How To File Taxes Using Sprintax

Read all the steps before logging in to Sprintax in Step 4.

Review Documents and Information You May Need

Determine which forms and documents from the list below that are relevant to you. If you had U.S. source income, you will receive one or more forms indicating the type, source and amount of income received. Learn more about income types at our U.S. Income Tax Basics page.

Follow the Instructions in Sprintax to Complete Federal Tax Forms

If You Did Not Have U.S. Income: Sprintax will generate a completed Form 8843 for you and each of your dependents.

If You Had U.S. Income: Sprintax will generate:

- a completed Form 8843 for you

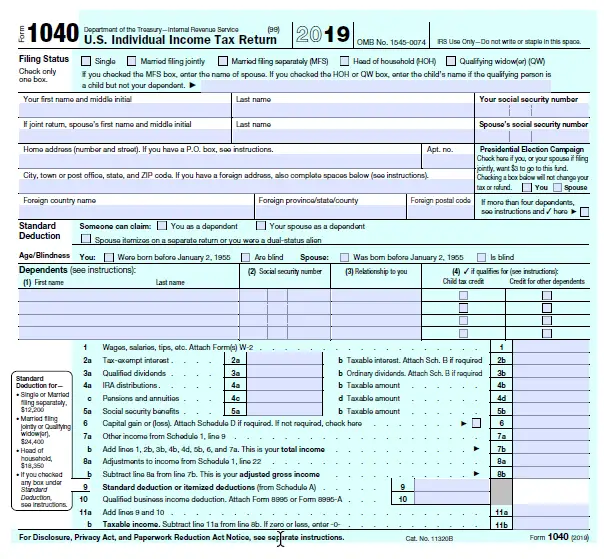

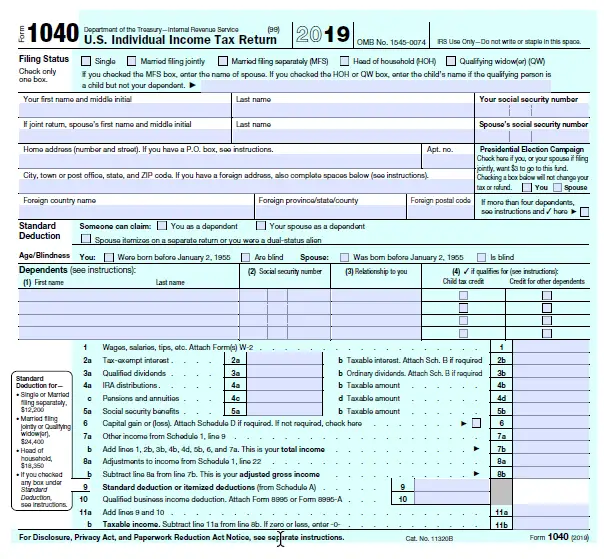

- a federal tax return, with either a 1040NR-EZ or form 1040NR, depending on your circumstances.

- a W-7 application for an ITIN if you do not have an SSN or an ITIN. See Special Situations below

Complete Your State Tax Return, If Applicable

After you finish your federal return, Sprintax will inform you if your income necessitates a state tax return as well. If so, you may choose to use Sprintax for an individual fee of $39.95. It is optional, however, and you may want to complete a NY State or other state tax return on your own.

If You Need Help With Your Return

If you are unable to get help filling out your North Carolina return, you can contact a service center for assistance or call toll-free at 1-877-252-3052. Your federal return must be completed before we can assist you in filling out your North Carolina return.

If you are disabled, have a low income, or are a senior citizen, income tax returns can be prepared free of charge through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. For location and dates of assistance call the Internal Revenue Service toll-free at 1-800-829-1040.

Can I Call The Irs To Get Answers

While you could try calling the IRS to check your status, the agencys live phone assistance is extremely limited.

The IRS is directing taxpayers to the Let Us Help You page on its website and to get in-person help at Taxpayer Assistance Centers around the country. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if youre eligible for assistance by calling: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if its been 21 days or more since you filed your taxes online, or if the Wheres My Refund tool tells you to. You can call 800-829-1040 or 800-829-8374 during regular business hours. If you have not received a refund yet, you shouldnt file a second tax return.

Don’t Miss: Do My Taxes Myself Online

Log In And Create A Sprintax Account

Do not file your 2021 tax return until you have all of your income statements! Some students and scholars get both a W-2 and a 1042-S. depending on the type of income. The 1042-S is generally issued in the first two weeks of March.When you log in through the Columbia Portal below with your UNI and password, it will take you to the Sprintax/Columbia page where you need to create a Sprintax account with a new username and password.

How Do You Buy An I Bond For A Child

Since you need to be 18 years old to buy Series I or Series EE bonds, adults will need to buy bonds on behalf of their children if they want their kids to own them. Here’s how to buy bonds for a minor child:

The balance of bonds you buy for your minor child will appear on the My Account tab under “Linked Accounts Information” once the purchase is complete.

Don’t Miss: Will I Get Money Back From Taxes

How Can I Submit My Tax Return For Free

Filing a tax return can be expensive. And hey, isnt a refund supposed to increase the size of your wallet? Fortunately, you have options that allow you to file your tax return absolutely free of charge. You can self-prepare a paper return or you can use TurboTax Free tax software program and then use Netfile to submit your return. People can benefit from help on a tax return, says Gurbaksh Mangat, a Surrey, B.C.-based accountant. When free filing, this help may come in the form of a tax and benefits guide or the aid of free tax software.

Read Also: Do You Get Taxed On Doordash

Where Do I Send My 1040ez Form

Whichever version of the 1040 form you use , your 1040 form has to be mailed to the IRS upon completion. However, the answer to this question depends on where you are located. You can check our list below to determine your appropriate IRS mailing address.

Whats your biggest 2022 HR challenge that youd like to resolve

Answer to see the results

You May Like: Where Do I Pay Property Taxes

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Still Waiting For Your Tax Refund The Irs Might Owe You More Money

If you filed your tax return on time, and you havent received your expected tax refund yet, the IRS probably owes you interest.

Katie Teague

Writer

Katie is a Writer at CNET, covering all things how-to. When shes not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

Dan Avery

Writer

Dan is a writer on CNETs How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Peter Butler

How To and Money writer

Im a writer/editor for CNET How-To and Money, living in South Berkeley, CA with two kids and two cats. I enjoy a variety of games and sports particularly poker, ping-pong, disc golf, basketball, baseball, puzzles and independent video games.

The deadline for filing US income taxes passed on April 18, and most Americans have received the tax refunds coming their way. The final IRS filing report for the 2022 tax season shows that the agency issued more than 96 million refunds for an average of $3,039 each.

Dont Miss: Doordash 1099 Nec

Don’t Miss: Are Donations To Hillsdale College Tax Deductible

What You Need To Know

Before filing, you can learn more about the advantages of filing online. Electronic filing is the fastest way to get your refund. If you file online, you can expect to receive your refund within 2 weeks. If filing on paper, you should receive your refund within 6 weeks.

These forms are subject to change only by federal or state legislative action.

All printable Massachusetts personal income tax forms are in PDF format. To read them, you’ll need the free Adobe Acrobat Reader.

If you have any suggestions or comments on how to improve these forms, contact the Forms Manager at .

If you need information about the most common differences between the federal and Massachusetts state tax treatment of personal income, please visit our overview page.

What Might Delay My Tax Refund

Heres are some typical reasons why tax refunds are delayed:

- Your return has errors or is incomplete.

- Your refund is suspected of identity theft or fraud.

- Your return needs further review.

- You didnt properly reconcile your stimulus payment with the recovery rebate credit.

In testimony to the House Ways and Means Committee, IRS Commissioner Charles P. Retting said that the agency received far more than 10 million returns last year in which taxpayers failed to properly reconcile their received stimulus payments with their recovery rebate credit, which required a manual review and resolution.

If the delay is due to a necessary tax correction made to a recovery rebate credit, earned income tax or additional child tax credit claimed on your return, the IRS will send you an explanation. If theres a problem that needs to be fixed, the IRS will first try to proceed without contacting you. However, if it needs any more information, it will write you a letter.

If youve requested a paper check for your tax refund, itll take longer, too about six to eight weeks, according to the IRS.

Don’t Miss: Can You Claim Private School Tuition On Taxes

Where Do I Mail My Federal Tax Return

Where to mail Form 1040? The taxpayers who are filing a paper tax return must mail their returns by April 15 to the Internal Revenue Service. If you arent required to file a paper tax return for any reason, we suggest e-filing though as it will be a lot faster for both you and the IRS.

The most common reason why taxpayers mail their returns to the IRS is to fill out certain tax forms that cannot be filed electronically. In these cases, the IRS needs to get the return mailed to them. One of the better examples of this is Form 4852 which is used for replacing Form W-2 in absence of it.

Regardless of the tax forms, you used to file your tax return with, you must mail Form 1040 along with the attachments to the Internal Revenue Service. As for the mailing addresses, they are below. The mailing address is different depending on your state of residence and whether or not youre mailing your return with payment or not.

Take note that it takes between two and six weeks to process paper tax returns for the IRS. If you can e-file, we highly suggest doing so as it will take less time to receive your refund.

| State |

|---|

How To Buy I Bonds

After inflation rose to a 40-year high in 2022, Series I savings bonds — better known as “I Bonds” — re-entered the mainstream conversation. In their latest release, I Bonds pay an annualized rate of 9.62%. Given persistent inflation, they will continue to pay competitive interest in the immediate future.

This article will review where and how to purchase I Bonds and answer a number of frequently asked questions.

Don’t Miss: How Much Federal Income Tax Should Be Withheld

Where To Send Your Individual Tax Account Balance Due Payments

| Internal Revenue Service CenterAustin, TX 73301-0010 | |

| Alabama, Alaska, Arkansas, California, Delaware, Georgia, Hawaii, Illinois, Indiana, Iowa, Kentucky, Maine, Massachusetts, Michigan, Minnesota, Missouri, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, South Carolina, Tennessee, Vermont, Virginia, Washington, Wisconsin | Internal RevenueService CenterKansas City, MO 64999-0010 |

| Arizona, Colorado, Connecticut, District of Columbia, Idaho, Kansas, Maryland, Montana, Nebraska, Nevada, North Dakota, Oregon, Pennsylvania, Rhode Island, South Dakota, Utah, West Virginia, Wyoming | Internal RevenueService CenterOgden, UT 84201-0010 |

| All APO and FPO addresses, American Samoa, nonpermanent residents of Guam or the Virgin Islands*, Puerto Rico , a foreign country: U.S. citizens and those filing Form 2555, 2555-EZ, or 4563 | Internal Revenue |

What Phone Number Is 800 829 0922

If you want to call the IRS, make sure you call the right number: 800-829-0922. The letter says you have 60 days from the date of the letter to appeal or you can sue in federal court. You may want to hire a tax professional and you may qualify for low-income taxpayer clinics. Theyre free or close to free.

You May Like: How To Check If My Tax Return Was Accepted

Determine If You Must File A Return

You must file a return if you:

- Owe income tax to the government

- Are asked by the CRA to file a return

Even if you dont owe any tax, you should file a tax return if you:

-

Expect an income tax refund from the government

-

Are applying for the GST/HST credit

-

Are eligible to receive the child tax credit

-

Might earn more income in Canada later and want to carry forward Tuition Payment and Education Credits to reduce the tax you owe in future years.

Learn more about if you have to file a return.

You do not need to pay taxes on your income from scholarships, fellowships, or bursaries, but you must provide UBC with your ITN or SIN when UBC requests it for tax purposes.

Filing Paper Returns Or Payments By Mail

If you do not prefer to e-file, you have the option to file your return using a paper form and related schedules. Most forms are available as fillable PDFs, allowing you to type in the information. Typed characters make processing go more smoothly because the forms can be read more accurately by the Departments scanners.

When you are ready to print the form, be sure to follow the printing instructions carefully to ensure our scanners can read and process your form. Printing the form in a different format slows processing.

Read Also: How Can You File Taxes From Previous Years

Closing Of Individual Po Box Addresses Could Affect Your Clients

Effective January 1, 2022, certain Post Office Boxes will be closed in Hartford, CT and San Francisco, CA. If you have pre-printed mailing labels for one of these payment addresses, destroy them now. To avoid delays, use the current address shown below. IRS encourages the use of electronic payment options available on IRS.gov.

What You Need To File A Tax Return

To file a Canadian tax return, you need one of the following:

- A Social Insurance Number

- An Individual Tax Number

As soon as you get a SIN or ITN, enter it in your Student Service Centre account so that UBC can provide the government with accurate information for your taxes.

If you have either of these numbers but it expired and you are not currently employed, you can use the expired number for filing taxes.

Also Check: When Are Federal Taxes Due In Texas

Where Do I Mail My Amended Tax Return

Use IRS Form 1040-X to file an amended tax return. You can e-file this return using tax filing software if you e-filed your original return.

If you are filing Form 1040-X because you received a notice from the IRS, use the address in the notice. Otherwise, use this article from the IRS on where to file Form 1040X. Find your state on the list to see where to mail your amended return.

Where Should I Mail My Tax Returns

There is no one address to mail your federal tax returns to.

Where the form needs to go will depend on exactly what return you are trying to file. Each type of form and tax return has its own mailing address and when you need to send it will depend on where in the country you live.

If you are filing but not making your tax payment then there will be a different address that you will need to use.

For example, if you are trying to file a Form 941 then you will need to use the following addresses:

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury |

|

P.O. Box 932100 Louisville, KY 40293-2100 |

You can find a full list of state by state addresses here on the IRSs website as well.

Recommended Reading: How Much Can I Make And Not File Taxes

Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

You do not have to report certain non-taxable amounts as income, including:

- elementary, secondary and post-secondary school scholarships

Nonresident Athlete Individual Income Tax

A nonresident individual who is a member of the following associations is considered a professional athlete and is required to electronically file a Louisiana income tax return, IT-540B reporting all income earned from Louisiana sources:

- Professional Golfers Association of America or the PGA Tour, Inc.

- National Football League

- East Coast Hockey League

- Pacific Coast League

Income from Louisiana sources include compensation for the services rendered as a professional athlete and all income from other Louisiana sources, such as endorsements, royalties, and promotional advertising. The calculation of income from compensation is based on a ratio obtained from the number of Louisiana Duty Days over the total number of Duty Days. Duty Days is defined as the number of days that the individual participated as an athlete from the official preseason training through the last game in which the individual competes or is scheduled to compete.

You May Like: How Long Does Your Tax Return Take

Don’t Miss: How To Reduce Federal Taxes