What Do I Need To Mail A Tax Return

It is recommended that you include copies of Forms W-2s, 1099s, and other income documents at the front of Form 1040. With the US Postal Service services option for tracking your delivery, you should send out your Returns with your tax return. By doing so, you ensure that your Tax Return is received by the IRS.

Example For A Return Beginning With An Alpha Character:

To find Form SS-4, Application for Employer Identification Number, choose the alpha S.

Find forms that begin with Alphas:C, S, W

Note: Some addresses may not match a particular instruction booklet or publication. This is due to changes being made after the publication was printed. This site will reflect the most current Where to File Addresses for use during Calendar Year 2022.

Your Income Tax Return And Supporting Documents

When you file your income tax return with the Canada Revenue Agency , there are certain forms and supporting documents that you need to submit with your return. However, there are also documents that you need to keep in case of an audit or post assessment, while other documents can be disposed of. Heres what you need to know.

Also Check: Does Doordash Tax You

You May Like: How To Find Out If You Owe Back Taxes

Obtaining Copies Of Your Notices Of Assessment And Tax Slips

If you have lost or misplaced your notices of assessment or tax slips from prior years, you can obtain copies from the CRA website. View a copy by using My Account or the CRA Mobile App.

Your employer has until the end of February of the following year to issue you a copy of your T4 slip for any income earned in the previous year.

If you have lost the tax slip or have not received it in the current year, check you CRA My Account. T-slips and other information such as RRSP contributions are stored in your online account. If the slip doesnt show in your CRA My Account or you are not yet a CRA My Account holder, you have to ask your employer for a copy. If your employer is unable to provide your tax slip, the CRA recommends attaching a note to your paper return with your name and address, the type of income, and the steps you are taking to obtain a copy of the tax slip.

Resources:

Recommended Reading: What Tax Return Does An Llc File

How Do I Mail My Return If I Live Outside The United States

The tax return or payment through the U.S. Postal Service can be used when you live in the United States. Otherwise, you need a private delivery service, especially when you need proof that your payment was received on time.

Private delivery services you can use that are approved by the institution are FedEx, UPS, or DHL Express. Consider placing each statement in a separate envelope and then placing them all in one large envelope for a better documentation order.

You May Like: What Is Tax Liabilities On W2

Mailing Options & Services

These mailing services apply a postmark to your return. If your return is postmarked by the IRS deadline date, it is considered on time. With service, you can pay for postage online and print a shipping label from your own computer. Generating a Click-N-Ship label with postage creates an electronic record for the label on that specific date, so it is important that you send your package on the shipping date you used to create the label. Your online Click-N-Ship account will save your shipping history for six months.

- 12 business day delivery

- USPS Tracking® included

- 13 business day delivery

- USPS Tracking included

- 15 business day delivery

- Extra services available

Whats Open Whats Closed Monday Dec 26th Will Mail Run Today

A USPS mailbox in MedfordSteph Solis

With Christmas 2022 falling on a Sunday, many government offices and businesses are observing the official holiday on Monday, Dec. 26.

Heres a look at whats open and whats closed on Monday, Dec. 26:

Federal offices Closed

State, most county and city offices Closed

Banks Most closed Monday

Garbage pickup Will be delayed, check with your local provider for schedule.

FedEx – Closed, except for FedEx Custom Critical service.

UPS – Closed, except for UPS Express Critical is still available.

Stock markets Closed Monday

Pharmacies – Open

Will mail run Monday?

As a result of Christmas falling on a Sunday, all Post Offices will be closed for the observation of the federal holiday on Monday, Dec. 26, so there wont be any mail delivery.

That means the majority mail except for Priority Mail Express wont be delivered. All Post Office locations will be reopen for business and regular mail delivery will resume after the holidays on Tuesday, Dec. 27.

If you purchase a product or register for an account through one of the links on our site, we may receive compensation.

Don’t Miss: Do I Need To File Taxes To Get Stimulus Check

Filing An Extension Application

You can e-file an extension application or mail it to the IRS. There are two application forms, depending on the business type: Form 7004 for corporations and partnerships, and Form 4868 for other business types and personal returns.

You can also use IRS E-File to electronically to request an extension on your personal tax return, which will give you until October 17, 2022, to file. To get an extension, you must estimate your tax liability and pay any amount due.

How Should I Contact The Irs For Help

The IRS received 167 million calls this tax season, which is four times the number of calls in 2019. And based on the recent report, only 7 percent of calls reached a telephone agent for help. While you could try calling the IRS to check your status, the agencys live phone assistance is extremely limited right now because the IRS says its working hard to get through the backlog. You shouldnt file a second tax return or contact the IRS about the status of your return.

The IRS is directing people to the Let Us Help You page on its website for more information. It also advises taxpayers to get in-person help at Taxpayer Assistance Centers. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if youre eligible for assistance by calling them: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if its been 21 days or more since you filed your taxes online, or if the Wheres My Refund tool tells you to contact the IRS. You can call: 800-829-1040 or 800-829-8374 during regular business hours.

Read Also: What Is The Difference Between Estate Tax And Inheritance Tax

How Do I Fix My Tax Return If It Gets Rejected

If the IRS computers look at your return and something just doesnt add up, your tax return gets rejected. The issue could be as simple as a typo in a Social Security Number or an address.

The good news is that you can simply file your taxes againno amended return process needed. Just log back into 1040.com to see which part of your return needs to be fixed, make the change, and refile .

Here are a few of the most common errors:

- A name doesnt match Social Security records

- An address was entered incorrectly

- An Employer Identification Number was entered incorrectly

- A date of birth was entered incorrectly

- A child was already claimed on someone elses return

- Using the married filing separately status in a community property state AZ, CA, ID, LA, NM, NV, TX, WA, or WI which is not allowed

- An incorrect number was used to identify yourself to the IRS, such as an incorrect prior-year AGI or Employer Identification Number

Also Check: Which Hybrid Cars Are Eligible For Tax Credits

Where To File Your Return

Taxpayers using eFile will have their returns processed electronically once they are submitted.

For taxpayers filing using paper forms:

- If you expect a refund, be sure to mail your return to the North Carolina Department of Revenue, PO Box R, Raleigh, NC 27634-0001.

- If you owe taxes, mail your return and payment to the North Carolina Department of Revenue , PO Box 25000, Raleigh, NC 27640-0640. Make your check or money order payable to the NC Department of Revenue. Important: The Department will not accept a check, money order, or cashier’s check unless it is drawn on a U.S. bank and the funds are payable in U.S. dollars.

Don’t Miss: How To Determine Tax Liability

Deadlines For Mailing Your Tax Returns In 2022

The deadline for 2021 individual tax returns is April 18, 2022 for all states except Maine and Massachusetts. This deadline is specific to this year because April 15, the usual deadline, is a holiday in the District of Columbia. Taxpayers in Maine or Massachusetts have until April 19, 2022, to file their returns because of the Patriots’ Day holiday in those states. April 18, 2022 is also the deadline for making first-quarter 2022 estimated tax payments to the IRS.

If you request an extension on your 2021 tax return, the deadline to file is October 17, 2022.

Please Note The Following When Sending Mail To The Colorado Department Of Revenue:

Certified Mail, Express Mail & Courier Services

Although these mailing methods give the option to receive proof of delivery, sending forms or payments by certified mail, express mail or a courier service may delay processing. Sending forms and payments by first class standard mail via the U.S. Postal Service ensures the fastest processing time.

Proper Postage on the Envelope

Addressing the Envelope

Zip Code

Double Check the Mailing Address

Don’t Miss: Is Medical Insurance Tax Deductible

Using A Private Delivery Service

You can use a private delivery service, but only certain IRS-approved services are acceptable.

The IRS listsDHL, Federal Express, and UPSas designated private delivery services, but only some of the services from these companies are acceptable, including:

- DHL Express : DHL Express 9:00, DHL Express 10:30, DHL Express 12:00, DHL Express Worldwide, DHL Express Envelope, DHL Import Express 10:30, DHL Import Express 12:00, DHL Import Express Worldwide

- Federal Express : FedEx First Overnight, FedEx Priority Overnight, FedEx Standard Overnight, FedEx 2 Day, FedEx International Next Flight Out, FedEx International Priority, FedEx International First, FedEx International Economy

- United Parcel Service : UPS Next Day Air Early A.M., UPS Next Day Air, UPS Next Day Air Saver, UPS 2nd Day Air, UPS 2nd Day Air A.M., UPS Worldwide Express Plus, UPS Worldwide Express

Who Qualifies For The Middle Class Tax Refund

You must have lived in California for at least half of the 2020 tax year and filed your state tax return by Oct. 15, 2021, to qualify.

Any California resident who filed state taxes individually and made $250,000 or less is eligible for the Middle Class Tax refund, as are couples who filed jointly and made $500,000 or less. Individual filers who earned over $250,000 in 2020 — and couples who made more than $500,000 combined — are not eligible for the refund, nor is anyone who was claimed as a dependent in the 2020 tax year.

In addition, you must have lived in the state of California for at least half of the 2020 tax year, have filed your state tax return by Oct. 15, 2021, and still be a California resident on the date the MCTR payment is issued.

Read Also: Where To Send Amended Tax Return

Make Sure You Mail On Time

The postmark on your envelope is what counts when mailing your tax return. Some post office locations offer extended hours and late postmarking before Tax Day.

You can purchase a certificate of mailingat the post office to prove that you mailed your return on a specific date. Keep the certificate the post office doesnt keep copies.

Before you mail that return, make sure you have the correct IRS, and include your return address on your mailing label and that you have enough postage.

Use A Secure Method To Mail Your Return

Always use a secure method, such as certified mail return receipt requested, when youre sending returns and other documents to the IRS. This will provide confirmation that the IRS has actually received your documents or payment.

In addition to addressing it correctly and using sufficient postage, be sure the envelope is postmarked no later than the date your return is due. The date of the registration is the postmark date if you use registered mail. The date stamped on the receipt is the postmark date if you use certified mail.

Make sure the return is sent out no later than the date due if you use an IRS-approved private carrier.

You May Like: How Much Is The Gas Tax In California

Don’t Miss: When Are Oregon State Taxes Due

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you arent required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

How Long Does It Take To Get Your Tax Return If You Send It By Mail

You should receive your refund in about six to eight weeks from the date the IRS receives your paper tax return if it is complete and accurate. e filing a claim electronically, your refund should be delivered in a few weeks, even faster considering how rapidly the refunds are available when you opt for direct deposit.

Also Check: Doordash Filing Taxes

Recommended Reading: How To Get Tax Info From Unemployment

Individual Tax Forms And Instructions

We offer several ways for you to obtain Maryland tax forms, booklets and instructions:

You can also file your Maryland return online using our free iFile service.

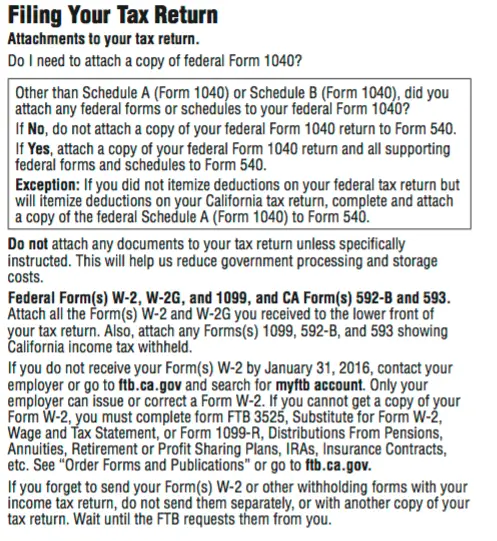

Do Not Send

- Federal forms or schedules unless requested.

- Any forms or statements not requested.

- Returns by fax.

- Returns completed in pencil or red ink.

- Returns with bar codes stapled or destroyed.

Fill-out forms allow you to enter information into a form while it is displayed on your computer screen and then print out the completed form. You must have the Adobe Acrobat Reader 4.1 , which is available for free online. You can also print out the form and write the information by hand. Fill-out forms are better than hand written forms because they offer a cleaner and crisper printout for your records and are easier for us to process.

IMPORTANT: The Acrobat Reader does not allow you to save your fill-out form to disk. To do so, you must have the full Adobe Acrobat 4.1 product suite, which can be purchased from Adobe. Maryland fill-out forms use the features provided with Acrobat 3.0 products. There is no computation, validation or verification of the information you enter, and you are fully responsible for the accuracy of all required information.

How Much Do You Have To Make To File Taxes

The IRS has several criteria for determining who must file a tax return. It depends on your filing status , the amount of federal income tax withheld from your earnings, and your gross income for the year. Even if your income is low enough to avoid filing, you may want to file to claim the earned income tax credit or other tax credits or to get a refund for the year.

You can use the interactive tax assistant on the IRS website, which takes you through a process of answering questions to help you figure out if you need to file a tax return

Also Check: Which Pages Of Tax Return To Print

Also Check: How Much Tax Withheld From Unemployment

Social Security Benefits: Payment Dates

The January check next year will be based on recipients’ birth dates, according to the Social Security Administration.

- People who claimed Social Security before May 1997 or who receive both Social Security and Supplemental Security Income will receive their Social Security payment on January 3.

- People who receive SSI will get their first 2023 payment on December 30 of this year. That is because these benefits are usually paid on the 1st of each month, but due to January 1 being a holiday and December 31 falling on a Saturday, the Social Security Administration said it will issue these checks two days earlier than usual.

- For people whose birthday falls between the 1st to 10th of any month, their Social Security payments arrive on the second Wednesday of the month. That means the first check with the 2023 COLA will land on January 11.

- Those with birthdays that fall between the 11th to 20th of any month will have their payments deposited or mailed on the third Wednesday of each month. Their first check with the enhanced COLA will arrive on January 18.

- If a recipient’s birthday falls between the 21st and 31st, their payments are scheduled for the fourth Wednesday of each month. Their first 2023 COLA will arrive on January 25.