it can be completed. Pursuant to K.S.A. 45-219, requesters are responsible for payment of costs incurred by the County in providing access to or furnishing copies of public records. These fees are indicated on the form below.

Examples of public records maintained by the Treasurers Office*:

- Real Estate and Personal Property Tax Rolls

- Real Estate and Personal Property Tax Payments

- Tax Distribution Records

*If you are looking for public records including Mortgages and Deeds, please visit the Records and Tax Administration website to submit a request.

Associated Documents:

Dont Miss: How Much Does H& r Block Charge To Do Taxes

You May Like: How To Deduct Taxes From Gross Pay

What Is Box 2 On A 1098

If the interest was paid on a mortgage, home equity loan, or line of credit secured by a qualified residence, you can only deduct the interest paid on acquisition indebtedness, and you may be subject to a deduction limitation. Box 2. Shows the outstanding principal on the mortgage as of January 1, 2021.

What Is Property Tax

Property tax is real estate tax paid by the owner of a property. It is based on the value of the property. Your property is assessed by local government to determine how much your property is worth and how it should be taxed.

Property taxes are a major source of income for city, county, and state governments.

Recommended Reading: When Will I Get My Child Tax Credit

About Loudoun County Taxes

- Real estate and personal property tax rates are set in early April by the Board of Supervisors.

- The Commissioner of Revenue then assesses real estate and personal property tax values.

- Annual tax bills are then prepared and mailed by the Treasurer. Personal property bills are mailed in early April, Real estate bills are mailed in early May.

- There is no local income tax.

- To get text alerts about taxes, including notices of upcoming deadlines, text TAXES to 888777.

Where Do Your Tax Dollars Go

Your total property tax bill provides for more than just the cost of city services. Like the city, Halton Region prepares a budget each year, with a large part of their operating expenditures funded through property taxes. The Province determines education tax rates.

The Citys portion of the overall 2021 residential tax bill is 45.4 cents of every tax dollar and the remaining 54.6 cents goes to Halton Region and the Province of Ontario for education taxes.

The city considers it very important for taxpayers to understand what city services they receive for their property tax dollars. For 2021, an urban residential property assessed at $500,000 amounts to approximately $1,770 in property taxes for city services.

Read Also: How Do You Do Your Own Taxes Online

How Do I Find Property Taxes On A 1098

They may not be on there. Several years ago there used to be a specific box for them, but not on the newer 1098 forms. You may find property taxes in box 10, which is “other.” If not, and you don’t have your own records, then you’ll have to locate the amount in another way.

A phone call to your lender might be the easiest way to get the figure. Also, many counties/municipalities have a property tax database on their web sites, where you can enter some identifying information and then see your annual property taxes going back a number of years.

Is Box 10 On My 1098 The Amount I Should Use For Property Real Estate Taxes

Yes if you have an amount indicated as real estate taxes paid in Box 10 of your Form 1098, this represents the amount of real estate taxes you paid on yourresidence during the tax year. If you can itemize your deductions, you can claim an itemized deduction for real estate taxes paid on your primary residence this is the amount which should beincluded on your federal income tax return, on Form 1040 Schedule A, ItemizedDeductions, Line 6, .

Heres how to enterreal estate taxes paid in TurboTax:

- In your return, click on Federal Taxes tab

- Under Your tax breaks, select Edit/Add button for Property Taxes

On Enter the PropertyTaxes You Paid, enter the amount of real estate taxes paid on the home in theYour Main Home box, per the Form 1098 Box 10

Recommended Reading: Who To Call For Tax Questions

Which Payment Method Is Best For Me

My payment is due today:

Online, telephone or in-person payments made via your financial institution that are completed before your banks cut-off time if it is before your due date will be reflected as payments made on time. Check with your financial institution to find out the cut-off time applicable to you.

Online payments by card through Paymentus made on weekdays do not have a cut-off time until 10PM. This means payments made on a due date before 10PM via Paymentus should be reflected as payments made on time.

I want a payment receipt:

You will receive a physical receipt when paying in-person at one of our Client Service Centres and an electronic confirmation when paying online by card.

I want to pay online:

You can pay your property tax bills online by payment card.

I am house-bound:

You can pay via your financial institution online or by telebanking, online by payment card, through our PAD plan or by mail.

I have no computer:

You can pay via your financial institution in-person or by telebanking, through our PAD plan, by mail or by dropping off a chequeat one of the secure payment drop-boxes located outside the main entrance of the Kanata Client Service Centre at 580 Terry Fox Drive or the Orleans Client Service Centre at 255 Centrum Boulevard.

Form : Mortgage Interest Statement And How To File

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Don’t Miss: Should I Shred Old Tax Returns

How To Pay Your Surrey Property Taxes Online

Pay by Pre-Authorized Pre-Payment Plan

Put money towards next years Annual Utilities and Property Taxes with a monthly withdrawal from your financial institution with the Pre-Authorized Pre-Payment Plan . With PAPP, youll start paying your taxes for 2021.

The pre-payment plan will accumulate 10 monthly withdrawals from your bank account, interest prescribed by the Province, and apply the funds towards your:

- annual utilities balance in February, due April 2 , and

- property taxes balance in May.

Be sure to get familiar with the payment withdrawal dates and details to avoid penalties. In particular, mark the July manual payment date in your calendar.

Metered utilities are not covered by PAPP. See your metered utilities payment options, or learn about the auto-debit payment plan.