Meet The Deadline For The Extension

The IRS must receive Form 4868 on or before the tax filing deadline, which is usually April 15 unless that day falls on a weekend or holiday. In this case, it would be the next business day.

The IRS will charge a late filing penalty, a late payment penalty, and interest on any unpaid balance you owe if you don’t file your return or an extension on time and if you also fail to pay on time. But you’ll at least avoid the late-filing penaltywhich is a hefty 5% of the taxes you owe for every month your return is lateif you file an extension by the April due date, then file your return by the extended deadline in October.

This penalty increases to $435 or 100% of the taxes you owe, whichever is less, if you’re 60 days late or more. The penalty applies to all returns due from Jan. 1, 2020 onward.

Capital Gains Tax Canada

There is no special capital gains tax in Canada. Instead, capital gains are taxed at your personal income tax rate. Only 50% of your capital gains are taxable. This means that only half of your capital gains amount will be added to your taxable income.

If you have incurred both capital gains and losses, you can use your capital losses to offset the amount of your capital gains. For example, if you have capital gains of $10,000 and losses of $4,000, your net capital gain would be only $6,000.

You can rollover your capital losses to offset capital gains in the future, or you can retroactively apply them to capital gains that you have realized in the past three years. For example, if you have capital gains of $10,000 and losses of $14,000, your capital gains for that year would be $0. You can then roll over the leftover capital loss of $4,000 to apply to future years, or the previous three years.

How Do Canadian Inheritance Tax Laws Work If The Estate Is Inherited By A Surviving Spouse Or Common

Any non-registered capital property may be transferred to the deceased taxpayers spouse or common-law partner.

For any registered assets , the deceased person is deemed to have received the fair market value of his or her plan assets immediately prior to death. This amount must be included in the income of the deceased persons tax return.

However, it is possible to defer income tax if an eligible person has been designated as the beneficiary of the RRSP or RRIF. An eligible person includes a spouse or common-law partner, a financially dependent child or grandchild under 18 years of age or a financially dependent mentally or physically infirm child or grandchild of any age.

Don’t Miss: Tax Lien Investing California

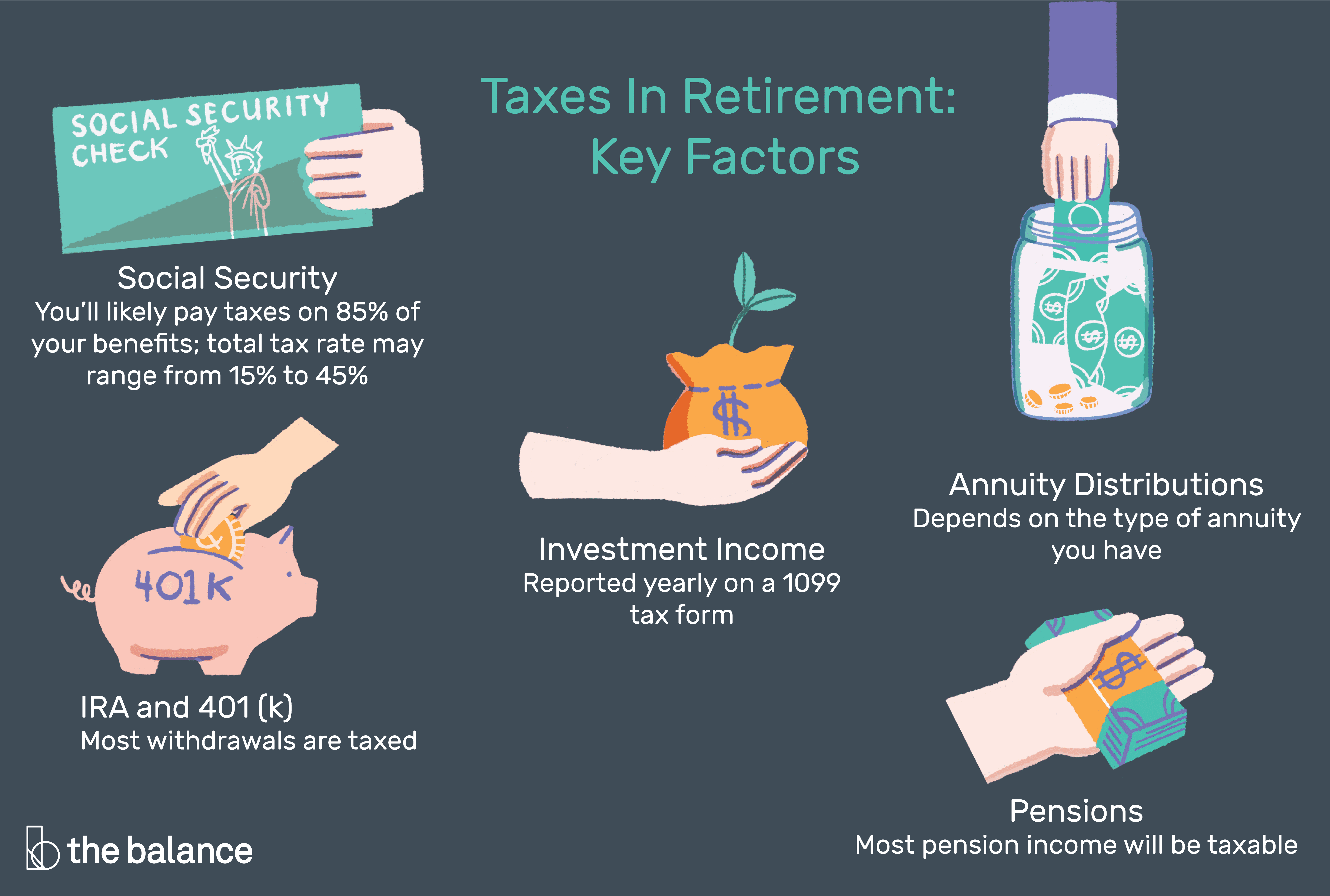

Calculating Your Social Security Income Tax

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income. If you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your social security benefits in 2021, according to the Social Security Administration.

For the 2021 tax year, single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either a) half of your annual Social Security benefits or b) half of the difference between your combined income and the IRS base amount.

The example above is for someone who is paying taxes on 50% of his or her Social Security benefits. Things get more complicated if youre paying taxes on 85% of your benefits. However, the IRS helps tax payers by offering software and a worksheet to calculate Social Security tax liability.

Valuing Cryptocurrencies Either As Capital Property Or Inventory

To file your income tax return, you need to know how to value your cryptocurrencies. This depends on whether they are considered capital property or inventory. When cryptocurrencies are held as capital property, you must record and track the adjusted cost base so that you can accurately report any capital gains.

If the cryptocurrencies are considered to be inventory, use one of the following two methods of valuing inventory consistently from year to year:

- value each item in the inventory at its cost when it was acquired or its fair market value at the end of the year, whichever is lower

- value the entire inventory at its fair market value at the end of the year

You might have to use other methods of valuing inventory, depending on the type of business you have. For example, property described in the inventory of a business that is an adventure or concern in the nature of trade must be valued at the cost you acquired the property for.

You will have to compare the cost and the fair market value of each item to figure out which is lower. You then use the lower figure for each item to calculate the total value of your inventory at the end of the year.

“Cost” as used in the phrase “cost at which the taxpayer acquired the property,” means the original cost of the particular item of inventory , plus all reasonable costs incurred to buy that particular block of cryptocurrency.

Use the same inventory method from year to year. Please review our archived page on inventory .

Also Check: How To Buy Tax Lien Properties In California

Guide For Cryptocurrency Users And Tax Professionals

Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations. The Senate reviewed the issue of taxation on cryptocurrency in 2014 and recommended action to help Canadians understand how to comply with their taxes, which the Canada Revenue Agency is doing by presenting this guide.

How To Minimize Oas Clawback

Your total worldwide income is considered when determining OAS clawback .

Some of the strategies to reduce or eliminate the OAS Clawback are:

- Use up your TFSA first. Withdrawals from a TFSA are not taxable.

- Trigger capital gains before age 65 when you start collecting your OAS.

- Maximize all the tax deductions at your disposal including using up your RRSP contribution room. If you are over age 71 and have contribution room, you can still contribute to a spousal RRSP account if your partner is under 71.

- Delay collecting CPP till later years when your income level is lower.

- Split pension income with a spouse in order to lower net income for both individuals.

Read more on how to minimize the OAS clawback.

Recommended Reading: Can You File Missouri State Taxes Online

Is My Social Security Income Taxable The Quick Answer

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security benefits and add that amount to all your other income, including tax-exempt interest. This number is known as your combined income .

If your combined income is above a certain limit , you will need to pay at least some tax.

The limit is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. The limit for joint filers is $32,000. If you are married filing separately, you will likely have to pay taxes on your Social Security income.

Tax Brackets & The Tax Cuts And Jobs Act Of 2017

The Tax Cuts and Jobs Act of 2017 guides current tax policy. Among its notable achievements:

- Number of brackets remained steady at seven.

- Four of the lowest five marginal rates dropped between one and four points the top rate sank 2.6 points, to 37%.

- Modified bracket widths.

- Eliminated the personal exemption, but nearly doubled the standard deduction.

- Indexed brackets and other provisions to the Chained Consumer Price Index measure of inflation .

- Retains the charitable contribution deduction.

- Caps the mortgage interest deduction to the first $750,000 in principal value.

- Deduction for state and local income, sales, and property taxes limited to a combined $10,000.

While taxpayers still may use itemizing if their total deductions work to their advantage , boosting the standard deduction was designed to simplify calculations for the vast majority of filers and it worked. For the 2018 tax year, 90% of households opted for the standard deduction, up from 70% in recent previous years .

Don’t Miss: Buying Tax Liens California

Soal Essay Pkk Kelas Xii Smk

Feminist legal theory essay? Conclusion of essay on environmental pollution, personal reflective essay on education essay questions on islamic art. My country malaysia sample essay, batang ina essay sikkim ki prakritik soundarya essay in hindi, family body essayAnimal testing should be banned persuasive essay susunan essay yang benar: essay in safety precautions essay on hierarchy.

Essay about friends betrayal.

How Does The Cpp Work

You will contribute towards the CPP from your employment earnings from age 18 to 70. The CPP Investment Board then invests CPP funds. Once you retire, you will then receive a monthly retirement pension that is equal to a certain percentage of your lifetime average earnings.

The base CPP benefit provides a monthly pension of up to 25% of your contributory earnings for the best 40 years of earnings. With changes enhancing CPP contributions, the monthly pension amount can rise to up to 33.33% of your contributory earnings. This pension amount counts as income, and so you must pay income tax on your CPP benefit.

The earliest that you can receive your retirement pension is when you turn 60 years of age. If you have a disability, you may receive the CPP disability benefit if you are under the age of 65, or the CPP post-retirement disability benefit if you have already started to receive your CPP retirement pension.

If you start receiving your pension between 60 and before you turn 65, your pension amount will be permanently reduced at a rate of 0.6% for every month before age 65, for a maximum reduction of 36%.

Every month after age 65 permanently increases your pension amount by 0.7%, up to a maximum of 42% when you turn 70.

Don’t Miss: Michigan Gov Collectionseservice

> > > Get Your Free Gold Investor Kit Here

An individual retirement account is one of several types of IRAs. This type of IRA allows you to invest in bonds, stocks, and other assets, instead of having to invest in mutual funds and other products. A good gold IRA has a lower cost of investment than a standard or Roth IRA which invests solely in bonds, stocks, and mutual funds. However, there are differences between a standard and a hedge against inflationary climate.

There are several types of IRAs that an individual can open for investing. The most common IRA types include a standard IRA, a hedge against inflation, and a gold IRA. If you want to have the most flexibility with your investments, then you should invest in a standard IRA. To learn more about these different IRAs, as well as the pros and cons, we have looked at some of the more popular options.

In Canada There Is No Inheritance Tax

Instead, the Canada Revenue Agency treats the estate as a sale, unless the estate is inherited by the surviving spouse or common-law partner, where certain exceptions are possible. This means that the estate pays the taxes owed to the government, rather than the beneficiaries paying. By the time the estate is settled, the beneficiary should not have to worry about taxes.

Read Also: How Can I Make Payments For My Taxes

Electronic Federal Tax Payment System

Its free, safe, and convenient. You can pay your taxes online or by phone on the IRS own system.

Youll need to set up an EFTPS account ahead of time and receive an EFTPS Personal Identification Number and an Internet Password.

Dont wait until the last minute to pay your taxes with EFTPS. You must schedule payment by 8 p.m. ET the day before you want to pay your tax.

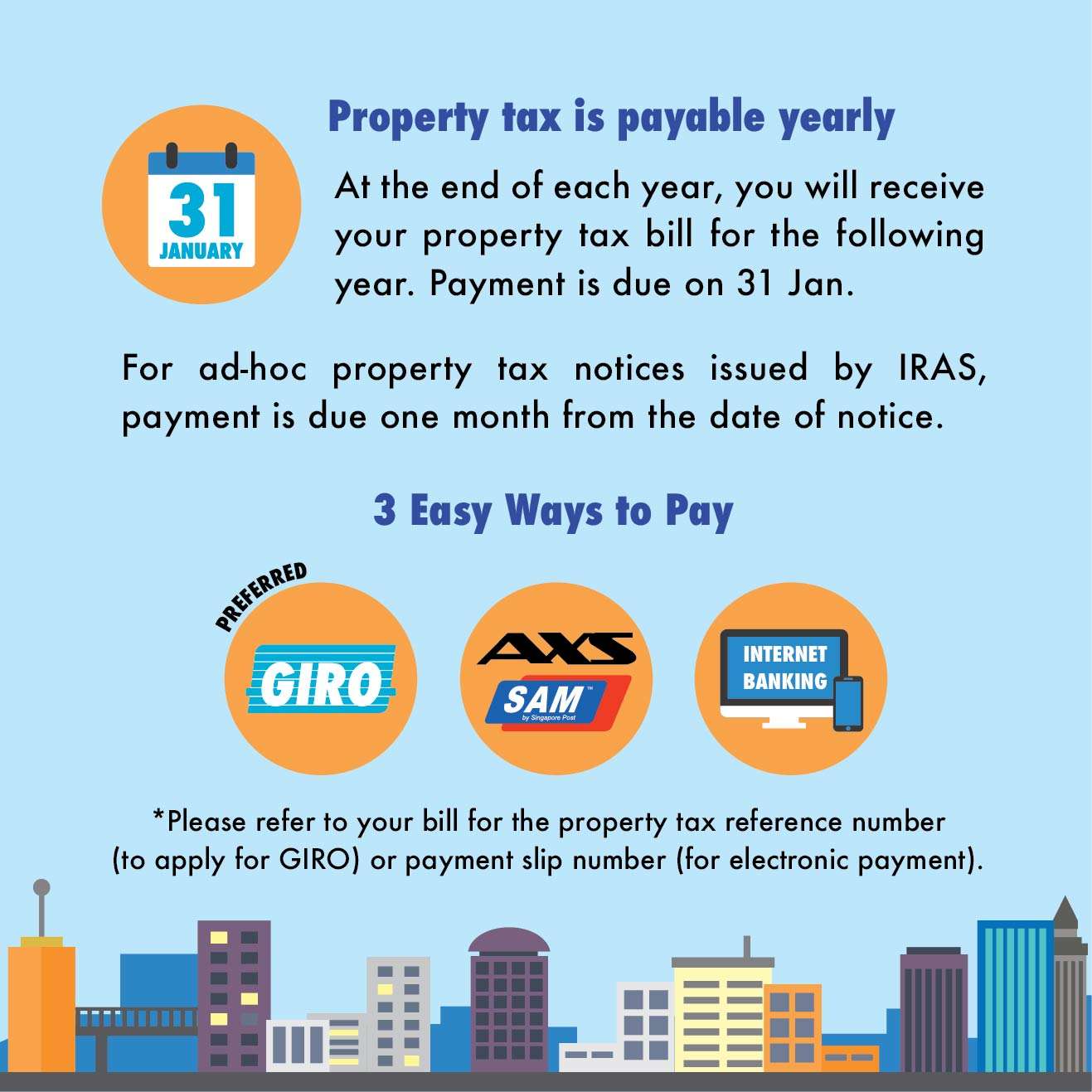

Secured Property Taxes Terms

Annual Secured Property Tax BillThe annual bill, which includes the General Tax Levy, Voted Indebtedness, and Direct Assessments, that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1, due in two installments.

Adjusted Annual Secured Property Tax BillA bill that replaces the Annual Secured Property Tax Bill due to the following reasons: a change or correction to the assessed value of the property the allowance of an exemption that was previously omitted the correction of a Direct Assessment placed on the property from a municipality or special district or the inclusion of a penalty for failure to comply with certain requirements of the Office of the Assessor prescribed by law .

Ad ValoremAccording to the value Based on value. For example, the Office of the Assessor calculates property taxes based on the assessed value of a property.

Non-Ad Valorem Not according to the value.

AssessmentThe rate or value of a property for taxation purposes.

Assessors Identification Number A 10-digit number that identifies each piece of real property for property tax purposes, e.g., 1234-567-890.

California Relay ServiceA telecommunications relay service that provides full telephone accessibility to people who are deaf, hard of hearing, or speech impaired.

Current YearThe current fiscal tax year in which the Department of Treasurer and Tax Collector issues an Annual Secured Property Tax Bill.

Testate

Read Also: How To Buy Tax Lien Certificates In California

What Are Canadas Inheritance Tax Rates

As there is no inheritance tax in Canada, all income earned by the deceased is taxed on a final return.

Non-registered capital assets are considered to have been sold for fair market value immediately prior to death. Any resulting capital gains are 50% taxable and added to all other income of the deceased on their final return where income tax will be calculated at the applicable personal income tax rates. They are taxed at the applicable capital gains tax rates.

The fair market value of a Registered Retirement Savings Plan or a Registered Retirement Income Fund is included in the deceased persons income and taxed at the regular applicable personal income tax rates with no special treatment for any capital gains earned within the RRSP or RRIF.

Which Turbotax Is Best For You

When a loved one has passed, all the paperwork and legal jargon can seem a little confusing or daunting to deal with. But with the right information ahead of time, you can still navigate the tax waters to file your return with TurboTax Online.

However, if you feel a bit overwhelmed, consider TurboTax Live Assist & Review and get unlimited help and advice from a real person as you do your taxes. Plus, theres a final review before you file. Or, you can choose TurboTax Live Full Service and have one of our tax experts do your return from start to finish.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Also Check: Do You Have To Report Roth Ira On Taxes

How To Pay Your Taxes

If you owe taxes, the IRS offers several options where you can pay immediately or arrange to pay in installments:

- Electronic Funds Withdrawal. Pay using your bank account when you e-file your return.

- Direct Pay. Pay directly from a checking or savings account for free.

- . Pay your taxes by debit or credit card online, by phone, or with a mobile device.

- Pay with cash. You can make a cash payment at a participating retail partner. Visit IRS.gov/paywithcash for instructions.

- Installment agreement. You may be able to make monthly payments, but you must file all required tax returns first. Apply for an installment agreement through the Online Payment Agreement tool.

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

Read Also: How Does H And R Block Charge

Calculating Taxable Income Using Exemptions And Deductions

Of course, calculating how much you owe in taxes is not quite that simple. For starters, federal tax rates apply only to taxable income. This is different than your total income, otherwise known as gross income. Taxable income is always lower than gross income since the U.S. allows taxpayers to deduct certain income from their gross income to determine taxable income.

To calculate taxable income, you begin by making certain adjustments from gross income to arrive at adjusted gross income . Once you have calculated adjusted gross income, you can subtract any deductions for which you qualify to arrive at taxable income.

Note that there are no longer personal exemptions at the federal level. Prior to 2018, taxpayers could claim a personal exemption, which lowered taxable income. The new tax plan signed by President Trump in late 2017 eliminated the personal exemption, though.

Deductions are somewhat more complicated. Many taxpayers claim the standard deduction, which varies depending on filing status, as shown in the table below.