Real Estate Taxes And Assessments

- Real estate taxes are based on real property assessments and the real property tax rate, which is set annually by the Board of Supervisors.

- Real estate in Virginia is assessed at 100% of its fair market value.

- Loudoun County real estate taxes are collected twice a year. The due dates are June 5 and December 5.

- The 2022 Real Property Tax Rate for Regular District 1: $0.890 per $100 in assessed value.

- Have questions about real property assessments or fair market valuations? Visit the Commissioner of the Revenue.

Property Taxes Not Included

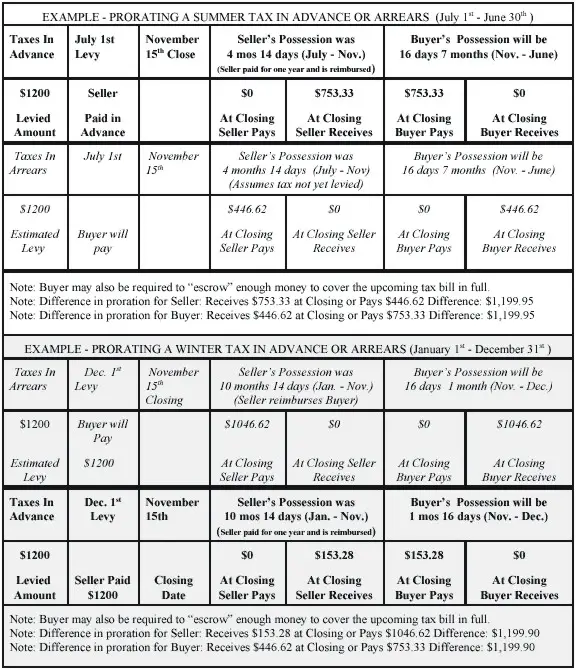

It’s a common condition for taking out a mortgage for you to include 1/12 of your annual property tax bill along with your monthly mortgage check. The money goes into an escrow account your lender uses to pay the tax bill. That guarantees your house the bank’s collateral won’t be taken for unpaid property taxes. Your lender should send you an annual statement detailing the amount of taxes paid, but it doesn’t have to be part of the 1098.

How To File Form : Mortgage Interest Deduction

Taxpayers don’t need to actually include Form 1098 with their tax returns because the information included in the form has already been provided to the IRS. Rather, taxpayers use the information provided on Form 1098 if they plan to deduct their mortgage payments. If you’re planning to file your tax return electronically, you enter the information from the form into the appropriate boxes on your tax return to record your interest deduction information.

If you’re receiving a Form 1098 for the first time, you may wonder how to make sense of it. There are 11 boxes to take note of when reviewing your statement.

- Box 1: Mortgage interest received from the borrower. This box shows how much interest you paid to your lender for the year.

- Box 2: Outstanding mortgage principal.This box shows how much is owed on the principal of the loan.

- Box 3: Mortgage origination date. This shows the date when your mortgage originated.

- Box 4: Refund of overpaid interest. If you overpaid mortgage interest that was refunded, it would be listed here.

- Box 5: Mortgage insurance premiums.If you’re paying private mortgage insurance or mortgage insurance premiums for the loan, those amounts are entered here.

- Box 6: Points paid on the purchase of the principal residence. This box shows mortgage points you may be able to deduct.

- Boxes 7 through 11.These include information about the mortgage and the property itself.

You May Like: How To Check Income Tax Return Status

Where Can I Find My 1098 Mortgage

You can get your mortgage info by going to your lenders website. Other documents, like your monthly mortgage bills and your Closing Disclosure , will also have some of this info. Your lender should send you a 1098 by January 31. If you havent received one by then, contact them for the info you need.

Are There Exceptions To The Property Tax Deduction

You can’t claim deductions for every kind of tax levied against your properties. For instance, you can’t deduct the cost of any assessments levied against you for the building of streets, water systems, sewer systems and sidewalks in your community. You can’t deduct the portion of your property tax bill that’s allocated for services such as water or trash collection.

If you live in a building or community that charges homeowners association fees, you can’t deduct them. And you also can’t deduct any payments you’ve made on loans that finance the addition of energy-saving improvements to your home. Depending on your situation, there may be other deductions and credits available for these energy-saving home improvements.

Don’t Miss: Where To Find Federal Tax Id Number

I Paid More Toward Interest In Another Month Than The Statement Is Showing Why Is That

Each tax year, you can only deduct mortgage interest for 13 months worth of payments, including January of the following year. The reasoning for this is that mortgage interest is paid sometime after the actual interest charge. January is included because the interest was accrued in December of the previous year.

When In Doubt Contact A Tax Pro

Look, figuring out your property tax deduction can definitely make your head spin, especially when tax percentages vary depending on your county. If you have a relatively simple return and want to try filing on your own, check out Ramsey SmartTax.

If you feel like you need extra help, reach out to a tax Endorsed Local Provider theyre RamseyTrusted and will make sure youre on the right path to getting your taxes done quickly and accurately.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

Don’t Miss: How Do I File Last Years Taxes

What Is Form : Mortgage Interest Statement

Form 1098: Mortgage Interest Statement is an Internal Revenue Service form that is used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the amount totals $600 or more. Related expenses include points paid on the purchase of the property. Points refer to prepaid interest made on a home loan to improve the rate on the mortgage offered by the lending institution.

Form 1098 serves two purposes:

- Lenders use it to report interest payments in excess of $600 they received for the year. The IRS collects this information to ensure proper financial reporting for lenders and other entities that receive interest payments.

- Homeowners use it to determine the total amount of interest they paid for the year when figuring their mortgage interest deduction for their annual tax returns.

Prepaid Mortgage Interest And Points

As part of the mortgage interest deduction, homeowners may be able to deduct prepaid mortgage interest and/or points associated with your mortgage transaction in some cases as well for a given year. Additionally, lending companies must report this information in certain cases on Form 1098.

In order to make sure you have the most accurate information regarding the number of points paid on your mortgage, itll be important to keep your closing documents and refer to them when filing your taxes.

Its important to note that there are strict regulations around the year in which you claim the prepaid interest and/or points on your taxes. We advise talking to a tax preparation professional if you have questions.

Recommended Reading: How Much Do You Have To Earn To Pay Tax

Does 1098 Include Property Tax

Form 1098 Tax Document Obtain Form 1098 from your mortgage lender. This tax document lists the mortgage interest you pay during the year and also lists any real estate taxes your lender paid on your behalf through an escrow account. Any amounts shown should include a description, such as Taxes or Property Tax.

Online And Mobile Banking

Additionally, if you have an escrow account, property tax information may be accessed within online and mobile banking. In addition to the previous years tax total, you may also view your current year-to-date property taxes.

Also Check: Do You Pay Taxes On Coinbase

How Does The Property Tax Deduction Work

The most important rule to remember is that you can only claim the property tax deduction if you choose to itemize your taxes. If you claim the standard deduction, youre not eligible to also claim your property taxes.

Its up to you to figure out which decision makes the most financial sense. Depending on your personal situation, the standard deduction could be higher than what you would save by itemizing, so be sure to do the math and choose wisely.

Instructions For Form 1098

Future Developments

For the latest information about developments related to Form 1098 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form1098.

What’s New

Continuous-use form and instructions.

Form 1098 and these instructions have been converted from an annual revision to continuous use. Both the form and instructions will be updated as needed. For the most recent version, go to IRS.gov/Form1098.

Reminders

General instructions.

In addition to these specific instructions, you should use the current General Instructions for Certain Information Returns. Those general instructions include information about the following topics.

-

When and where to file.

-

Electronic reporting.

-

Other general topics.

You can get the general instructions at General Instructions for Certain Information Returns, available at IRS.gov/1099GeneralInstructions, or IRS.gov/Form1098.

Online PDF fillable Copies B and C.

To ease statement furnishing requirements, Copies B and C are fillable online in a PDF format, available at IRS.gov/Form1098. You can complete these copies online for furnishing statements to recipients and for retaining in your own files.

Recommended Reading: Do Retirees Have To File Taxes

Find Tax Bills For Your Property Taxes

This isnt the time to guesstimate how much you paid in property taxes for the year. You want to be super accurate. If you have a home mortgage, your mortgage company should provide you with a 1098 Form that states how much property tax you paid. If you cut a check to pay your taxes directly, make sure you have the bill or a bank statement showing how much you paid.

If you want to find out how much you paid in taxes for your car, youll need your vehicle registration form. Youll also need that form if you get pulled over for going 40 mph in a school zone, so dont lose it!

How Do I Find Out What Property Taxes Will Be On The Properties I’m Considering

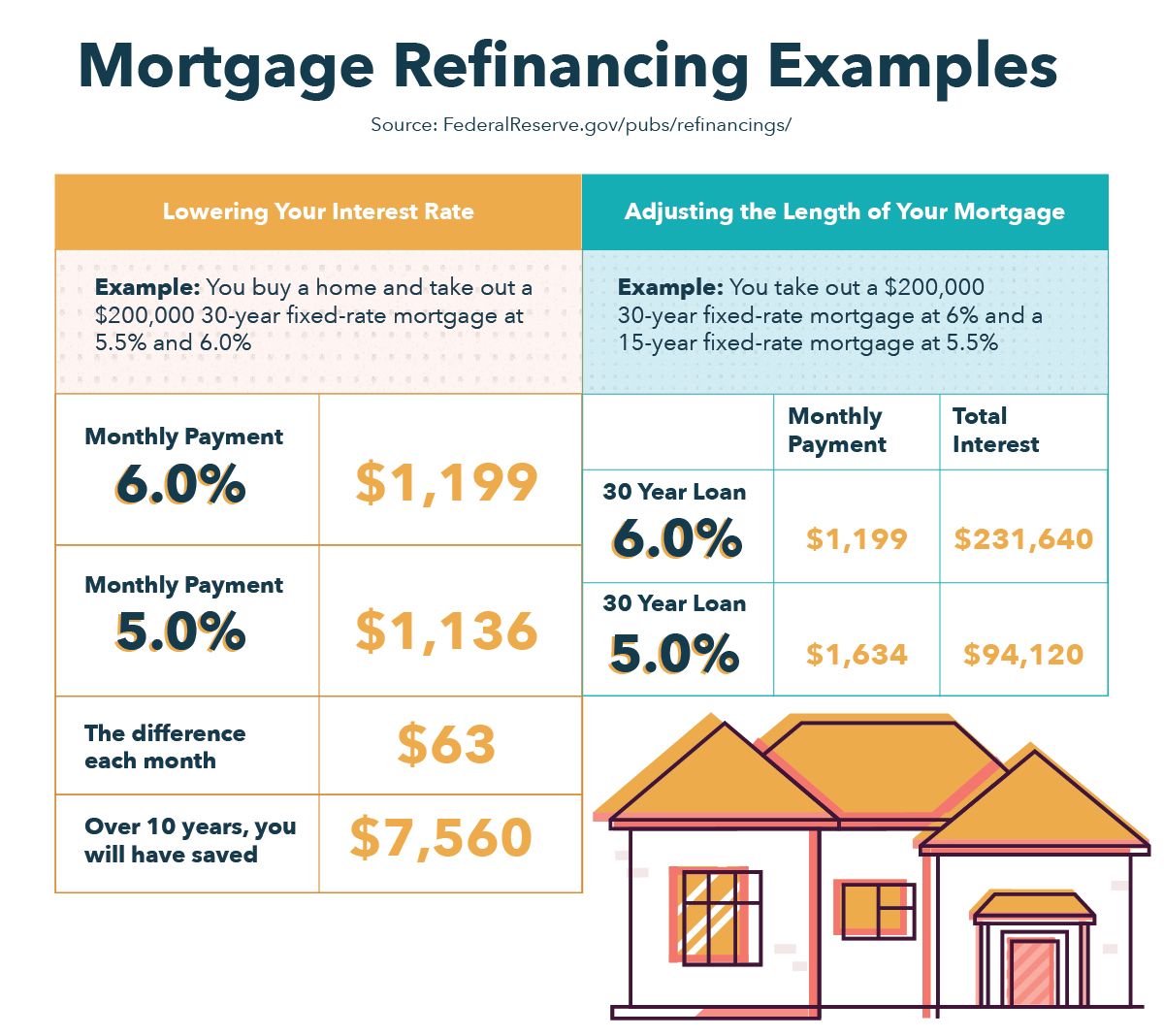

The higher your property taxes, the more expensive it will be to own your home. For example, say your home comes with yearly estimated property taxes of $8,400. If you escrow your property taxes, that will add $700 to your monthly mortgage payment.

You can also ask home sellers what they’re paying but understand that you’ll probably pay more if your purchase price exceeds the current owner’s assessed value. It also varies because you might qualify for different exemptions as well.

Even if you can deduct them, though, it’s important to consider the impact property taxes have on home buying.

You May Like: What Happens If I Forgot To File Taxes

Is Box 10 On My 1098 The Amount I Should Use For Property Real Estate Taxes

Yes – if you have an amount indicated as real estate taxes paid in Box 10 of your Form 1098, this represents the amount of real estate taxes you paid on yourresidence during the tax year. If you can itemize your deductions, you can claim an itemized deduction for real estate taxes paid on your primary residence – this is the amount which should beincluded on your federal income tax return, on Form 1040 Schedule A, ItemizedDeductions, Line 6, .

Here’s how to enterreal estate taxes paid in TurboTax:

- In your return, click on Federal Taxes tab

- Under Your tax breaks, select Edit/Add button for Property Taxes

On Enter the PropertyTaxes You Paid, enter the amount of real estate taxes paid on the home in the”Your Main Home box, per the Form 1098 Box 10

How Will My Forbearance Impact My Year

If youâre on a forbearance plan, the following may be affected on your 1098 form if any mortgage payments were missed or paid less than the amount due.

- Mortgage interest

- Real estate taxes

- Mortgage insurance paid

If this happens, the amount of mortgage interest received from the borrower and the amount of mortgage insurance premiums paid may be different than prior years. Since every situation is unique, we encourage you to consult with a trusted tax professional for advice. Visit our COVID-19 mortgage forbearance FAQ and Tax Documents FAQ pages for more information.

Recommended Reading: Where Do I Get Irs Tax Forms

Property Tax Write Offs

You only get to write-off the property taxes you or your lender paid the county this year. If you paid more than the total bill into escrow some lenders require an escrow cushion for emergencies the excess is not deductible. In addition to your lender’s report, you can contact your county’s property tax department. Most counties let you look up a copy of the bill online.

What Is Box 2 On A 1098

If the interest was paid on a mortgage, home equity loan, or line of credit secured by a qualified residence, you can only deduct the interest paid on acquisition indebtedness, and you may be subject to a deduction limitation. Box 2. Shows the outstanding principal on the mortgage as of January 1, 2021.

Read Also: How To Find Out What You Owe In Taxes

What Is Lake County Doing To Lower My Bill

Lake County has more than 200 individual entities that levy property taxes, which is why the Lake County Board is pursuing partnerships and looking for consolidation opportunities to reduce this number. Consolidation efforts are centered around partnerships that will enhance efficiency, accountability, and cost savings.

- Learn how the County Board has kept the tax levy flat for Fiscal Years 2020 and 2021.

- Learn more about consolidation efforts and how your property tax dollars are used to help make Lake County a great place to live, work and visit.

Real Estate Taxes Are Not Listed In 1098 /box 10 I Have A Separate Form With The Real Estate Tax Info Should I Enter It In The 1098 Real Estate Box

Yes you can claim an itemized deduction for realestate taxes paid on your primary residence, even if it is not included on Form 1098 Box 10 – If a real estate taxespaid amount was not reported to you on your Form 1098, it still represents the amount of real estate taxes you paid on yourresidence during the tax year, and this is the amount which should beincluded on your federal income tax return, on Form 1040 Schedule A, ItemizedDeductions, Line 6, , if you itemize your deductions.

Here’s how to enterreal estate taxes paid in TurboTax:

- In your return, click on Federal Taxes tab

- Under Your tax breaks, select Edit/Add button for Property Taxes

On Enter the PropertyTaxes You Paid, enter the amount of real estate taxes paid on the home in the”Your Main Home box from your form.

Recommended Reading: How Do I Change My Tax Withholding On Unemployment

How Much Can Be Deducted

The total amount you can deduct is dependent on the changes to the Tax Cuts and Jobs Act, which was passed at the end of 2017. This affects both itemized and standard deductions.

Lets unpack that a little bit.

Itemized Property Tax Deduction

The Tax Cuts and Jobs Act capped the deduction for state and local taxes, including property taxes, at $10,000 . This means that if the amount of taxes youve paid out over the course of the year exceeds those amounts, youre not able to claim the full amount of your property taxes.

Plus, this cap is on a combination of taxes not just your home. In addition to property taxes, the cap includes state and local income and sales taxes , so youll likely exceed that capped amount quickly.

Standard Deduction

While the Tax Cuts and Jobs Act capped the deduction for property taxes, it also nearly doubled the amount of the standard deduction. It should be noted that standard deduction amounts are indexed annually for inflation, so theyre further on the rise.

Standard deduction amounts for 2020 and 2021

|

Filing Status |

|

$18,800 |

Be Sure Youre Itemizing Your Deductions

Yes, its the age-old question: Should you itemize or take the standard deduction? If taking the standard deduction will result in a lower tax bill, dont waste your time itemizing and claiming property taxes. For 2021, the standard deduction is $25,100 if youre married filing jointly. It takes a bunch of deductions to exceed the standard deduction, and thats why 87% of taxpayers use the standard deduction instead of itemizing.3

Recommended Reading: How Long Does It Take To File Your Taxes

Cant Find My Property Tax On 1098

matter of courtesyProperty taxes $XXXX.XX

If this doesn’t appear on the front of your 1098, then look on the back,or even on the second page. Look especially for a listing of transactions related to your escrowaccount.

If you can’t find the property taxes anywhere on the 1098 or theaccompanying pages, then give your mortgage company a shout.

Do I Need To Include Form 1098 With My Tax Return

There is no need to attach Form 1098-T to your tax return. All information and assistance that ASU can provide to you is contained in this notice. There is no IRS requirement that you must claim the tuition and fees deduction or an education credit.

Recommended Reading: Are Membership Dues Tax Deductible

Why Does My 1098 Not Show Property Taxes Paid

Your lender sends one copy to you and one to the Internal Revenue Service. If you take the mortgage interest write-off, the form gives you and the government a record of how much interest you paid. But, even if your lender handles your property tax payments, that information may not appear on your 1098.

About Loudoun County Taxes

- Real estate and personal property tax rates are set in early April by the Board of Supervisors.

- The Commissioner of Revenue then assesses real estate and personal property tax values.

- Annual tax bills are then prepared and mailed by the Treasurer. Personal property bills are mailed in early April, Real estate bills are mailed in early May.

- There is no local income tax.

- To get text alerts about taxes, including notices of upcoming deadlines, text TAXES to 888777.

- See a detailed list of Tax Rates.

Recommended Reading: Will I Get Money Back From Taxes