Salaries And Other Compensation:

Employee salaries, gross wages, commissions, bonuses and other types of compensation count as tax-deductible expenses. Compensation can even extend to salaries paid to children and spouses, provided payments were made through payroll and those individuals performed services for your business. The amount paid does need to be considered reasonable.

Current Or Capital Expenses

Renovations and expenses that extend the useful life of your property or improve it beyond its original condition are usually capital expenses. However, an increase in a property’s market value because of an expense is not a major factor in deciding whether the expense is capital or current. To decide whether an amount is a current expense or a capital expense, consider your answers to the questions in the following chart.

Current or capital expensesFor more information, see Chapter 4 Capital cost allowance and Income Tax Folio S3-F4-C1, General Discussion of Capital Cost Allowance.

You cannot claim expenses you incur to buy capital property. However, as a rule, you can deduct any reasonable current expense you incur to earn income. The deductible expenses include any GST/HST you incur on these expenses less the amount of any input tax credit claimed.

Also, since you cannot deduct personal expenses, enter only the business part of expenses onForm T2125, Form T2042 or Form T2121.

Travel Meals And Entertainment

Go out on the town with your clients, pick up the bill and get a tax deduction. What could be easier? Just make sure that the outing is business-related. In other words, any payments you deduct for travel, meals and entertainment must be ordinary and necessary in your trade or business.

- In general, for tax years prior to 2018, entertainment expenses must be directly related to, or associated with, the conduct of your trade or business.

- Beginning in 2018, generally, entertainment expenses are no longer deductible.

Travel expenses include those for ordinary and necessary travel away from home for your business. You must meet two conditions to take the travel expense deduction:

If your trip meets these requirements, you can deduct a wide variety of travel-related expenses, including costs for:

Other deductible expenses include:

- Costs for dry cleaning and laundry care

- Telephone calls

- Use of fax machines

Meal expenses include those incurred while traveling away from home or for entertainment of business customers at your place of business, a restaurant or other location. This deduction may also apply to meals you furnish on your premises to your employees.

For more information on travel, see IRS Publication 463: Travel, Entertainment, Gift, and Car Expenses.

You May Like: How To Calculate Tax In Texas

Exclusive And Regular Use

In all cases, a home office must be used regularly and exclusively to conduct business. Spreading work out on the kitchen table does not qualify, even if it happens every day, because the area is not exclusively used for work. A completely isolated workspace is not necessary. The IRS allows for a “separately identifiable space” in other words, partitions are not required ). A desk in a corner of a room could qualify if it is used exclusively for work. However, the IRS is strict in its interpretation of “exclusive use” of the space. Even children’s toys or a television in the “exclusive use” zone is enough to disqualify the space ).

The taxpayer must also regularly use the area of the home for business. Incidental or occasional use of an area is not regular use, and expenses related to such use are not deductible, even if the space has no other purpose. Exclusive use is not required if a residence is used as a day care facility or for storage of inventory or product samples when there is no other business location.

Business Travel And Vehicle Expenses

As an entrepreneur, youre probably mobile.

If you use your vehicle to transport packages , meet with clients, or carry out any other business operations, you have a range of business expenses you can choose to claim.

When your vehicle is used exclusively for business purposes, you can deduct the full expense of its operation. But if you use it for both business and personal purposes, youll need to calculate the percentage of the cost of operation that applies to business.

You have two options for claiming a business mileage deduction:

- The standard mileage rate deduction, as of 2017, is $0.535 per mile. Track this throughout the year with an app like MileIQ, and check the relevant IRS page every financial year in case the rate has changed.

- The entire cost of what you paid in vehicle costs over the course of the yearincluding fuel, maintenance, and repairs.

Other travel expenses you incur in the course of doing businessparking fees, cab fares, or conferences tickets, for examplecan be claimed.

Easily calculate your cash flow

Give your business a cash flow health check with Shopify’s cash flow calculator. Learn more about your finances and get a handle on your cash flow in less than five minutes.

Read Also: How Much Inheritance Tax Do You Have To Pay

Assign A Category To All Transactions

Using the list of categories you came up with, look at your spending details and assign anything deductible. Pay particular attention to where receipts are required. Note that keeping business and personal finances separate is a top financial tip for small businesses and shields you from liability, so as you assign an expense, make sure itâs business-related.

What Business Expenses Are Allowable

All revenue expenses must have been incurred wholly and exclusively for the purposes of running the business to be allowable for tax purposes. This means that the costs must be incurred while actually performing the business or trying to attract more business. There are special rules for pre-trade expenses.

Read Also: Where Do I Get Federal Tax Forms

What Kind Of Deductions Can I Take As A Small Business

Sure, you pay tax on your business profits. But theres good news, too. You can potentially reduce your taxable income significantly by taking all the deductions youre entitled to as business expenses.

To determine whether you can deduct an expense, ask yourself: Is this expense both ordinary and necessary to the business? The IRS requires both elements.

Common small business deductions include costs for:

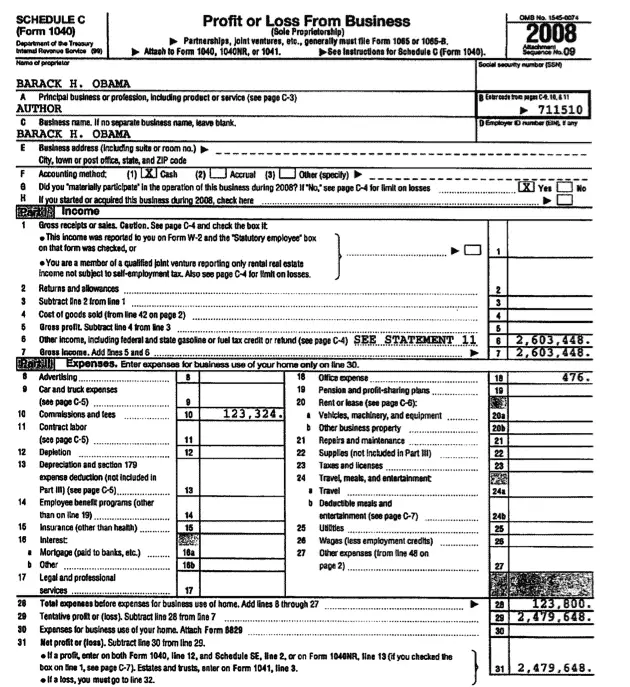

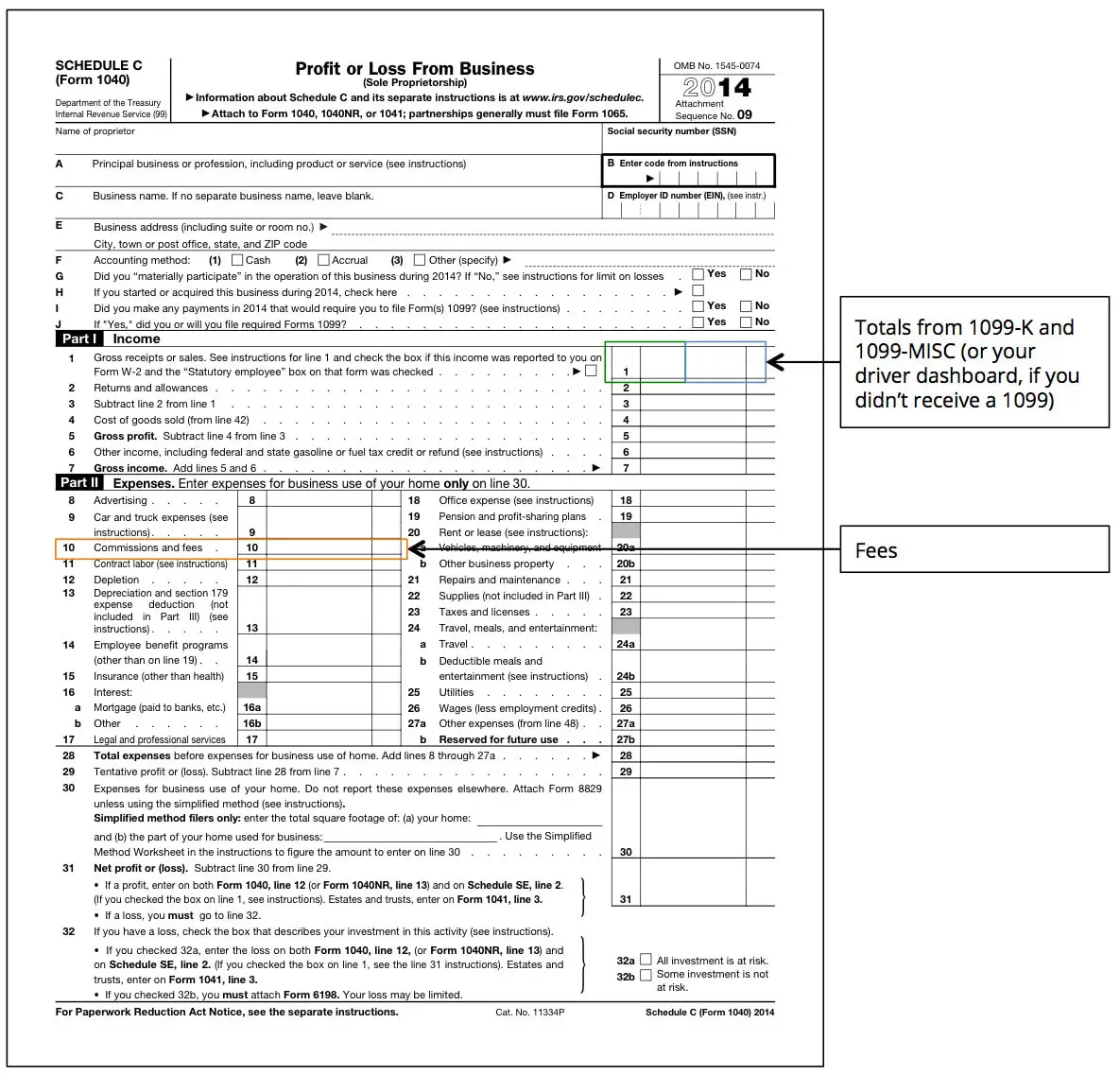

How Do I Claim My Self

You work out what you can claim back and add the details to your tax return.

If youve kept your expenses organised , that will make this process easier.

And ultimately, it could be a matter of giving a single figure for your allowable expenses or providing a detailed breakdown on your tax return.

Either way, you should accurately work out your expenses in case HMRC comes back with questions.

Also Check: How Do Tax Returns Work

Purchasing An Active Trade Or Business

Recoverable start-up costs for purchasing an active trade or business include only investigative costs incurred during a general search for or preliminary investigation of the business. These are costs that help in deciding whether to purchase a business. Costs incurred to purchase a specific business are capital expenses that can’t be amortized.

Business Tax Fees Licences And Dues

You can deduct any annual licence fees and some business taxes you incur to run your business.

You can also deduct annual dues or fees to keep your membership in a trade or commercial association, as well as subscriptions to publications.

You cannot deduct club membership dues if the main purpose of the club is dining, recreation or sporting activities.

Recommended Reading: Where’s My Income Tax

Limitations For Those Not Involved In Providing Services

If you’re not involved in providing services, you can still qualify for a pass-through deduction if your business income exceeds $440,100/$220,050, but it is subject to a special limit: Your deduction can’t exceed:

50% of your applicable share of the W-2 employee wages paid by the business, or

25% of your share of W-2 wages, plus 2.5% of the original purchase price of the long-term property used in the production of incomefor example, the real property or equipment used in the business.

This deduction is scheduled to end on January 1, 2026.

S Corporation Owners And Other Employees

Unreimbursed corporate expenses paid by shareholders are treated as unreimbursed “employee” business expenses. As noted earlier, under the TCJA, unreimbursed employee business expense deductions are no longer permitted. Like other employers, S corporation owners should establish an accountable plan to have the company reimburse home office allocations.

About the author

Dayna E. Roane, CPA/ABV, CGMA, is a shareholder with Perry & Roane PC in Niwot, Colo.

To comment on this article or to suggest an idea for another article, contact Paul Bonner, a JofA senior editor, at or 919-402-4434.

AICPA resources

You May Like: What Can Be Deducted On Taxes

Iv: Information On Your Vehicle

In this section, you give the IRS information about any vehicles for which you’re deducting expenses in Part II. The IRS uses the answers in this section when reviewing your vehicle deduction to see if it seems legitimate. So it’s important, for example, to be able to answer YES to the question about whether you have written documentation for your deduction. If you answer NO, dont be surprised if the IRS asks you to justify the deduction.

How The Standard Mileage Rate Method Works

To qualify for the standard mileage rate method, you must use it the first year you use a car for your business activity. If you use the standard mileage rate method the first year, you can switch to the actual expense method in a later year.

But you can’t switch back to the standard mileage rate if you claimed accelerated depreciation deductions when you used the actual expense method or took bonus depreciation or a Section 179 deduction for the vehicle.

Don’t Miss: How To Pay Virginia State Taxes

Line 9820 Small Tools

If a tool costs you less than $500, you can deduct its full cost. If it costs you $500 or more, add the cost to your CCA schedule as Class 8 property.

Small tools that cost less than $500 are fully deductible in the year you buy them. You may claim them as an expense at line 9820 or claim CCA by including them in Class 12 . Either method is acceptable, but do not claim the amount twice. For more information on CCA, see Chapter 4.

Calculating The Deduction: Actual

The home office deduction is computed by categorizing the direct vs. indirect business expenses of operating the home and allocating them on Form 8829, Expenses for Business Use of Your Home. Direct expenses can be fully deducted. For instance, the costs of carpeting and painting the home office room are 100% deductible. Indirect expenses are allocated pro rata between business and personal use. Any reasonable method can be used. Ratios based on square footage are most common, but the number of rooms used for business vs. personal use has been allowed as well ). Indirect expenses include real estate taxes, mortgage interest, rent, utilities, insurance, depreciation, maintenance, and repairs.

The Sec. 164 limitation on the deduction of state and local taxes introduced by the TCJA does not affect the amount of real estate taxes that can be deducted as part of home office expenses. As was the case before passage of the TCJA, the business use portion of the tax is calculated by multiplying the full amount of the real estate taxes by the business use percentage, and the business use portion is deductible under Sec. 280A. The individual portion of the real estate taxes is combined with the taxpayer’s other state and local taxes to determine whether the taxpayer’s individual deduction for state and local taxes is limited to $10,000. The business portion of the real estate taxes is deductible whether the taxpayer itemizes or takes the standard deduction.

Recommended Reading: What Is The Tax Rate In Tennessee

What Can Be Written Off As Business Expenses

Small businesses, freelancers and entrepreneurs can write off a range of business expenses when filing their income tax, including:

- Car expenses and mileage

- Office expenses, including rent, utilities, etc.

- Office supplies, including computers, software, etc.

- Health insurance premiums

- Business-related travel expenses, including flights, rental cars, hotels, etc.

Simplified Logbook For Motor Vehicle Expense Provisions

Following a Federal initiative to reduce the paper burden on businesses, you can choose to maintain a full logbook for one complete year to establish a base year’s business use of a vehicle.

After one complete year of keeping a logbook to establish the base year, you can use a three-month sample logbook to extrapolate business use for the entire year, as long as the usage is within the same range of the results of the base year. Businesses will have to show that the use of the vehicle in the base year remains representative of its normal use.

What type of vehicle do you own?

The kind of vehicle you own can affect the expenses you can deduct. For income tax purposes, you should know the definitions of motor vehicles, zero-emission vehicles, passenger vehicles and zero-emission passenger vehicles.

If you own a passenger vehicle or a zero-emission passenger vehicle, or you lease a passenger vehicle or a vehicle that would otherwise qualify as a ZEPV, there may be a limit on the amounts you can deduct for CCA, interest and leasing costs. We explain the CCA limits in Chapter 4. You will find the limits on interest and leasing costs later in this section.

The following chart will help you to determine if you have a motor vehicle or a passenger vehicle. The chart does not cover every situation, but it gives some of the main definitions for vehicles bought or leased and used to earn self-employment income.

Vehicle definitionsBusiness use of a motor vehicle or passenger vehicle

Recommended Reading: How Long Does It Take To Get Your Tax Refund

Business Interest And Bank Fees

If you borrow money to fund your business activities, the bank will charge you interest on the loan. Come tax season, you can deduct the interest charged both on business loans and business credit cards. You can also write off any fees and additional charges on your business bank account and credit card, such as monthly service fees and any annual credit card fees.

Legal Accounting And Other Professional Fees

You can deduct the fees you incurred for external professional advice or services, including consulting fees.

You can deduct accounting and legal fees you incur to get advice and help with keeping your records. You can also deduct fees you incur for preparing and filing your income tax and GST/HST returns.

You can deduct accounting or legal fees you paid to have an objection or appeal prepared against an assessment for income tax, Canada Pension Plan or Quebec Pension Plan contributions, or employment insurance premiums. However, the full amount of these deductible fees must first be reduced by any reimbursement of these fees that you have received. Enter the difference on line 23200, Other deductions, of your income tax return .

If you received a reimbursement in the tax year, for the types of fees that you deducted in a previous year, report the amount you received on line 13000, Other income, of your income tax return of the current year .

You cannot deduct legal and other fees you incur to buy a capital property, such as a boat or fishing material. Instead, add these fees to the cost of the property. For more information on capital property, go to Claiming capital cost allowance .

For more information, go to Interpretation Bulletin IT-99, Legal and Accounting Fees.

Read Also: Can I File My Taxes By Mail

Can I Claim The Cost Of Buying Assets As A Business Expense

Buying assets is treated differently from business expenses. Capital assets are things that you will keep and use in the business, such as some vehicles , plant and machinery. You can claim capital allowances against the cost of buying these.

The Annual Investment Allowance allows businesses to spend up to £1 million a year on new assets and then deduct that cost from their taxable profits. There is also a 100 per cent first-year allowance that let you claim back tax on an asset in the year you purchase it.

What Are Business Expense Categories

Youâll also save significant headaches for your bookkeeper or tax preparer. Speaking of, itâs worth spending time with a financial adviser to understand the types of expenses you can and canât include in a specific category.

Below is an example small-business expense categories list that applies to most companies, outlining whatâs included and how you can qualify for a deduction. Add to this industry-specific categories, such as R& D costs or spending to seek VC funding.

Read Also: Where To Do Taxes For Free

Your Share Of Net Income Before Adjustments

On Form T2125 for business and professional income, enter your share of line 9369 on amount 5A.

On Form T2042 for farming income, enter your share of amount 4C on amount 5A.

On Form T2121 for fishing income, enter your share of line 9369 on amount 5A.

This is the amount left after you subtract the amounts that the other partners are responsible for reporting. On the “Details of other partners” chart, indicate the full names and addresses of the other partners, as well as a breakdown of their shares of the income and their percentages of the partnership. You can also get this amount from your T5013 slip.