How Are Condos Taxed In Ny

In 2021, the tax rate on houses is 21.045%, and the tax rate on co-ops and condos is 12.82%.

Every week, Mansion Global sends out a tax question to real estate lawyers. Why are condominiums taxed differently from single-family homes? How do condo taxes work? There are two types of residential property available in New York City. Class 1 residences are taxed at an assessed value of 21.999%. This figure cannot rise more than 6% in a year or 20% over five years for a Class 1 property. The cap does not apply to a homes value if it is increasing quickly. Condo owners are charged separately by the city, and they must pay the city a bill.

Compare Neighboring Property Tax Cards

If you think that your property tax is higher than those of others with similar homes in the area, you stand a good chance of having your property tax lowered. Tax cards are public information, so you can go through them and find homes in your area with a similar build, footage, and age to demonstrate the fact to the assessors office and ask for a reduction in property tax.

Property Tax Payment Options

The easiest and fastest way to pay your property taxes is with online banking, or setting up a pre-authorized payment plan with the City of Surrey. Credit card payments are currently not accepted.

Get your property tax information electronically and avoid lineups. Log in to MyProperty Accounts and change your bill delivery method to email by May 1 of the year to get your bill online.

You can also mail your payment to City Hall, or pay in person at City Hall.

Our customer service team is happy to assist you if you have any questions. For property tax and utility information, call 604-591-4181 or email .

Pay by Online Banking

Pay your property taxes online through your bank’s website. When you pay online, we suggest you pay 3 days before the property tax due date. With most banks, you can schedule your payment ahead of time so you don’t forget.

Contact your financial institution directly if you require assistance or have questions about payment services

Read Also: How Does Ira Help With Taxes

Do You Qualify For A Property Tax Exemption

Some municipalities offer lower property tax rates for specifics groups of people, including seniors, veterans, and people using their land for certain purposes . Talk to your realtor and/or local taxing authority to see if you might qualify for a rate exemption in your area. If so, theyll be able to provide guidance on what youll need to do in order to prove your eligibility and get approved for a lower tax rate.

What Are Property Taxes

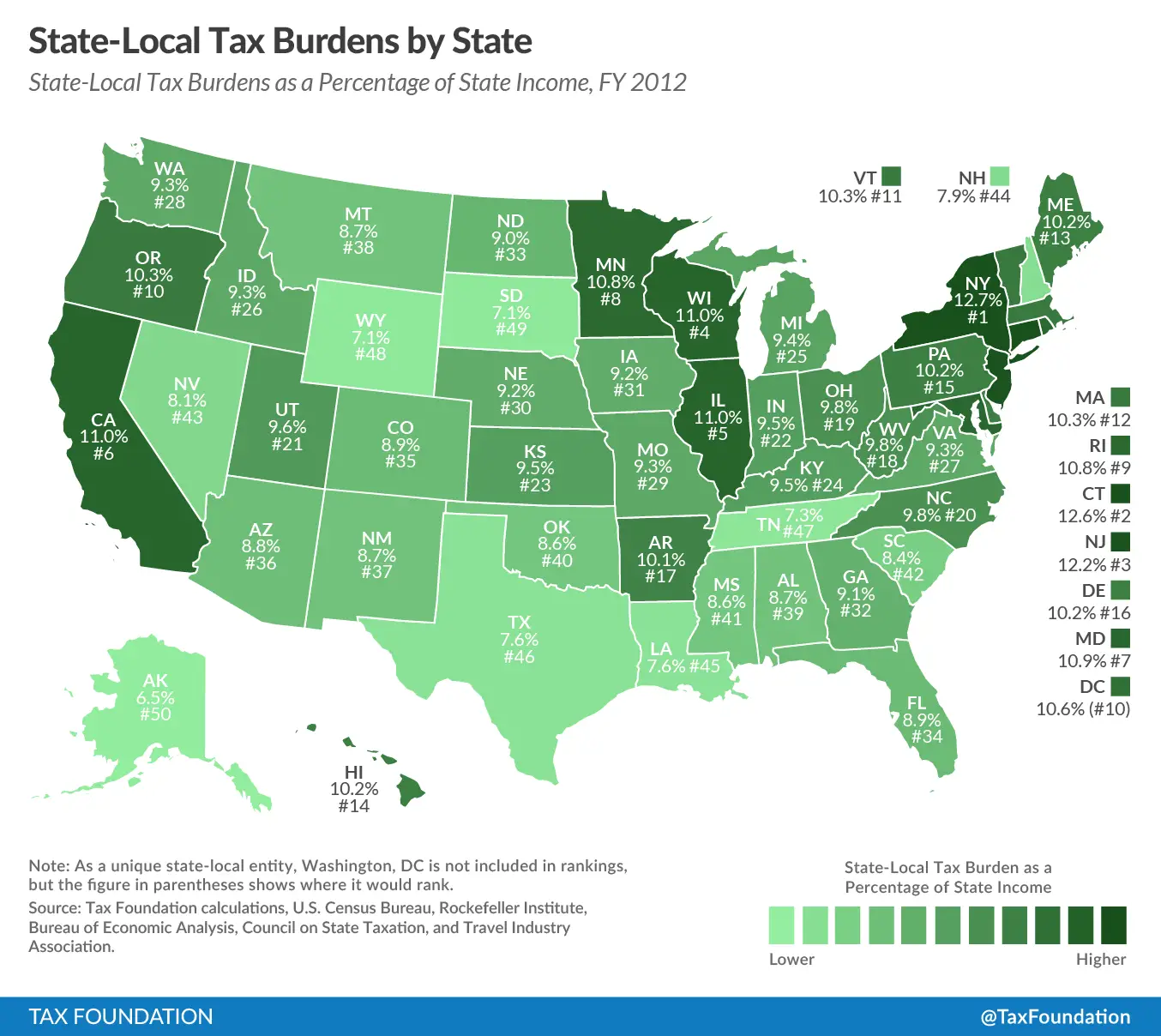

A property tax is what it sounds like a tax paid on a residential or commercial property owned by individuals like you or a legal entity. The rate is determined by your local government and is based on many factors. Well talk more about how to calculate property tax later. Since the tax rate is determined based on your local government, it varies across states and even across zip codes!

Take a state like New Jersey where homeowners pay an average property tax rate of 2.47% for 2021. On a $327,700 house that means $675 per month and $8,108 per year in property taxes.

On the other end of the spectrum, there are states like Alabama where average property tax on homeowners is 0.42%. With median property value at $137,200, this means Alabamians pay an average annual property tax of $572. A relative bargain.

Despite the many dissimilarities between New Jersey and Alabama, its still somewhat shocking to see a difference in annual property taxes to the tune of $7,500. It makes you think: What exactly goes into determining property taxes and where does the money you pay ultimately go? You may be surprised to learn how your property taxes benefit your community in a variety of ways.

Read Also: When Am I Getting My Tax Refund 2021

How To Use A Cash

When you take out a cash-out refinance, the rules surrounding mortgage-related tax deductions are a bit different than a traditional mortgage. The IRS sets some specific guidelines for tax deductions related to capital improvements, renovations, and mortgage points.

Below youll find a closer look at the possible deductions you could take on your taxes. Before committing to any of the following possibilities, consult with a tax professional. With their specialized expertise, they can help you create an efficient tax plan based on your entire tax picture.

Online Mobile Or Telephone Banking

You can add the City of Kitchener as a bill payee with most banks. Use the tax roll number on your property tax bill as the account number.

Contact your banks customer service department if this does not work.

Allow at least five business days for your bank to process the transaction and send us your payment.

You May Like: How To Report Tax Evasion

Do You Pay Property Tax On Condos In New York State

There is no definitive answer to this question as it largely depends on the particular condo complex and/or development in question. However, in general, it is typically the case that condo owners in New York State are responsible for paying property taxes on their units. This is just one of the many expenses that come with owning a condo, and it is important to be aware of all potential costs before making a purchase.

The most commonly used method is to price home values based on market value. Condominiums are typically given large discounts when they are assessed. Builders in New York can charge higher prices if they advertise a special deal. Some of the properties undertaxed are mansions that have been converted into condos worth a million dollars or more. In Amherst, approximately one in ten homes has a condo tax break. Condoms are taxed far less frequently than the rest of the citys budget, in addition to streets, parks, trails, schools, and libraries. Some New York homeowners are unfairly treated by the state, according to assessors.

Are New York Property Taxes Paid In Advance

Depending on the value of the property, you can expect to pay your property taxes twice or four times per year. We mail and post your taxes on our website about a month before the due date. Payments made the previous business day are due the following business day, regardless of whether the due date falls on a weekend or a federal holiday.

Also Check: How To Reduce Taxes On Stock Gains

Texas Voters Overwhelmingly Pass Moderate Tax Relief Measures

TEXAS â Over the weekend, Texas voters overwhelmingly passed a pair of statewide ballot measures.

Proposition 1 will essentially cut school district property taxes for homeowners 65 and older or those who are disabled. Proposition 2 will raise the stateâs homestead exemption, or the dollar amount of a homeâs value thatâs exempt from taxation by school districts. About 87% of voters supported proposition one, while about 85% supported Proposition 2.

The owner of an average home worth about $300,000 will save around $175 each year.

âIt is a victory,â Dale Craymer, president of the Texas Taxpayers and Research Association, said during an interview on Capital Tonight. âThe measure of that victory will be up to others to decide.â

Craymer says the changes will help homeowners in the long run, and that the Legislature will be in a suitable position to do more come 2023. He says state lawmakers have several options for additional relief, including giving more money to schools and again increasing the homestead exemption.

âThe good news is, Texas has record budget surplus,â said Craymer. âSo, this next Legislature is going to have a lot of cash on hand to put into property tax.â

However, property tax relief does not benefit renters, who have seen skyrocketing rents across the state.

Read Also: How To Find Tax Id

How Often Do You Pay Real Property Tax

Every January 1, real property tax begins and can be paid one time for the entire year, or in quarterly installments on or before March 31 the first installment. This is the second in a series of articles. On September 30, the third installment will be presented.

Time To Address High Property Taxes In Upstate New York

There is no denying that upstate New York has high property taxes. It is mostly due to a complicated and flawed assessment process. There has been an increase in the budgets of many towns, cities, villages, and schools in the past few years despite a decline in population and school enrollment. Another factor is that assessments that appear higher than they should be due to a complex and flawed assessment process. When this process is followed, values for a property may be artificially inflated, especially in rural areas. As a result, property taxes may rise. It is critical for the people of upstate New York to address property taxes. Despite a declining population and enrollment, it is critical that local governments do not increase their budgets year after year. Property taxes in the area will be reduced as a result of this.

Recommended Reading: How To Find State Tax Id Number

Inquiry & Payment Counters And Drop Box Services

Property Tax, Utility and Parking Violation Inquiry & Payment Counters have reopened. Counters at Metro Hall remain closed.

Property tax accounts for newly constructed properties are created after the occupancy date. Property owners will receive a property assessment change notice from Municipal Property Assessment Corporation before receiving the first property tax bill. MPAC provides the City with the assessment information to create your new tax account.

New owners will not be able to make payment by digital, cheque or in-person options, before receiving their first property tax bill. Only after you have received your first tax bill, you can then set up your payment options through MyToronto Pay, or with your bank or financial institution.

Log on to the Lookups to view your account details, billing and payment information.

Toronto, ON M2N 5V7

In-person requests

Property Tax, Utility and Parking Violation Inquiry & Payment Counters have reopened. Counters at Metro Hall remain closed.

How Is Property Tax Calculated

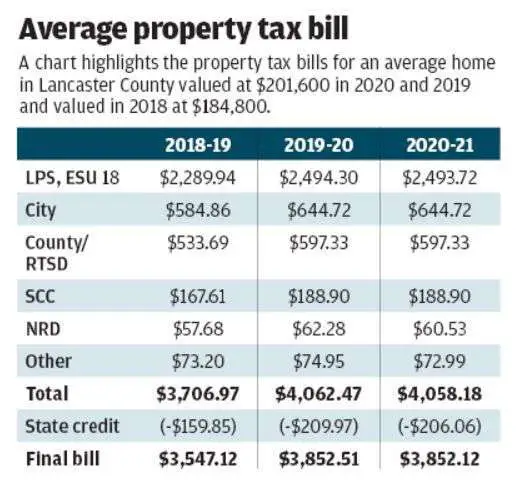

To determine your tax bill, the tax office multiples your propertys assessed value . For example, if your home is assessed at $200,000, and the local tax rate is 1%, your tax bill would be $2,000. Of course, the higher the assessed value, the higher the tax bill.

Some local governments apply the tax rate to just a portion of the assessed value. This is known as the assessment ratio. If your home is assessed at $200,000, and your county has an assessment ratio of 80% and a tax rate of 1%, your tax bill would be $1,600 .

Also Check: When Is Tax Filing Day

Should I Pay Off My Escrow Balance

I need cash for an escrow. Should I pay the entire amount or pay just the balance? There is no adverse effect on your escrow shortage balance whether you pay it in full or in monthly installments. When you make the minimum payment, your lender will grant you complete freedom.

Get Your Escrow Account Refund

Typically, banks charge a small fee for storing your funds in an escrow account however, if the party wishes to use the funds, banks may receive a small fee. The banks make no direct profit on these accounts. There is a good chance that you will receive a refund if your escrow account balance is less than the $50 minimum.

Paying At The Automatic Banking Machine

Pay through the ABM at your bank. Keep your receipt for your payment records.

Pay by Mail

Mail your cheque or money order payment and remittance stub with Home Owner Grant application completed, if eligible.

Make cheques payable to City of Surrey and include your folio number on the cheque. Post-dated cheques are accepted. Make sure the cheque is dated on or before the property tax due date.

Send in your payment a minimum of 3 days before the property tax due date. We must receive your payment by or before the July 2 due date. If your mail is lost or delayed, and does not arrive by the due date, you may receive a penalty charge.If your payment cannot be processed due to an error on a cheque, insufficient bank funds or a returned item you will be charged a late payment penalty.

Read Also: When Should I Get My Tax Refund 2021

Californias Property Taxes: How They Work And How Theyve Changed Over Time

In California, property taxes are primarily a local government responsibility. The Consumer Price Index is calculated by each county and city, and the rates are adjusted each year to account for changes in the index. The states total property tax bill, which is about 1.07% of its annual income, ranks 39th in the country. Despite ranking near the top, Californias property tax burden is actually lower than it was a few decades ago. Property taxes in California have not risen in tandem with inflation as a result of the states Proposition 13 cap on property tax increases the state has also enacted a number of other tax breaks, such as the homestead and veterans exclusion. Prop 13 was passed in 1978 to establish the property tax system in California. The tax rate for a state is 1%, and the tax assessed value of your property is determined by multiplying it by the state tax rate. The proposition also specifies that the states standard tax rate will be 1%.

How Often Do You Pay Property Taxes

Homeowners typically pay property taxes one of two ways:

1. The homeowner can pay quarterly or in full. Each year’s taxes are paid the following year. Make sure you factor this into your .

2. Many mortgages include property taxes in the monthly payment amount. The mortgage servicer sets aside what the homeowner has paid toward property taxes and pays on the homeowner’s behalf when the bill comes due.

Also Check: How To Grow Your Tax Business

Does Pmi Stay The Same

If your mortgage payment is current, the mortgage servicer will automatically terminate when your principal balance exceeds 78% of the original appraised value of your home. If you choose to use PMI, your lender must be aware of these specific details in order to approve your application.

Making A Down Payment On Your Mortgage

If you make a down payment on your mortgage, you can reduce the amount of mortgage insurance you will be required to pay. Your mortgages LTV determines the amount of mortgage insurance you will be required to purchase. If you put down $36,000 and buy a home worth $180,000, you will only have to pay $14,000 in mortgage insurance. You will pay more for PMI if you have a low FICO score than if you have a high score.

New York Citys Low Property Taxes

In New York City, home values are valued at an average of just under $850,000, and property taxes are only slightly higher, at just over 1%. Despite the fact that it may not appear to be much, it is actually lower than the national average of 1.59%. New Yorks low tax rate is due, in part, to the fact that the state does not levy a personal property tax, which is the most common type of tax in the United States. In New York state, property taxes are 4.96%, income taxes are 4.96%, and sales taxes are 34.13%. These taxes account for roughly 15% of the budget of a New Yorker. Despite the fact that some states have higher property taxes, New Yorkers should be pleased with the low rates throughout the state.

Read Also: Is Personal Loan Interest Tax Deductible

Whats The Difference Between Property Taxes And Real Estate Taxes

Property taxes and real estate taxes are interchangeable terms. The IRS calls property taxes real estate taxes, but they are the same in all aspects. The money collected helps the government fund services for the community.

Sometimes youll also see a special assessment tax. This occurs when your locality needs to raise money to fund a specific project.

What Happens To The Money You Used To Pay Your Taxes

There are several ways you can pay those taxes. Many people pay them monthly on their own or may choose to pay them twice a year when they come due. Others choose to pay them through their mortgage with an escrow account.

One of the pitfalls of not having an escrow account is the temptation to spend that extra money you have been saving rather than pay the amount at the end of the year. Many find themselves in hot water because of that common practice and may be better served to have that payment rolled into their monthly mortgage payment. It is also common to pay ones homeowners insurance with an escrow account.

It is common, particularly with first-time home buyers, to forget to factor in taxes and insurance with their monthly mortgage payments. You can find yourself stretched thin when you start paying that extra several hundred dollars a month.

You May Like: How To Submit Tax Forms

Is Pmi The Same As Property Insurance

Insurance for homeowners and mortgage policies differ greatly. In the event of a lawsuit, your homeowners insurance policy protects you and your home. It protects your lender in the event that you are unable to make your mortgage payment. Mortgage insurance, also known as private mortgage insurance , is a type of insurance that protects against default on mortgage loans.

Home insurance protects both the inside and outside of your home in the same way that sunscreen protects you from the sun. Even though home insurance is typically more expensive on a monthly basis, you will be well protected. Please see the information below for more on this coverage and who is required to obtain it. To put it another way, if you have 20 percent down, you will most likely have to pay mortgage insurance monthly. You can calculate your personal mortgage insurance as a percentage of your total loan. There are some cases where a portion of a mortgage may be tax deductible. This is only applicable to homeowners who itemize their federal taxes, which are done by the vast majority of homeowners.

If you put down less than 20%, you may be required to carry mortgage insurance. Mortgage companies want assurance that they will receive their funds back if they do not receive them. If you want to protect yourself against title-related issues, owners title insurance is the best option.